- Created by BrianQ, last modified by AdrianC on Mar 20, 2018

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 14 Next »

https://help.myob.com/wiki/x/94CyAQ

ANSWER ID:22973

Payroll can produce a CSV file for reporting to the IRD using ir-File, and other reports can be used for manual filing.

This page explains how to generate the required reports for filing to the IRD. These include:

- your Employer Superannuation Contribution Tax (ESCT),

- the Employer Monthly Schedule (EMS/IR348), and

- the Employer Deductions Remittance Advice (EDF/IR345).

Filing electronically

Before you can file electronically, you'll need to register on the IRD website.

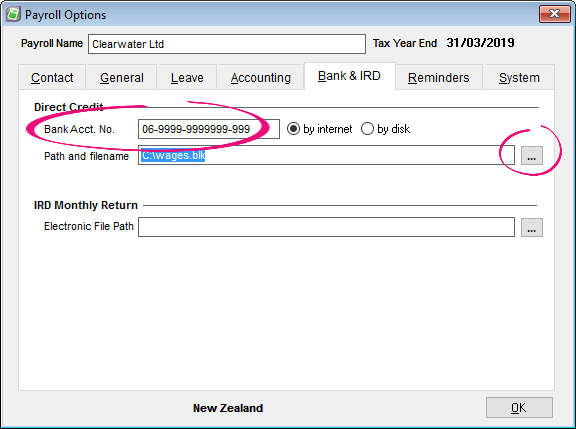

- Open the Tools menu and choose Options. The Payroll Options window appears.

- Click the Bank & IRD tab.

- In the Direct Credit section, enter the Bank Acct. No. required for direct credit purposes.

- Click the ellipsis button (...) at the end of the Path and filename field to locate your Bank folder.

- The Browse for Folder window appears. Select the Bank folder then click OK.

If you do not already have a Bank folder set up, click the Make New Folder button to create one. - In the IRD Monthly Returns section, click the ellipsis button (...) at the end of the Electronic File Path field to locate your IRD FILES folder. The Browse for Folder window appears.

- Click to select the IRD FILES folder then click OK.

If you do not already have an IRD FILES folder set up, click the Make New Folder button to create one.

Payroll is now ready to start producing the CSV files required for electronic filing as described in the next section.

- Update your PAYE period by clicking the Payroll menu, and choosing Change PAYE Period.

- Select Update PAYE Period, then click OK. The Print Employer Monthly Schedule (IR348) window appears.

- Select Summary Format (for own records) and Create CSV files for electronically filing to the IRD.

Click Next, then click Print.

Payroll produces the CSV file and advises that it has created a file in your ir-File folder. This file contains both your EMS file (IR348) and a KED file containing information on all employees joining KiwiSaver.- Click OK then click Close.

The IRD Remittance Advice / Employer Deductions (IR345) window appears. Select the option Create Direct Credit file for electronically paying the PAYE to the IRD as shown below:

- Payroll produces a Direct Credit file and saves it to your Bank folder.

This file may not be required if you are not electronically paying the IRD, however it must be produced for the IR345 (Remittance Advice / Employer Deductions) file to be created.

Click OK. Payroll creates the required EDF file (IR345) and saves it in the same location as your EMS and KED files.

A KED file will only be produced if there have been any changes to KiwiSaver enrollments during the current month.

If you want to file electronically to the IRD you need to register on the IRD website.

Want a demonstration?

View an ir-File demonstration on the IRD website.

Want to test a file upload?

Before uploading a file to the IRD, you can test its compatability using the IRD's file testing portal.

Getting an error when uploading?

If you're getting the error "FAILED:H082:The first field of the top line of the file is invalid. The field must be corrected before the file can be sent" when uploading your CSV file to the IRD website, this can mean you're trying to upload the wrong file, or the file is corrupt. Try re-creating the CSV file as described in Task 2 above (Create the CSV Files for electronically filing to the IRD), then try to upload the file again.

Filing manually

To print the required reports, click Reports > IRD Reports, and either select the two reports individually (Employer Monthly Schedule and IRD Remittance Advice), or create both by selecting Create IRD Reports.

Use the information in these reports to help you complete the IR348 (Employer Monthly Schedule) and IR345 (Employer Deductions) forms manually, then send them to the IRD.

FAQs

If you don't get the option to choose a period for which to produce a direct credit file, and instead receive the message Your report selection is finished, complete the following:

- Go to the Tools menu and choose Options.

- Click the Bank & IRD tab.

- Ensure a Direct Credit - Path and filename has been set up.