You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 11 Next »

https://help.myob.com/wiki/x/Hp6RAw

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

New Zealand only. For Australia, see Tax codes (Australia).

GST codes are used to track GST paid to or by your business. Each GST code represents a particular type of GST.

You can't create GST codes or delete existing ones.

MYOB has an extensive list of GST codes that can be used in a variety of situations—for example, when doing business with overseas customers, when tracking capital acquisitions, and so on.

You can edit GST codes, combine some GST codes and assign GST codes to items or accounts.

What you can edit in GST codes

Only users with the Accountant/Bookkeeper or Administrator user roles and permissions can edit GST codes. See Users.

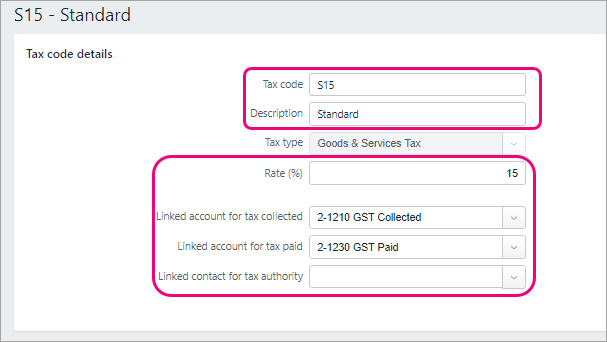

In most tax codes, you can edit all of the fields in a tax code except the Tax type:

If you change the rate for a GST code, it won't change the rate for existing transactions which used that GST code.

You can also change or create a new Linked contact for tax authority.

In the N-T GST code, you're not able to change the Tax code, Tax type or Rate.

- Go to the Accounting menu and click GST codes to open the GST codes list.

- Click the GST code you want to edit.

Make your changes.

You can only enter a maximum of 3 letters in the GST code field.

- Click Save to save your changes.

To combine GST codes

Merge two GST codes to remove any unused codes.

You can only combine GST codes that have the same:

- rate

- linked accounts

- linked contacts (if a linked contact has been chosen).

When you combine codes, you’ll select a code to delete, and which code to move this history to. All contacts, accounts and other records update to the new code.

AccountRight browser users

Make a backup in AccountRight before combining GST codes.

- Go to the Accounting menu and click Tax codes to open the Tax codes list.

- Click Combine Tax Codes.

- Choose the GST code you want to keep from the Move transaction history to list. This is the code the deleted code’s history moves to.

Choose the GST code to delete from the Delete this tax code list.

The next action cannot be undone

Before continuing, check you’ve selected the correct GST codes to combine. If you're not sure, click Go back.

Once you combine GST codes, the only way you can go back to the old GST codes is to restore from a backup (if you have AccountRight installed) and re-enter transactions posted using these codes since the backup. If you're not an AccountRight user and haven't created a backup before combining GST codes then this is not an option.

You can also edit some details of the combined GST code, such as the name, rate or linked accounts.

Click Combine.

To assign GST codes to accounts

You can assign a GST code to any detail account in your accounts list. The GST code you assign will appear as the default GST code when you post a transaction to this account.

For example, you have assigned the standard code (S15) to your electricity expense account. When you settle your electricity bill in the Spend Money window and allocate it to this account, the standard code will appear in this window by default.

You can allocate a GST code to an account. To open this window, go to the Accounting menu > Chart of accounts, and click account name of the required account.

To assign GST codes to items

When you set up an item, you must assign a GST code to use when selling it. If you use AccountRight Standard, Plus or Premier, you’ll also need to assign a GST code to use when buying the item.

These item GST codes will appear by default when buying and selling your items unless you have specified that the customer or supplier GST code is to be used instead (see below).

You assign GST codes to items in the following tabs of the item:

- Buying and Selling section

- Profile section.

For more information, see Creating items.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.