Upgraded from MYOB Essentials? Your help is here.

If you've just converted from AccountRight or AccountEdge to MYOB Business - welcome aboard!

Our Migration Team will have sent you an email confirming the completion of your conversion. If you haven't converted to MYOB Business yet, but you'd like to, check out our migration services (Australia | New Zealand).

Need to import data from AccountRight or AccountEdge? See Importing and exporting data.

You're almost ready

Like any move, there's a couple of things which need tidying up before you can settle in.

If you used payroll in AccountRight or AccountEdge (Australia only) you'll need to complete your payroll setup in MYOB Business.

You'll also need to set your email reply details up before you use the email functions in MYOB Business.

Let's take a closer look.

Complete your payroll setup (Australia only)

Before you can use payroll, there are a few things you'll need to do in MYOB Business.

Do these things in MYOB Business

1. Set up Pay superannuation

You'll need to set up Pay Super to pay your employee's super contributions. For all the details, see Set up Pay superannuation.

2. Check employee leave balances

Your employees' opening and current leave balances have been brought across from your previous MYOB software, but it's a good ideas to check they're correct.

To help check employee leave balances:

In your previous MYOB software, run the Entitlement Balance Summary report for the current payroll year. This will show the Opening Hours and Available Hours of leave for each employee.

In MYOB Business, check the Opening balance for each employee’s leave (Payroll menu > Employees > click an employee's name to open their record > Leave tab). Make sure the annual leave and personal leave balances in MYOB Business match the Available Hours shown in the Entitlement Balance Summary report from your previous MYOB software. You might need to change the Opening balance values in MYOB Business to correct any differences caused by rounding, etc.

If you need to adjust an employee's leave balance, see Managing your employees’ leave.

3. Set up Single Touch Payroll reporting

To report your payroll information to the ATO from MYOB Business, you'll need to set up Single Touch Payroll. It's similar to how you set it up in your previous MYOB software—and because you've done it before you'll know what to expect. As part of the setup process you'll notify the ATO of your previous payroll software so they know you've moved to MYOB Business.

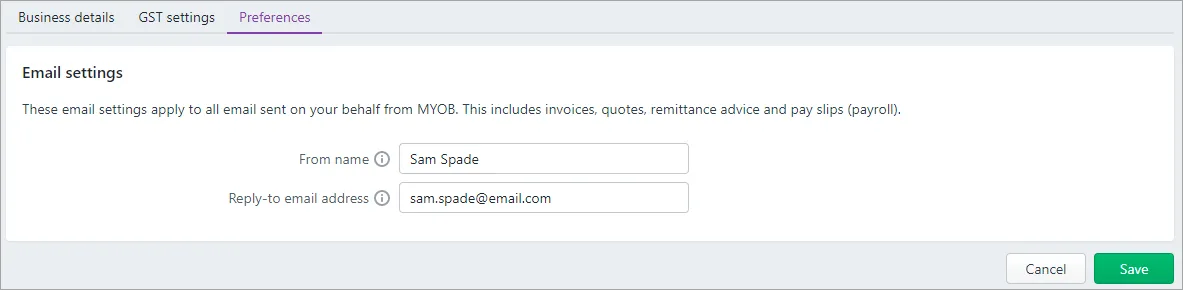

Enter your email reply details

Before you start using the email function in MYOB Business, you'll need to enter your reply details.

To set your reply-to email address and 'from' name

You can set your reply-to email address, and the name your emails come from, in your business settings.

Click your business name and choose Business settings.

Click the Preferences tab.

Enter your From name. This can be a business name or a contact person.

Enter your Reply-to email address. This will be the email address used when your clients reply to email you send them from MYOB.

When you're done, click Save.

Learn about setting up your default emails.