You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 13 Next »

https://help.myob.com/wiki/x/EwcNB

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

On the Entitlements screen (MPPP3300), you can maintain details and calculations for entitlements. An entitlement can be leave, or any other type of entitlement you might owe to an employee.

Understanding entitlement options

When creating an entitlement, there are some options that are worth understanding in detail. These options appear in the different tabs on the Entitlements screen.

Definition section

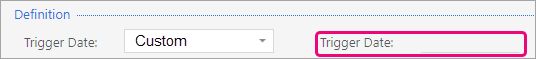

The Trigger Date dropdown lets you select when an entitlement starts to accrue. You can choose between Employee Start Date, Start of Calendar Year, Employee's Date of Birth or Custom.

If you select Custom for the Trigger Date dropdown, you can enter a date in the second Trigger Date field.

Changes section

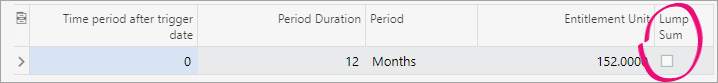

You can select the Lump Sum checkbox if you want an entitlement to accrue only at the end of a period.

Properties section

- When creating a leave entitlement, you need to select the Leave checkbox. This allows leave transactions to be included in the Entitlement History report, and lets you update the Entitlement Adjustments screen—if you need to.

- When creating a non-accruing entitlement, you need to select the Non Accruing Entitlement checkbox. This disables the options Entitlement may be paid/taken in advance and Cap accrual per period. It also disables the options in the Payslip section.

On the Accrued from tab, you can select which pay items need to be taken into consideration when this entitlement is applied to employees that have their entitlement calculated by hours worked. What exactly does this "need to be taken into consideration" mean? And is "entitlement calculated by hours worked" an option selected on the Entitlements screen, or in another part of MYOB Advanced People? Do these pay items need to be added manually, or do they automatically appear in the Accrual base items section?

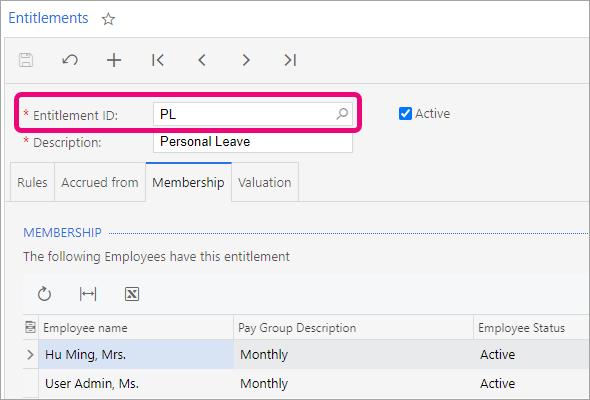

After you add an entitlement to an employee's standard pay, the employee is added to the list on the Membership tab.

To see which employees have a certain entitlement, select the entitlement in the Entitlement ID field.

On the Valuation tab, you can choose how you want an entitlement's units are valued. For the Valuation Method, you can select either Standard hourly rate, Specific pay rate or Custom.

For example, in Australia, leave accruals are usually valued at the current standard rate of the employee.

If you set the Provisioning Method to Actuals, you can also select the Auto adjust provisioned entitlement amount checkbox.

If you select the checkbox, MYOB Advanced People automatically recognises a change in rate value, and re-values the entire provisioned amount when a current pay run is completed.

Creating an entitlement

- On the Entitlements screen (MPPP3300), click the plus icon (

) in the toolbar.

) in the toolbar. - Complete the Entitlement ID and Description fields.

Select the Active checkbox.

- Click the Rules tab.

In the Definition section, complete the fields.

In the Changes section, you can specify how much the entitlement will accrue per period. Click the plus icon (

) to add a new row.

) to add a new row.Complete the fields for the new row.

In the Properties, Payslip, Termination treatment and Self Service sections, select the options that apply to this entitlement.

Click the Accrued from tab.

- In the Accrual base items section, select the pay items that apply when this entitlement is applied to employees that have their entitlement calculated by hours worked.

Click the Valuation tab.

Complete the Valuation Method, Provisioning Method and Rate fields.

On the toolbar, click the save icon (

).

).You can't delete an entitlement after saving it. However, you can deselect the Active checkbox if you no longer need to use the entitlement.

What's next?

After you've created an entitlement, you need to create a pay item for it. That way, that the entitlement accruals and payments can be recorded.