You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 10 Current »

https://help.myob.com/wiki/x/5grFBQ

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

What's changed for 2023–2024

MYOB IMS Payroll applies the following changes from your first pay period with an end date on or after 1 April 2023.

| Detail | Old value | New value |

|---|---|---|

| ACC earner levy rate | 1.46% | 1.53% |

| ACC income maximum | $136,544.00 | $139,384 |

| Maximum ACC earner levy | $1,993.54 | $2,132.57 |

| Period | New value |

|---|---|

| Annual | $22,828 |

| Monthly | $1,902.33 |

| 4-weekly | $1,756 |

| Fortnightly | $878 |

| Weekly | $439 |

| Rate | Old rate | New rate |

|---|---|---|

| Adult | $21.20 | $22.70 |

| New starter and trainee | $16.96 | $18.16 |

Before processing your first pay of the new year

Before you process your first pays with an Employee Payment Date after 1 April 2023, make sure you've upgraded to MYOB IMS Payroll version 6.80.

After upgrading, there's a few procedures you need to do.

You can generate end of tax year reports by going to Tools > End of Tax Year. We recommend you generate the reports listed below. For other reports you might need, we recommend consulting your tax agent or accountant

- Certificate of Earnings: (Optional) Produce a Certificate of Earnings for your employees.

- Trial Balance YTD: Use this option to produce a Tax Year to Date Trial Balance report.

- ACC Levy Report: Produce an ACC Levy Report for the 2023–2024 tax year using the following option:

- Total Leave Report: Produce a Total Leave report (Annual, Sick and Alternative Leave). To generate a report containing the Company Leave liability as at the end of the tax year, tick the Termination Value? option.

- Costing Summary Report: Produce this report if you have Costings activated and if your company tax year begins on 1 April 2023.

Terminated Employees: If you intend to delete terminated employees (up to a nominated termination date) when opening the first pay period for the new tax year, you should produce a report listing the employee details. Enter your intended nominated termination date and select ‘Full Details’ (recommended) or ‘Name, Address & Termination Date listing’.

If you want to extract information about the terminated employees you intend to delete, you can use the ‘Employee Information – Find Record’ facility to select and extract the appropriate data required. The “Filtering records” section of the Find Record Grid document details how to select the appropriate terminated employees for the extract.

Once terminated employees are deleted, they no longer appear on any standard or historical report. So, make sure you back up your payroll company prior to opening the first pay period for the new tax year, during which the deletion process can be undertaken.

- Preview the report.

- Click the Save button on the top left of the report page.

- On the Save Report tab, specify the location and file name for the report.

- In the Save as Type field, select PDF File (*.PDF).

- Click Save.

Go to Tools > End of Tax Year, then click Backup.

In the Take a backup copy of your company files screen, choose a location and allocate a unique file name for each payroll company that can be easily identifiable should you require it in the future.

If you have any employees in KiwiSaver, a KiwiSaver Compliant Fund or a Company Superannuation scheme then this section applies to you.

Company Superannuation (if applicable), KiwiSaver and/or a Compliant Fund ESCT rates will need to be checked and updated for the new tax year. You need to do this immediately prior to starting a new Tax Year. This facility is available via the Tools > ESCT Rate Update option.

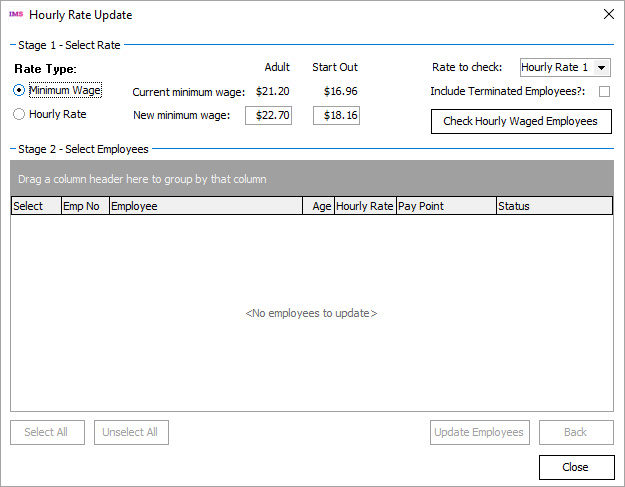

If you have any employees on a Minimum Wage Rate, then this rate must be updated for the time worked starting 1 April 2023.

The new Minimum Wage rates applicable from 1 April 2023 are as follows:

- Adult: $22.70 (was $21.20)

- Start-Out / Training: $18.16 (was $16.96)

The rates may be updated manually on the employee’s Payment tab or Company Payments tab (whichever is applicable) or via the Hourly Rate Update window, which is available within the Tools menu.

The Minimum Wage Rate Update facility is available to assist in identifying and updating employees who are either on the ‘Adult Minimum Wage’ or the ‘Start-Out / Training’ Minimum Wage Rate’.

Step 1: Select the rate options

- Select the Minimum Wage Rate Type. The ‘New’ Minimum Wage Rates will be populated automatically.

- Rate To Check: Nominate the Hourly Rate field (1 – 5) to check for either of the old rates.

- Include Terminated Employees?: This option can filter terminated employees from the rate options. You may want to include terminated employees if they were on the Minimum Wage Rate and may be re-employed again later.

- Check Hourly Waged Employees: Ensure your Minimum Wage Rate has been updated and matches the nominated rate field. This process applies to waged employees only.

Step 2: Select the employees

Select the employees you want to update, and then click Update Employees. The rate updates will be automatically audited.

Opening the first pay period for the 2023–2024 tax year

- Tax: Ensure that the Period and Year indicators are selected. The ‘Open’ process will attempt to determine when a new tax year has started and set these indicators accordingly based on the first Employee Payment Date entered which is on or after 1 April 2023.

Costing: Ensure that the Period indicator is selected. If your company tax year begins on 1 April 2023 then also select the Year indicator.

The Year option should only be selected if you do not want to retain the Costing Period and YTD (year to date) totals past this point. If you want to retain Costing YTD totals at year end for specific Costing Codes, then via the ‘Company Controls – Costing Codes’ tab select the ‘Retain Costing YTD Total at Year End?’ indicator for each Costing Code concerned. The Reset Accumulator for the ‘Year’ can then be selected and those Costing Codes, as flagged, will retain their YTD totals.

- Deductions: This applies to the deductions that are not flagged as ‘PAYE / KiwiSaver / Student Loan / Child Support (CSE, NCP)’ on the deduction master record, e.g., Social Club etc. Ensure that the Period indicator is selected and select Year to reset the YTD accumulators for these deductions.

- KiwiSaver: Ensure that the Period indicator is selected. If your KiwiSaver reporting year starts in April (as indicated on the ‘Company Controls – Company’ tab) ensure that the ‘KiwiSaver - Year’ indicator is selected. You can select your KiwiSaver reporting year within the ‘Company Controls – Company’ tab. This is for YTD reporting figures such as on the Payslip YTD balances section.

The KiwiSaver Reporting period can either be April or July. If July is selected on the ‘Company Controls’ tab then, for your first pay in July, the KiwiSaver ‘Year’ indicator will be automatically selected.

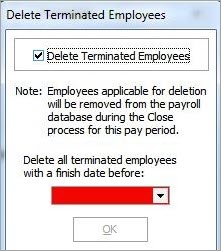

Optionally, delete terminated employees

When you open your first pay for the new tax year, you can choose to delete employees who have a termination date. If you want to do this, enter a threshold date, such as 1 April 2023, so that all employees terminated before this date will be deleted.

All information regarding the terminated employees will be removed from the payroll company (for example, Accumulators, Timesheet History) once the Pay Period is ‘Closed’. Make sure you have a copy of the Employee Listing or have generated an extract file of employees to be deleted prior to opening the first pay period, as detailed in Process 1 in this document.