You can use the GST & Provisional Tax function to fill out and file your GST return manually or online using Inland Revenue Department's eGST service.

Before you prepare your GST return, you should:

Review your GST codes setup: Make sure the GST Code is Reported on GST Return option is selected for GST codes with a rate of zero (and deselected for exempt GST codes). See Setting up GST codes for more information on creating and editing GST codes.

Review your GST reports: There are several GST detail reports available that you may want to review before preparing your GST return.

Give your tax agent access to your myIR account: If your tax agent will be filing GST returns online on your behalf, you will need to give them access to your myIR account and delegate the GST return filing service to the agent. See the IR website to learn how to grant others access to your myIR account.

File your GST return online (eGST)

If your company file is online, you can choose to file your GST returns online (eGST). It’s easy to do, and there are no forms to fill out and send.

Let's step you through it:

In your online company file, go to the Accounts command centre and click GST & Provisional Tax. The GST & Provisional Tax window appears.

In the File Online tab, click Get Started and a browser window will appear. If the Get Started button can't be clicked, ensure you're working on an online company file.

Enter your MYOB account details (these are the same details you use to sign into My Account).

If prompted, enter your company file User ID and Password (these are the same details you use to sign on to your company file).

To continue working on an existing return, click the date listed in the Period end column, then skip to step 7.

To start a new return:

Click Add return. The Return details page appears.

Enter your IRD/GST number and select your Return type.

If prompted, enter your myIR user ID and password.

Don't have a myIR user ID? It's easy to register for myIR by heading to the IRD's registration page.

Getting an error when logging in to the IRD website? Clear your internet browser cache and try again. ( Chrome or other browser)

Enter your GST output tax adjustment account and GST input tax adjustment account. Ensure these are not both the same account.

Choose your GST taxable period, Period end and Accounting basis. Note that the 6 month GST taxable period option is not yet available.

Can't choose a month in Period end?

If you've prepared a GST return for a previous period, that period won't appear in the Period end drop down list.

Select whether you want to include year-end adjustments in the return.

Click Create. The return appears, pre-filled with the amounts that have been transferred from AccountRight.

Review the amounts and click Validate to check the formatting. Make any changes that are required.

(Optional) To save your changes (if you want to complete the return later) click Save.

Click Prepare to file, and if all details are correct, click File. A message appears requiring you to confirm that you want to file the return with Inland Revenue.

Click Confirm.

Click File to file the return with Inland Revenue. The GST lodgement page reappears showing the submission status of the return.

File your GST return manually

Go to the Accounts command centre and click GST & Provisional Tax. The GST & Provisional Tax window appears.

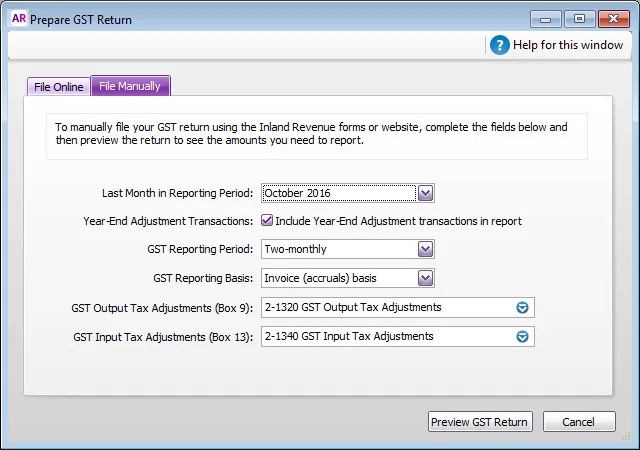

If you're using AccountRight 2016.2 or later, click the File Manually tab.

Choose the last month of your reporting period.

Can't choose a GST reporting period beyond March 31?

Some financial reports are only available for the current and next financial years. If you haven't closed a financial year for a while, you'll first need to close a previous financial year before you can select a later date.

If you've recorded end-of-year adjustments and you want to include them in your return, select the Include Year-End Adjustment transactions in report option.

Choose the GST Reporting Period and GST Reporting Basis which your business uses to report GST. This is the accounting period and basis chosen by your business when you registered for GST. If you're unsure which basis your business uses, find out from your accountant or Inland Revenue.

Not registered for GST? If you're using AccountRight 2020.2 or later, choose Not Registered as your GST Reporting Period then click OK to finish.

Select the accounts you use to record GST Output and GST Input adjustment activity. Ensure these are not both the same account.

Click Preview GST Return. The Print Preview window appears, displaying your GST return information.

If the information on the report is correct, click Print to print a copy of the report.

If you need to edit your GST return information, click Close to return to the GST & Provisional Tax window.You can use the information from the GST Return that you printed or complete and lodge your actual GST Return (GST101) electronically or by post. See the Inland Revenue website for more information about these options.

To record your GST Return transaction in your company file

After you have prepared your GST Return, you need to:

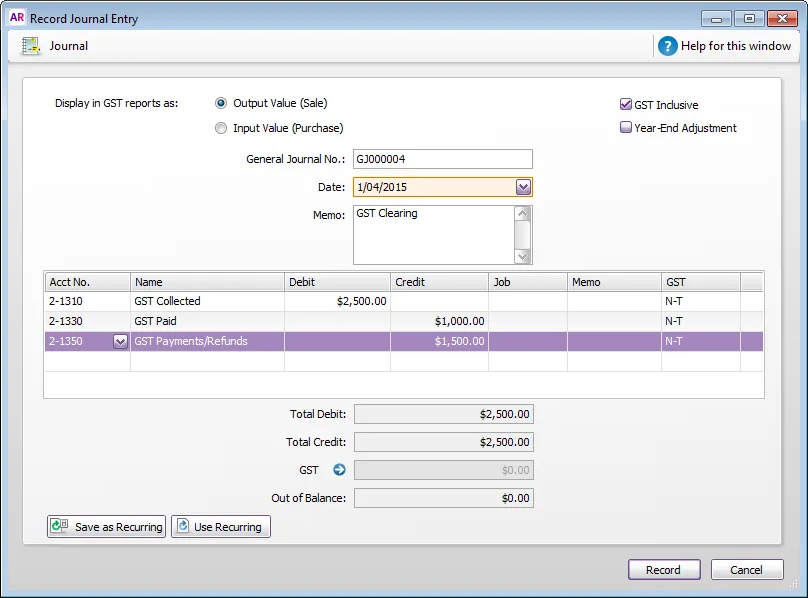

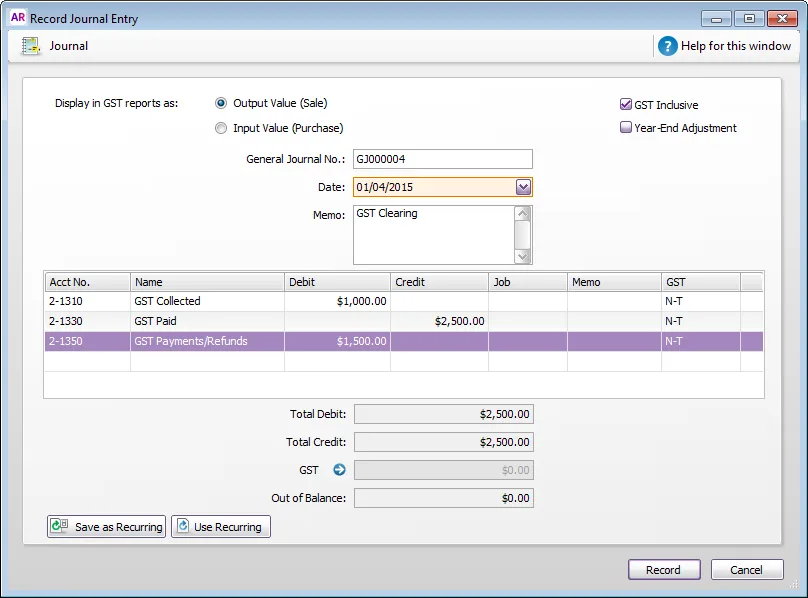

create a journal entry to clear your GST Collected and GST Paid accounts for the Return period and post the difference to your GST Payments/Refunds account, and

record a Spend Money or Receive Money transaction for the Inland Revenue payment.

Example journal entry - if you owe Inland Revenue

In this example, your GST Return shows that you have collected $2,500 in GST and paid $1,000 in GST. This means you need to pay Inland Revenue $1,500 in GST. Your journal entry will look like this:

Example journal entry - if Inland Revenue owes you

In this example, your GST Return shows that you have paid $2,500 in GST and collected $1,000 in GST. This means you're owed $1,500 from Inland Revenue. Your journal entry will look like this:

Recording the Inland Revenue payment

If you need to pay Inland Revenue, record a Spend Money transaction from the GST Payments/Refunds account.

If you need to receive a payment from Inland Revenue, record a Receive Money transaction to post the payment to your GST Payments/Refunds account.