AccountRight Plus and Premier only

AccountRight calculates the amount of superannuation you need to pay on behalf of your employees, but on occasions the figure calculated might appear to be wrong. This page guides you through the areas you need to check, and how to adjust incorrect superannuation amounts.

If you're having trouble with a Pay Super payment, see Troubleshooting Pay Super payments.

To check that the superannuation category is set up correctly

Go to the Payroll command centre and click Payroll Categories.

Click the Superannuation tab then click the zoom arrow next to the Superannuation Guarantee category. This category usually relates to the compulsory superannuation required to be paid by employers. If you have multiple funds, you'll need to check each fund in turn.

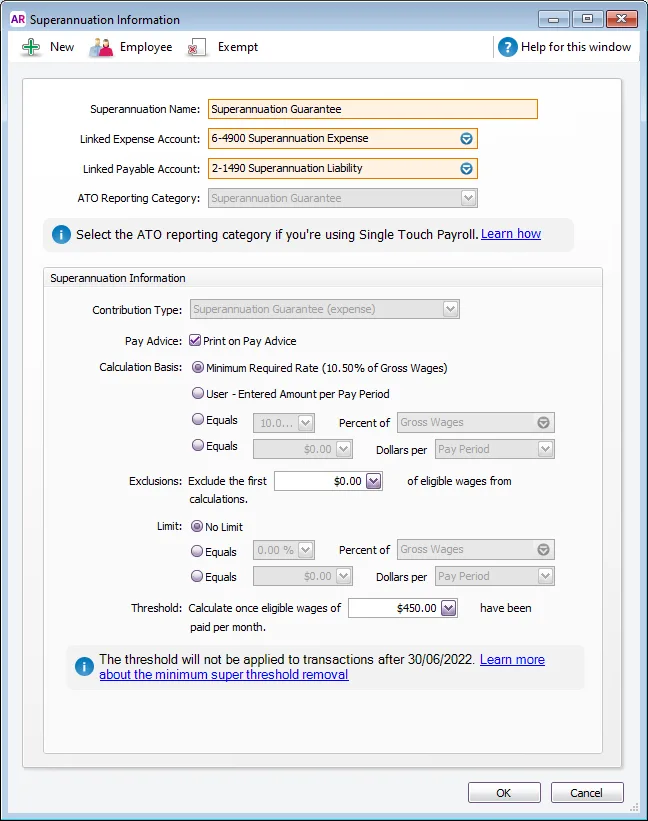

Check the details of the category based on the following example.

This is an example only based on the Superannuation Guarantee category that exists in your software by default. Your business circumstances and current legislation may require different setup. Speak to your accounting advisor or the relevant wage authority.

Linked Expense Account - Usually set to an expense account of your choice. Check with your accounting advisor if unsure.

Linked Payable Account - Usually set to a liability account of your choice. Check with your accounting advisor if unsure.

Contribution Type - This is the type of superannuation, such as Superannuation Guarantee or Salary Sacrifice. This selection determines whether the contribution is paid in addition to gross pay, or deducted from gross or net pay.

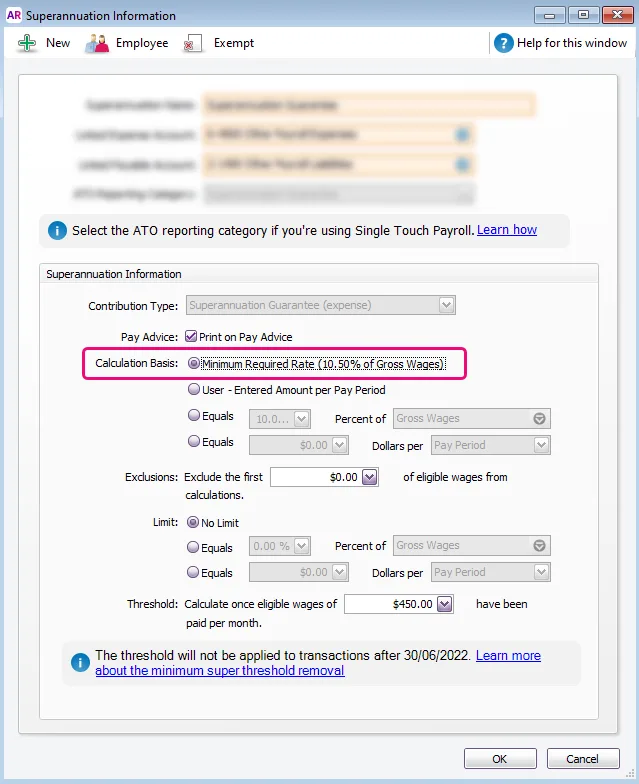

Calculation Basis - We recommend setting this to Minimum Required Rate to automatically apply the minimum legislated super rate for your employees. Learn more about staying compliant with super guarantee rate increases.

Exclusions - This is for amounts that should be excluded from the calculation.

Limit - Used to set a limit (or cap) for super contributions. This is usually set to No Limit, but check with the ATO if unsure.

Threshold - Used to set a monthly wage threshold before super will be calculated. From 1 July 2022, the Australian Government removed the $450 per month threshold for super guarantee eligibility so you'll no longer see this field if the Contribution Type is set to Superannuation Guarantee. This means superannuation must be paid on all ordinary times earnings for pays dated 1 July 2022 or later. For pays dated 1 July 2022 or later, this field will be ignored. Learn more about the removal of the $450 earnings threshold for super.

Click Employee and select all employees entitled to this superannuation.

Click OK to return to the Superannuation Information window.

Click Exempt and ensure only the appropriate categories have been made exempt. In other words only select a category if you don't want superannuation to calculate on that particular wage category.

Click OK to return to the Superannuation Information window.

Click OK and exit to the Payroll command centre.

Click Process Payroll to test whether this category is working.

To check that previous superannuation calculations were correct

Go to the Reports menu and choose Index to Reports.

Click the Payroll tab.

Select the Register Detail report (under the Employees heading) then click Advanced Filters.

Select All Employees and select Year-to-Date as the period.

Click Run Report.

Check that the superannuation amounts are correct for each employee.

How is superannuation calculated?

Superannuation guarantee contributions are calculated each pay run on the wage categories that are not exempt from super calculations. It's calculated based on the Calculation Basis set in the superannuation guarantee pay item (Payroll > Payroll Categories > Superannuation tab > Superannuation Guarantee). We recommend setting this to Minimum Required Rate so the correct rate will always be used – even when the government change the super rate. Tell me more...

Due to the removal of the $450 super threshold, the super calculation no longer needs to take into account previous pays in the same calendar month.

Also see Paying super for employees aged under 18.

The ATO has a super guarantee calculator if you want to check how much super you should be paying.

Fixing incorrect super calculations from previous months

If the incorrect super calculation is from a previous payroll year, check with your accounting advisor before attempting to correct this in your software.

If there are only a few incorrect pays, it is best to delete or reverse and re-enter these. If these pays have been previously reconciled, make sure that you reconcile the bank account again. For more information on this see Reconciling your bank accounts.

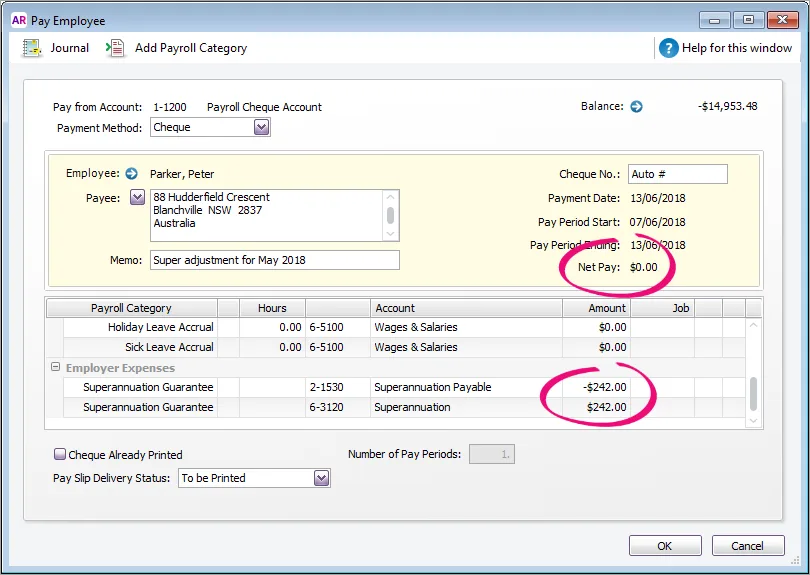

If there are many incorrect transactions, it may be easier to make correcting entries. You will need to enter a $0.00 pay (known as a VOID pay) for each employee and each month in which the wrong amount of super was paid.

To fix a super payment

Start a new pay run for the employee.

Enter the pay Memo as "Super adjustment" or similar. The date should be entered as the last day of the month.

Enter wage amounts as zero.

Enter the super adjustment amount.

Zero out all sick leave and holiday pay accrual amounts. This means the net pay will be $0.00

See our example below.

FAQs

Why is an employee earning zero super?

Make sure the superannuation category has been assigned to the employee (Payroll command centre > Payroll Categories > Superannuation tab > open the applicable super category > Employee > make sure the employee is selected > OK).

Also, the Limit in the superannuation category might be set to zero. See To check that the superannuation category is set up correctly above for more details.

How do I exempt a wage category from accruing super?

Super might not be payable on certain wage categories. If you're unsure about whether a wage category should accrue super, check with the ATO.

To prevent super accruing on a wage category:

Go to the Payroll command centre and click Payroll Categories.

Click the Superannuation tab then click the zoom arrow next to the Superannuation Guarantee category.

Click Exempt.

Select the wage category to be exempted from accruing super.

Click OK.

Why isn't super being calculated on a wage category?

If you've set up a wage category which isn't accruing super, check the following.

If you're unsure about whether a wage category should accrue super, check with the ATO.

Go to the Payroll command centre and click Payroll Categories.

Click the Superannuation tab then click the zoom arrow next to the Superannuation Guarantee category.

Click Exempt.

Ensure all wage categories which should be accruing super are not selected (super will not be calculated on any wage category selected here).

Click OK.

Why is my salary sacrifice super calculating incorrectly?

If you have set up salary sacrifice to use a fixed percentage, the calculation will look at the total pay for the month and work out the amount to sacrifice. So, if your salary sacrifice is set up mid-month there may be previous pay amounts used in the calculation.

In these cases, manually enter the correct salary sacrifice amount when recording your pays. The following month the calculation will correct.