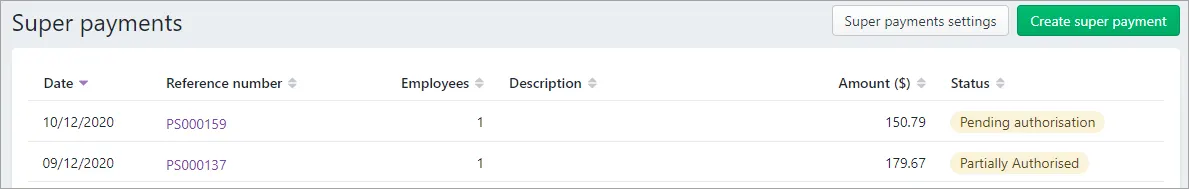

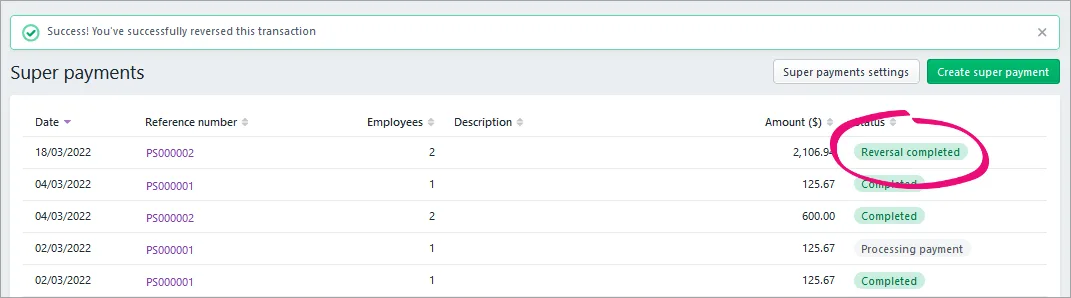

After you've created a super payment, it'll be listed on the Super payments screen with a status.

You'll only be able to reverse a super payment if the status is:

Payment failed

Reversal required

Paid or returned super

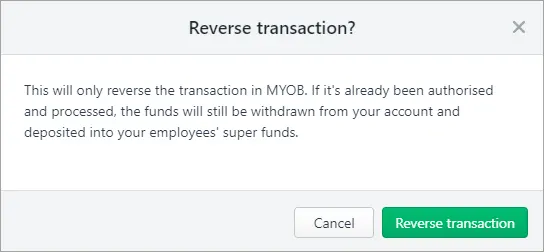

If a super payment has the status Reversal required or Payment failed only reverse the payment if none of the contributions in the payment have been paid. If a contribution has been paid, or has been returned from the super fund, see Returned superannuation contributions.

Reversing a super payment doesn't change any of your employees' pays. It just returns the contributions back to the Create super payment screen with all the other unpaid contributions. If you've paid an employee the wrong super amount, find out how to adjust the employee's super in a pay run.

Also, if an employee's super fund details are wrong you'll need to update their fund details before paying their super.

To reverse a super payment

Go to the Payroll menu and choose Super payments.

If prompted, log in with your MYOB account details.

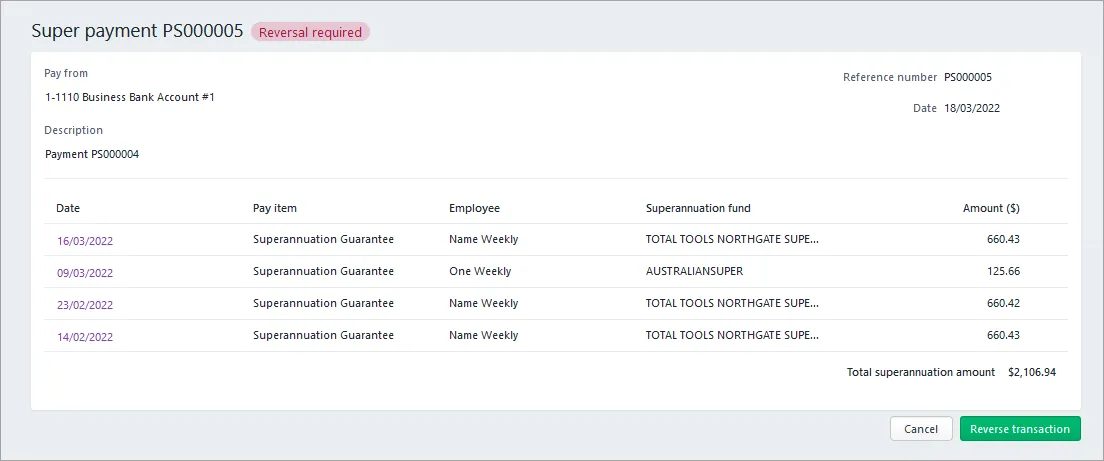

Click the payment to be reversed. The contributions within the payment will be listed.

Confirm the details of the payment you're about to reverse.

Click Reverse transaction.

At the confirmation, click Reverse transaction.

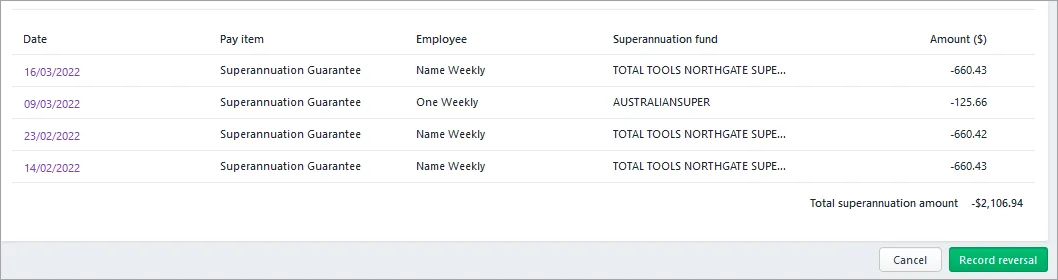

The super payment will be shown with negative values for the contributions.

Click Record reversal. The payment is reversed and is now listed with the status Reversal Completed.

Each of the contributions within the reversed payment will be listed again on the Create super payment screen.