If you need to reimburse an employee for a business expense, you can include the reimbursement in the employee's pay. The tasks below explain how to set this up and process the pay.

If you're reimbursing an employee for something they've purchased for your business, we'll also show you how to record that purchase.

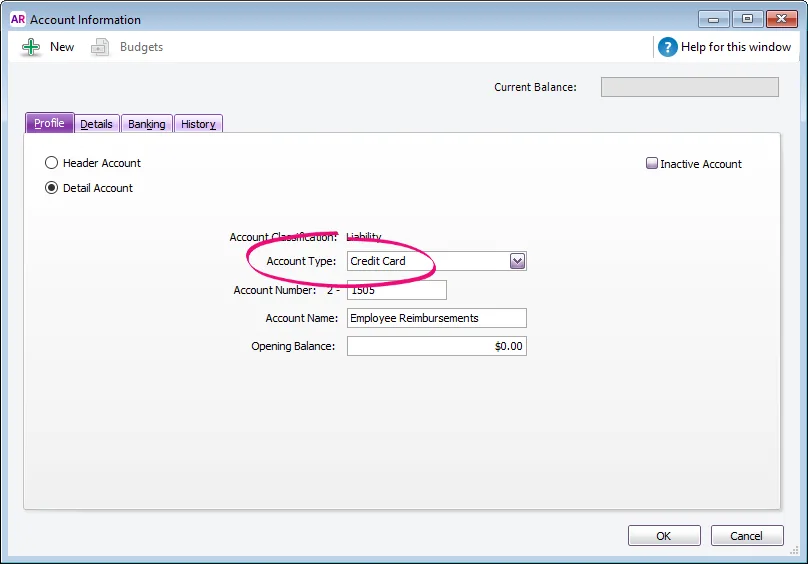

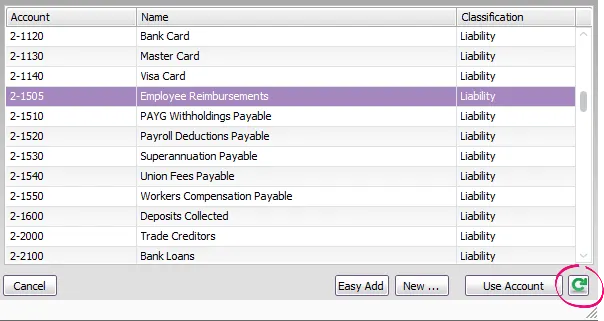

1. Set up a clearing account

Create a liability account to be used as a temporary holding account for the value of the employee purchase (Accounts command centre > Accounts List > Liability tab > New). Make sure the Account Type is set to Credit Card.

Here's our example:

This account will be linked to a new payroll wage category we'll create in the next task.

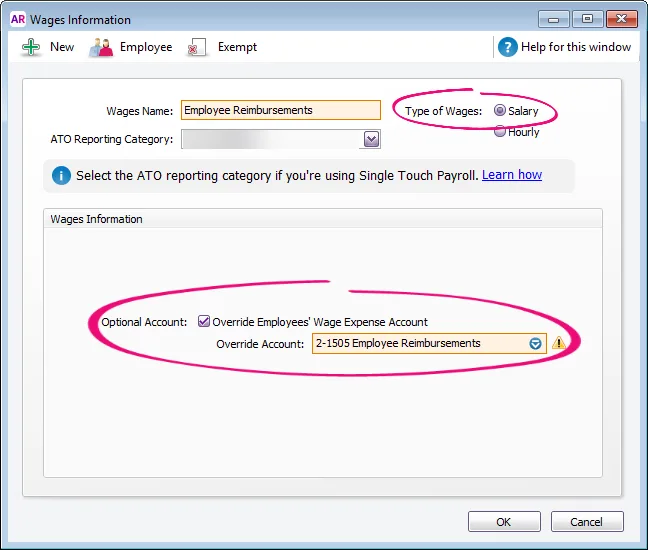

2. Set up a payroll wage category

Create a wage category which you'll use to reimburse the employee (Payroll command centre > Payroll Categories > Wages tab > New)

Select Salary for the Type of Wages.

Choose the applicable ATO Reporting Category. If unsure, check with your accounting advisor or the ATO. Learn more about assigning ATO reporting categories for Single Touch Payroll reporting.

Select the option Override Employees' Wages Expense Account.

For the Override Account, select the liability account created above. If you can't find it, click the green Refresh button to ensure the new account is included in the list.

Once selected, ignore the warning about the type of account chosen.

Here's our example:

Assign this wages category to the employee who's being reimbursed (click Employee and select the employee).

Exempt the wages category from tax calculations (click Exempt and choose PAYG Withholding).

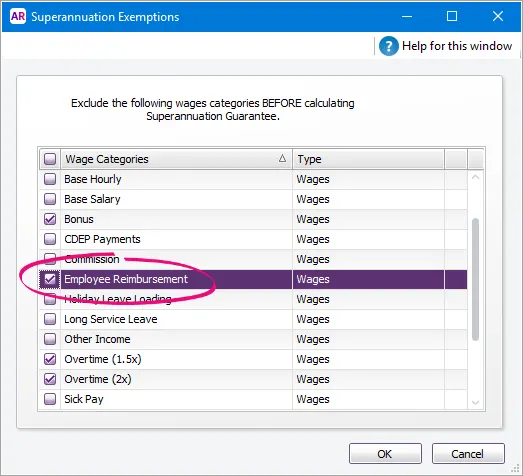

3. Exempt the reimbursement from superannuation

To ensure the reimbursement wages category isn't included in the superannuation calculation:

Go to the Payroll command centre and click Payroll Categories.

Click the Superannuation tab.

Click the zoom arrow next to the Superannuation Guarantee category. The Superannuation Information window is displayed.

Click Exempt. The Superannuation Exemptions window is displayed.

Select the Employee Reimbursement wages category created above.

Click OK to both the Superannuation Exemptions and Superannuation Information windows.

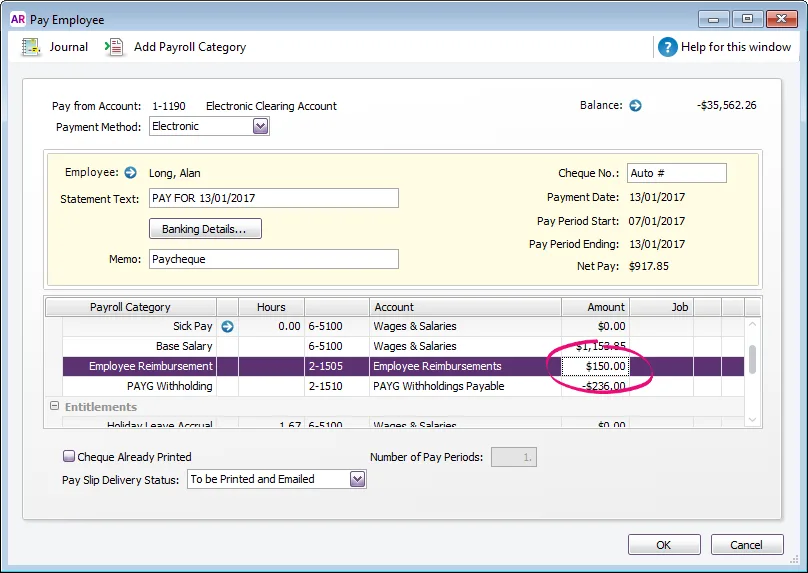

4. Reimburse the employee

When you process payroll, enter the reimbursement amount on the employee's pay.

This will:

reimburse the employee for their purchase, and

put the amount into the temporary holding account you created earlier. This will be cleared in the next task.

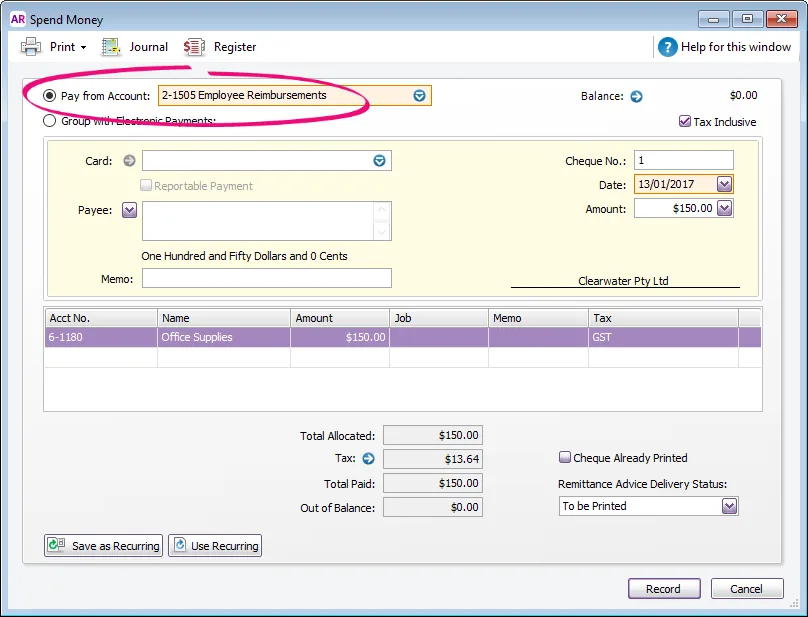

5. Record the purchase

The last thing to do is record a Spend Money transaction to account for the purchase. This achieves the following:

the purchase can be allocated to the applicable expense account

the applicable tax code can be assigned based on what was purchased and how it needs to be accounted for, and

the Employee Reimbursement Liability account is returned to a zero balance.

If you're not sure which tax code to use, check with your accounting advisor.

Here's our example: