When you personalise a form (Setup menu > Customise Forms > select form > Customise), you can choose to add fields and columns. These fields and columns are specific to the form you're customising, and automatically display data that comes from your company file, like an invoice number, item price or customer address. We've listed them below for each form type.

If you want to add your own text to a form, see Add text and fields to forms.

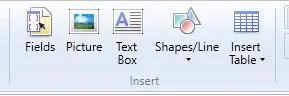

To add a field

Click Fields in the Customise toolbar.

To add a table column

Right-click the table and choose Show/Hide Columns, then choose the columns you want to show.

Fields you can add to forms

Here are the fields you can add to each form. If the field you need to add isn't listed, you can add a text box to your form and enter the required text.

These field descriptions are based on the Australian AccountRight versions. The fields used in New Zealand forms are identical, except for some minor local differences. For example, in the Australian products, tax related fields are labelled as "Tax" while for New Zealand, they're labelled as "GST".

Cheque Layout

Supplemental fields from the Card Information window and Supplemental fields from the Company Information window can also be used on this form.

Field name | Data that will print in this field |

|---|---|

ABN (Australia only) | The Australian Business Number (ABN) entered in the Company Information window |

Amount in English | The amount entered on the transaction. Amounts up to and including 99,999.99 are printed in words; larger amounts are printed in numeric form. |

Amount in Numeric | Amount on transaction in numeric form |

Cheque Amount | The amount entered on the transaction in numeric form |

Cheque Number | The cheque number entered on the transaction |

Company Trading Name | The name under which your company does business |

Date | The date entered on the transaction |

Memo | The memo entered in the Journal Memo field of the transaction |

Payee | The information entered or selected in the Payee field on the transaction |

Some fields may not be available on some versions of the form layout.

See also Personalising cheques.

Cheque Stub Layout—Regular

If you choose the Laser Cheque form, these fields appear twice — once for each stub.

Supplemental fields from the Company Information window can also be used on this form.

Field name | Data that will print in this field |

|---|---|

Account Name | The name of the allocation account entered on the transaction |

Acct. No. | The allocation accounts entered on the transaction |

Allocation Amount | The allocation amounts entered on the transaction |

Allocation Memo | The memo for each allocation amount entered on the transaction |

Category (Not Basics) | The financial tracking category assigned to the transaction associated with this cheque |

Cheque Amount | The amount entered on the transaction, in numeric form |

Cheque Number | Cheque number entered on the transaction |

Date | Date entered on the transaction |

Memo | The memo entered in the Journal Memo field of transaction |

Payee | The information entered or selected in the Payee field on the transaction |

Some fields may not be available on some versions of the form layout.

See also Personalising cheques.

Cheque Stub Layout—Payable (Not Basics)

If you choose the Laser Cheque form, these fields appear twice — once for each stub.

Supplemental fields from the Company Information window can also be used on this form.

Field name | Data that will print in this field |

|---|---|

Allocation Amount | The amount entered in the Amount Applied field in the Pay Bills window |

Category | The financial tracking category assigned to the transaction associated with this cheque |

Cheque Amount | The amount displayed in the Amount field of the Pay Bills window in numeric form |

Cheque Number | Cheque number entered in the Pay Bills window |

Date | Date entered in the Pay Bills window |

Invoice Date | The date entered in the Date field on the purchase |

Invoice Debit Memos | The total of any debit memos posted against this bill |

Invoice Debit Memos With Label | The total of any debit memos posted against this bill with the label “DM” |

Invoice Discounts | The total discounts that have been applied to this bill |

Invoice Discounts With Label | The total discounts that have been applied to this bill with the label “DISC” |

Invoice Payments | The total payments that have been applied to pay this bill |

Invoice Total Amount | The original value of the bill |

Invoice Total Debits | The total of payments and debit memos posted against this bill |

Memo | The memo entered in the Journal Memo field of the Pay Bills window |

Payee | The information entered or selected in the Payee field in the Pay Bills window |

Purchase No. | The entry in the Purchase No. field on the bill |

Purchase No. With Label | The entry in the Purchase No. field on the bill with the label “Purchase”. |

Supplier’s No. | The entry in the Supplier Inv No. field on the bill |

Supplier’s No. With Label | The entry in the Supplier Inv No. field on the bill with the label “Invoice #” |

Some fields may not be available on some versions of the form layout.

See also Personalising cheques.

Cheque Stub Layout—Refund

If you choose the Laser Cheque form, these fields appear twice — once for each stub.

Field name | Data that will print in this field |

|---|---|

ABN (Australia only) | The Australian Business Number (ABN) entered in the Company Information window |

ACN (Australia only) | Your company’s 9-digit Australian Company Number, from the Company Information window |

Allocation Amount | The amount entered in the Amount field of the Settle Returns & Credits window |

Category (Not Basics) | The financial tracking category assigned to the transaction associated with this cheque |

Cheque Amount | The amount displayed in the Amount field in the Settle Returns and Credits window in numeric form |

Cheque Number | Cheque number entered in the Settle Returns and Credits window |

Date | Date entered in the Settle Returns and Credits window |

Invoice Date | The date of the customer credit |

Invoice No. | The invoice number of the customer credit |

Memo | The memo entered in the Journal Memo field of the Settle Returns and Credits window |

Payee | The information entered or selected in the Payee field in the Settle Returns and Credits window |

Some fields may not be available on some versions of the form layout.

See also Personalising cheques.

Cheque Stub Layout—Paycheque/Pay Advice (Plus and Premier, Australia only)

If you choose the Laser Cheque form, these fields appear twice — once for each stub.

Supplemental fields from the Applied Payment Details window can also be used on this form.

Field name | Data that will print in this field |

|---|---|

ABN | The Australian Business Number (ABN) or Tax File Number (TFN) entered in the Company Information window |

ACN | Your company’s 9-digit Australian Company Number, from the Company Information window |

Amount | Amount applicable to allocation line |

Annual Salary | This employee’s annual salary, as shown on the employee’s card |

Category | The financial tracking category assigned to this paycheque transaction |

Cheque Amount | Amount in the Net Pay field in the Pay Employee transaction |

Cheque Number | The number assigned to this cheque in the Pay Employee transaction |

Company Name | From the Company Information window |

Deduction Amount | Lists the deduction amounts for each category — shown as positive numbers |

Employee Name | From the Card Information window for this employee |

Employment Basis | This field can't be added to the form. If you require this information to show on a pay slip, add it as a text field. |

Employment Classification | The classification specified for this employee on the Payroll Details tab of the Card Information window |

Ending Date | The last day of the pay period represented by this paycheque; from the Pay Period end field of the Pay Employee transaction |

Gross Amt | The total amount of the paycheque before taxes, expenses and deductions |

Hours | For employees paid by the hour, the number of hours applicable to each allocation line |

Hourly Rate | For employees paid by the hour, the entry in the Hourly Rate field in the Card Information window— Payroll Details-Wages For salary employees, calculated based on the entries in Annual Salary, Pay Frequency and Hours in Pay Period fields |

Memo | The memo entered in the Journal Memo field of the transaction |

Name of Employer | The company name entered in the Company Information window |

Payment Date | The Payment Date from the Pay Employee transaction |

Payment Method | The payment method designated on the Pay Employee transaction (Cash, Cheque or Electronic) |

Payroll Category | The payroll categories applicable to each allocation line. Only those categories with an amount for this paycheque or an amount in the YTD (year-to-date) column will print. |

Rate | The rate (if any) applicable to each allocation line |

Starting Date | The Pay Period Start Date from the Pay Employee transaction |

Superannuation Fund Name | The Superannuation Fund linked to the Employee card |

Payroll Category | Type of payroll category — Wages, Deductions, Superannuation Deductions, Entitlements, Taxes, Employer Expenses, Superannuation Deductions |

Wages Amount | The total amount of wages applied to each payroll category |

YTD Amount | The sum of the Pay History amounts applied to each category listed on the paycheque. For entitlements, the amount includes YTD and carry-over amounts. |

The category must be included on the paycheque or the YTD amount will not appear.

Some fields may not be available on some versions of the form layout.

See also Personalising cheques.

Invoice—Service

More fields are available to customise this form:

Field name | Data that will print in this field |

|---|---|

*Inv/PO No.* | The number of the transaction with an asterisk before and after it |

ABN (Australia only) | The Australian Business Number (ABN) entered in the Company Information window |

ACN (Australia only) | Your company’s 9-digit Australian Company Number, from the Company Information window |

Applied | The total of the payments that have been applied to the sale |

Balance | Amount of the sale including GST and freight charges minus any payments that may have been applied; that is, the amount that appears in the Balance Due field of the sale. |

Barcode | A scannable barcode representation that includes the Payee Number provided when you subscribed to M-Powered Services. The barcode is generated using data from your software and data provided by Australia Post. If you have not entered a valid Payee Number in the Company Information window, “Not Available” will print in this field. |

Category (Not Basics) | The financial tracking category assigned to this sale |

Comment | The comment entered on the transaction |

Company Address | The company address entered in the Company Information window |

Company Name | The company name entered in the Company Information window. |

Cust PO No. | The entry in the Customer PO No. field on the transaction |

Cust/Suppl ABN (Australia only) | The Australian Business Number (ABN) for this customer, from the Card Information window — Selling Details view |

Customer Reference | A reference number for your company that is derived from the Payee Number on the Company Information window. If you have not entered a valid Payee Number in the Company Information window, “Not Available” will print in this field. |

Date | The date entered on the transaction |

Description | The description of each line item entered on the transaction |

Due Date | The date the payment is due, based on the terms of the sale |

Ex Amount | The tax-exclusive amount of each line item entered on the transaction |

Ex Freight | The freight charges that apply to the sale, excluding GST on the freight charges |

Ex Subtotal | The subtotal of all amounts on the transaction, exclusive of any GST applied to these amounts |

Ex Subtotal + Freight | The GST-exclusive subtotal amount for each item, including freight charges |

Freight + tax | Includes the freight amount plus the GST on the freight |

GST Total | The total amount of GST charged for line items and freight on the sale |

Inc Amount | The amount of each line item, including the tax applied |

Inc Freight | The freight charges that apply to the sale, including GST on the freight charges |

Inc Subtotal | The total amount of all line items on the sale to which GST is applied |

Invoice No. | The invoice number entered on the transaction |

Invoice Type | The sale status of the invoice (Quote, Order or Invoice) |

Job Description | The description of the job whose job number is entered for a line item |

Job Name | The name of the job whose job number is entered for a line item |

Job Number | The job number entered for a line item |

Line Tax | The amount of tax for each line item |

Mailing Address | The address entered in the Address 1: Bill To selection of the Location field in the Card Information window — Profile view |

Memo | The memo entered in the Journal Memo field of the transaction |

Original Amount in English | The amount of the sale including GST and freight charges (but not including any payments that may have been applied) in words. Words will print for amounts up to and including 99,999.99; for larger amounts, the amount will print in numeric form. |

Page No. | The pages of the sale are counted; this field displays the number of the page. |

Payment Method | The payment method selected when entering a payment for the sale. Data won’t print in this field if more than one payment has been applied to the sale. |

Referral Source | The referral source entered on the transaction |

Sales Value | The total amount of the sale used to compute GST |

Salesperson (Not Basics) | The salesperson entered on the transaction |

Ship Date | The date entered in the Promised Date field on the transaction |

Ship Via | The shipping method entered on the transaction |

Shipping Address | The shipping address entered on the transaction |

Tax | The amount of tax charged for line items and/or freight on the sale |

Tax Code | The tax code applied to each line item in the invoice. |

Tax Code Description | The applicable tax description(s) from the Tax Code List |

Tax Code—Freight | Displays the tax code applied to freight charges if the freight entered on the sale is taxed. |

Tax Code w/o Import (Consolidated) | The code that applies to all consolidated GST codes applied to this sale; any imported GST codes are not shown here. |

Tax Rate | Displays the tax rate applied to each line item in the sale |

Tax Subtotal | The total amount of all taxes applied to line items on the invoice |

Tax Total | The total amount of tax charged for line items and freight on the sale |

Terms | The terms that appear on the top of the transaction, that is, next to the Terms zoom arrow |

Total | The total of the line items plus GST and freight charges. Doesn’t reflect any payments that may have been applied. |

Some fields may not be available on some versions of the form layout.

Invoice—Item

More fields are available to customise this form:

Field name | Data that will print in this field |

|---|---|

*Inv/PO No.* | The number of the transaction with an asterisk before and after it |

ABN (Australia only) | The Australian Business Number (ABN) entered in the Company Information window |

ACN (Australia only) | Your company’s 9-digit Australian Company Number, from the Company Information window |

Amount + GST | The amount of the line item plus the amount of the GST for the line item |

Applied | The total of the payments that have been applied to the sale |

Balance | Amount of the sale including GST and freight charges minus any payments that may have been applied; that is, the amount that appears in the Balance Due field of the sale. |

Barcode | A scannable barcode representation that includes the Payee Number provided when you subscribed to M-Powered Services. The barcode is generated using data from your software and data provided by Australia Post. If you have not entered a valid Payee Number in the Company Information window, “Not Available” will print in this field. |

Category (Not Basics) | The financial tracking category assigned to this sale |

Col | An X is printed if the terms for the sale are COD |

Comment | The comment entered on the transaction |

Company Address | The company address entered in the Company Information window |

Company Name | The company name entered in the Company Information window. |

Cust PO No. | The entry in the Customer PO No. field on the transaction |

Cust/Suppl ABN (Australia only) | The Australian Business Number (ABN) for this customer, from the Card Information window — Selling Details view |

Customer Reference | A reference number for your company that is derived from the Payee Number on the Company Information window. If you have not entered a valid Payee Number in the Company Information window, “Not Available” will print in this field. |

Date | The date entered on the transaction |

Description/Backordered Label | The description of each line item entered on the transaction. The word “Backordered” appears above the line items that are entered in the Backorder column. |

Disc % | The discount entered in the Disc % column of the sale |

Due Date | The date the payment is due, based on the terms of the sale |

Ex Amount | The tax-exclusive amount of each line item entered on the transaction |

Ex Freight | The freight charges that apply to the sale, excluding GST on the freight charges |

Ex Price 2 | The amount of each line item entered on the transaction, exclusive of GST, limited to 2 decimal places |

Ex Subtotal | The subtotal of all amounts on the transaction, exclusive of any GST applied to these amounts |

Ex Subtotal + Freight | The GST-exclusive subtotal amount for each item, including freight charges |

Freight + tax | Includes the freight amount plus the GST on the freight |

GST Total | The total amount of GST charged for line items and freight on the sale |

Inc Amount | The amount of each line item, including the tax applied |

Inc Freight | The freight charges that apply to the sale, including GST on the freight charges |

Inc Price | The amount of each line item entered on the transaction, inclusive of GST. May be shown with 6 decimal places, based on rounding |

Inc Price 2 | The amount of each line item entered on the transaction, inclusive of GST, limited to 2 decimal places |

Inc Subtotal | The total amount of all line items on the sale to which GST is applied |

Invoice No. | The invoice number entered on the transaction |

Invoice Type | The sale status of the invoice (Quote, Order or Invoice) |

Job Description | The description of the job whose job number is entered for a line item |

Job Name | The name of the job whose job number is entered for a line item |

Job Number | The job number entered for a line item |

Line Tax | The amount of tax for each line item |

Mailing Address | The address entered in the Address 1: Bill To selection of the Location field in the Card Information window — Profile view |

Memo | The memo entered in the Journal Memo field of the transaction |

My Item No. | The number of the item entered on the sale. This is the number for the item entered in the Item Information window. |

Original Amount in English | The amount of the sale including GST and freight charges (but not including any payments that may have been applied) in words. Words will print for amounts up to and including 99,999.99; for larger amounts, the amount will print in numeric form. |

Page No. | The pages of the sale are counted; this field displays the number of the page. |

Payment Method | The payment method selected when entering a payment for the sale. Data won’t print in this field if more than one payment has been applied to the sale. |

Ppd | An X is printed if the terms of the sale are Prepaid. |

Price | The amount of each line item entered on the transaction, exclusive of GST. May be shown with 6 decimal places, based on rounding |

Qty/Units | The amount entered in the Ship or Backordered field on the sale |

Referral Source | The referral source entered on the transaction |

Sales Value | The total amount of the sale used to compute GST |

Salesperson (Not Basics) | The salesperson entered on the transaction |

Ship Date | The date entered in the Promised Date field on the transaction |

Ship Via | The shipping method entered on the transaction |

Shipping Address | The shipping address entered on the transaction |

Tax | The amount of tax charged for line items and/or freight on the sale |

Tax Code—Freight | Displays the tax code applied to freight charges if the freight entered on the sale is taxed. |

Tax Code | The tax code applied to each line item in the invoice. |

Tax Code Description | The applicable tax description(s) from the Tax Code List |

Tax Code w/o Import (Consolidated) | The code that applies to all consolidated GST codes applied to this sale; any imported GST codes are not shown here. |

Tax Rate | Displays the tax rate applied to each line item in the sale |

Tax Total | The total amount of tax charged for line items and freight on the sale |

Terms | The terms that appear on the top of the transaction, that is, next to the Terms zoom arrow |

Total | The total of the line items plus GST and freight charges. Doesn’t reflect any payments that may have been applied. |

Total Qty/Units | The total of all amounts in the Qty/Units column |

Unit | The entry in the Selling Unit of Measure field in the Selling Details view of the Item Information window for the line item |

Some fields may not be available on some versions of the form layout.

Invoice—Professional

More fields are available to customise this form:

Field name | Data that will print in this field |

|---|---|

*Inv/PO No.* | The number of the transaction with an asterisk before and after it |

ABN (Australia only) | The Australian Business Number (ABN) entered in the Company Information window |

ACN (Australia only) | Your company’s 9-digit Australian Company Number, from the Company Information window |

Applied | The total of the payments that have been applied to the sale |

Balance | Amount of the sale including GST and freight charges minus any payments that may have been applied; that is, the amount that appears in the Balance Due field of the sale. |

Barcode | A scannable barcode representation that includes the Payee Number provided when you subscribed to M-Powered Services. The barcode is generated using data from your software and data provided by Australia Post. If you have not entered a valid Payee Number in the Company Information window, “Not Available” will print in this field. |

Category (Not Basics) | The financial tracking category assigned to this sale |

Comment | The comment entered on the transaction |

Company Address | The company address entered in the Company Information window |

Company Name | The company name entered in the Company Information window. |

Cust PO No. | The entry in the Customer PO No. field on the transaction |

Customer Reference | A reference number for your company that is derived from the Payee Number on the Company Information window. If you have not entered a valid Payee Number in the Company Information window, “Not Available” will print in this field. |

Cust/Suppl ABN (Australia only) | The Australian Business Number (ABN) for this customer, from the Card Information window — Selling Details view |

Date | The date entered on the transaction |

Description | The description of each line item entered on the transaction |

Due Date | The date the payment is due, based on the terms of the sale |

Ex Amount | The tax-exclusive amount of each line item entered on the transaction |

Ex Subtotal | The subtotal of all amounts on the transaction, exclusive of any GST applied to these amounts |

Invoice No. | The invoice number entered on the transaction |

Invoice Type | The sale status of the invoice (Quote, Order or Invoice) |

Job Description | The description of the job whose job number is entered for a line item |

Job Name | The name of the job whose job number is entered for a line item |

Job Number | The job number entered for a line item |

Line Tax | The amount of tax for each line item |

Mailing Address | The address entered in the Address 1: Bill To selection of the Location field in the Card Information window — Profile view |

Memo | The memo entered in the Journal Memo field of the transaction |

Original Amount in English | The amount of the sale including GST and freight charges (but not including any payments that may have been applied) in words. Words will print for amounts up to and including 99,999.99; for larger amounts, the amount will print in numeric form. |

Page No. | The pages of the sale are counted; this field displays the number of the page. |

Payment Method | The payment method selected when entering a payment for the sale. Data won’t print in this field if more than one payment has been applied to the sale. |

Reference Date | The date of service for each line item entered on the transaction |

Referral Source | The referral source entered on the transaction |

Sales Value | The total amount of the sale used to compute GST |

Salesperson (Not Basics) | The salesperson entered on the transaction |

Shipping Date | The date entered in the Promised Date field on the transaction |

Tax | The amount of tax charged for line items and/or freight on the sale |

Tax Code | The tax code applied to each line item in the invoice. |

Tax Code Description | The applicable tax description(s) from the Tax Code List |

Tax Code w/o Import (Consolidated) | The code that applies to all consolidated GST codes applied to this sale; any imported GST codes are not shown here. |

Tax Rate | Displays the tax rate applied to each line item in the sale |

Tax Total | The total amount of tax charged for line items and freight on the sale |

Terms | The terms that appear on the top of the transaction, that is, next to the Terms zoom arrow |

Total | The total of the line items plus GST and freight charges. Doesn’t reflect any payments that may have been applied. |

Some fields may not be available on some versions of the form layout.

Invoice—Time Billing

Supplemental fields from the Card Information window and Supplemental fields from the Company Information window are also available to customise this form.

Field name | Data that will print in this field |

|---|---|

Applied | The total of the payments that have been applied to the sale |

Balance | Amount of the sale including GST and freight charges minus any payments that may have been applied; that is, the amount that appears in the Balance Due field of the sale. When the preference I include Items on Time Billing Invoices is marked, freight can be included on the Time Billing invoice layout, and the data in this field will include any freight charges entered. |

Barcode | A scannable barcode representation that includes the Payee Number provided when you subscribed to M-Powered Services. The barcode is generated using data from your software and data provided by Australia Post. If you have not entered a valid Payee Number in the Company Information window, “Not Available” will print in this field. |

Category | The financial tracking category assigned to the transaction associated with this invoice |

Comment | The comment entered on the transaction |

Company Address | The company address entered in the Company Information window |

Company Name | The company name entered in the Company Information window. |

Cust PO No. | The entry in the Customer PO No. field on the transaction |

Customer Reference | A reference number for your company that is derived from the Payee Number on the Company Information window. If you have not entered a valid Payee Number in the Company Information window, “Not Available” will print in this field. |

Date | The date entered on the transaction |

Description/Backordered Label | The description entered in the Notes column on the transaction |

Due Date | The date the payment is due, based on the terms of the sale |

Invoice No. | The invoice number entered on the transaction |

Invoice Type | The sale status of the invoice (Quote, Order or Invoice) |

Job Description | The description of the job whose job number is entered for a line item |

Job Name | The name of the job whose job number is entered for a line item |

Job Number | The job number entered for a line item |

Mailing Address | The address entered in the Address 1: Bill To selection of the Location field in the Card Information window — Profile view |

Memo | The memo entered in the Journal Memo field of the transaction |

My Activity No. | Activity number from the Activity Information window — Profile view or the Item number from the Item Information window — Profile view. When the preference I include Items on Time Billing Invoices is marked, item numbers can appear in this field. |

Original Amount in English | The amount of the sale including GST and freight charges (but not including any payments that may have been applied) in words. Words will print for amounts up to and including 99,999.99; for larger amounts, the amount will print in numeric form. |

Page No. | The pages of the sale are counted; this field displays the number of the page. |

Payment Method | The payment method selected when entering a payment for the sale. Data won’t print in this field if more than one payment has been applied to the sale. |

Qty/Units | The amount entered in the Hours/Units field on the sale |

Reference Date | The date of service for each line item entered on the transaction |

Referral Source | The referral source entered on the transaction |

Sales Value | The total amount of the sale used to compute GST |

Ship Date | The date entered in the Promised Date field on the transaction |

Ship Via | The shipping method entered on the transaction. When the preference I include Items on Time Billing Invoices is marked, this field can appear on the Time Billing invoice layout. |

Shipping Address | The shipping address entered on the transaction. When the preference I include Items on Time Billing Invoices is marked, this field can appear on the Time Billing invoice layout. |

Terms | The terms that appear on the top of the transaction (that is, next to the Terms zoom arrow) |

Total | The total of the line items plus GST and freight charges. (Doesn’t reflect any payments that may have been applied.) When the preference I include Items on Time Billing Invoices is marked, freight can be entered on the Time Billing invoice layout, and this total will include any freight charges entered. |

Total Qty/Units | The total of all amounts in the Qty/Units column |

Unit | The entry in the Unit of Measurements field of the Activity Information window |

Some fields may not be available on some versions of the form layout.

Labels—Service

Supplemental fields from the Card Information window and Supplemental fields from the Company Information window can also be used on this form.

Field name | Data that will print in this field |

|---|---|

*Inv/PO No.* | The number of the transaction with an asterisk before and after it |

Comment | The comment entered on the transaction |

Cust PO No. | The entry in the Customer PO No. field on the transaction |

Date | The date entered on the transaction |

Invoice No. | The invoice number entered on the transaction |

Ship Date | The date entered in the Promised Date field on the transaction |

Ship Via | The ship method entered on the transaction |

Shipping Address | The shipping address entered on the transaction |

Some fields may not be available on some versions of the form layout.

Labels—Item

Supplemental fields from the Card Information window and Supplemental fields from the Company Information window can also be used on this form.

Field name | Data that will print in this field |

|---|---|

*Inv/PO No.* | The number of the transaction with an asterisk before and after it |

Comment | The comment entered on the transaction |

Cust PO No. | The entry in the Customer PO No. field on the transaction |

Date | The date entered on the transaction |

Invoice No. | The invoice number entered on the transaction |

No. of items | The total number of items entered in the Shipped column of the sale |

Ship Date | The date entered in the Promised Date field on the transaction |

Ship Via | The ship method entered on the transaction |

Shipping Address | The shipping address entered on the transaction |

Some fields may not be available on some versions of the form layout.

Labels—Professional

Supplemental fields from the Card Information window and Supplemental fields from the Company Information window can also be used on this form.

Field name | Data that will print in this field |

|---|---|

*Inv/PO No.* | The number of the transaction with an asterisk before and after it |

Comment | The comment entered on the transaction |

Cust PO No. | The entry in the Customer PO No. field on the transaction |

Date | The date entered on the transaction |

Invoice No. | The invoice number entered on the transaction |

Mailing Address | The address entered in the Address 1: Bill To selection of the Location field in the Card Information window — Profile view |

Ship Date | The date entered in the Promised Date field on the transaction |

Some fields may not be available on some versions of the form layout.

Labels—Time Billing (Not Basics)

Supplemental fields from the Card Information window and Supplemental fields from the Company Information window can also be used on this form.

Field name | Data that will print in this field |

|---|---|

*Inv/PO No.* | The number of the transaction with an asterisk before and after it |

Comment | The comment entered on the transaction |

Cust PO No. | The entry in the Customer PO No. field on the transaction |

Date | The date entered on the transaction |

Mailing Address | The address entered in the Address 1: Bill To selection of the Location field in the Card Information window — Profile view |

Ship Date | The date entered in the Promised Date field on the transaction |

Ship Via | The ship method entered on the transaction |

Shipping Address | The shipping address entered on the transaction |

Some fields may not be available on some versions of the form layout.

Packing Slip—Service (Not Basics)

More fields are available to customise this form:

Field name | Data that will print in this field |

|---|---|

*Inv/PO No.* | The number of the transaction with an asterisk before and after it |

Applied | The total of the payments that have been applied to the sale |

Balance | Amount of the sale including GST and freight charges minus any payments that may have been applied; that is, the amount that appears in the Balance Due field of the sale. |

Category | The financial tracking category assigned to this sale |

Comment | The comment entered on the transaction |

Company Address | The company address entered in the Company Information window |

Company Name | The company name entered in the Company Information window. |

Date | The date entered on the transaction |

Description | The description of each line item entered on the transaction |

Due Date | The date the payment is due, based on the terms of the sale |

Ex Subtotal + Freight | The GST-exclusive subtotal amount for each item, including freight charges |

Freight | The freight amount entered on the sale. Includes the freight amount plus the GST on the freight |

Freight + tax | Includes the freight amount plus the GST on the freight |

Inc Freight | The charge including freight |

Invoice Type | The sale status of the invoice (Quote, Order or Invoice) |

Job Description | The description of the job whose job number is entered for a line item |

Job Name | The name of the job whose job number is entered for a line item |

Job Number | The job number entered for a line item |

Mailing Address | The address entered in the Address 1: Bill To selection of the Location field in the Card Information window — Profile view |

Memo | The memo entered in the Journal Memo field of the transaction |

Original Amount in English | The amount of the sale including GST and freight charges (but not including any payments that may have been applied) in words. Words will print for amounts up to and including 99,999.99; for larger amounts, the amount will print in numeric form. |

Page No. | The pages of the sale are counted; this field displays the number of the page. |

Payment Method | The payment method selected when entering a payment for the sale. Data won’t print in this field if more than one payment has been applied to the sale. |

Referral Source | The referral source entered on the transaction |

Sales Value | The total amount of the sale used to compute GST |

Ship Date | The date entered in the Promised Date field on the transaction |

Ship Via | The shipping method entered on the transaction |

Shipping Address | The shipping address entered on the transaction |

Terms | The terms that appear on the top of the transaction, that is, next to the Terms zoom arrow |

Total | The total of the line items plus GST and freight charges. Doesn’t reflect any payments that may have been applied. |

None | The title of the form appears in this text field. You may edit this title like any other form text field. |

Some fields may not be available on some versions of the form layout.

Packing Slip—Item (Not Basics)

More fields are available to customise this form:

Field name | Data that will print in this field |

|---|---|

*Inv/PO No.* | The number of the transaction with an asterisk before and after it |

Applied | The total of the payments that have been applied to the sale |

Balance | Amount of the sale including GST and freight charges minus any payments that may have been applied; that is, the amount that appears in the Balance Due field of the sale. |

Category | The financial tracking category assigned to this sale |

Col | An X is printed if the terms for the sale are COD |

Comment | The comment entered on the transaction |

Company Address | The company address entered in the Company Information window |

Company Name | The company name entered in the Company Information window. |

Cust PO No. | The entry in the Customer PO No. field on the transaction |

Date | The date entered on the transaction |

Description/Backordered Label | The description of each line item entered on the transaction. The text “Backordered” appears above the line items that are entered in the Backorder column. |

Disc % | The discount entered in the Disc% column of the sale. |

Due Date | The date the payment is due, based on the terms of the sale. |

Freight + tax | Includes the freight amount plus the GST on the freight |

Invoice Type | The sale status of the invoice (Quote, Order or Invoice) |

Job Description | The description of the job whose job number is entered for a line item |

Job Name | The name of the job whose job number is entered for a line item |

Job Number | The job number entered for a line item |

Mailing Address | The address entered in the Address 1: Bill To selection of the Location field in the Card Information window — Profile view |

Memo | The memo entered in the Journal Memo field of the transaction |

Original Amount in English | The amount of the sale including GST and freight charges (but not including any payments that may have been applied) in words. Words will print for amounts up to and including 99,999.99; for larger amounts, the amount will print in numeric form. |

Packing Item No. | The item number that is recorded in the Item Information window and entered when the item is sold |

Page No. | The pages of the sale are counted; this field displays the number of the page. |

Payment Method | The payment method selected when entering a payment for the sale. Data won’t print in this field if more than one payment has been applied to the sale. |

Ppd | An X is printed if the terms for the sale are Prepaid. |

Price | The amount entered in the Price column of the sale. |

Qty/Units | The amount entered in the Ship or Backordered field on the sale |

Referral Source | The referral source entered on the transaction |

Ship Date | The date entered in the Promised Date field on the transaction |

Ship Via | The shipping method entered on the transaction |

Shipping Address | The shipping address entered on the transaction |

Subtotal | The total of the line item amounts on the sale (no GST included). |

Subtotal + GST | Includes the subtotal amount plus the GST on the subtotal |

Terms | The terms that appear on the top of the transaction, that is, next to the Terms zoom arrow |

Total | The total of the line items plus GST and freight charges. Doesn’t reflect any payments that may have been applied. |

Unit | The entry in the Selling Unit of Measure field in the Selling Details view of the Item Information window for the line item |

None | The title of the form appears in this text field. You may edit this title like any other form text field. |

Some fields may not be available on some versions of the form layout.

Packing Slip—Professional (Not Basics)

More fields are available to customise this form:

Field name | Data that will print in this field |

|---|---|

*Inv/PO No.* | The number of the transaction with an asterisk before and after it |

Applied | The total of the payments that have been applied to the sale |

Balance | Amount of the sale including GST and freight charges minus any payments that may have been applied; that is, the amount that appears in the Balance Due field of the sale. |

Category | The financial tracking category assigned to this sale |

Comment | The comment entered on the transaction |

Company Address | The company address entered in the Company Information window |

Company Name | The company name entered in the Company Information window. |

Cust PO No. | The entry in the Customer PO No. field on the transaction |

Date | The date entered on the transaction |

Description | The description of each line item entered on the transaction. |

Due Date | The date the payment is due, based on the terms of the sale. |

Invoice Type | The sale status of the invoice (Quote, Order or Invoice) |

Job Description | The description of the job whose job number is entered for a line item |

Job Name | The name of the job whose job number is entered for a line item |

Job Number | The job number entered for a line item |

Mailing Address | The address entered in the Address 1: Bill To selection of the Location field in the Card Information window — Profile view |

Memo | The memo entered in the Journal Memo field of the transaction |

Original Amount in English | The amount of the sale including GST and freight charges (but not including any payments that may have been applied) in words. Words will print for amounts up to and including 99,999.99; for larger amounts, the amount will print in numeric form. |

Page No. | The pages of the sale are counted; this field displays the number of the page. |

Payment Method | The payment method selected when entering a payment for the sale. Data won’t print in this field if more than one payment has been applied to the sale. |

Reference Date | The date of service for each line item entered on the transaction. |

Referral Source | The referral source entered on the transaction |

Ship Date | The date entered in the Promised Date field on the transaction |

Subtotal | The total of the line item amounts on the sale (no GST included). |

Subtotal + GST | Includes the subtotal amount plus the GST on the subtotal |

Terms | The terms that appear on the top of the transaction, that is, next to the Terms zoom arrow |

Total | The total of the line items plus GST and freight charges. Doesn’t reflect any payments that may have been applied. |

None | The title of the form appears in this text field. You may edit this title like any other form text field. |

Some fields may not be available on some versions of the form layout.

Remittance Advice—Pay Bills (Not Basics)

Supplemental fields from the Company Information window can also be used on this form.

Field name | Data that will print in this field |

|---|---|

Category | The financial tracking category assigned to this sale |

Cheque Amount | The amount entered on the transaction in numeric form |

Cheque Number | The cheque number entered on the transaction |

Company Address | The company address entered in the Company Information window |

Company Name | The company name entered in the Company Information window |

Finance Charges | The total amount of the finance charge from each invoice within the Pay Bills transaction |

Finance Charges—Label | The finance charge label for the invoice field within the Pay Bills transaction |

Memo | The memo entered in the Journal Memo field of the transaction |

Page No. | The pages of the transaction are counted; this field displays the number of the page. |

Payee | The name and address of the selected supplier, as entered in the supplier card. |

Account Name | The name of the account selected in the transaction window (Pay Bills, Spend Money or Credit Refund) |

Account No. | The number of the account selected in the transaction window (Pay Bills, Spend Money or Credit Refund) |

Allocation Amount | The allocation amount entered on the transaction |

Invoice Debit Memos | The total of any debit memos posted against this bill |

Invoice Discounts | The total discounts that have been applied to this bill |

Invoice Payments | The total payments that have been applied to pay this bill |

Invoice Total Amount | The original value of the bill |

Invoice Total Debits | The total of payments and debit memos posted against this bill |

Some fields may not be available on some versions of the form layout.

Remittance Advice—Spend Money

Supplemental fields from the Company Information window can also be used on this form.

Field name | Data that will print in this field |

|---|---|

A.B.N (Australia only) | The Australian Business Number (ABN) entered in the Company Information window |

A.B.N Branch (Australia only) | The A.B.N. Branch number entered in the Company Information window |

A.C.N (Australia only) | Your company’s 9-digit Australian Company Number, from the Company Information window |

Category (Not Basics) | The financial tracking category assigned to this sale |

Cheque Amount | The amount entered on the transaction in numeric form |

Cheque Number | The cheque number entered on the transaction |

Company Address | The company address entered in the Company Information window |

Company Name | The company name entered in the Company Information window |

Memo | The memo entered in the Journal Memo field of the transaction |

Page No. | The pages of the transaction are counted; this field displays the number of the page. |

Payee | The name and address of the selected supplier, as entered in the supplier card. |

Payment Date | The date entered Payment Date field on the transaction |

Sales Tax Number | The Sales Tax Number from the Company Information window |

Supplier's A.B.N (Australia only) | The Australian Business Number (ABN) for this supplier, from the Card Information window — Buying Details view |

Account Name | The name of the account selected in the transaction window (Pay Bills, Spend Money or Credit Refund) |

Account No. | The number of the account selected in the transaction window (Pay Bills, Spend Money or Credit Refund) |

Allocation Amount | The allocation amount entered on the transaction |

Allocation Memo | The allocation memo entered on the transaction |

Some fields may not be available on some versions of the form layout.

Remittance Advice—Credit Refund

Supplemental fields from the Company Information window can also be used on this form.

Field name | Data that will print in this field |

|---|---|

A.B.N (Australia only) | The Australian Business Number (ABN) entered in the Company Information window |

A.B.N Branch (Australia only) | The A.B.N. Branch number entered in the Company Information window |

A.C.N (Australia only) | Your company’s 9-digit Australian Company Number, from the Company Information window |

Category (Not Basics) | The financial tracking category assigned to this sale |

Cheque Amount | The amount entered on the transaction in numeric form |

Cheque Number | The cheque number entered on the transaction |

Company Address | The company address entered in the Company Information window |

Company Name | The company name entered in the Company Information window |

Memo | The memo entered in the Journal Memo field of the transaction |

Page No. | The pages of the transaction are counted; this field displays the number of the page. |

Payee | The name and address of the selected supplier, as entered in the supplier card. |

Payment Date | The date entered Payment Date field on the transaction |

Account Name | The name of the account selected in the transaction window (Pay Bills, Spend Money or Credit Refund) |

Account No. | The number of the account selected in the transaction window (Pay Bills, Spend Money or Credit Refund) |

Allocation Amount | The allocation amount entered on the transaction |

Allocation Memo | The allocation memo entered on the transaction |

Some fields may not be available on some versions of the form layout.

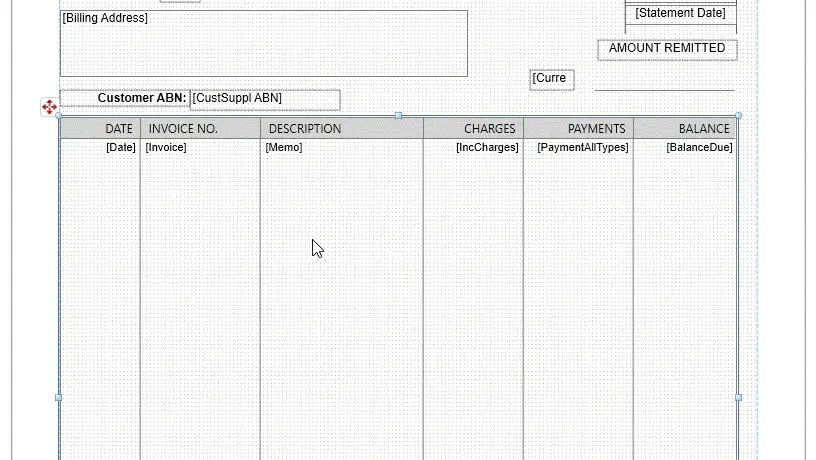

Statements—Invoice

Supplemental fields from the Card Information window and Supplemental fields from the Company Information window can also be used on this form.

Field name | Data that will print in this field |

|---|---|

*Inv/PO No.* | The number assigned to each sales transaction with an asterisk before and after it |

“Amount Remitted” | None. The basic form layout provides only a text title here, allowing you to present this portion of the statement to your customer as a remittance stub. Your customer may enter a remittance amount on the horizontal line below this text. |

1st Ageing Period | The entry in this field depends on your selections for Ageing in the Reports & Forms tab of the Preferences window. If you selected Daily Ageing, a number of days is displayed. The field displays the greatest number of days an invoice can be overdue for the 1st Period. For example, if “30 Days” is the entry in the Period 1 field, this entry is the title for amounts that are overdue 1 to 30 days. (Overdue amounts appear in the Period 1 data field.) If you selected Monthly Ageing and Identify by Month Names, the name of the month previous to the current month is displayed; this entry represents the month in which the invoice became overdue. If you selected Monthly Ageing and Identify by Month Numbers, the entry is 1 Month; this entry is the title for how many months the invoice is overdue. |

2nd Ageing Period | The entry in this field depends on your selections for Ageing in the Reports & Forms view of the Preferences window. If you selected Daily Ageing, a number of days is displayed. The field displays the greatest number of days an invoice can be overdue for the 2nd Period. For example, if “60 Days” is the entry in the Period 2 field, the entry is the title for amounts that are 31 to 60 days overdue. (Overdue amounts appear in the Period 2 data field.) If you selected Monthly Ageing and Identify by Month Names, the name of the month that is two months previous to the current month is displayed; the entry represents the month in which the invoice became overdue. If you selected Monthly Ageing and Identify by Month Numbers, the entry is 2 Months; this entry is the title for how many months the invoice is overdue. |

3rd Ageing Period | The entry in this field depends on your selections for Ageing in the Reports & Forms view of the Preferences window. If you selected Daily Ageing, a number of days is displayed. The field displays the greatest number of days an invoice can be overdue for the 3rd Period. For example, if “60+ Days” is the entry in the Period 3 field, the entry is the title for amounts that are overdue more than 60 days. (Overdue amounts appear in the Period 3 data field.) If you selected Monthly Ageing and Identify by Month Names, the name of the month that is three months previous to the current month is displayed; the entry represents the period in which the invoice became overdue. If you selected Monthly Ageing and Identify by Month Numbers, the entry is 2+Months; this entry is the title for how many months the invoice is overdue. |

Balance Due | Amount of the sale including GST and freight charges minus any payments that have been applied. This is the amount that appears in the Balance Due field of each sale. |

Barcode | A scannable barcode representation that includes the Payee Number provided when you subscribed to M-Powered services. The barcode is generated using data from your software and data provided by Australia Post. If you have not entered a valid Payee Number in the Company Information window, “Not Available” will print in this field. |

Billing Address | The address entered in the Address 1: Bill To selection of the Location field in the Card Information window — Profile view |

Company Address | The company address entered in the Company Information window |

Company Name | The company name entered in the Company Information window |

Current Date | The date shown in your company file; the date the statement is printed and on which any finance charges will be applied to an outstanding balance. |

Current | The total of the balance due amounts that isn’t past the payment due date. The amount is calculated using the terms that appear in the Terms field of each invoice. |

Customer Reference | A reference number for your company that is derived from the Payee Number on the Company Information window. If you have not entered a valid Payee Number in the Company Information window, “Not Available” will print in this field. |

Cust PO No. | The entry in the Customer PO No. field on each transaction |

Cust/Suppl ABN (Australia only) | The Australian Business Number (ABN) for this customer, from the Card Information window — Selling Details view |

Date | The date entered on each invoice and payment on the statement |

Deposits Balance | The total amount of deposits available to be applied to this customer’s orders. |

Ex Charge | The amount due each invoice, exclusive of any finance charges. Finance charges are added to the amount due only if you’ve marked “Add Finance Charges to Amount Due” in the Advanced Filters window. |

Ex Total | The total amount due on the open invoices, minus any finance charges. Finance charges are added to the amount due only if you’ve marked “Add Finance Charges to Amount Due” in the Advanced Filters window. |

Finance Charges | The total finance charge made to this customer as of the date the statement is printed |

Finance Charges—Label | Displays a title for the amount appearing in the Finance Charges data field. |

ID# | Displays the number of each invoice and the number of each payment applied to the invoice. |

Inc Charges | The amount that appears in the Total Amount field of each invoice (includes any finance charges) |

Inc Total | The total amount due on the open invoices, including the amount of any applicable taxes. Finance charges are added to the amount due only if you’ve marked “Add Finance Charges to Amount Due” in the Advanced Filters window. |

Invoice No. | The invoice number entered on the sale. (An invoice statement lists only invoices that are open.) |

Memo | The memo entered on each invoice |

Page No. | The pages of the statement are counted; this field displays the number on each page. |

Payments—All Types | Displays all payments applied to each invoice, including credits, discounts and payments received. |

Payments—Credits Applied | Displays all credits applied to each invoice. |

Payments—Discounts Applied | Displays all discounts applied to each invoice. |

Payments—Received Payments | Displays all payments received for each invoice. |

Period 1 | The total amount overdue in the 1st Ageing Period. This amount is calculated using the terms that appear in the Terms field of each invoice. (For information about the 1st Ageing Period, see that field’s information in this table.) |

Period 2 | The total amount overdue in the 2nd Ageing Period. This amount is calculated using the terms that appear in the Terms field of each invoice. (For information about the 2nd Ageing Period, see that field’s information in this table.) |

Period 3 | The total amount overdue in the 3rd Ageing Period. This amount is calculated using the terms that appear in the Terms field of each invoice. (For information about the 3rd Ageing Period, see that field’s information in this table.) |

Statement Date | The date on which the statement was created. |

Tax | The amount of tax charged on each invoice on the statement |

GST Subtotal | The total amount of all GST applied to all invoices on the statement |

None | The title of the form appears in this text field. You may edit this title like any other form text field. |

Some fields may not be available on some versions of the form layout.

Statements—Activity

Supplemental fields from the Card Information window and Supplemental fields from the Company Information window can also be used on this form.

Field name | Data that will print in this field |

|---|---|

“Amount Remitted” | None. The basic form layout provides only a text title here, allowing you to present this portion of the statement to your customer as a remittance stub. Your customer may enter a remittance amount on the horizontal line below this text. |

1st Ageing Period | The entry in this field depends on your selections for Ageing in the Reports & Forms view of the Preferences window. If you selected Daily Ageing, a number of days is displayed. The field displays the greatest number of days an invoice can be overdue for the 1st Period. For example, if “30 Days” is the entry in the Period 1 field, this entry is the title for amounts that are overdue 1 to 30 days. (Overdue amounts appear in the Period 1 data field.) If you selected Monthly Ageing and Identify by Month Names, the name of the month previous to the current month is displayed; this entry represents the month in which the invoice became overdue. If you selected Monthly Ageing and Identify by Month Numbers, the entry is 1 Month; this entry is the title for how many months the invoice is overdue. |

2nd Ageing Period | The entry in this field depends on your selections for Ageing in the Reports & Forms view of the Preferences window. If you selected Daily Ageing, a number of days is displayed. The field displays the greatest number of days an invoice can be overdue for the 2nd Period. For example, if “60 Days” is the entry in the Period 2 field, the entry is the title for amounts that are 31 to 60 days overdue. (Overdue amounts appear in the Period 2 data field.) If you selected Monthly Ageing and Identify by Month Names, the name of the month that is two months previous to the current month is displayed; the entry represents the month in which the invoice became overdue. If you selected Monthly Ageing and Identify by Month Numbers, the entry is 2 Months; this entry is the title for how many months the invoice is overdue. |

3rd Ageing Period | The entry in this field depends on your selections for Ageing in the Reports & Forms view of the Preferences window. If you selected Daily Ageing, a number of days is displayed. The field displays the greatest number of days an invoice can be overdue for the 3rd Period. For example, if “60+ Days” is the entry in the Period 3 field, the entry is the title for amounts that are overdue more than 60 days. (Overdue amounts appear in the Period 3 data field.) If you selected Monthly Ageing and Identify by Month Names, the name of the month that is three months previous to the current month is displayed; the entry represents the period in which the invoice became overdue. If you selected Monthly Ageing and Identify by Month Numbers, the entry is 2+Months; this entry is the title for how many months the invoice is overdue. |

As Of Date | The first date on which charges in this statement were posted. |

Balance Due | Amount of the sale including GST and freight charges minus any payments that have been applied. This is the amount that appears in the Balance Due field of each sale. |

Balance | The balance carried forward for this customer, as at the “Activity From” date |

Barcode | A scannable barcode representation that includes the Payee Number provided when you subscribed to M-Powered services. The barcode is generated using data from your software and data provided by Australia Post. If you have not entered a valid Payee Number in the Company Information window, “Not Available” will print in this field. |

Billing Address | The address entered in the Address 1: Bill To selection of the Location field in the Card Information window — Profile view |

Company Address | The company address entered in the Company Information window |

Company Name | The company name entered in the Company Information window |

Current | The total of the balance due amounts that isn’t past the payment due date. The amount is calculated using the terms that appear in the Terms field of each invoice. |

Current Date | The date shown in your system for the date the statement is printed. |

Cust PO No. | The entry in the Customer PO No. field on each transaction |

Customer Reference | A reference number for your company that is derived from the Payee Number on the Company Information window. If you have not entered a valid Payee Number in the Company Information window, “Not Available” will print in this field. |

Cust/Suppl ABN (Australia only) | The Australian Business Number (ABN) for this customer, from the Card Information window — Selling Details view |

Date | The date entered on each invoice and payment on the statement |

Deposits Balance | The total amount of deposits available to be applied to this customer’s orders. |

Ex Charge | The amount due each invoice, exclusive of any finance charges. Finance charges are added to the amount due only if you’ve marked “Add Finance Charges to Amount Due” in the Advanced Filters window. |

Ex Total | The total amount due on the open invoices, minus any finance charges. Finance charges are added to the amount due only if you’ve marked “Add Finance Charges to Amount Due” in the Advanced Filters window. |

Finance Charges | The total finance charge made to this customer as of the date the statement is printed |

Finance Charges—Label | Displays a title for the amount appearing in the Finance Charges data field. |

Inc Charges | The amount that appears in the Total Amount field of each invoice (includes any finance charges) |

Inc Total | The total amount due on the open invoices, including the amount of any applicable taxes. Finance charges are added to the amount due only if you’ve marked “Add Finance Charges to Amount Due” in the Advanced Filters window. |

Memo | The memo entered on each invoice |

Page No. | The pages of the statement are counted; this field displays the number on each page. |

Payment | The amount that appears in the Applied to Date field of each invoice |

Period 1 | The total amount overdue in the 1st Ageing Period. This amount is calculated using the terms that appear in the Terms field of each invoice. (For information about the 1st Ageing Period, see that field’s information in this table.) |

Period 2 | The total amount overdue in the 2nd Ageing Period. This amount is calculated using the terms that appear in the Terms field of each invoice. (For information about the 2nd Ageing Period, see that field’s information in this table.) |

Period 3 | The total amount overdue in the 3rd Ageing Period. This amount is calculated using the terms that appear in the Terms field of each invoice. (For information about the 3rd Ageing Period, see that field’s information in this table.) |

Ref. No. | The number entered on each invoice, order and payment. |

Tax | The amount of tax charged on each invoice on the statement |

To Date | The date shown in your system; this is the date on which finance charges (if any) are applied to any outstanding balance |

None | The title of the form appears in this text field. You may edit this title like any other form text field. |

Some fields may not be available on some versions of the form layout.

Mailing Labels

Supplemental fields from the Card Information window can also be used on this form.

Field name | Data that will print in this field |

|---|---|

First Address | The address entered in the Address 1: Bill To selection of the Location field in the Card Information window — Profile view |

Name | The name entered in the Name field of the Card Information window — Profile view |

Some fields may not be available on some versions of the form layout.

Purchase Order—Service (Not Basics)

Supplemental fields from the Card Information window and Supplemental fields from the Company Information window can also be used on this form.

Field name | Data that will print in this field |

|---|---|

*Inv/PO No.* | The number of the transaction with an asterisk before and after it |

Amount | The amount of each line item entered on the transaction |

Amount + GST | The amount of the line item plus the amount of GST for the line item |

Applied | The total of the payments that have been applied to this purchase |

Balance | Amount of purchase including GST and freight charges minus any payments that may have been applied. This is the amount that appears in the Balance Due field of the purchase. |

Category | The financial tracking category assigned to this purchase |

Comment | The comment entered on the transaction |

Company Address | The company address entered in the Company Information window |

Company Name | The company name entered in the Company Information window |

Date | The date entered on the transaction |

Description | The description of each line item entered on the transaction |

Due Date | The date the payment is due, based on the terms of the purchase |

Ex Subtotal + Freight | The GST-exclusive subtotal amount for each item, including freight charges |

Freight + GST | Includes the freight amount plus the GST on the freight |

Job Description | The description of the job whose job number is entered for a line item |

Job Name | The name of the job whose job number is entered for a line item |

Job Number | The job number entered for a line item |

Mailing Address | The address entered in the Address 1: Bill To selection of the Location field in the Card Information window — Profile view |

Memo | The memo entered in the Journal Memo field of the transaction |

Original Amount in English | The amount of the purchase including GST and freight charges (but not including any payments that may have been applied). Amounts up to and including 99,999.99 are printed in words; larger amounts are printed in numeric form. |

Page No. | The pages of the purchase are counted; this field displays the number of the page |

Purchase Type | The type of the purchase at the time it is printed — Bill, Order or Quote |

Purchases Value | The total amount of the purchase used to compute GST |

Shipping Address | The shipping address entered on the transaction |

Ship Date | The date entered in the Promised Date field on the transaction |

Ship Via | The shipping method entered on the transaction |

Supp Inv No. | The entry in the Supplier Inv No. field on the transaction |

Terms | The terms that appear on the top of the transaction, next to the Terms zoom arrow |

Total | The total of the line items plus GST and freight charges. Doesn’t reflect any payments that may have been applied. |

Some fields may not be available on some versions of the form layout.

Purchase Order—Item (Not Basics)

More fields are available to customise this form:

Field name | Data that will print in this field |

|---|---|

*Inv/PO No.* | The number of the transaction with an asterisk before and after it |

Amount | The amount of each line item entered on the transaction |

Amount + GST | The amount of the line item plus the amount of GST for the line item |

Applied | The total of the payments that have been applied to this purchase |

Balance | Amount of purchase including GST and freight charges minus any payments that may have been applied. This is the amount that appears in the Balance Due field of the purchase. |

Category | The financial tracking category assigned to this purchase |

Col | An X is printed if the terms for the purchase are COD |

Comment | The comment entered on the transaction |

Company Address | The company address entered in the Company Information window |

Company Name | The company name entered in the Company Information window |

Cust PO No. | The entry in the Customer PO No. field on the transaction |

Date | The date entered on the transaction |

Description/Backordered Label | The description of each line item entered on the transaction. The text “Backordered” appears above the line items that are entered in the Backorder column. |

Disc % | The discount entered in the Disc% column of the purchase |

Due Date | The date the payment is due, based on the terms of the purchase |

Ex Subtotal + Freight | The GST-exclusive subtotal amount for each item, including freight charges |

Freight + GST | Includes the freight amount plus the GST on the freight |

Inc Price | The price of each line item entered on the transaction, inclusive of GST. May be shown up to 6 decimal places, based on rounding |

Inc Price 2 | The price of each line item entered on the transaction, inclusive of GST. Limited to 2 decimal places |

Job Description | The description of the job whose job number is entered for a line item |

Job Name | The name of the job whose job number is entered for a line item |

Job Number | The job number entered for a line item |

Mailing Address | The address entered in the Address 1: Bill To selection of the Location field in the Card Information window — Profile view |

Memo | The memo entered in the Journal Memo field of the transaction |

My Item No. | The number of the item entered on the purchase, which is the number for the item entered in the Item Information window |

Original Amount in English | The amount of the purchase including GST and freight charges (but not including any payments that may have been applied). Amounts up to and including 99,999.99 are printed in words; larger amounts are printed in numeric form. |

Page No. | The pages of the purchase are counted; this field displays the number of the page |

Ppd | An X is printed if the terms for the purchase are Prepaid. |

Price | The price of each line item entered on the transaction, exclusive of GST. May be shown up to 6 decimal places, based on rounding |

Price 2 | The price of each line item entered on the transaction, exclusive of GST. Limited to 2 decimal places |

Purchase Type | The type of the purchase at the time it is printed — Bill, Order or Quote |

Qty/Units | The amount entered in the Received or Backordered field on the purchase |

Ship Date | The date entered in the Promised Date field on the transaction |

Ship Via | The shipping method entered on the transaction |

Shipping Address | The shipping address entered on the transaction |

Suppl Inv No. | The entry in the Supplier Inv No. field on the transaction |

Supplier’s Item No. | The number entered in the Supplier Item Number field found in the Buying Details view of the Item Information window |

GST Code—Freight | An X is printed if the freight entered on the purchase is taxed |

Terms | The terms that appear on the top of the transaction, next to the Terms zoom arrow |

Total | The total of the line items plus GST and freight charges. Doesn’t reflect any payments that may have been applied. |

Total Qty/Units | The total of all amounts in the Qty/Units column |

Unit | The entry in the Selling Unit of Measure field in the Selling Details view of the Item Information window for the line item |

None | You may add another text field below this heading to display the name of the salesperson responsible for this purchase. |

Some fields may not be available on some versions of the form layout.

Purchase Order—Professional (Not Basics)

Supplemental fields from the Card Information window and Supplemental fields from the Company Information window can also be used on this form.

Field name | Data that will print in this field |

|---|---|

*Inv/PO No.* | The number of the transaction with an asterisk before and after it |

Amount + GST | The amount of the line item plus the amount of GST for the line item |

Applied | The total of the payments that have been applied to this purchase |

Balance | Amount of purchase including GST and freight charges minus any payments that may have been applied. This is the amount that appears in the Balance Due field of the purchase. |

Category | The financial tracking category assigned to this purchase |

Comment | The comment entered on the transaction |

Company Address | The company address entered in the Company Information window |

Company Name | The company name entered in the Company Information window |

Cust PO No. | The entry in the Customer PO No. field on the transaction |

Date | The date entered on the transaction |

Description | The description of each line item entered on the transaction |

Due Date | The date the payment is due, based on the terms of the purchase |

Ex Amount | The tax-exclusive amount of each line item entered on the transaction. |

Ex Subtotal | The tax-exclusive subtotal amount of the item, including any freight charges that apply. |

Job Description | The description of the job whose job number is entered for a line item |

Job Name | The name of the job whose job number is entered for a line item |

Job Number | The job number entered for a line item |

Mailing Address | The address entered in the Address 1: Bill To selection of the Location field in the Card Information window — Profile view |

Memo | The memo entered in the Journal Memo field of the transaction |

Original Amount in English | The amount of the purchase including GST and freight charges (but not including any payments that may have been applied). Amounts up to and including 99,999.99 are printed in words; larger amounts are printed in numeric form. |

Page No. | The pages of the purchase are counted; this field displays the number of the page |

Purchase Type | The type of the purchase at the time it is printed — Bill, Order or Quote |

Reference Date | The date of service for each line item entered on the transaction |

Ship Date | The date entered in the Promised Date field on the transaction |

Suppl Inv No. | The entry in the Supplier Inv No. field on the transaction |

Tax Code—Freight | An X is printed if the freight entered on the purchase is taxed |

Terms | The terms that appear on the top of the transaction, next to the Terms zoom arrow |

Total | The total of the line items plus GST and freight charges. Doesn’t reflect any payments that may have been applied. |

Some fields may not be available on some versions of the form layout.

Payment Receipts

Supplemental fields from the Card Information window and Supplemental fields from the Company Information window can also be used on this form.

Field name | Data that will print in this field |

|---|---|

Allocation Amount | The allocation amount entered on the transaction |