If an employee is entitled to paid public holidays, these days can be processed on their pay like any other paid workday. This means if an employee takes 5 days off work (4 days as annual leave and 1 day for a public holiday), simply process a regular pay with 4 days annual leave.

The FairWork website is a great resource to learn about public holidays and getting paid for public holidays.

If you'd like to show public holidays separately on a pay, here's how:

To show public holidays separately on a pay

To show public holidays separately on a pay, you'll need to create a new wage category and assign it to your employees.

Go to the Payroll command centre and click Payroll Categories.

Click the Wages tab.

Click New.

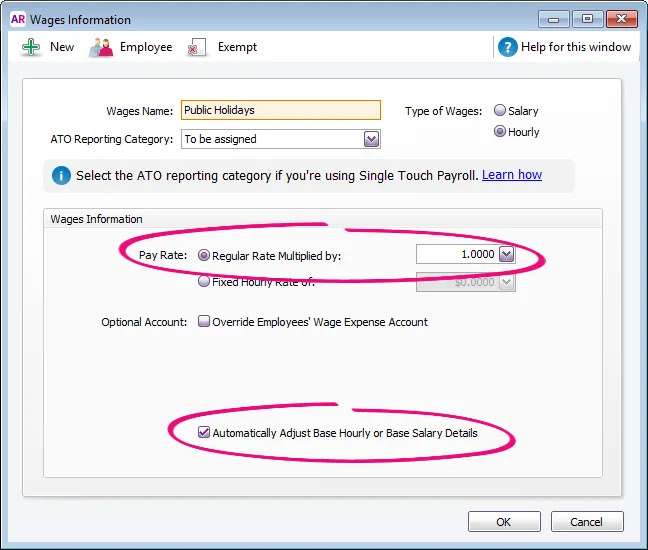

Name the new category 'Public Holidays' (or similar).

For the Type of Wages, select Hourly.

Choose the applicable ATO Reporting Category. Typically this will be the same ATO Reporting Category you've chosen for your Base Hourly or Base Salary wage categories. Learn more about assigning ATO reporting categories for Single Touch Payroll reporting.

Select these options:

Pay Rate as Regular Rate Multiplied by 1.0000

Automatically Adjust Base Hourly or Base Salary Details

Click Employee and select the employees requiring this category to be included on their pay.

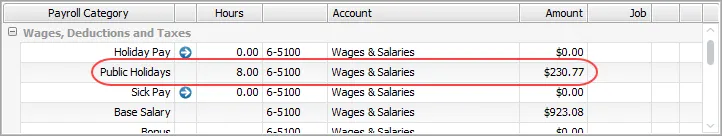

Here's our example.

When you record a pay which includes a public holiday, enter the number of hours against the Public Holidays category. The Base Hourly or Base Salary amount will adjust automatically.

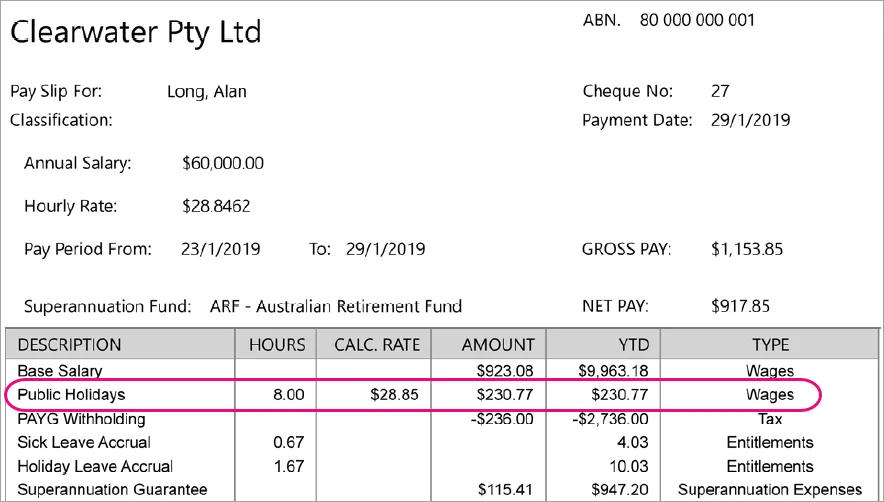

Here's how it will appear on the employee's pay slip: