- Created by admin, last modified by AdrianC on Dec 15, 2015

This information applies to MYOB AccountRight version 19. For later versions, see our help centre.

https://help.myob.com/wiki/x/eAKc

ANSWER ID:9334

AccountRight Premier and Enterprise only

Fluctuations in foreign currency exchange rates after an invoice or bill has been issued can result in what is known as an unrealised gain or loss. When the account is paid, the gain or loss is realised.

This support note explains how to track and reflect these unrealised gains or losses.

Why do I need to record unrealised gains and losses?

If a business conducts a high volume of trade in a foreign currency, the potential impact of exchange rate fluctuations increases. If you want to understand the potential effect the exchange rate has on a multicurrency transaction, you need to determine the unrealised gain or loss for the transaction.

If a business needs to reflect this in the balance sheet, then unrealised gains and losses would need to be recorded.

At the end of a given reporting period, some businesses choose to update their records to reflect the value of any unrealised gains or losses resulting from these fluctuations.

You should check with your accountant whether this is necessary for your business.

AccountRight includes the Unrealised Gain/Loss report to help you easily determine these values. Prior to running this report you need to update the exchange rate, otherwise the report will calculate the gain or loss based on an incorrect exchange rate.

To update the exchange rate

- Go to the Lists menu and choose Currencies.

- Click the zoom arrow next to the currency in question and enter the new exchange rate.

- Click OK.

To run the Unrealised Gain/Loss report:

- From the Accounts command centre, go to the Reports menu and choose Index to Reports.

- Scroll down to the Currency heading and select the Unrealised Gain/Loss report.

- Click Customise and enter the date as at which you want to determine the unrealised gain or loss.

- Click Display.

Once the value of the unrealised gain or loss has been determined for the period, it can be recorded using a general journal entry.

When you track unrealised gains and losses, you make an entry for the current month, then reverse the entry you made in the previous month. It's important that you remember to reverse the previous month's entry; if you don't, gain and loss amounts for future months will be inaccurate.

The debit and credit postings on this journal entry will depend upon whether the gain or loss is affecting an asset or a liability account. There should be a debit and a credit for each account listed in the report.

| If the affected account is | record this in the journal entry |

|---|---|

| an asset account |

|

| a liability or equity account |

|

Example

A US customer has been billed for consulting services on the 1 March 2016 for a total of US$1000.00. At the time the exchange rate was Local $1.30 to USD $1.

At the end of the month, the invoice hasn't been paid and in the meantime the exchange rate has become Local $1.20 to USD $1.

Having updated the exchange rate to 1.2, the Unrealised Gains/Loss Report shows an unrealised loss of Local $100.00 as at 31 March 2016.

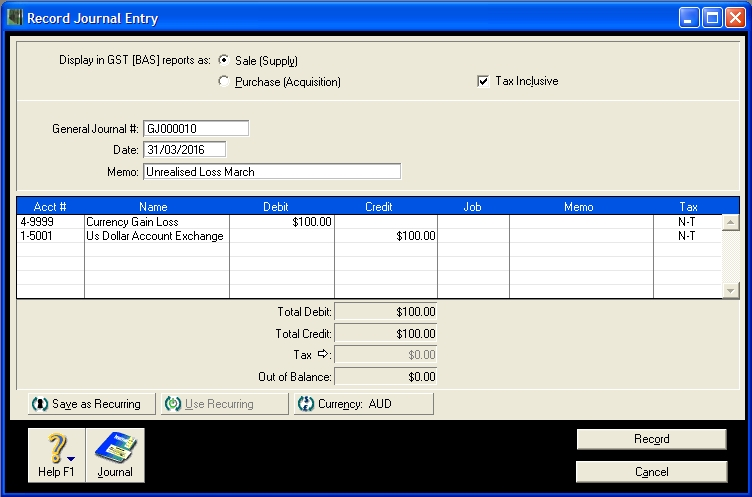

The resulting journal entry based on the above example looks like this:

Save time!

Save these general journal entries as recurring transactions to speed up future entries. See the AccountRight help to learn more about recurring transactions (Australia | New Zealand).

Subsequently, by the end of April, payment for this sale has been received and other open invoices have been recorded in the company file.

The general journal entered for Unrealised Gain/Loss at the end of March must be reversed:

To reverse the journal entry

- Go to the Setup menu and choose Preferences.

- Click the Security tab.

- Select the option Transactions CAN'T be Changed; They Must Be Reversed [System-wide] then click OK.

- Display the general journal entered in the previous month. It can be accessed through the General tab of the Transaction Journal.

- Go to the Edit menu and choose Reverse.

- Change the date of the transaction to the first of the new month and click Record Reversal.

Prior to running the Currency Unrealised Gain/Loss report for April, the exchange rate for the currency is updated. Once the report for April has been run, the new general journal entry is recorded.