| UI Text Box |

|---|

| New Zealand only For Australian help, click here. |

There are two ways you can pay an employee a bonus or commission: - include the payment in the employee's regular pay, or

- process the payment in a separate pay.

To add a bonus or commission payment to an employee's pay, you'll need to set up a new pay item and assign it to the employee. Superannuation and KiwiSaver contributionsSome bonus and commission payments need to be included in your superannuation (Australia) or KiwiSaver (New Zealand) calculations. To clarify your obligations for your bonus or commission payments, speak to your accounting advisor or check the ATO guidelines (Australia) or IRD guidelines (New Zealand). Tax on bonus and commission paymentsWhen paying a bonus or commission, MYOB treats the total gross pay as the employee's regular wage and taxes it accordingly. This means you'll need to calculate and manually adjust the PAYG withholding on the pay. For the current rates of PAYG withholding on bonuses and commissions, in Australia check the ATO guidelines. If you're in New Zealand check the Inland Revenue website.

| UI Expand |

|---|

| title | 1. Set up a bonus or commission pay item |

|---|

| Set up a bonus or commission pay itemYou can create one pay item for a bonus or commission payment, then assign it to the applicable employees. If the amount of the payment varies between employees, just change the amount when you do a pay run. Or you can can create separate pay items for each employee - it's up to you. - Go to the Payroll menu and choose Pay items.

- Click Create earning.

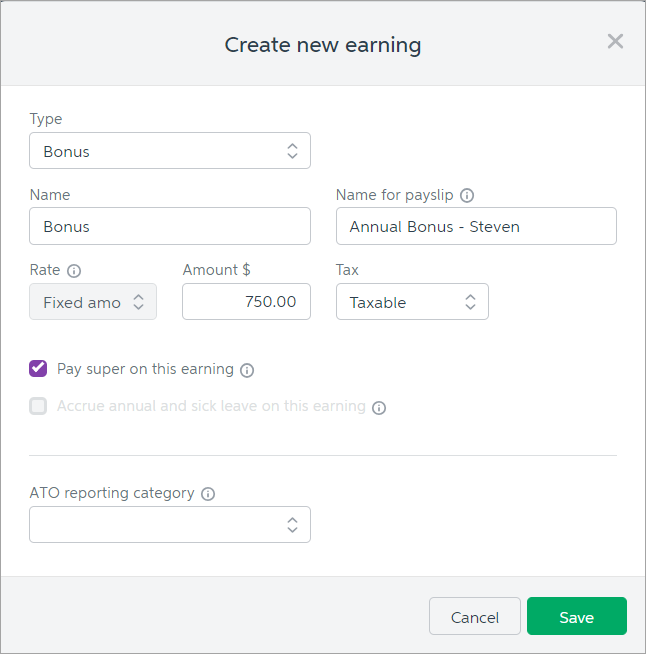

- Set up the earning:

- For the Type, select Bonus or Commission.

- (Optional) Change the Name for the earning.

If you'd like a different, more personalised, name to show on payslips for this earning, enter a Name for payslip, such as "Annual Bonus - Steven". Otherwise, this can be the same as the Name field. - Enter the Amount for the bonus or commission. If needed, you can change this amount during the pay run.

- Choose whether the bonus or commission is Taxable or Non-Taxable. If unsure, check with your accounting advisor or the ATO/ IRD.

Choose how to handle superannuation/ KiwiSaver contributions: - Australian businesses: if the payment should be included in super calculations, select the Pay super on this earning option.

New Zealand businesses: if . If the payment should be excluded from compulsory employer contributions, select the option Don't include in KiwiSaver contributions. To exclude the pay item from gross earnings, select the option Don't include in gross earnings when calculating leave payments.

- (Australia only, if reporting through Single Touch Payroll) Select the applicable ATO reporting category. If unsure, check with your accounting advisor or the ATO. Learn more about Assign ATO reporting categories for Single Touch Payroll.

Here's our example setup for a $750 bonus payment:

Click Save.Assign the pay item to the employee as described in the next task. |

| UI Expand |

|---|

| title | 2. Assign the pay item to an employee |

|---|

| Assign the pay item to an employee- From the Payroll menu, choose Employees.

- Click the employee's name.

- Click the Pay items - earnings & deductions tab.

- In the Earnings section, click the dropdown arrow next to the Add earning... field.

- Choose the bonus or commission pay item you created above. The pay item is assigned to the employee.

- Click Save.

|

| UI Expand |

|---|

| title | 3. Pay the bonus or commission |

|---|

| Pay the bonus or commission - Go to the Payroll menu and choose Enter Pay.

- Select the employee to be paid then click Start Pay Run.

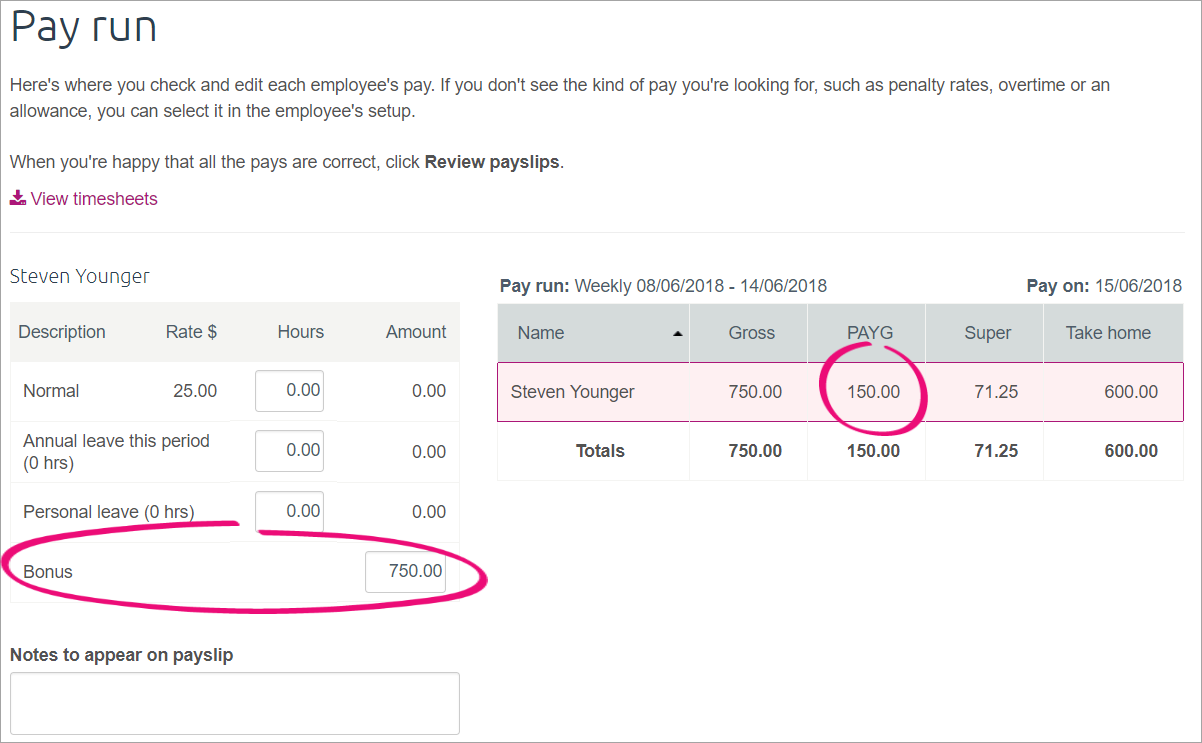

- Enter or confirm the bonus or commission amount being paid.

- If this is a bonus or commission-only pay, remove all other Hours and Amounts from the pay.

- Click into the PAYG or PAYE field and enter the tax for this payment. See above for calculation information. Here's our example of a bonus-only pay:

- Continue processing the pay as normal.

|

|