- Created by ErikV, last modified by RonT on Jun 06, 2023

https://help.myob.com/wiki/x/yS13AQ

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

New Zealand only

For Australian help, click here.

'Pay items' are the additional earnings and deductions in an employee's pay, on top of their normal salary or wages.

Common pay items include:

| Earnings | Deductions |

|---|---|

|

Once you've created your pay items, you can assign the pay items to your employees. Then when you do a pay run, the pay items will be included in your employees' pays.

Viewing pay items

Go to the Pay items page (Payroll menu > Pay items) to see your pay items. You can choose whether to show Active Pay Items, Deleted Pay Items or All Pay Items.

On this page you can create new pay items and change or delete pay items.

Creating pay items

When you create a pay item, you can assign it to one or more employees—saving time with your payroll setup.

OK, let's step you through it.

To create an earning pay item

- Go to the Payroll menu and choose Pay items. The Pay items page appears.

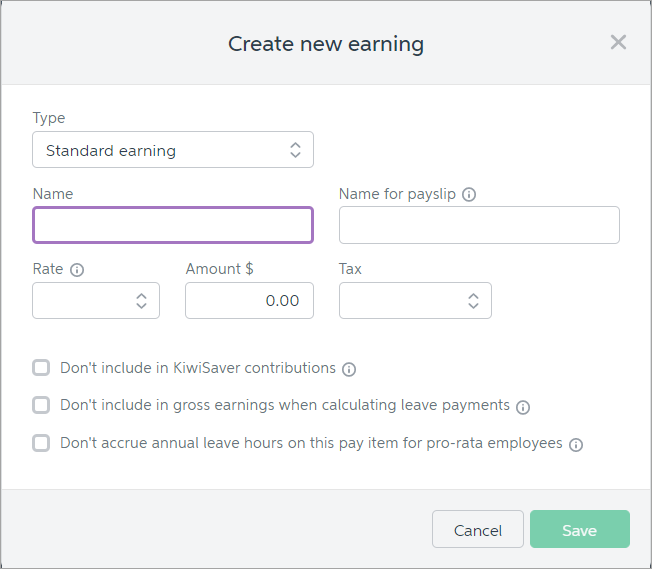

- Click Create earning. The Create new earning window appears.

Select the earning Type.

Standard earning Select this if you want to pay some hours at a different rate to ordinary pay (for example, additional rates). You can add as many standard earnings as you want to cover different situations, such as public holiday pay or Sunday pay.

Allowance Allowances are payments you make to employees on top of their pay. For example, you might pay an employee a travel allowance to cover the expenses of driving to meetings with clients, or a uniform allowance to cover the cost of their uniform.

You can see a description of some common allowances on the IRD website.

When you create a new allowance, the amount you enter in the Amount field will be the default amount per pay. You can change this amount when you process the pay run.

Bonus Bonuses are payments that apply to more than one period (for example, you might pay your employees a quarterly bonus for performance).

Whenever you want to pay a bonus, enter the bonus amount on the Bonus line in the pay run.

Commission Commissions usually relate to a single pay period.

Whenever you want to pay a commission, enter the commission amount on the Commission line in the pay run.

Enter the earning Name, such as "Saturday rate".

If you'd like a different, more personalised, name to show on payslips for this earning, enter a Name for payslip, such as "Saturday rate - Steven".

Choose the earning Rate.

Fixed Amount same amount each pay Per Hour set amount per hour Multiplier of normal rate multiply the hourly rate (New Zealand only) Per unit amount per number of units (New Zealand only) Per km amount per kilometre - Enter the earning Amount. If needed, you can change this amount during the pay run.

- Choose whether the earning is Taxable or Non-Taxable. If unsure, check with your accounting advisor or the ATO/IRD.

Select your options.

this option... means this... Don't include in KiwiSaver contributions Select this option if compulsory employer and employee contributions should be excluded from this earning. If unsure, check with your accounting advisor or check the IRD website. Don't include in gross earnings when calculating leave payments Select this option to exclude the pay item from gross earnings for leave calculations. If you're not sure which pay items to exclude, check the IRD website. Learn more about Leave calculations. Don't accrue annual leave on this pay item for pro-rata employees Select this option if you don't want employees to accrue pro-rata annual leave on this pay item. Note that employees with a fixed annual leave entitlement will never accrue leave on pay items. - Click Save.

- Repeat these steps to create additional earning pay items.

- When you're done, you can assign pay items to your employees.

To create a deduction pay item

- Go to the Payroll menu and choose Pay items. The Pay items page appears.

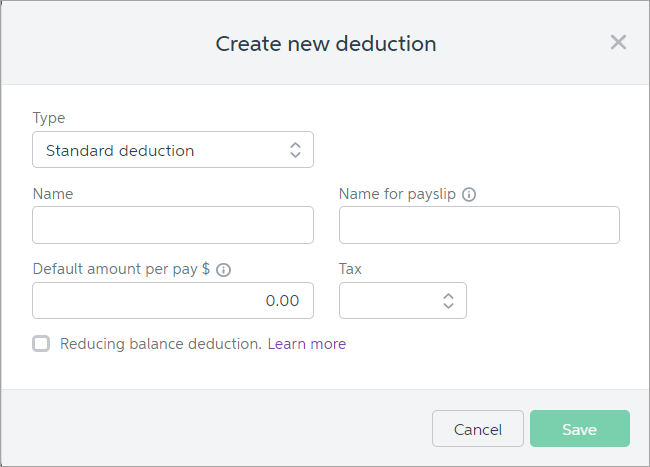

- Click Create deduction. The Create new deduction window appears.

Select the deduction Type.

Type Description Standard deduction This is for any deduction which isn't a child support or court fines deduction. Child support If you are required to make child support deductions for an employee, you will be notified by the IRD of the amount to deduct.

Employees who pay child support are entitled to keep 60% of their net (after-tax) earnings. If a child support deduction will leave the employee with less than 60% of their net pay, MYOB Essentials will automatically adjust the child support deduction to comply with the protected net earnings rule.

Court fines If the Ministry of Justice notifies you by letter to deduct money from an employee's pay and pay it to them, you need to set up a court fines deduction.

Employees who are required to pay court fines are entitled to keep 60% of their net (after-tax) earnings. If a court fines deduction will leave the employee with less than 60% of their net pay, MYOB Essentials will automatically adjust the court fines deduction to comply with the protected net earnings rule.

Want to add an SLCIR deduction?

You can enter compulsory extra deductions (SLCIR deductions) from the Tax tab in the employee profile.

Enter the deduction Name, such as "Union fees".

If you'd like a different, more personalised, name to show on payslips for this deduction, enter a Name for payslip, such as "Union fees - Steven".

Enter the Default amount per pay. This will be the default amount, but you can change it when processing your pays.

You can also override this amount on the employee details page when assigning the pay item to an employee.

In the Tax field, choose whether the deduction is Before tax or After tax. If unsure, check with your accounting advisor or the ATO/IRD.

Click Save.

- Repeat these steps to create more deductions.

- When you're done, you can assign pay items to your employees.

What's next?

When you're done, don't forget to assign pay items to your employees to ensure they're included on their pays.

FAQs

What if the amount of a pay item varies between employees?

You can set a different amount for employee deductions when assigning pay items.

Otherwise you can either:

- create a single pay item with a zero amount, assign it to your employees, then enter the amount against the pay item when you do a pay run, or

- create separate pay items for each employee.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.