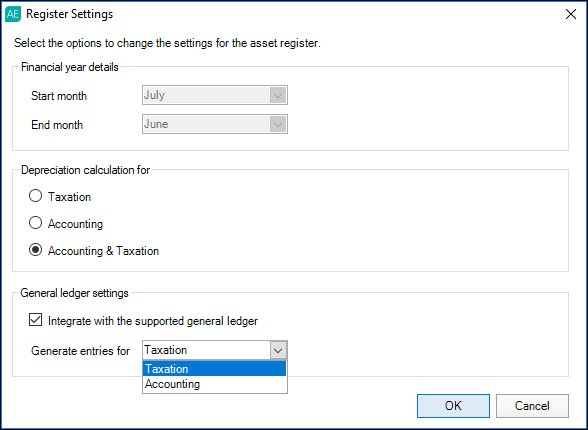

You must configure the Financial year details for the first year of the asset register. The financial year is a 12-month period. The financial year details for an asset register cannot be edited in successive years. can specify Asset Register settings for financial year details and how to calculate taxation and accounting depreciation for each client separately. These settings are saved for subsequent years. You can only edit the Asset Register's financial year details in the year it was created so make sure these details are correct before rolling forward to a new year. | UI Text Box |

|---|

| The examples in this help use an AU system. The same information applies for NZ, but you may see or use some different options or details. |

| HTML |

|---|

<script src="https://fast.wistia.com/embed/medias/xrs03c2hba.jsonp" async></script><script src="https://fast.wistia.com/assets/external/E-v1.js" async></script><div class="wistia_responsive_padding" style="width:560px;height:315px;position:relative;"><div class="wistia_responsive_wrapper" style="height:315px;left:0;position:absolute;top:0;width:560px;"><div class="wistia_embed wistia_async_xrs03c2hba videoFoam=true" style="height:100%;width:100%"> </div></div></div> |

How to configure the asset register | To specify Asset Register settings |

|

- On the TASKS bar, click Register settings.

In the Register Settings window, from the Start month drop-down, select the appropriate start of the financial year.

The end month is automatically calculated 11 months from the

|

. | UI Text Box |

|---|

| | You can only change the financial year details if no asset year has been created |

|

| (the asset register status is blank |

|

Taxation only Accounting - Select the checkbox to indicate the depreciation calculation:

- Taxation only

- Accounting only

- Accounting and Taxation

|

If you wish to integrate the Asset Register with the supported general ledger

|

If you are in non-integrated mode, the , tick the Integrate with the supported general ledger checkbox

|

If you previously used the Asset Register in without general ledger integration, the Integrate with the supported general ledger checkbox is not available. |

Select what entries will be generated from depreciation calculations. If the type of depreciation calculation selected is:

|

| Depreciation calculation | then... |

|---|

| Taxation only | Depreciation calculations will generate taxation entries automatically | | Accounting |

|

| only | Depreciation calculations will generate accounting entries automatically | | Accounting and Taxation |

|

| Select from either Accounting or Taxation depreciation journals you want posted back into Trial balance view or Workpaper Period. |

Image Added Image Added

- Click OK. Changes are saved to the

|

|