New Zealand only The New Zealand Government has announced a wage subsidy to support businesses impacted by COVID-19. To see if you're eligible, check the NZ Government’s fact sheet on the wage subsidy. This subsidy is taxable and functions in a similar way as Accident Compensation Corporation (ACC) payments. That means, employers are required to pay 80% of their employee’s wage during this time. The government will pay a wage subsidy as a lump sum and covers 12 weeks per employee. The amounts of the subsidy are: - $585.80 (for employees who work 20+ hours), or

- $350.00 (for employees who work less than 20 hours)

This is a Gross amount and supplemented with the employee’s wages up to 80% of what they would normally earn. To keep it clear for your employee’s and yourselves, we recommend setting up a new pay code for the subsidy payment. For more information, see the NZ Government’s Employer COVID-19 wage subsidy and leave payment information sheet. | UI Expand |

|---|

| title | 1. Create a new pay code |

|---|

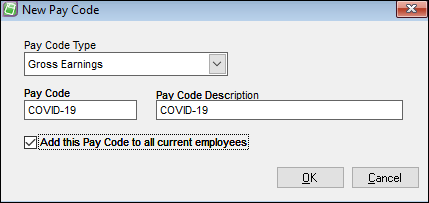

| - Go to the Maintenance command centre and click Maintain Pay Codes.

- Click New. The New Pay Code window appears.

- In the Pay Code Type field, choose Gross Earnings.

- Enter COVID-19 in the Pay Code field.

- Enter COVID 19 in the Description.

- If you're applying the COVID 19 subsidy to all employees, select Add this Pay Code to all current employees.

Here's the pay code example:

- Click OK.

- In the Maintenance command centre, click Maintain Employees.

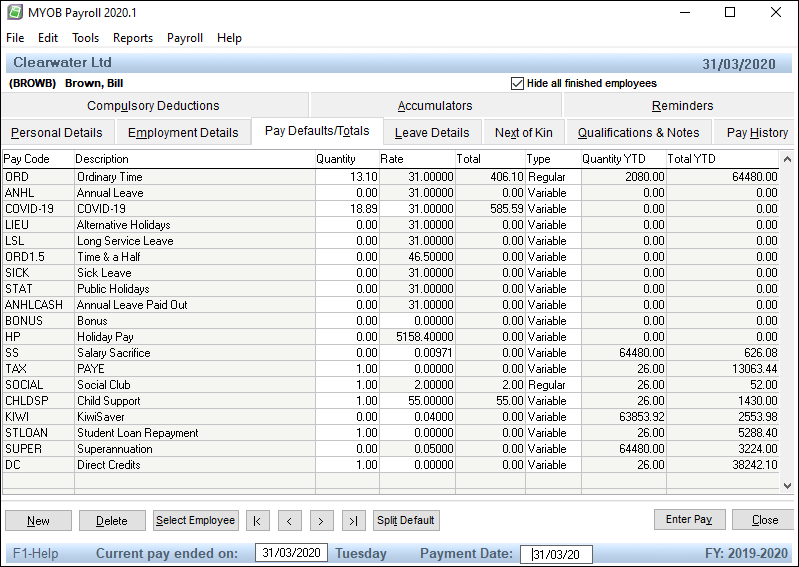

- Click the Pay Defaults/Totals tab.

- Click New.

- Select the COVID-19 pay code.

- Click OK.

Work out the Quantity (hours) to enter against the COVID-19 pay code. To do this, divide the employee's subsidy payment amount by their normal hourly rate.

In this example, the subsidy is $585.80 which is divided by $31 to give a Quantity of 18.8968. - Work out the employee's remaining hours to bring their pay up to 80% of their normal earnings. To do this, work out what 80% of the employee's normal gross pay is, and subtract the COVID-19 subsidy amount.

For example, if the employee normally earns $31 per hour for 40 hours per week:- $31 X 40 = $1240

- 80% of $1240 = $992

- $992 - $585.80 = $406.20

- Work out how many hours this amount represents, for example $406.20 divided by the hourly rate (406.20/31 = 13.1032)

- In the Quantity field, enter these hours against the applicable pay code. This will be based on the employee's circumstances, so might be entered against ordinary time, annual leave or sick leave (for example).

Here's our example pay code:

- Click Close.

|

| UI Expand |

|---|

| Go to the Prepare Pays command centre and click Enter Pays. Double click the employee. Click Add Default, select the COVID-19 pay code and click OK. In the Quantity column enter the hours you've calculated for the COVID-19 pay code and the pay rate in the Rate column. IMAGE Click the PAYE rate. Click Tax Override. - Enter the back pay amount into the Extra Pay Amount field.

- Select the appropriate tax code based on the employee's annual income, then click Ok.

Tax codes:

SB: 0 to $14000

S: $14000 to $48000

SH: $48001 to $70000

ST: more than $70000 CAN'T ENTER A RATE HERE, WHY NOT?

IMAGE? Process the rest of the pay as normal.

|

|