- Created by admin, last modified by RonT on Sep 15, 2020

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 24 Next »

https://help.myob.com/wiki/x/qgJXAw

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

Whether it's an overpayment, an underpayment or something else in a recorded pay needs fixing, you can either adjust the employee's next pay, or record a separate pay for the adjustment.

Sometimes it might be easier to simply delete or reverse the pay and start again—it's up to you.

How does changing a pay affect STP?

With STP, your employees' year to date (YTD) figures are sent to the ATO after each pay run. So if changing an employee's pay affects their YTD figures, the updated figures will be sent to the ATO the next time you do a pay run.

If you want to remove or "undo" a pay that you've sent to the ATO, you'll be able to delete or reverse it based on its status in the Payroll Reporting Centre. This ensures you're not deleting anything which has already been accepted by the ATO.

Let's take a look at the details:

Each of these scenarios uses a similar approach—adjust the following pay or record a separate adjustment pay. If this doesn't suit your needs, you can delete the incorrect pay then re-enter it.

To fix a pay which contained the wrong leave or super amounts, you can either:

- make the adjustment on the next pay by increasing or decreasing the leave or super, or

- record a new pay for the adjustment

If you record a separate pay for the adjustment:

- Enter the adjusted leave hours or super amounts as positive or negative values depending on the adjustment. For example, if you've paid an employee too much leave, enter a negative number of leave hours.

- Zero out all the pay items that you're not adjusting and finalise the pay as usual. Need a pay run refresher?

To fix a pay where the wrong amount of PAYG tax was withheld, work out how much PAYG tax has been overpaid or underpaid, then adjust the PAYG on the employee's next pay.

Alternatively, you can create a separate pay for the adjustment and enter the adjustment value against the PAYG Withholding category. Remember to zero out all other hours and values on the pay.

If the employee had overpaid PAYG, enter the adjustment as a positive value. If it's to adjust an underpayment, enter a negative value.

If you've overpaid an employee you'll need to make the adjustment by reducing their next pay, or deleting or reversing the pay and recording it again.

Note that you can't record negative amounts in pays.

If you've underpaid an employee you can:

- make the adjustment on the next pay, or

- record a new pay for the adjustment

Enter the adjustment value against the hours or amount for the pay item that was overpaid. Remember to zero out all the pay items that you're not adjusting. The net pay amount should be equal to the underpayment.

Whether you can delete or reverse a pay is based on its status in the STP Payroll Reporting Centre. This ensures pays which have been accepted by the ATO can't be deleted. Instead, you'll only have the option to reverse the pay then report that reversal to the ATO. Learn more about STP report statuses.

| If the status is... | You can only... |

|---|---|

| Rejected or Not Sent | delete the pay |

| Sent, Accepted or Accepted with errors | reverse the pay |

You should only delete or reverse a pay if the amount hasn't been withdrawn from your bank account. If you need to adjust an overpaid or underpaid amount, see 'To fix the hours or amounts in a pay' above.

If you've already paid the employee and reconciled your bank account, deleting or reversing the payroll transaction can affect future bank reconciliations. Therefore, you'll need to unmatch or unreconcile it first.

- it's in the current payroll year

- it's NOT part of a processed bank file payment

- it's NOT part of a Pay Super payment

To delete or reverse an employee's pay:

- Go to the Payroll menu and click Pay runs.

- Click the Date of payment to display the details.

Click the name of the Employee whose pay you want to delete. Based on the status of the pay run in the Payroll Reporting Centre, you'll have the option to either delete or reverse the pay. See above for more details.

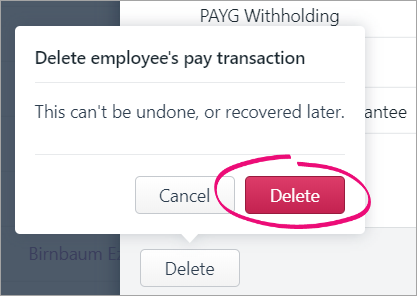

If deleting the pay:

Click Delete.

At the confirmation message, click Delete.

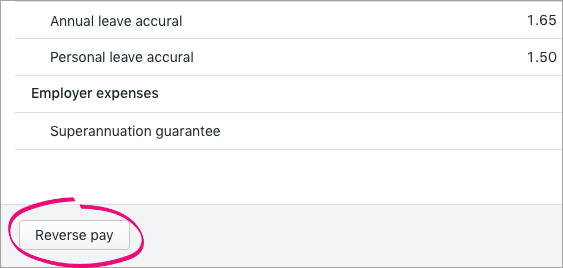

If reversing the pay:

- Click Reverse pay.

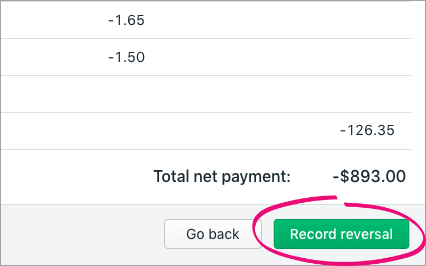

The details of the pay reversal are shown (a negative pay). - Click Record reversal.

- Enter the name of the authorised sender and click Send to submit the reversal to the ATO. The employee's year-to-date payroll amounts are updated accordingly.

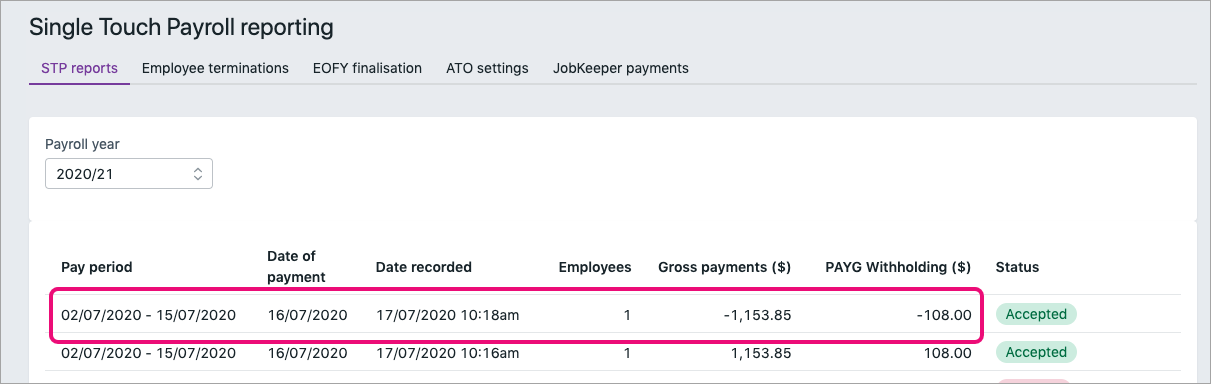

The reversed pay will appear in the Payroll Reporting Centre with a negative amount, like this example:

- Click Reverse pay.

To delete or reverse an entire pay run

If you need to delete or reverse all the employee pays in a pay run, you'll need to delete or reverse the pay of each employee in the pay run as described above.

To delete or reverse all pays in a pay run

If you need to delete or reverse an entire pay run (all employee pays for a pay period), you'll need to delete or reverse the pay of each employee in the pay run as described above.

If a pay you want to delete or reverse is included in an electronic bank file transaction, you'll first need to delete the bank file transaction. Note that this only deletes the bank file transaction in MYOB but doesn't affect your actual bank accounts.

- Go to the Banking menu and click Find transactions.

- On the Debits and credits tab:

- Enter a date range that includes the pay date in the Date from and Date to fields.

- In the Account field, choose the Electronic Clearing Account.

- Click the Reference no to open the pay transaction.

- In the lower right corner, click the electronic payment reference number.

Details of the electronic payment are shown, including all payments within the payment file. - Click Delete.

- At the confirmation message, click Delete. All the payments that were included in the bank file are now listed again on the Record payment and download bank file page.

You'll now be able to delete or reverse the pay. If required, you can also re-process payments to create a new bank file.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.