- Created by MichelleQ, last modified by AdrianC on May 16, 2023

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 48 Next »

https://help.myob.com/wiki/x/WQL2BQ

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

MYOB Essentials, Australia only

Single Touch Payroll (STP) is a simple way to report your employees’ payroll information to the ATO and keep your business compliant. Tell me more about STP.

When you set up STP in MYOB Essentials you'll be setting up for STP Phase 1.

STP Phase 2

The ATO has expanded STP to include additional information in your payroll reporting through STP Phase 2. The deadline to begin reporting on STP Phase 2 was 1 January 2023. Your MYOB Essentials will be upgraded to the new platform where you’ll be able to transition to STP Phase 2.

We’ve been working with the ATO and have been granted an extension to the 1 January deadline, so you'll have time to move to the new platform and begin STP Phase 2 reporting. You now have until 31 March 2023 to report your first STP Phase 2 pay run.

Once you've set up payroll, MYOB Essentials helps you get STP ready—here's what's involved:

Ready to get started?

To get started, go to the Payroll menu and choose Payroll Reporting.

MYOB Essentials will guide you through the setup process, which includes the following:

What you need to do

There are 3 quick setup tasks—click each for details.

- Check company and employee details meet ATO requirements.

- Assign ATO reporting categories to your payroll categories.

- Connect to the ATO to allow payroll info to be submitted.

Get your employees to set up a myGov account so they can access their year-to-date payroll info and end of year summary.

FAQs

How do I know if I'm set up for STP?

You'll know you're set up when you go to the Payroll menu > Payroll Reporting and see the Payroll reporting centre:

If you don't see this, but instead you're prompted to set up Single Touch Payroll, see above for details.

Once you're set up and you process a pay run, you'll be prompted to declare and submit the information to the ATO. You'll only be able to do this if you've completed the Connect to the ATO steps.

What if I'm setting up STP part-way through the year?

| If you... | do this... |

|---|---|

| will pay an employee again this payroll year | Keep processing your pays as you normally would. When you process the first pay after setting up STP, the year-to-date totals for the employees you're paying will be sent to the ATO. |

| have paid an employee this payroll year but you're unlikely to pay them again | You can send the employee's year-to-date totals to the ATO by recording a $0 (zero dollar) pay for employee. Remove all hours, amounts and entitlements from the pay. When the $0 pay is recorded, you'll be prompted to declare and send the details to the ATO. (click to enlarge image)

|

What happens after I'm set up for STP?

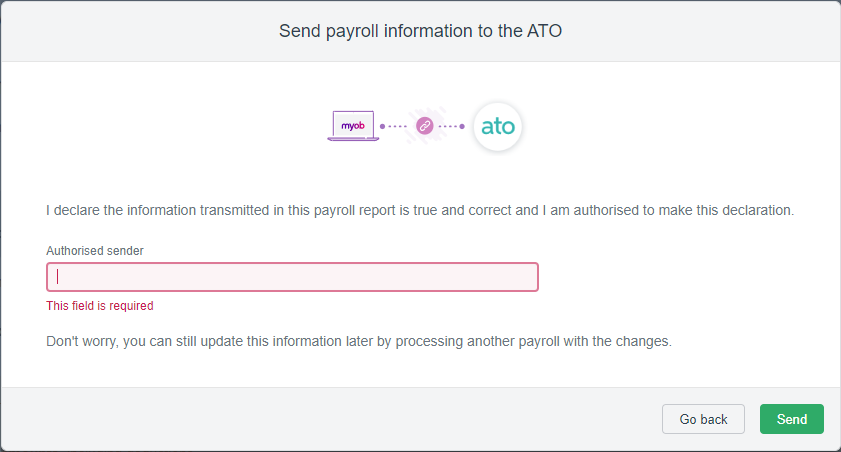

Once you've connected to the ATO, you're all set up for Single Touch Payroll reporting. You won't notice anything new while entering your pays, but after you process a pay you'll now have to send the payroll information to the ATO.

This is easily done, enter the name of the authorised sender and click Send.

Each time you submit a pay run, your employees' year-to-date payroll information is submitted to the ATO.

You can check the status of your submissions by going to the Payroll menu and choosing Payroll Reporting.

Learn more about what happens after you've set up Single Touch Payroll.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.