This information applies to MYOB AccountRight version 19. For later versions, see our help centre.

https://help.myob.com/wiki/x/dQGc

ANSWER ID:9143

AccountRight Plus, Premier and Enterprise, Australia only

Some federal and state awards provide for annual leave loading for employees taking annual leave. This is generally calculated at a rate of 17.5% and is subject to certain rules in relation to PAYG Withholdings. This page explains how to correctly record leave loading payments in your software.

Under the terms of most awards, the loading is strictly payable only on the award rate. It is usually paid on the rate of pay actually received. If you are uncertain about this please check with the employee's relevant award or employment agreement.

Watch our series of short videos about setting up and using payroll:

Setting up and recording leave loading

A Holiday Leave Loading wage category exists in your software by default. The steps below describe how to allocate this category to the employees who are entitled to leave loading, and how to record a pay which includes leave loading.

- Go to the Payroll command centre and click Payroll Categories. The Payroll Categories List window will be displayed.

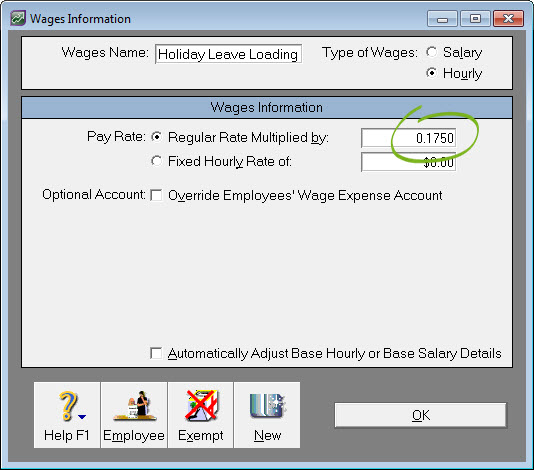

- Click the Wages tab.

- Click the zoom arrow next to the Holiday Leave Loading category. The Wages Information window appears. Notice the Pay Rate is set to 0.1750. This assumes a 17.5% rate of leave loading.

- Click Employee. The Linked Employees window appears.

- Select the employees who are entitled to receive leave loading.

- Click OK to the Linked Employees window.

- Click OK to the Wages Information window to return to the Payroll Categories List window.

- Click OK to complete the setup.

When processing your payroll, the Holiday Leave Loading category will be available for the employees who were allocated this category in the previous task.

When an employee takes leave, enter the number of hours leave in the Hours column for both the Holiday Pay category and the Holiday Leave Loading category. This will ensure the employee is paid their holiday pay, and their leave loading.

Speak to your accountant or refer to the ATO website for information on calculating the tax on leave loading.

FAQs

As of 1 July 2012, the tax-free component of leave loading was removed. This means that all leave loading is now taxable. Speak to your accountant or refer to the ATO website for the most current leave loading tax rates and information.

All leave loading payments are part of the employee's assessable income and details must be included in the payment summary.