- Created by admin, last modified by AdrianC on Dec 15, 2015

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 9 Current »

This information applies to MYOB AccountRight version 19. For later versions, see our help centre.

https://help.myob.com/wiki/x/oAKy

ANSWER ID:9134

AccountRight Plus, Premier and Enterprise, Australia only

If you have employees who are entitled to regular rostered days off (RDO), use this information as a guide to setting it up in AccountRight.

Set up RDO payroll categories

You'll need to create wage and entitlement categories to track and pay RDO amounts.

This category is used when paying out RDO amounts to an employee.

- Go to the Payroll command centre and click Payroll Categories.

- Click the Wages tab and then click New.

- Name the new category RDO Paid.

- Set the Type of Wages to Hourly.

- For the Pay Rate select the Regular Rate Multiplied by 1.0000 option.

- Select the Automatically Adjust Base Hourly or Base Salary Details option.

The Wages Information window should look like the following example:

- Click Employee and select the employees who are entitled to RDOs then click OK.

- Click OK.

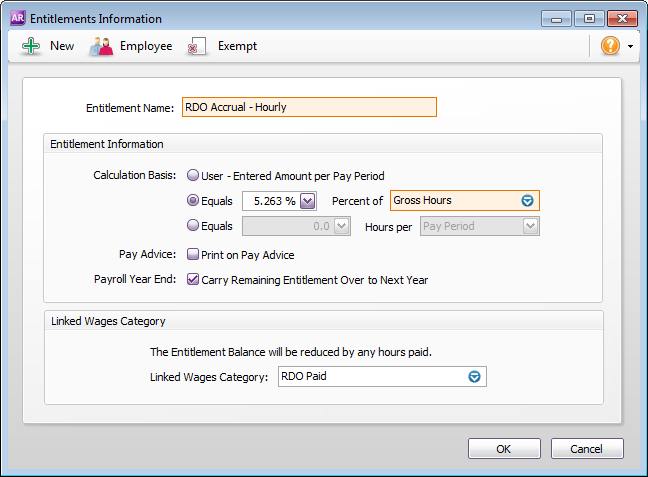

- In the Payroll Categories List window, click the Entitlements tab and then click New.

- Name the new category RDO Accrual - Hourly.

Set the Calculation Basis to Equals [x] Percent of [Gross Hours] and enter the applicable percentage.

Calculating the percentage of gross hours

Use the following formula to determine the percentage of gross hours:

PGH=HWD / [(HWW x FQW) - HWD]

Where:

PGH=Percentage of Gross Hours

HWD=Hours Worked in a Day

HWW=Number of hours in a working week

FQW=Frequency of RDO (in weeks)

Example: Your employees work 40 hours per week but are paid for 38 and get a paid RDO every 4 weeks. The calculation looks like this:

HWD=7.6 (38 hours a week / 5 days)

HWW=38

FQW=4 (1 RDO every 4 weeks)

PGH=7.6 / [(38 x 4) - 7.6] = 5.263%

- Set the Linked Wages Category to RDO Paid.

- Click Exempt and select the RDO Paid wage category, and all other pay categories that should be excluded from the accrual calculation, for example overtime, then click OK.

- Click Employee and select the hourly-based employees who are entitled to RDOs, then click OK.

- Click OK.

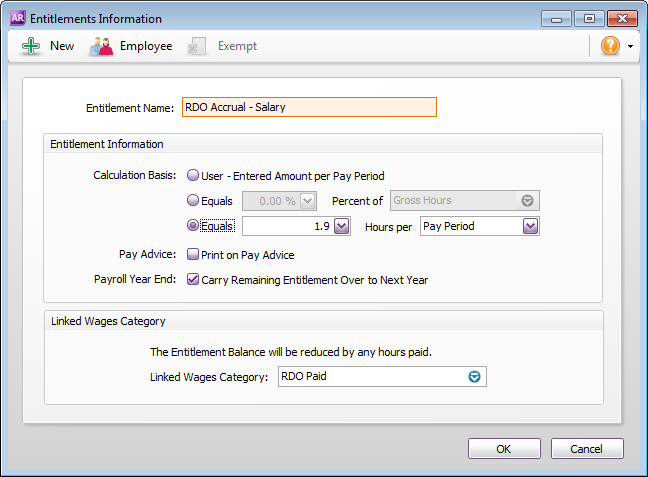

- In the Payroll Categories List window, click the Entitlements tab and then click New.

- Name the new category RDO Accrual - Salary.

Set the Calculation Basis to Equals [x] Hours per [Pay Period] and enter the applicable number of hours.

Calculating the hours per pay period

Use the following formula to determine the hours per pay period:

HPP=(HWD / FQW) x WPP

Where:

HPP=Hours per pay period

HWD=Hours in a working day

FQW=Frequency of RDO (in weeks)

WPP=Weeks in pay period

Example: Your employees work 40 hours per week but are paid for 38 and get a paid RDO every 4 weeks:

HWD=7.6 (38 hours per week / 5 days)

FQW=4 (1 day every 4 weeks)

WPP=1

HHP=(7.6 / 4) x 1 = 1.9 hours

- Set the Linked Wages Category to RDO Paid.

- Click Exempt and select the RDO Paid wage category, and all other pay categories that should be excluded from the accrual calculation, for example overtime, then click OK.

- Click Employee and select the hourly-based employees who are entitled to RDOs, then click OK.

- Click OK.

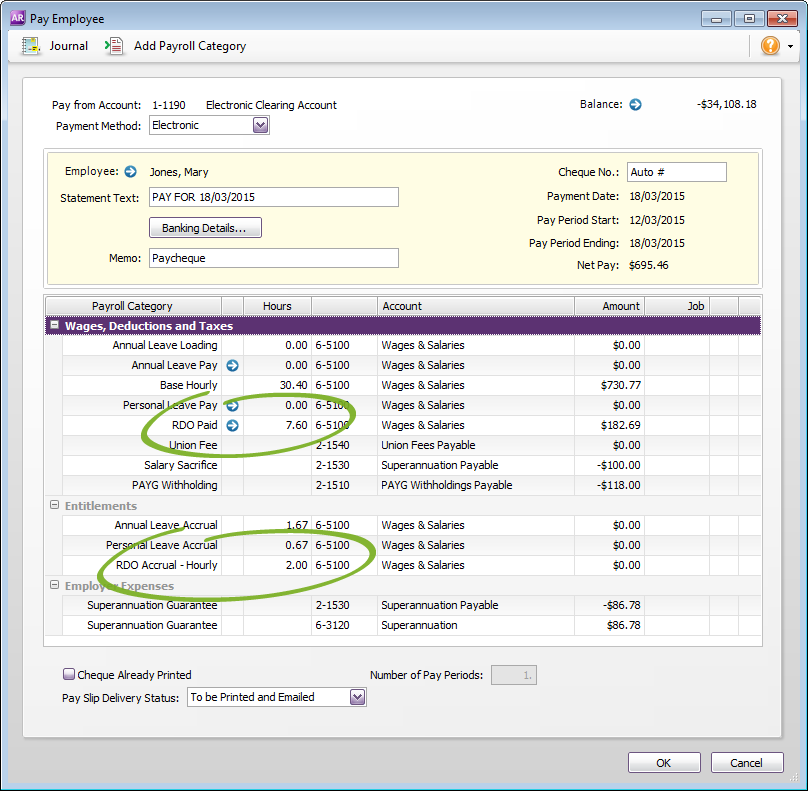

Process a pay with RDO amounts

When you enter a paycheque for an employee and no RDO is taken, enter the paycheque as normal.

RDO entitlements for selected employees will accrue automatically. When you enter the hours taken against the RDO Paid wage category, the Base Hours/Base Salary amounts will reduce accordingly.

In our example shown below, one RDO of 7.6 hours is taken. 30.4 hours are paid as Base Hourly and 7.6 hours as RDO. The net pay remains the same as a regular pay period.

Also, 2 hours per week in RDO Accrual entitlements has accrued (38 x 5.263%= 2 hours).