- Created by LouiseB, last modified by MathangiS on Jun 20, 2019

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 170 Next »

https://help.myob.com/wiki/x/xtM6Ag

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

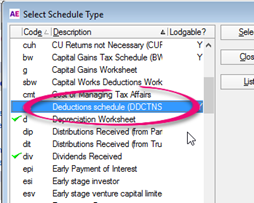

The ATO have introduced a new Deductions schedule (DDCTNS) to lodge with a 2019 individual tax return. See Claiming deductions on the ATO website.

If you're a claiming a deduction in your individual tax return, the DDCTNS is mandatory.

- There's a new Deductions schedule (DDCTNS) and some worksheets have been updated to integrate with it.

- The way you enter deductions has changed. Learn how to complete the new schedule.

When do I need a DDCTNS schedule?

If you're claiming a deduction in any of the labels below, you'll need to complete a DDCTNS schedule.

| D1 Work-related car deductions |

| D8 Dividend deductions |

| D2 Work-related travel expenses |

| D9 Gifts or donations |

| D3 Work-related clothing, laundry and dry-cleaning expenses |

| D10 Cost of managing tax affairs |

| D4 Work-related self-education expenses |

| D12 Personal superannuation contributions |

| D5 Other work-related expenses |

| D13 Deduction for project pool |

| D6 Low-value pool deduction |

| D14 Forestry-managed investment scheme deduction |

| D7 Interest deductions |

| D15 Other deductions |

| D11 - Deductible amount of undeducted purchase price of a foreign pension or annuity Each foreign pension has their own undeducted purchase price (UPP), and the total amounts will show in label D11, therefore a DDCTNS schedule is not required. | |||

How do I use the new DDCTNS?

You can navigate to it from 2 places:

1 Select Preparation > Schedule

2 Select it from ATO Schedules.

You can no longer enter data directly into the deduction labels, apart from label D11.

Depending on the deduction item, you'll need to use the new DDCTNS schedule or any supporting worksheet. Each supporting worksheet integrates to the new DDCTNS schedule to help you report it to the ATO.

When you click on any of the deduction labels, you'll see either

- the DDCTNS schedule or

- the supporting worksheets like motor vehicle worksheet (mve) or depreciation worksheets, that integrate to the DDCTNS schedule.

You can't see additional repeating fields in the schedule to record individual descriptions and amounts. Click Insert then press CTRL+INSERT to insert additional records. You can't insert records below deductions from the depreciate worksheet or the motor vehicle worksheet.

The ATO have provided the following guidance on the level of detail required:

The details to be provided should be at an appropriate level, that is stationery expense $x rather than by individual stationery items.

The table shows the differences in data entry for 2018 and 2019, as well as the maximum entries allowed in each label.

| Deduction item | 2018: Schedule/worksheet at the label for data entry | 2019: Schedule/worksheet at the label for data entry | Maximum entries |

|---|---|---|---|

D1 Work related car expenses For more than 10 deduction items, enter the first 9 items and consolidate the additional items and their values into the 10th item. | Motor vehicle expenses (mve) | Motor vehicle expenses (mve) | 10 |

| D2 Work-related travel expenses | Work-related travel expenses dissection grid | DDCTNS | 20 |

| D3 Work-related uniform, occupation specific or protective clothing, laundry and dry cleaning | Generic schedule 2018 | DDCTNS | 20 |

| D4 Work-related self-education expenses | Work-related self-education expenses worksheet (sed) | Work-related self-education expenses worksheet (sed) | 20 |

| D5 Other work-related expenses | Other work-related travel expenses dissection grid (pre-fill data from the ATO) | Other work-related expense(pwe) (pre-fill data from the ATO and manual data-entry) | 50 |

| D6 Low value pool deductions | Depreciation worksheet or directly entered value in the return | DDCTNS and depreciation worksheet | Not a repeatable group |

D7 Interest deductions | Interest deductions (idd) | DDCTNS | 20 |

| D8 Dividend deductions | Dividend deductions (ddd) | DDCTNS | 20 |

| D9 Gift and donations | Gift and donations (pgd) (pre-fill data from the ATO and manual data-entry) | Gift and donations (pgd) (pre-fill data from the ATO and manual data-entry) | 20 |

| D10 Cost of managing tax affairs | Cost of managing tax affairs (cmt) | Cost of managing tax affairs (cmt) | 20 |

| D12 Personal superannuation contributions | Personal superannuation contributions 2018 (psc) | Personal superannuation contributions 2019 (psc) | 25 |

D13 Deductions for project pool | Depreciation worksheet | Depreciation worksheet | 20 |

D14 Forestry managed investment scheme deduction | Forestry managed investment scheme worksheet 2018 (fms) | Forestry managed investment scheme worksheet 2019 (fms) | 20 |

| D15 Other deductions | Label E - Enter the value directly in the return Label J - Other deductions (ode) | Label E - DDCTNS Label J - Other deductions (ode) | 100 |

Data entry from the DDCTNS schedule

Item D7 - Interest deductions

- Click label I to open the DDCTNS schedule.

- Scroll down to D7 Interest deductions and fill in the description and the amount.

If you want to add more records, click the

icon located near the Return properties.

icon located near the Return properties.

If

is greyed out, make sure the cursor is on the last data-entry field.

is greyed out, make sure the cursor is on the last data-entry field.- Fill in a depreciation motor vehicle worksheet if required.

- The amount at D7 total integrates to item 7 label I Interest deductions, and the details in the DDCTNS schedule will lodge with the tax return.

Data entry from a supporting schedule

Item D5 - Other work-related expenses

- Click label E to open an Other Work Related Expenses worksheet.

- Enter the description and amount for all the items, then close the worksheet.

- Open the DDCTNS schedule. You'll see items from the Other work-related expenses worksheet listed at label D5.

- The amount at D5 total integrates to item D5 label E Other work-related expenses, and the details in the DDCTNS schedule will lodge with the tax return.

Rolling over deductions from 2018 to 2019

By adding the DDCTNS schedule, we had to replace some of the worksheets and dissection grids. This means that existing schedules and worksheets at deduction labels will not rollover into 2019, with the exception of motor vehicle worksheets (mve).

Tax office copy PDF

The ATO don't provide a tax office PDF version of the DDCTNS schedule.

For paper lodgments, print amounts at deduction items and action codes at D1, D3 and D4 in the main income tax return.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.