You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 180 Next »

https://help.myob.com/wiki/x/N9Q6Ag

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

The ATO has introduced a new Deductions schedule (DDCTNS) to lodge with a 2019 individual tax return. See Claiming deductions on the ATO website.

If you're claiming a deduction in your individual tax return, the DDCTNS is mandatory.

- We've added the new Deductions schedule (DDCTNS) and updated worksheets that integrate with it.

- The way you enter deductions has changed. Learn how to use the new DDCTNS schedule.

When do you need a DDCTNS?

If you're claiming a deduction at any of the labels ticked below, you'll need to complete a DDCTNS.

| D1 Work-related car deductions |

| D9 Gifts or donations |

| D2 Work-related travel expenses |

| D10 Cost of managing tax affairs |

| D3 Work-related clothing, laundry and dry-cleaning expenses | D11 - Deductible amount of undeducted purchase price of a foreign pension or annuity * | |

| D4 Work-related self-education expenses |

| D12 Personal superannuation contributions |

| D5 Other work-related expenses |

| D13 Deduction for project pool |

| D6 Low-value pool deduction |

| D14 Forestry-managed investment scheme deduction |

| D7 Interest deductions |

| D15 Other deductions |

| D8 Dividend deductions |

How to use the new DDCTNS

You can navigate to it from 2 places:

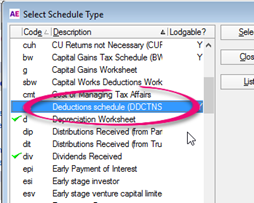

1 Select Preparation > Schedule

2 Select it from ATO Schedules.

You can no longer enter data directly into the deduction labels D1–D15, with the exception of label D11.

The DDCTNS schedule opens if there is no supporting worksheet at the deductions labels.

You can only see one data-entry row. To add a row, press CTRL+INSERT. To delete a row, press CTRL+DELETE.

The ATO has recommended that you group your expenses, for example, you have a total stationery expense rather than individual stationery items.

The table below shows the:

- differences between 2018 and 2019 schedules/worksheets

- maximum entries allowed for each label.

| Deduction item | 2018 schedule/worksheet | 2019 schedule/worksheet | Maximum entries |

|---|---|---|---|

D1 Work-related car expenses For more than 10 deduction items, enter the first 9, then total the amount of the additional items into the 10th item. | Motor vehicle expenses (mve) | Motor vehicle expenses (mve) | 10 |

| D2 Work-related travel expenses | Work-related travel expenses dissection grid | DDCTNS | 20 |

| D3 Work-related uniform, occupation specific or protective clothing, laundry and dry cleaning | Generic schedule 2018 | DDCTNS | 20 |

| D4 Work-related self-education expenses | Work-related self-education expenses worksheet (sed) | Work-related self-education expenses worksheet (sed) | 20 |

| D5 Other work-related expenses | Other work-related travel expenses dissection grid (pre-fill data from the ATO) | Other work-related expense(pwe) (pre-fill data from the ATO and manual data-entry) | 50 |

| D6 Low value pool deductions | Depreciation worksheet or value entered directly in the return | DDCTNS and depreciation worksheet | 1 |

D7 Interest deductions | Interest deductions (idd) | DDCTNS | 20 |

| D8 Dividend deductions | Dividend deductions (ddd) | DDCTNS | 20 |

| D9 Gifts or donations | Gifts or donations (pgd) (pre-fill data from the ATO and manual data-entry) | Gifts or donations (pgd) (pre-fill data from the ATO and manual data-entry) | 20 |

| D10 Cost of managing tax affairs | Cost of managing tax affairs (cmt) | Cost of managing tax affairs (cmt) | 20 |

| D12 Personal superannuation contributions | Personal superannuation contributions (psc) | Personal superannuation contributions (psc) | 25 |

D13 Deductions for project pool | Depreciation worksheet | Depreciation worksheet | 20 |

D14 Forestry managed investment scheme deduction | Forestry managed investment scheme worksheet (fms) | Forestry managed investment scheme worksheet (fms) | 20 |

| D15 Other deductions | Label E - Enter the value directly in the return | Label E - DDCTNS | 100 |

Data entry from the DDCTNS schedule

Item D7 - Interest deductions

- Click label I to open the DDCTNS schedule.

- Scroll down to D7 Interest deductions and fill in the description and the amount.

To add a record, click the

icon located near the Return properties.

icon located near the Return properties.

If

is greyed out, make sure the cursor is on the last data-entry field. remove this line...

is greyed out, make sure the cursor is on the last data-entry field. remove this line...If the last field you enter is immediately before the total for the worksheet, either tab-off the field or save the schedule otherwise your changes won't be saved. ???? F6 is save.

- Click Deductions from depreciation worksheets or Deductions from motor vehicle worksheets (mve) to edit.

- The amount at D7 total integrates to item D7 label I Interest deductions in the main return.

Data entry from a supporting schedule

Item D5 - Other work-related expenses

- Click label E to open an Other Work Related Expenses worksheet.

- Enter the description and amount for all the items, then close the worksheet.

- The amount at D5 total in the DDCTNS is shown at item D5 label E Other work-related expenses in the income tax return.

Rolling over deductions from 2018 to 2019

By introducing the new DDCTNS, we've changed or replaced some worksheets and grids. Only the Depreciation worksheet and the Motor vehicle worksheet will rollover to 2019. You must create all other deductions worksheets for 2019.

Tax office copy PDF

There is no ATO PDF version of the DDCTNS.

For paper lodgments, print amounts at deduction items and action codes at D1, D3 and D4 in the main income tax return.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.