- Created by MichelleQ, last modified by AdrianC on Sep 09, 2019

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 22 Next »

https://help.myob.com/wiki/x/F5dqAg

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

Australia only

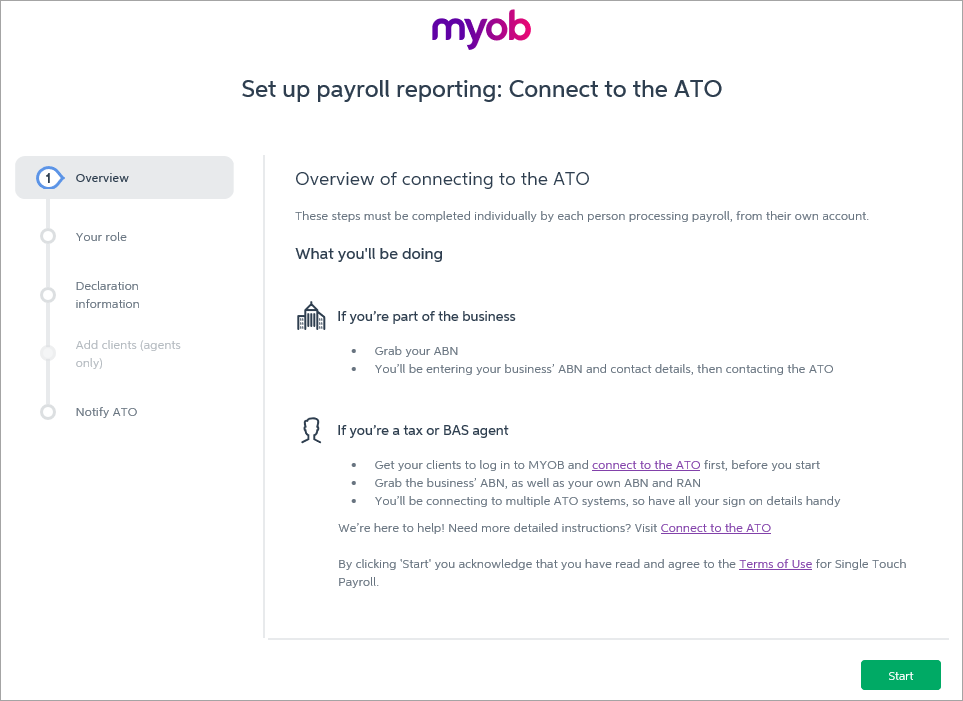

The final step to set up Single Touch Payroll is to connect to the ATO. This is where you let the ATO know you're using MYOB software.

- Make sure you're connected to the internet

- Sign in to your MYOB account (you'll be prompted to do this automatically if you open MYOB Essentials). If you don't have an MYOB account, you'll need to get one

Learn how to connect to the ATO

Who needs to complete these steps?

Only the person setting up Single Touch Payroll will need to connect to the ATO for STP.

Additional users will need to add themselves as declarers before they can send payroll information to the ATO.

To connect to the ATO

- Go to Payroll > Payroll Reporting.

- Click Connect to ATO.

- If prompted, click Check Payroll Details to fix any issues with your payroll setup.

- Click Start and follow the prompts to complete the ATO connection.

- Follow the prompts to complete the ATO connection. For guidance, refer to the procedures below that are relevant for your role in the business.

Perform the steps below if you're someone from the business, such as the payroll officer for the business.

- Make sure you've got your ABN handy and click Start.

- At the Your role step, choose Someone from the business and click Continue.

- Enter your declarer information, including your ABN, name and contact details and click Continue. As you selected Someone from the business in step 2, you'll skip the Add clients step.

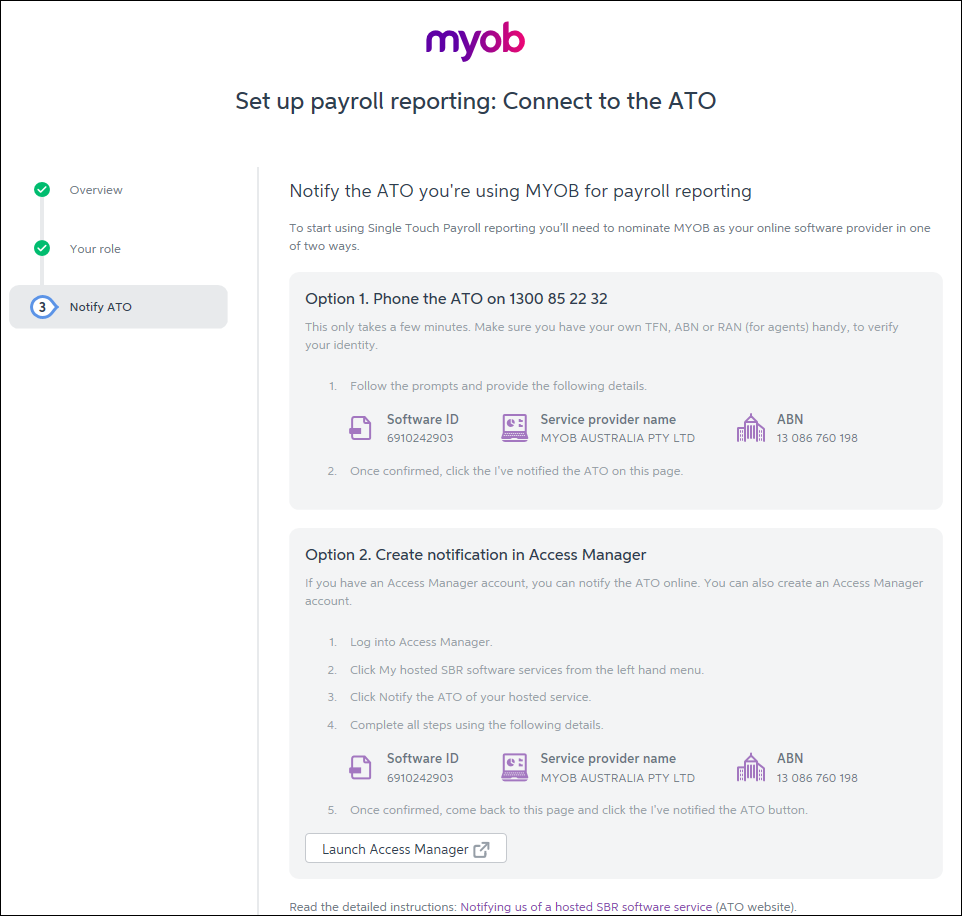

- At the Notify ATO step, you need to let the ATO know you're using MYOB for payroll reporting:

- Get the Software ID. This is unique to you and you can't share it - each client and agent will have their own . If you use the wrong Software ID, the ATO will reject your reports.

- Choose how you want to notify the ATO that you're using MYOB for payroll reporting. If you:

- don't have an Access Manager account, choose Option 1 to call the ATO - this is an automated service, which should only take a few minutes.

- have an Access Manager account, follow the onscreen steps in Option 2.

- Get the Software ID. This is unique to you and you can't share it - each client and agent will have their own . If you use the wrong Software ID, the ATO will reject your reports.

- Once you've notified the ATO that you're using MYOB software, click I've notified the ATO and in the message that appears, click I've notified the ATO.

Perform the steps below if you're you're a registered tax or BAS agent.

You’ll need to enter your own details here, signed into MYOB as yourself. You cannot complete this on behalf of your client.

- Make sure you've got your ABN handy and click Start.

- At the Your role step:

- choose either A tax agent or A BAS agent

- enter your agent ABN and Registered Agent Number

- click Search to find your contact details – if you can't find these, you'll need to add them. Click Continue.

- Enter your declarer information, including the business's ABN, your name and contact details and click Continue.

- At the Add clients step, add this business to your client list in the Tax Agent Portal (skip this step if they're already on your client list).

- Click I've added this client.

- At the Notify ATO step, you need to let the ATO you're using MYOB for payroll reporting:

- Get the Software ID. This is unique to you and you can't share it – each client and agent will have their own . If you use the wrong Software ID, the ATO will reject your reports.

- Choose how you want to notify the ATO that you're using MYOB for payroll reporting. If you:

- don't have an Access Manager account, choose Option 1 to call the ATO - this is an automated service, which should only take a few minutes.

- have an Access Manager account, follow the onscreen steps in Option 2.

- Get the Software ID. This is unique to you and you can't share it – each client and agent will have their own . If you use the wrong Software ID, the ATO will reject your reports.

- Once you've notified the ATO that you're using MYOB software, click I've notified the ATO and in the message that appears, click I've notified the ATO.

What happens after I've set up STP? The short answer is you'll keep paying your employees as normal – there'll just be a step to send your payroll info to the ATO after a payrun. See What happens after I've set up Single Touch Payroll?

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.