Press Enter at label F to open the dissection widow:

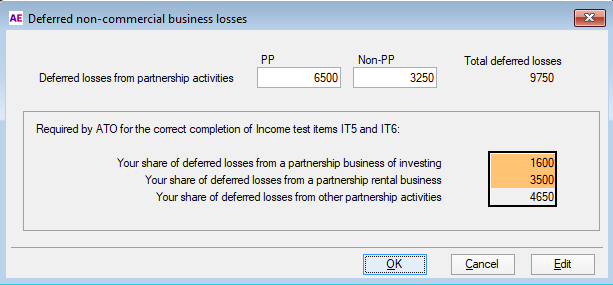

Enter the relevant amounts and we'll complete the return labels when you close the dissection window. See Deferred Non-commercial Business Losses worksheet.

The total amount of PP and Non-PP losses amount defaults to the share of deferred losses from other partnership activities field.

The two orange fields are ATO fields and must be dissected to show those losses related to:

- the business of investing, and

- rental business

Using the above example, on closing the window, the following amounts will have filtered through to:

label F - Total deferred losses of $9,750

label I - Primary production deferred losses of $6,500, and

label J - Non-primary production losses of $3,250.

The ATO will also receive the deferred losses for a partnership in the business of investing amount of $1,600 and the deferred losses from a partnership rental business of $3,500. The ATO uses these figures for cross matching purposes.

Whether losses have to be deferred depends on an Income test. If Income Test income exceeds $250,000 the losses must be deferred.