- Created by RonT, last modified by AdrianC on Apr 28, 2020

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 146 Next »

https://help.myob.com/wiki/x/24UWAw

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

Australia only

Updated 28 April 2020

We know that there's a lot to take in when it comes to JobKeeper and your business so we're doing everything we can to make it easier.

Information and updates are coming through thick and fast, and our help content is being updated with the latest information all the time, so check back regularly.

JobKeeper is a government scheme to help businesses continue paying their employees. Eligible employers will be reimbursed a fixed amount of $1500 per fortnight (before tax) for each eligible employee.

To be eligible for the JobKeeper payment, employers and their employees must meet a range of criteria. For eligibility criteria for you and your employees, and all the details on the JobKeeper scheme, visit the ATO website.

For the latest information about ATO measures and the support available for your business, visit ato.gov.au/coronavirus

| Date | Step | Action |

|---|---|---|

| Set up for JobKeeper with ATO | ||

| from 30 March | EOI | Express interest in JobKeeper |

| from 20 April | Enrol | Enrol for JobKeeper with the ATO. |

| Set up JobKeeper in MYOB | ||

| by 30 April | Notify | Report start fortnight for eligible employees. See steps below. |

| from 4 May | Declare | Submit pay via STP. See steps below. |

| by 8 May | Catch-up | Make sure your employees have been paid the correct JobKeeper amounts for April. This must include any required back pay to meet the minimum ($1500 per fortnight) for the April transition period. |

| Ongoing tasks | ||

| by 31 May | Meet April deadline | Deadline for reporting pay for April JobKeeper payments |

Setting up JobKeeper payment in MYOB Essentials

Once you've completed the enrollment process, you can set up the following in MYOB Essentials:

- a new income account - for receiving JobKeeper payments from the government

- two new allowance pay items - to report your employees JobKeeper payments via Single Touch Payment.

Our examples are based on simple scenarios.

There are lots of different agreements and awards specifying employee conditions and entitlements. If our approach doesn't suit your business needs, please get in touch with an MYOB Partner or accounting advisor.

Let's step you through it.

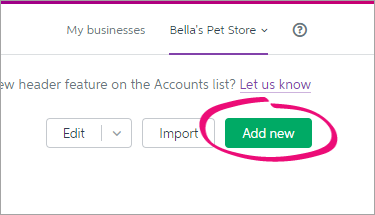

- Click your business name and choose Accounts list.

- Click Add new. The Add new box appears, in the Accounts tab.

Enter a unique Account Number.

Don’t use your real account number for bank and credit card accounts

The number you enter here is only used for tracking the account in MYOB Essentials. You don’t need to use your real bank or credit card account number.

- Enter the Account Name as JOBKEEPER SUBSIDY NO GST.

- Choose Income from the Account Type list.

- Choose NTR from the Tax Rate list.

- Click Save to add the accounts.

Here's our example:

You can now set up the required pay items to ensure JobKeeper payments are reported correctly to the ATO.

You'll need to set up pay items for:

- JobKeeper top-up - this is for employees earning less than the JobKeeper payment amount, or they've been stood down, who must be paid a top-up to bring their taxable gross to $1,500 per fortnight.

- JobKeeper start - this is for all employees to let the ATO know when you've started paying an employee JobKeeper payments. You'll only use this once for each employee to indicate when their JobKeeper payments started.

You only need to set up these pay items once.

Make sure you name these pay items exactly as described below. It's critical to enter the names exactly as defined by the ATO. Any changes may delay reimbursements.

Set up the JobKeeper top-up pay item

- Go to the Payroll menu and choose Employees.

- Click the employee's name.

- Click the Pay items - earnings & deductions tab.

- Under Earnings, add a new earning called JOBKEEPER-TOPUP.

- For the Type, choose Allowance.

For the Rate, choose Fixed amount.

Enter a value of 0.00 in the Amount.

- As the JobKeeper amount will be considered part of the employee's PAYG income, choose Taxable in the Tax field.

- Decide whether you need to Pay super on this earning.

As per the government's information, you must pay super on an employee's regular pay amount, but you can choose whether to pay super on top-up amounts.

Take a look at these examples for fortnightly paid employees:

Regular fortnightly income Fortnightly income with JobKeeper You must pay super on You can choose to pay super on $1000 $1500 $1000 $500 $1500 $1500 $1500 N/A $3000 $3000 $3000 N/A - Choose Allowance - Other for the ATO reporting category.

- Click Save. The new earning is now listed for the employee.

Here's our example pay item:

- Click Save. The new earning is now listed for the employee.

- Click Save to save your changes to the employee.

- Click the name of another employee that will receive JobKeeper.

- Click the Pay items - earnings & deductions tab.

- Under Earnings, choose the JOBKEEPER-TOPUP pay item.

- Click Save.

- Repeat steps 14 to 15 for every employee that will be receiving JobKeeper.

Set up a JobKeeper START pay item

- Go to the Payroll menu and choose Employees.

- Click the employee's name.

- Click the Pay items - earnings & deductions tab.

Under Earnings, add a new earning called JOBKEEPER-START-FNxx, where xx refers to the fortnightly period you start making JobKeeper payments (see the following table for help).

For example, if you're paying your employee their first JobKeeper payment on 11 April, use JOBKEEPER-START-FN01 as the pay item (as the pay date falls within the ATO's fortnightly period). The pay item name must match this (all capitals, with hyphens and no spaces) to ensure it's accepted by the ATO for Single Touch Payroll reporting. See the following table for help.FN If your pay date falls within The pay item Name must be this 01 30/03/2020 - 12/04/2020 JOBKEEPER-START-FN01 02 13/04/2020 - 26/04/2020 JOBKEEPER-START-FN02 03 27/04/2020 - 10/05/2020 JOBKEEPER-START-FN03 04 11/05/2020 - 24/05/2020 JOBKEEPER-START-FN04 05 25/05/2020 - 07/06/2020 JOBKEEPER-START-FN05 06 08/06/2020 - 21/06/2020 JOBKEEPER-START-FN06 07 22/06/2020 - 05/07/2020 JOBKEEPER-START-FN07 08 06/07/2020 - 19/07/2020 JOBKEEPER-START-FN08 09 20/07/2020 - 02/08/2020 JOBKEEPER-START-FN09 10 03/08/2020 - 16/08/2020 JOBKEEPER-START-FN10 11 17/08/2020 - 30/08/2020 JOBKEEPER-START-FN11 12 31/08/2020 - 13/09/2020 JOBKEEPER-START-FN12 13 14/09/2020 - 27/09/2020 JOBKEEPER-START-FN13 - For the Type, choose Allowance.

For the Rate, choose Fixed amount.

Enter a value of $0.01 in the Amount field.

- Choose Taxable in the Tax field.

- Leave the option, Pay super on this earning, deselected.

- Choose Allowance - Other for the ATO reporting category.

Here's our example pay item:

- Click Save. The new earning is now listed for the employee.

- Click Save to save your changes to the employee.

- Click the name of another employee that will receive JobKeeper.

- Click the Pay items - earnings & deductions tab.

- Under Earnings, choose the JOBKEEPER-START-FNxx pay item.

- Click Save.

- Repeat steps 12 to 15 for every employee that will be receiving JobKeeper.

If an employee becomes ineligible during the JobKeeper scheme, you'll need to create a new pay item to inform the ATO. See the FAQs below for details.

3. Do your first pay under JobKeeper

The first pay you complete under the JobKeeper scheme will look quite similar to any other pay day, but with these changes:

- You'll enter $0.01 against the JOBKEEPER-START-FNxx pay item for each employee you're paying. You only need to do this for the employee's first JobKeeper pay.

- You'll increase the PAYG by 1 cent to balance the pay.

- If you're paying an employee who's earned less than the JobKeeper payment, or the employee has been stood down, you'll enter a value against the JOBKEEPER-TOPUP pay item.

Also, let's establish the JobKeeper payment amounts you'll need to pay (before tax) based on an employee's pay frequency:

| Pay frequency | JobKeeper payment amount | Calculation |

|---|---|---|

| Weekly | $750 | 1500 / 2 |

| Fortnightly | $1500 | 1500 x 1 |

| Twice a Month | $1625 | 1500 x 26 / 24 |

| Monthly* | $3250 | 1500 x 26 / 12 |

| *Monthly paid employees must receive at least $1,500 for each full JobKeeper fortnight within the month. This is a minimum of $3,000 for each month except August 2020 which has 3 full fortnights. You can choose to pay $3,250 each month, but your reimbursements will be based on complete fortnights each month. | ||

Now, let's take you through it:

From the Payroll menu, choose Enter pay. The Pay centre page appears.

Under Confirm dates:

In the How often field, choose the pay frequency. For example, if it's a weekly pay, choose Weekly.

In the From and To fields, chose the first and last day of the pay period.

Choose the Pay on date. This is typically the day you're processing the pay run.

Under Select employees to pay:

Select the employees you're paying.

Click in the Email

column to select which employees you want to email payslips to. You'll need to have entered their email addresses on the Employee details tab of their employee record to be able to email their payslip.

column to select which employees you want to email payslips to. You'll need to have entered their email addresses on the Employee details tab of their employee record to be able to email their payslip.A tick

shows in the Bank File column if the employee is being paid electronically.

shows in the Bank File column if the employee is being paid electronically.

- Under Pay run , click Start pay run . The Pay run page appears where you can review the pay details.

On the Pay run page, enter the number of paid hours against the JobKeeper pay item and reduce their Normal hours by the same amount.:

| If an employee is | Do this |

|---|---|

| being paid less than the JobKeeper payment |

|

| being paid more than the JobKeeper payment | Enter their hours as you normally would against Normal. |

| stood down | Enter the full JobKeeper payment against the JOBKEEPER-TOPUP pay item. |

Here's some examples:

Example 1: Employee paid less than $750 a week

Here's an example of a casual employee who works 20 hours per week and whose pay is less than the JobKeeper amount ($750). For their 20 hours they earn $570.00 a week. Under JobKeeper, they'll now earn $750 a week so we've put their extra $180.00 against the JOBKEEPER-TOPUP pay item.

Because this is their first JobKeeper payment, the JOBKEEPER-START pay item is also included in their pay with a value of $0.01 against it. To balance the pay, we also increase the PAYG by 1 cent ($244.00 + $0.01 = $244.01)

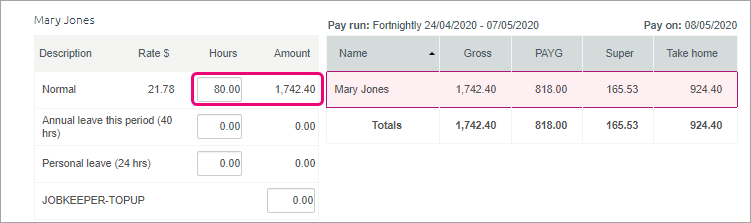

Example 2: Employee paid more than $1500 per fortnight

Here's an employee whose weekly pay is more than the fortnightly JobKeeper amount ($1500). They normally earn $1742.31 a fortnight. Under JobKeeper, they'll still be paid the same.

So we'll enter their pay as we normally would and record their hours against Normal.

But because it's the first pay they're receiving under the JobKeeper scheme, the JOBKEEPER-START pay item is also included in their pay with a value of $0.01 against it (after doing this first pay for them, we'll need to unlink the JOBKEEPER-START pay item from the employee). To balance the pay, we also increase the PAYG by 1 cent ($818.00 + $0.01 = $818.01)

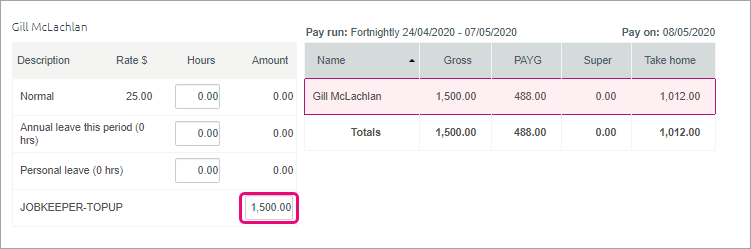

Example 3: Employee who is stood down

Here's an employee who has been stood down. Regardless of what they were earning while working, they'll now receive the full JobKeeper payment.

So in their fortnightly pay we'll enter $1500 against the JOBKEEPER-TOPUP pay item.

We'll record zero hours against Normal and any other pay items.

And because it's the first pay they're receiving under the JobKeeper scheme, we'll enter $0.01 against the JOBKEEPER-START pay item. To balance the pay, also increase the PAYG by 1 cent ($488.00 + $0.01 = $488.01).

After entering the JobKeeper amount and adjusting the employee's Normal amount, complete the rest of the pay run as normal.

After an employee's first JobKeeper pay

If you've submitted the employee's first JobKeeper pay to the ATO via Single Touch Payroll reporting, you can unlink the JOBKEEPER-START pay item from them.

Like this:

- Go to the Payroll menu and choose Employees.

- Click the employee's name.

- Click the Pay items - earnings & deductions tab.

- Under Earnings, click the ellipsis button next to the JOBKEEPER-START pay item and choose Unlink from employee.

- Click Save to save your changes to the employee.

- Repeat from step 2 for all other employees that you've submitted their first JobKeeper pay for.

You will now be able to process subsequent pays in a similar way to the first pay, but without using the JOBKEEPER-START pay item.

4. Receive JobKeeper payments from the government

The JobKeeper payments from the government will be deposited into your nominated bank account. Here's how to record those payments in MYOB Essentials.

If you use bank feeds

The deposits from the government will appear in MYOB Essentials when your bank feed transactions appear.

- If you've already recorded a Receive Money transaction for the deposit (as described below), you can match the bank feed transaction to it.

- If you haven't already recorded a Receive Money transaction for the deposit, you can allocate the deposit to the income account you created earlier. For details about allocating, see Allocating bank transactions.

If you don't use bank feeds, you'll need to manually record a Receive Money transaction.

Here's how:

To manually record a Receive Money transaction

- Create a Receive Money transaction (Banking menu> Receive money). Need a refresher?

- In the Deposit into field, select the account the money is being deposited into.

- In the Notes field, enter a description for this transaction.

- If you've set up the Australian Government or the ATO as a contact, choose it from the Payer list. You can add a new payer by clicking Add customer from the Payer list and entering their details.

- In the Allocate to field, select the income account you created earlier.

- In the Amount column, enter the JobKeeper payment amount you've received.

Here's our example:

- Click Save.

JobKeeper FAQs

How are leave accruals affected by JobKeeper?

Typically, an eligible employee's leave entitlements will not change under JobKeeper. So the amount of leave they were accruing before JobKeeper, will continue to accrue during JobKeeper. For more information, visit this Fair Work website.

If you need to record leave accruals for employees receiving JobKeeper, for example a stood down employee, you'll need to use a new pay item for this.

This new pay item will only be used to calculate leave accruals and will have no dollar amount against it. Therefore, it won't need to be reported to the ATO.

Let's step you through it:

- Go to the Payroll menu and choose Employees.

- Click the employee's name.

- Click the Pay items - earnings & deductions tab.

Under Earnings, click the Add earning dropdown button and choose Create new earning.

Set up the pay item as per below:

Click Save.

Assign this pay item to any other employee who needs to accrue leave under JobKeeper.

When you pay the employee, enter the amount of hours they need to accrue leave on.

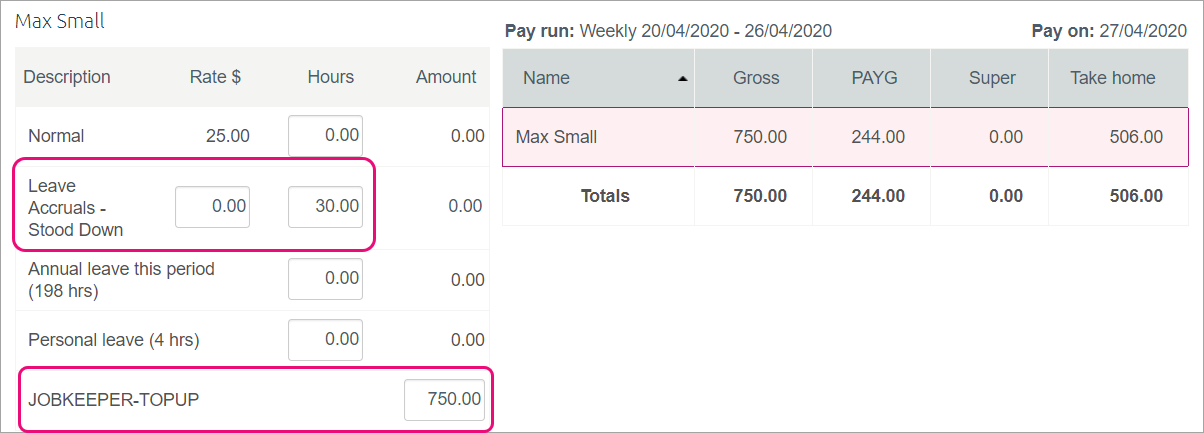

Example: An employee who has been stood down and is currently being paid $750 per week as part of JobKeeper.

We've entered the following:

- 30 hours against the Leave Accruals - Stand Down pay item (this has a 0.00 amount).

- 750 against the JOBKEEPER-TOPUP category.

Need help with this? Contact us or speak to an MYOB Partner.

What if I've already paid my employees since 30 March before setting up MYOB Essentials for JobKeeper payments?

No problem, there's no need to change the pays you've already done. Just set up for JobKeeper as described above and include the JOBKEEPER-START-FNxx pay item on the next pay run (see Do your first JobKeeper pay above for details).

When setting up the JOBKEEPER-START-FNxx pay item, make sure the name includes the applicable code indicating when your started making JobKeeper payments. For example, if you've already paid employees during the period 30/03/2020 - 12/04/2020, you'd name the pay item JOBKEEPER-START-FN01.

Use this table as a guide.

| FN | If your first pay date was within | The pay item name must be this |

|---|---|---|

| 01 | 30/03/2020 - 12/04/2020 | JOBKEEPER-START-FN01 |

| 02 | 13/04/2020 - 26/04/2020 | JOBKEEPER-START-FN02 |

| 03 | 27/04/2020 - 10/05/2020 | JOBKEEPER-START-FN03 |

| 04 | 11/05/2020 - 24/05/2020 | JOBKEEPER-START-FN04 |

| 05 | 25/05/2020 - 07/06/2020 | JOBKEEPER-START-FN05 |

| 06 | 08/06/2020 - 21/06/2020 | JOBKEEPER-START-FN06 |

| 07 | 22/06/2020 - 05/07/2020 | JOBKEEPER-START-FN07 |

| 08 | 06/07/2020 - 19/07/2020 | JOBKEEPER-START-FN08 |

| 09 | 20/07/2020 - 02/08/2020 | JOBKEEPER-START-FN09 |

| 10 | 03/08/2020 - 16/08/2020 | JOBKEEPER-START-FN10 |

| 11 | 17/08/2020 - 30/08/2020 | JOBKEEPER-START-FN11 |

| 12 | 31/08/2020 - 13/09/2020 | JOBKEEPER-START-FN12 |

| 13 | 14/09/2020 - 27/09/2020 | JOBKEEPER-START-FN13 |

Do I have to pay back pay?

Because the ATO requires each eligible employee to be paid at least $1500 per fortnight, you'll need to make sure your first JobKeeper pay includes any required back pay.

Example: Fortnightly employee owed JobKeeper back pay

You have an employee whose regular fortnightly pay is $1100.

Your business became eligible for JobKeeper from 30 March (1st fortnight of JobKeeper scheme), but you already processed a pay for the employee on 10 April (before you set up MYOB Essentials for JobKeeper). Your next pay is scheduled for 24 April (2nd fortnight of JobKeeper scheme).

You'll need to workout the amount of JobKeeper back pay you owe the employee from the previous pay and add it to their next pay.

So, if you've paid your employee their regular pay of $1100 per fortnight, your next pay will need to include the $400 JobKeeper top-up back pay, as well as the $400 they would be getting for this fortnight's JobKeeper top-up.

$1100 (regular pay) + $400 (JobKeeper top-up backpay) + $400 (JobKeeper top-up current pay) = $1900. This will bring their total gross pay to $1900.

This means $800 needs to be recorded against the JOBKEEPER-TOPUP pay item.

And because it's the first JobKeeper pay they're receiving under the scheme, we'll enter $0.01 against the JOBKEEPER-START-FN01 pay item. To balance the pay, you'll need to increase the PAYG by 1 cent.

Here's our example:

Set up a JobKeeper Finish pay item

If an employee becomes ineligible during the JobKeeper scheme, you'll need to create a new pay item and assign it to the employee. This lets you notify the ATO that the employee's payments are finished.

- Go to the Payroll menu and choose Employees.

- Click the employee's name.

- Click the Pay items - earnings & deductions tab.

Under Earnings, add a new earning called JOBKEEPER-FINISH-FNxx, where xx refers to the fortnightly period you stopped making JobKeeper payments (see the following table for help). The pay item name must match this (all capitals, with a hyphen and no spaces) to ensure it's accepted by the ATO for Single Touch Payroll reporting.

FN If the employee's final pay date falls within The pay item Name must be this 01 30/03/2020 - 12/04/2020 JOBKEEPER-FINISH-FN01 02 13/04/2020 - 26/04/2020 JOBKEEPER-FINISH-FN02 03 27/04/2020 - 10/05/2020 JOBKEEPER-FINISH-FN03 04 11/05/2020 - 24/05/2020 JOBKEEPER-FINISH-FN04 05 25/05/2020 - 07/06/2020 JOBKEEPER-FINISH-FN05 06 08/06/2020 - 21/06/2020 JOBKEEPER-FINISH-FN06 07 22/06/2020 - 05/07/2020 JOBKEEPER-FINISH-FN07 08 06/07/2020 - 19/07/2020 JOBKEEPER-FINISH-FN08 09 20/07/2020 - 02/08/2020 JOBKEEPER-FINISH-FN09 10 03/08/2020 - 16/08/2020 JOBKEEPER-FINISH-FN10 11 17/08/2020 - 30/08/2020 JOBKEEPER-FINISH-FN11 12 31/08/2020 - 13/09/2020 JOBKEEPER-FINISH-FN12 13 14/09/2020 - 27/09/2020 JOBKEEPER-FINISH-FN13 - For the Type, choose Allowance.

For the Rate, choose Fixed amount.

Enter a value of $0.01 in the Amount field.

- Choose Taxable in the Tax field.

- Leave the option, Pay super on this earning, deselected.

- Choose Allowance - Other for the ATO reporting category.

- Here's our example pay item:

- Click Save. The new earning is now listed for the employee.

- Click Save to save your changes to the employee.

When you process their last JobKeeper payment, enter $0.01 against the JOBKEEPER-FINISH pay item. To balance the pay, also increase the PAYG by 1 cent.

This will inform the ATO (when you send the pay via Single Touch Payroll reporting) that the employee will no longer receive JobKeeper payments.