- Created by admin, last modified by AdrianC on Jun 16, 2020

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 19 Next »

https://help.myob.com/wiki/x/iwRMAw

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

If you have unpaid invoices or bills at the time you start using MYOB, these are called historical transactions and they need to be recorded in MYOB. Then when you make or receive a payment for these transactions, you'll be able to apply it to the right invoice or bill.

Because historical transactions date from before you started using MYOB, to enter them you'll need to change your Opening balance month (you can't enter transactions dated before this). You'll also need to adjust the opening balances of your Trade Debtors (accounts receivable) and Trade Creditors (accounts payable) accounts to include these outstanding amounts.

The steps below can only be completed before you've recorded any other transactions in MYOB. It'll also impact your accounts and GST reporting, so we recommend speaking to an accounting advisor or MYOB Partner before proceeding (find an MYOB Partner in Australia | New Zealand).

Let's take you through it.

To be able to enter historical sales and purchases, you'll need to change your opening balance month.

- Click your business name and choose Business details.

- Under Financial year, change the Opening balance month (and year) based on the earliest historical sale or purchase you need to enter. For example, if you have a historical sale from July 2018, enter this as your Opening balance month.

- Click Save.

Include unpaid invoices and purchases in opening balances

The opening balances of your of your Trade Debtors (accounts receivable) and Trade Creditors (accounts payable) accounts should equal the amount owing on historical sales and purchases.

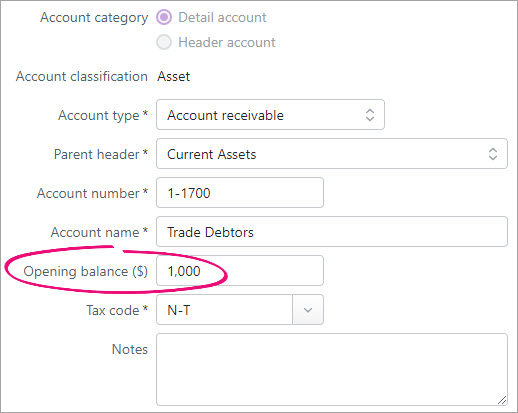

For example, if you have two unpaid historical invoices, one for $700 and another for $300, you have $1000 worth of historical sales. This means the opening balance of your Trade Debtors (accounts receivable) account should be $1000.00.

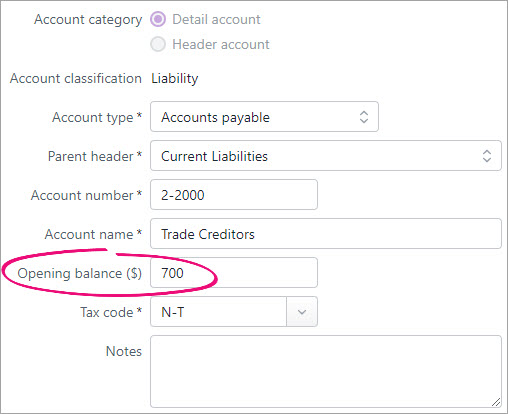

Likewise, if you have three unpaid bills, for $100, $200 and $400, you have $700 worth of historical purchases. This means the opening balance of your Trade Creditors (accounts payable) account should be $700.

To check your opening balances

- Go to the Accounting menu and choose Chart of accounts.

- Click to open your Trade Debtors (accounts receivable) account.

- Check the Opening balance and change it if required. This should equal the value of historical sales.

- Click Save.

- Click to open your Trade Creditors (accounts payable) account.

- Check the Opening balance and change it if required. This should equal the value of historical purchases.

- Click Save.

Record the historical sales and purchase transactions

You can now enter your historical sales and purchases just like any other sale or purchase. The only difference is that the transaction date you enter will be before the date you started using MYOB.

If you need a refresher, see Creating invoices and Creating bills.

Depending on how many invoices or bills you need to enter, and how you want to track them, you can either:

- create an individual invoice or bill for each historical sale or purchase, or

- create a single invoice or bill for each customer or supplier, for the total amount owing.

When entering these transactions, make sure you enter the original transaction date.

Once you've entered these historical transactions, you'll see them on your Invoices and Bills pages, along with the rest of your invoices and bills. You can apply partial or full payments against these transactions in the same way as any other payment. For more information, see Customer payments and Entering payments made to suppliers.

Customers or suppliers with an opening credit balance

If you're setting up a customer or supplier who has a credit balance, enter the contact's details then create a customer return or supplier return to record their credit balance. When creating the return you'll need to enter the Allocate to account. This account will be specific to your business, so check with your accounting advisor if unsure.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.