https://help.myob.com/wiki/x/_QRMAw

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

This content is obsolete, so we’ve retired the page.

You can remove any bookmarks to this page. If there’s something else you need, try searching our help centre.

The JobKeeper program ended on 28 March 2021

If you had employees being paid under JobKeeper right up to the end of the scheme, there's nothing you need to do in AccountRight (you don't need to select a Final Fortnight for those employees).

For key dates and actions for employers, see the ATO website.

To help businesses cope with COVID-19 restrictions, you might be eligible for financial support. To be eligible, your business needs to show a fall in turnover for a specified period in 2021 compared to an earlier corresponding period.

To see if your business is eligible for support and what periods you need to compare, check the government website for your state or territory:

NSW: www.service.nsw.gov.au/campaign/covid-19-help-businesses/grants-loans-and-financial-assistance

VIC: www.coronavirus.vic.gov.au/business-grants-and-support

QLD: www.business.qld.gov.au/starting-business/advice-support/grants/covid19-support-grants

WA: www.smallbusiness.wa.gov.au/lockdown-assistance

SA: www.business.sa.gov.au/COVID-19-business-information-and-support/Financial-support-for-sa-businesses

TAS: www.business.tas.gov.au/covid-19_business_support_packages

ACT: www.act.gov.au/business/business-support/covid-19-economic-support-for-business

NT: www.nt.gov.au/industry/business-grants-funding

Working out a change in turnover

Use the Profit and loss report in MYOB to determine your total income for the eligibility period in 2021, then compare it to the corresponding earlier period, for example 2019.

To determine the eligibility periods for the grant or payment you're applying for, check the government website links above.

You can then use the calculator in the Single Touch Payroll reporting centre to help work out your change in turnover.

It's much easier to do these steps in a web browser

You can run the profit and loss report across two financial years when accessing your company file in a web browser, which means you'll only need to run the report twice when following the steps below.

If you can't access your company file in a web browser

You're not able to run the profit and loss report across multiple financial years in your AccountRight software. Instead, you'll need to run the report four times – two reports for June and July 2021, then two reports for June and July 2019.

First we'll obtain your total income value for the 2021 period then compare it to an earlier corresponding period, for example 2019.

Open your AccountRight company file as you normally would and click the Open in web browser button.

- In the browser, go to the Reporting menu and choose Reports.

- Click to open the Profit and loss report.

- Use the Date from and Date to fields to enter your eligible 2-week period in 2021. You'll likely want to use the 2-week period that best highlights any decline in turnover..

- Click Report options to choose your Accounting method (Cash or Accrual).

- Take note of the Total income value. You might want to print or save this report for your records. Here's our 2021 example

- Run the report again for the corresponding earlier period to obtain the comparison value. You might want to print this report too for your records. Here's our 2019 example:

Now we'll use these values to determine your change in turnover using the calculator in the Payroll reporting centre.

COVID grants are not STP-reportable

Even though the calculator is in the Single Touch Payroll reporting centre, COVID-19 grant payments are not payroll related.

- Go to the Payroll menu and choose Single Touch Payroll reporting.

- Click the COVID-19 % Turnover Calculator tab.

Enter the values noted from your profit and loss reports into the GST Exclusive Sales fields for the respective periods.

The 2018-2019 Period fields can be used for whatever earlier period you're comparing to.

Any decline in turnover will be shown, like this example:

Any decline shown does not determine your grant eligibility. It's just a calculated value based on the numbers you entered. If you're unsure of your eligibility, check with your accounting advisor or the relevant government agency.

Applying for a grant

If you think your business is eligible for a COVID-19 grant, check the government website for your state or territory for application details. If you need help with your application, speak to your accounting advisor.

Recording a grant in MYOB

If you receive a government grant it'll be deposited into your nominated bank account.

We recommend you create an income account in AccountRight to keep the grant payment separate from your other income. This will help your accountant at tax time. Speak to your accounting advisor if you need more advice about this.

How you record the grant in AccountRight depends on whether or not you have a bank feed set up on that account.

The grant payment will automatically appear in your bank feed transactions.

- If you've already recorded a Receive Money transaction for the deposit (as described below), you can match the bank feed transaction to it.

- If you haven't already recorded a Receive Money transaction for the deposit, you can do so straight from the Bank Feeds window. When creating the Receive Money transaction, allocate the deposit to the applicable income account.

For details about how to work with bank feed transactions, see Approving a bank feed.

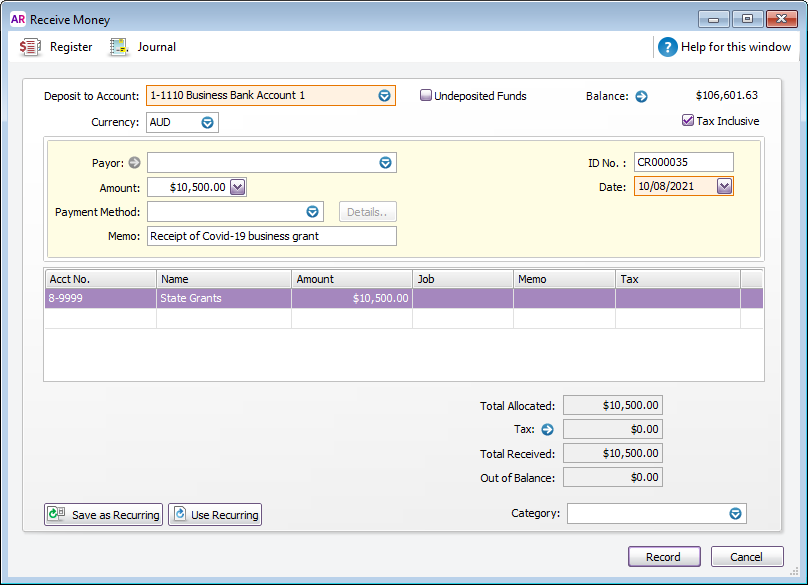

You'll need to manually record a Receive Money transaction, like this:

- Go to the Banking command centre and click Receive Money.

- In the Deposit to Account field, choose the bank account the grant payment went into.

- If you've set up a card for the government, choose this card in the Payor field.

- In the Amount field, enter the grant payment amount.

- Enter a Memo to describe this transaction. This'll make it easier to identify the transaction later.

- In the Acct No. field on the first line, choose the applicable income account.

- Choose the applicable Tax code . Check with your accounting advisor if you're not sure what to choose.

Here's our example:

- Click Record.