You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 10 Next »

https://help.myob.com/wiki/x/fwe0Aw

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

A deposit is a payment for goods or services that you haven't received a bill for yet. This means if you make a payment against a purchase order, it's considered a deposit.

Once a purchase order is converted to a bill, payments you apply are just like regular supplier payments.

How MYOB treats supplier deposits

Because you haven't been billed for the goods or services you've ordered, MYOB treats deposits differently to other payments. A supplier deposit is typically posted to an asset account because it's not yet considered a supplier payment. After you've received the supplier's bill and you've converted the purchase order to a bill, MYOB transfers the deposit from the asset account to your trade creditors account.

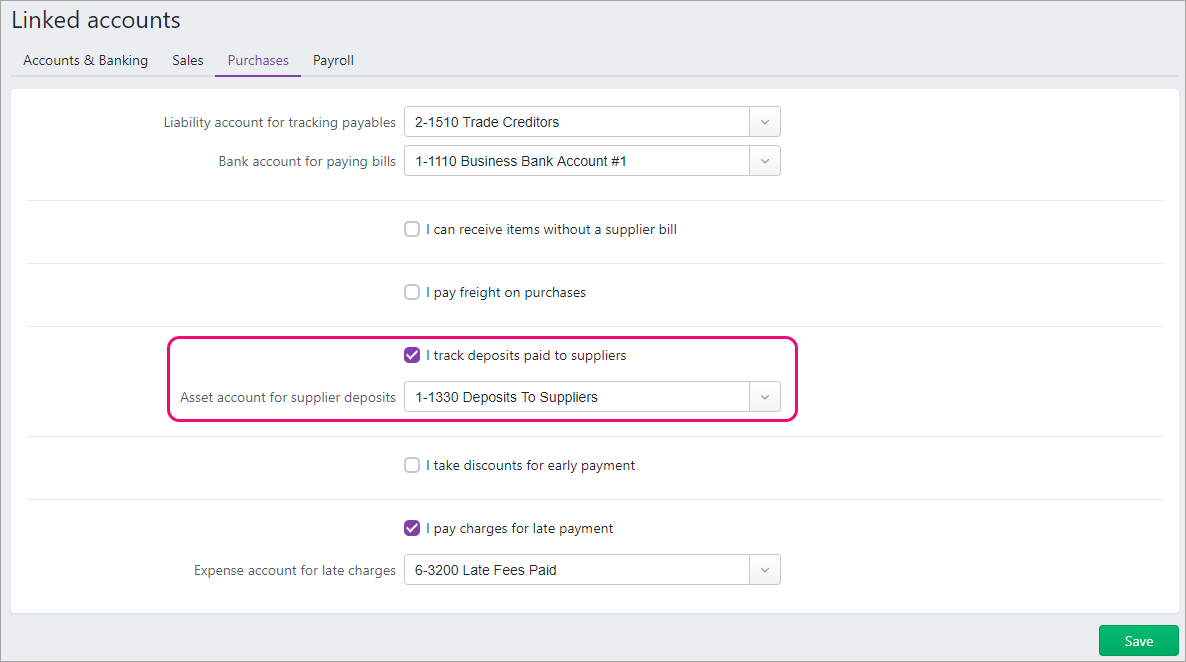

To be able to apply deposits to purchase orders, you'll need to specify the asset account you want to use to track your supplier deposits. Go to the Accounting menu > Manage linked accounts > Purchases tab > I track deposits paid to suppliers.

If you want, you can create a new asset account for this purpose. You can also find out more about linked accounts.

Recording a supplier deposit

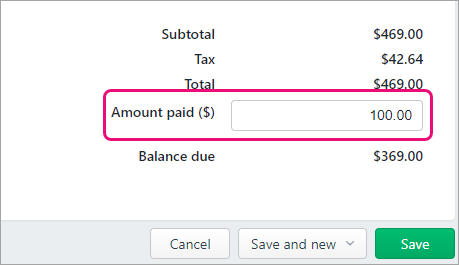

You can record a deposit when creating a purchase order by entering the deposit amount in the Amount paid ($) field.

To apply a deposit after you've saved the purchase order, and before it's converted to a bill, you can record it in a similar way to other supplier payments.

Just go to the Purchases menu > Create supplier payment > select the option Show purchase orders, then enter the deposit amount against the applicable purchase order.

Deleting a deposit

How you delete a deposit depends on the purchase order.

- From the Purchases menu, choose Purchase orders.

- Click the purchase order which has the payment you want to delete. If needed, use the filters at the top to help find the order.

- In the Activity history at the bottom of the bill, click the reference number for the payment to be deleted.

- Click Delete.

- At the confirmation, click Delete.

A common scenario is where a purchase order is created and a full or partial payment (deposit) is applied. Then, the order is converted to a bill but is subsequently cancelled.

Because of the way deposits are treated from an accounting perspective, you can't simply delete a deposit. Instead, you'll first need to "undo" the bill by create a supplier credit for the bill amount then settling that credit.

This ensures:

- the deposit can be refunded or forfeited

- there's an audit trail of what happened

- your MYOB account balances will be correct

- your GST reporting will be correct.

If you need to delete a deposit because the wrong amount has been applied, after completing the tasks below you'll need to create a new purchase order and apply the correct deposit amount.

1. Create a supplier credit for the bill amount

By creating a supplier credit (sometimes called a debit note or supplier return) for the bill amount, you'll be able to apply that credit to the bill—effectively undoing the original bill.

- From the Purchases menu, click Create bill.

Choose the same Supplier as the original bill.

- Select whether the amounts in the original bill were Tax inclusive or Tax exclusive.

- Enter a Description of what's being credited, for example "Supplier credit to reverse bill 000123".

- Select the same Account as the original bill.

For the Amount, enter the amount of the original bill as a negative number. For example, if the original bill was $100, enter -100.00

- Click Save.

Now, based on whether or not you're being refunded the deposit, you can settle this supplier credit against the original bill. See below for details.

Settle the credit (if the deposit is being refunded)

You can use the supplier credit you've created to:

- settle the outstanding balance of the original bill (minus the deposit amount), and

- record the deposit refund.

Here's how:

- Go to the Purchases menu and choose Supplier returns.

Choose the Supplier you created the credit for.

Click Apply next to the credit to be settled.

<pic>- In the list of displayed bills, find the original bill. The outstanding balance will be the amount of the original purchase order minus the deposit.

- In the Amount applied field for the original bill, enter the amount left owing on the bill.

<pic> - Click Record. This settles (closes) the bill and leaves a credit balance equal to the value of the deposit.

- Click Refund next to the remaining credit amount.

<pic> - Select the Bank account the refund is being paid into.

- Click Record. This refunds the deposit and settles the remaining balance of the supplier credit.

Settle the credit (if the deposit is not being refunded)

If the deposit is non-refundable, you need to:

- create a bill for the deposit amount (to account for the payment of this money to the supplier), then

- apply the supplier credit you've created to:

- close the deposit bill, and

- settle the outstanding balance of the original bill (minus the deposit amount)

Here's how:

Create a bill for the deposit amount

Record a new bill (need a refresher?) and use the following details:

- Choose the same Supplier as the original bill.

- If your business operates on a GST accrual basis, make sure the Date is in the correct reporting period.

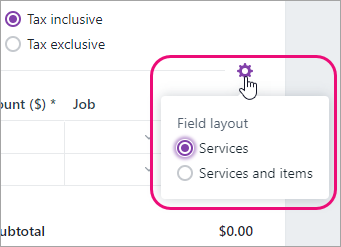

- Use the Services field layout

- Enter a Description which describes the transaction, such as Non-refundable deposit for order XXXX

- For the Account, choose ????

- For the Amount, enter the deposit amount.

Apply the supplier credit

- Go to the Purchases command centre and click Purchases Register.

Click the Returns and Debits tab.

- Click to select the supplier debit then click Apply to Purchase.

- Click to select the bill you created for the deposit amount.

- Change the Debit Amount field to match the deposit value.

- Click the Amount Applied column for deposit bill. This will change the value to match the Credit Amount field.

- Click Record. This settles the deposit component of the transaction which is now considered a payment to the supplier.

- Click to select the supplier debit again, then click Apply to Purchase.

- Click to select the supplier's original bill. This bill will have an outstanding balance of the original order amount minus the deposit.

- Click the Amount Applied column for the original bill. The value will change to match the remaining balance of the debit.

- Click Record. The remaining debit is applied and the original bill is closed.

Supplier deposit FAQs

What is a 'Transfer from deposits' transaction?

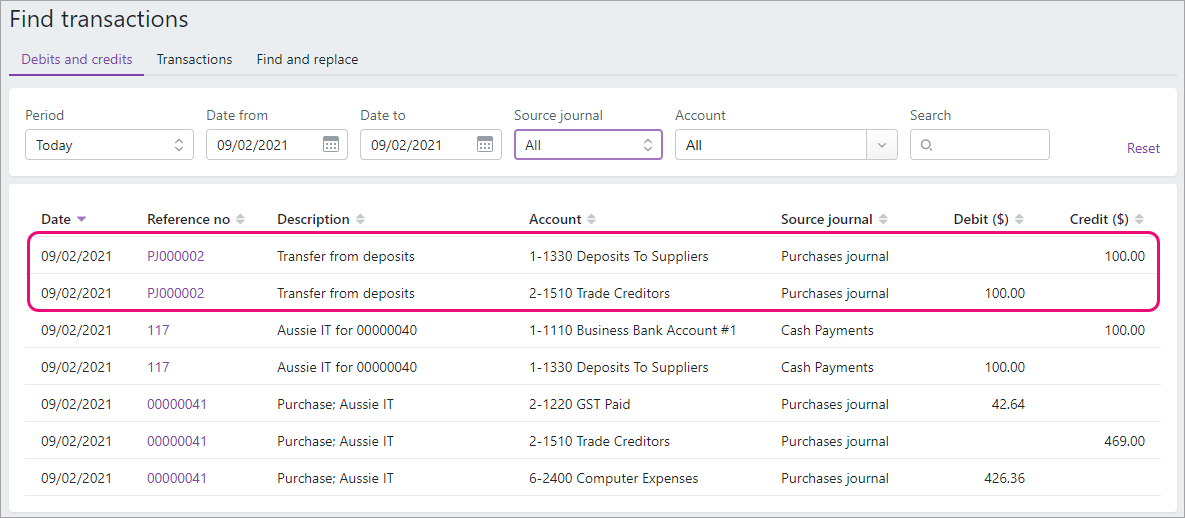

When a deposit is paid for a purchase order, the deposit amount is typically posted to an asset account. When the purchase order is converted to a bill, MYOB needs to transfer the deposit amount from the applicable account and post it to your trade creditors account. This will appear in your transaction journal as a Transfer from deposits.

This example shows what a $100 deposit looks like on the Find transactions page after the order has been converted to a bill:

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.