How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

Get started

We've been gradually rolling out a new and improved Dashboard. Find out about the improvements.

The Dashboard is the first page you’ll see when you sign up with MYOB and each time you subsequently log in. It provides a simple, easy-to-read snapshot of your business as it stands today.

Up next indicates the things you probably should do next in your business, such as allocate bank feed transactions, attach In tray documents to transactions, or chase up overdue invoices or bills. Click the arrow in an Up next section to work on these tasks.

Your Dashboard may look different to the one pictured, depending on:

- the product and features (like payroll) you use

- the functions your roles and permissions give you access to

- how much data is in your business

- any customisations you've applied.

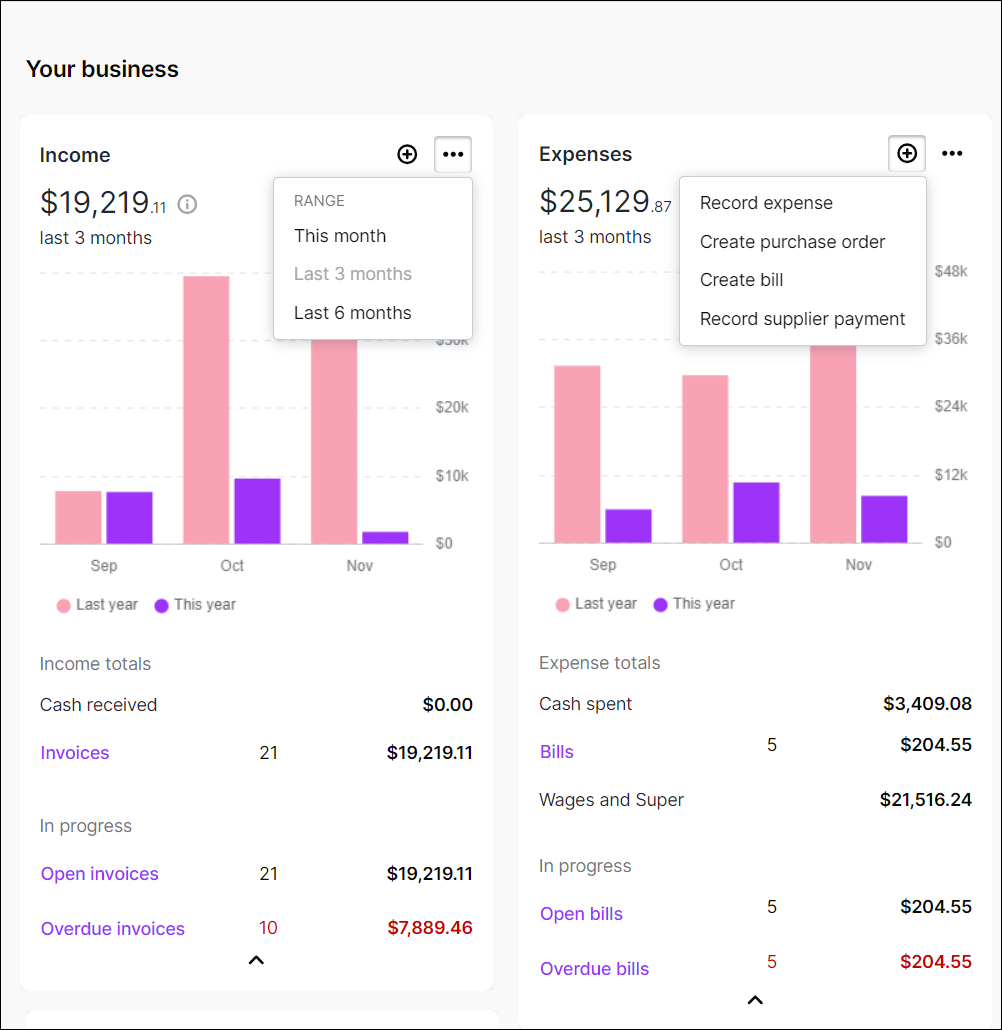

Income and Expenses

Income and Expenses show how much money is coming in and going out of your business. See total tax-exclusive income or expenses for a selected period, broken down by month into bar graphs (hover your mouse over a bar to show the exact amount). You can compare last year's figures to this year's, change the date range of a section or create new transactions.

Expand the sections to see total cash received or spent and the invoices, bills, wages and super payments that make up the figures. Quotes and purchase orders will be added soon.

From here, you can dive deeper. For example, click Open invoices to open the Invoices page filtered to open invoices for the selected period.

Click to add a new transaction, without having to go to menus.

If you only have the:

- Sales role and permissions, you'll see an Invoices section, showing only invoices and quotes

- Purchases role and permissions, you'll see a Bills section, showing only bills and purchase orders.

The amounts in these sections are tax-inclusive. Find out more about roles and permissions.

Bank accounts

View your bank feeds accounts. All of the bank accounts you get bank feeds from are listed, showing the account balance, when the bank feed last synced with MYOB Business and how many bank transactions you need to allocate.

Click into the link for unallocated transactions to open the Bank transactions page, ready for you to allocate them.

Don't have bank feeds? Click Connect with your bank on the Dashboard and follow the prompts to get started. For more information, see Bank feeds.

Pay runs

See a list of recent pay runs. Click a pay run date to see its details, including the pay periods and payment dates, without having to run reports. If there's a draft (saved) pay run you haven't finished yet, continue it straight from here.

You can also start a new pay run without having to go to the Payroll menu.

If you haven't set up payroll yet, click Get started to get the ball rolling.

Financial position

See a snapshot of your income, expenses and net profit for this financial year.

Hover your mouse over a line graph to see the value at that point or expand the section to see totals for income, expenses and net profit. Change the date range by selecting an option in the top right. For more detail on the performance of your business, you can view the Profit and loss report.

You can choose whether to calculate Financial position (and Income and Expenses) by money spent or received (the Cash accounting method) or by expected income and expenses (the Accrual accounting method):

GST, Superannuation, PAYE and KiwiSaver

If you've upgraded from MYOB Essentials, you might notice some familiar information in the Dashboard:

- (Australia) see the GST payable and, if you use payroll, how much super is payable to your employees.

- (New Zealand) see the PAYE withholdings payable and, if you use payroll, how much KiwiSaver is payable to your employees.

The GST section only appears if your business is registered for GST. The amounts in this section are based on the balances of your GST Collected and GST Paid linked accounts.

If you haven't onboarded any employees, Superannuation or PAYE and KiwiSaver won't appear on the Dashboard until after you've done your first pay run.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.