ING Living Super is moving to OneSuper

From 30 November 2023, ING Living Super (USI 13355603448001) will stop accepting contributions. Existing members of this fund will be transferred to OneSuper and will retain their existing membership number. Learn more about this change on the ING website.

You'll need to add OneSuper (USI 43905581638019) as a super fund in AccountRight, and assign this fund to the impacted employees.

See below for details on adding and assigning super funds.

The super funds your employees belong to need to be set up in AccountRight. So in addition to setting up superannuation payroll categories, you'll need to:

Add the standard and self-managed (SMSF) super funds that your employees use

Assign the relevant funds to your employees.

Before you can set up superannuation funds

You need to register for Pay Super - it’s included with your AccountRight subscription and you can use it to make super payments directly from AccountRight. This ensures you stay on top of government obligations, including SuperStream.

If you had already set up any self-managed super funds before registering for Pay Super, you'll need to create new self-managed super funds for these employees after registering for Pay Super.

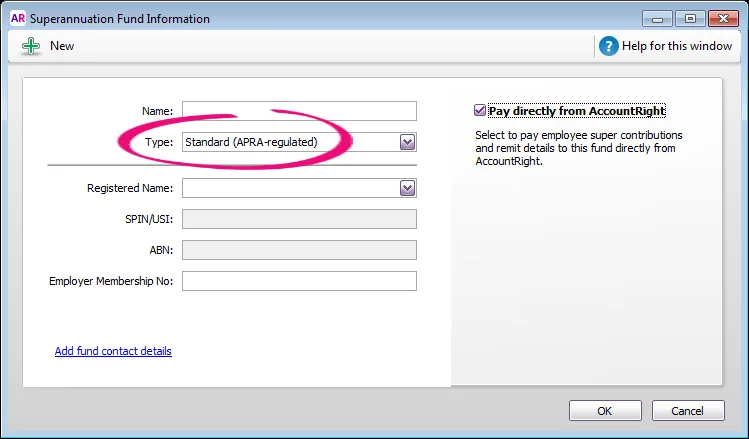

To add a standard super fund

Standard super funds are those used by most employees. These funds are registered with – and regulated by – APRA (Australian Prudential Regulation Authority). If you need to set up a self-managed super fund, see the info in the section below.

Go to the Lists menu and choose Superannuation Funds. The Superannuation Fund List window appears.

Click New. The Superannuation Fund Information window appears.

Enter the Name you want to use for the fund within AccountRight. For example, you might want to give a fund with a long or confusing name a shorter, clearer one. (This is different to the fund's Registered Name, which we'll get to shortly.)If you've signed up to Pay Super, select the fund Type as Standard (APRA-regulated). Standard funds are those registered with – and regulated by – APRA (Australian Prudential Regulation Authority).

Select the fund's Registered Name from the list. This is the name that's registered with APRA.

If a SPIN (Superannuation Product Identification Number) or USI (Unique Superannuation Identifier) exists for the fund, it will appear in the SPIN/USI field automatically. The ABN for the fund will appear automatically as well.Can't find a super fund?

It might be listed under a slightly different name than you're used to. In the Registered Name drop-down, try entering and searching for the fund's SPIN/USI. You can also check our list of super funds to make sure the fund can be paid using Pay Super. Still can't find the fund? Contact us.

If you have your membership number for the fund, type it in the Employer Membership Number field. This is a unique employer identification number provided by some funds when you register an employee or group of employees.

Click the Add fund contact details link to add the fund's Phone Number and Website.

If you've signed up for Pay Super and want to pay the fund directly from AccountRight, make sure you select the Pay directly from AccountRight option on the right.

Click OK. The fund now appears in the Superannuation Fund List window.

Repeat from step 2 for each additional standard fund you want to create.

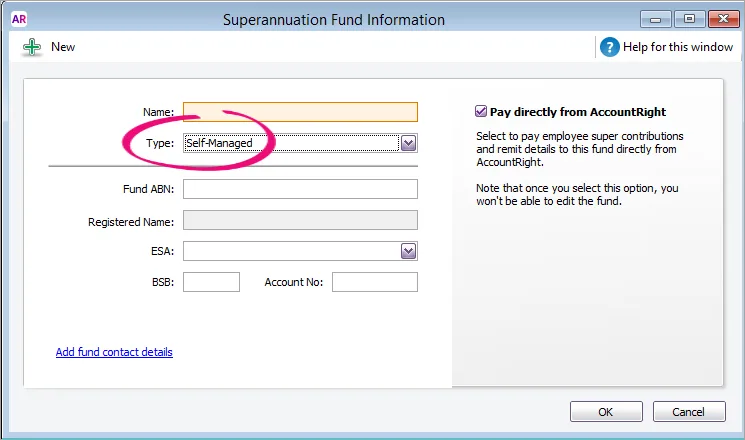

To add a self-managed super fund

If you've set up Pay Super, you can add a self-managed super fund into AccountRight. For standard super funds, see the info above.

Go to the Lists menu and choose Superannuation Funds. The Superannuation Fund List window appears.

Click New. The Superannuation Fund Information window appears.

Enter the Name you want to use for the fund within AccountRight. For example, you might want to give a fund with a long or confusing name a shorter, clearer one. (This is different to the fund's Registered Name, which we'll get to shortly.)

Select the fund Type as Self-Managed. If you can't select this option, make sure you've set up Pay Super.

Enter the fund's ABN. The Registered Name for the fund will appear automatically. If it doesn't, check the ABN you've entered.

Select the fund's ESA from the list. This is the Electronic Service Address, and is used to send data messages to the fund about the contributions you make.

Not sure which ESA to select? Check with your employee or the trustee/administrator of the Self Managed Super Fund. For more details on where to obtain an ESA, check the ATO website.

Enter the fund's BSB and Account Number.

Click the Add fund contact details link to add the fund's Phone Number and Address.

If you've signed up for Pay Super and want to pay the fund directly from AccountRight, make sure you select the Pay directly from AccountRight option on the right.

Once you've selected this option for a Self-Managed fund, you won't be able to edit the fund, so make sure you've entered the correct details.

Click OK. The fund now appears in the Superannuation Fund List window.

Repeat from step 2 for each additional SMSF you want to create.

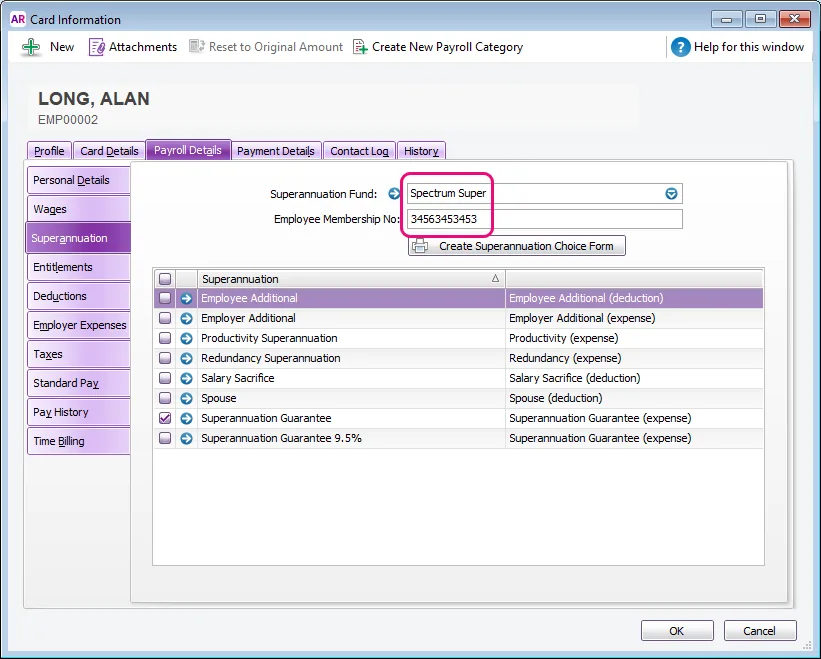

To assign funds to your employees

Once you've added your employees' super funds into AccountRight (see above for details), you need to assign the applicable fund to each of your employees.

You can select a super fund on the Payroll Details tab of each employee’s card (Card File command centre > Cards List > open an employee card > click the Payroll Details tab > Superannuation tab.)

You'll also need to enter the Employee Membership No. Here's an example:

If the employee doesn't have a membership number, contact their nominated super fund who will advise what to enter here.

To edit or delete a super fund

Self-managed funds can't be edited. Instead, you'll need to create a new self-managed fund with the updated details and assign it to the applicable employees. You'll need to enter a different name in the Name field to the one use previously to be able to save the new fund.

To edit a standard super fund

Changes made to a super fund will apply to all employees who are assigned to that fund.

Go to the Lists menu > Superannuation Funds.

Click the zoom arrow to open the fund.

Make your changes.

Click OK.

To delete a super fund

A super fund can only be deleted if it hasn't had a payment made to it.

Go to the Lists menu > Superannuation Funds.

Right-click the fund to be deleted and choose Delete Superannuation Fund.

To set your business's default super fund

Every employer must have a default super fund (see the ATO guidelines about this). This is the super fund your employees can join if they don't already have one. It can be any complying fund that's registered by the Australian Prudential Regulation Authority (APRA). If you need help choosing a default super fund, ask your advisor.

Once you've decided on your default super fund, contact that fund to obtain an employer membership number. You can then add this super fund into AccountRight (as described above), then set it as your default super fund.

To set your default super fund in AccountRight

Go to the Setup menu and choose General Payroll Information.

Choose your Default superannuation fund.

Click OK.

If a new employee chooses your default fund, you'll need to contact the fund so they can allocate a membership number. Also see Add an employee for details on setting an employee's super fund.