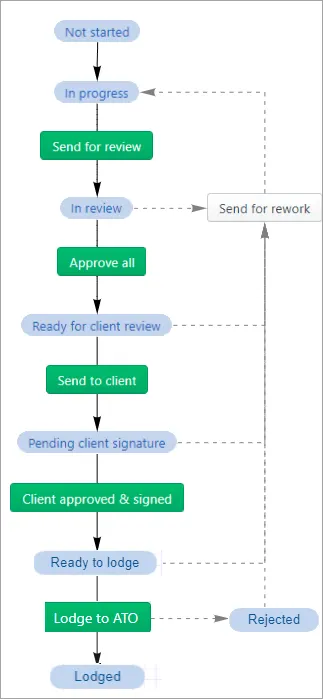

Once all the data is entered into the tax return, follow the workflow below to complete and lodge the return.

Tax return workflow

Tax returns and activity statements are grouped by different statuses:

Status | Description |

|---|---|

Not started | Tax returns/Activity statement that has been created but you haven't started working on it. |

Non-lodgable | This status only applies to a non-lodgable BAS (it's locked so you can't edit it). You don't need to lodge these forms unless you're varying the ATO calculated installments. |

In progress | You're working on the activity statement or tax return. |

In review | Your work is being reviewed, either by a manager or a partner. When finished, approve the form to update the status to Ready for client review. |

Ready for client review | A manager or partner has approved the form. It's now locked and ready to send to the client. |

Pending client signature | You've asked the client to review and digitally or physically sign the form, and are waiting for them to approve it. |

Rejected by client | The client rejected the form. Click the link to find out more in the client task details. |

Ready to lodge | The client signed and approved the form, and it's ready to lodge. |

Processing lodgment | You've lodged the form to the ATO and we're waiting for a response. No action required. |

Rejected | The ATO rejected the form. Check the rejection code and fix the data. Re-validate and lodge the form. |

Failed to load | The ATO pre-fill failed and we can’t load the form. |

Lodged | Successfully lodged to the ATO. |