AccountRight Plus and Premier only

If you were unable to report your payroll information to the ATO while processing pays, you can send the report from the online reporting centre. Remember, you need to report your payroll information on or before each pay day according to the rules of reporting through Single Touch Payroll (ATO website).

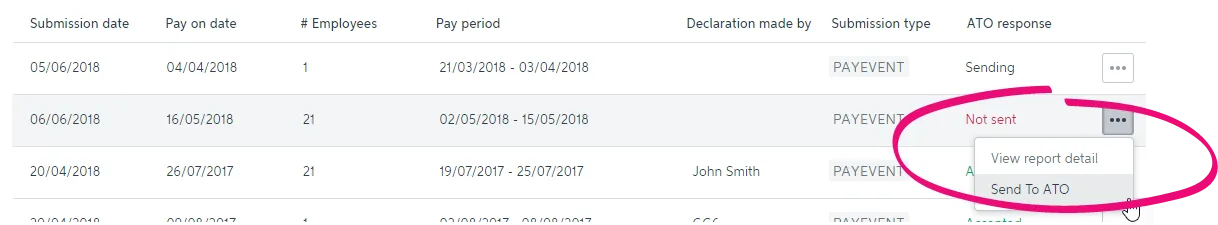

You can only send reports that are in the status of Not sent.

To send reports outside of a pay run

Go to the Payroll command centre and click Payroll Reporting.

Click Payroll Reporting Centre.

If prompted, sign in using your MYOB account details (email address and password).

Find the report you want to send.

What if there are no reports in the Payroll Reporting Centre?

This could be because you've set up Single Touch Payroll after you've started entering pays for the financial year. But don't worry, the ATO does not receive the details of individual pay runs, only the year-to-date payroll amounts. So, the next time you record a pay and submit it to the ATO, the latest year-to-date totals will be submitted.

If this isn't the reason there's no reports in the Payroll Reporting Centre, check Where are my Single Touch Payroll reports? for more tips.

Click the elipses ... and choose Send to ATO.

Enter your details into the declaration and click Send.

If your report has been rejected by the ATO, see Fix rejected reports in Single Touch Payroll for more information.

Report statuses

Here's a description of each report status you might see in the payroll reporting centre and what to do if something needs fixing.

Sending

The report has just been sent from MYOB and is in transit to the ATO.

There's nothing to fix - reports will sit in Sending until the ATO receives them. This can take up to 72 hours during peak periods.

Pays in reports with this status can only be reversed. Tell me more

Sent

The report has been sent and is awaiting a reply from the ATO.

There's nothing to fix - wait for the ATO's response.

Pays in reports with this status can only be reversed. Tell me more

Not sent

The report has not arrived at the ATO for one of these reasons:

The declaration hasn't been agreed to.

The person who processed the pay has not gone through the connect to ATO steps and added themselves as a declarer.

To fix this if you haven't added yourself as a declarer:

Go to the Payroll command centre, then click Payroll Reporting.

Click Connect to ATO.

Follow the prompts to add your details.

If you clicked "Cancel" at the declaration, follow the steps above to send the report (making sure to agree to the declaration).

Accepted

Report has been sent to and accepted by the ATO with no errors.

All good!

Rejected

The report has been sent but rejected by the ATO. Rejected reports will have a reason for the rejection, and what needs to be fixed for it to be accepted.

The Rejected status will remain for the report. Once you've addressed the issue, updated payroll information will be sent to the ATO on your next pay run.

To fix this, see Fix rejected reports

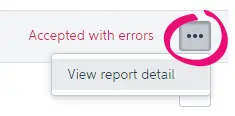

Accepted with errors

Report has been sent to and accepted by the ATO, however there are some things that you'll need to fix before the next pay run.

To fix this:

Go to the Payroll command centre, then click Payroll Reporting.

Click the ellipses button of the report, and choose View report detail.

The information you need to check and update is listed in the report. Fix all items before your next pay run.

FAQs

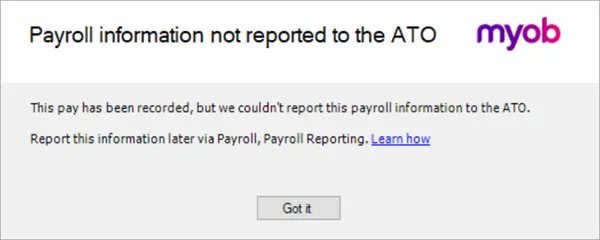

Why wasn't my payroll information reported to the ATO?

If you're connected to the internet, your payroll information should be sent to the ATO without any issues.

But if you see this message when trying to declare to the ATO when processing your payroll, it can mean:

you're not connected to the internet

your internet connection isn't stable, or

your computer needs updating.

So after receiving the above message, make sure your internet connection is fine and try submitting the report again as described above.

If you're still having trouble, you might need to install a Microsoft security update on your computer.

To install the required update, you (or your IT person) can follow this Microsoft support article.

What information is sent to the ATO?

Your employees' year to date figures are sent to the ATO. This means each time you submit a pay run to the ATO, your employees' latest year to date figures are sent.

How do I fix or delete a report that's been sent to the ATO?

With STP, your employees' year to date (YTD) figures are sent to the ATO after each pay run. So if changing an employee's pay affects their YTD figures, the updated figures will be sent to the ATO the next time you do a pay run.

If you want to remove or "undo" a pay that you've sent to the ATO, you'll be able to delete or reverse it based on its status in the Payroll Reporting Centre. This ensures you're not deleting anything which has already been accepted by the ATO. For details, see Changing a recorded pay.

Pay runs will remain listed in the payroll reporting centre even after deleting or reversing a pay in AccountRight.

If the pay you need to change is in a payroll year that's been finalised with the ATO, see Changing a pay after finalising with Single Touch Payroll.

How do I delete a report that is showing a 'Not sent' status?

You can't delete or "undo" a report from the STP reporting centre – even the ones with a Not sent status. This status means the pay has been recorded but it hasn't been reported to the ATO.

Even if you delete a pay from AccountRight, the pay run report will remain in the STP reporting centre with a Not sent status.

Don't worry, the next time you record a pay and submit it to the ATO, your employees' latest year-to-date totals will be submitted – so they'll have the most up to date totals.

Why am I seeing the error "Something went wrong at our end" when accessing the STP reporting centre?

If you're connected to the internet, you should be able to access the STP reporting centre without any issues.

But if you see this message, it can mean:

you're not connected to the internet

your internet connection isn't stable

we're experiencing an outage or performing maintenance (check our status hub for info about outages or maintenance), or

your computer needs updating.

So first, make sure your internet connection is fine and try again.

If you're still having trouble, you might need to install a Microsoft security update on your computer. To do this, you (or your IT person) can follow this Microsoft support article.