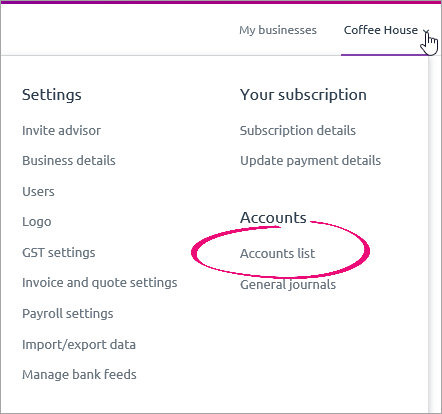

In the Accounts List page (accessible by clicking your business name and choosing Accounts list) you can view, add, edit and delete accounts (or, make them inactive). You can also enter opening balances for new accounts, and view account tax rates.

Watch this video to learn more about managing your accounts list. | HTML |

|---|

<div class="wistia_responsive_padding" style="padding:56.25% 0 0 0;position:relative;"><div class="wistia_responsive_wrapper" style="height:100%;left:0;position:absolute;top:0;width:100%;"><iframe src="//fast.wistia.net/embed/iframe/cw4tjbjghb?videoFoam=true" title="Wistia video player" allowtransparency="true" frameborder="0" scrolling="no" class="wistia_embed" name="wistia_embed" allowfullscreen mozallowfullscreen webkitallowfullscreen oallowfullscreen msallowfullscreen width="100%" height="100%"></iframe></div></div>

<script src="//fast.wistia.net/assets/external/E-v1.js" async></script> |

AccountsAccounts provide a means for grouping similar transactions. For example, if your business pays rent for the use of its premises, you would create a rent account and then allocate all rent payments to that account. Accounts also include your bank and credit card accounts. Account numbersEach account is identified by a unique five digit number. The first digit indicates the account’s classification (for example, accounts starting with 6 are expense accounts). The remaining four digits determine its location within the classification. The lower the number, the higher up in the list it appears. For example, account 1-1100 appears above 1-1200. Account typesEach account must be assigned an account type before it can be used to track your business’s financial activity. You can choose from 12 different account types: - Banking, Current Assets, Fixed Assets (asset accounts)

- Credit Card, Current Liabilities, Long Term Liabilities (liability accounts)

- Equity (equity account)

- Income, Other Income (income accounts)

- Cost of Sales, Expense, Other Expense (expense accounts)

Each account type serves a specific purpose. If you’re unsure about which type you should assign to a new account, ask your accounting advisor. Note that an account type can't be changed if it has a current balance. For information on changing an account type, see Adding, editing and deleting accounts. Accounts listThe accounts you use for your business are grouped in an accounts list (also known as a chart of accounts). When you registered and set up MYOB Essentials, an accounts list was selected for you based on the business type you specified. You also reviewed this accounts list during setup. If any of the existing accounts that came with MYOB Essentials don’t meet your business needs, you can edit them so that they do. You can also make an existing account inactive, add a new account, and in certain circumstances, delete an account. | HTML |

|---|

<h2><i class="fa fa-comments"></i> FAQs</h2><br> |

| UI Expand |

|---|

| title | What are the default accounts lists for each business type? |

|---|

| What are the default accounts lists for each business type?All accounts lists provided by MYOB Essentials include the same set of standard accounts, plus some extra accounts tailored for the specific business type. For example, a business that sells products will have a Cost of Sales account for Raw Materials, and a business involved in agriculture will have an expense account for Pesticide. System accountsSystem accounts are required by MYOB Essentials, and will be created even if you choose not to use one of the accounts lists provided by MYOB Essentials. You can’t delete these accounts. - Asset accounts: ABN withholding credits, Accounts receivable

- Liability accounts: ABN withholdings payable, Accounts payable, GST collected, GST paid, PAYG withholdings payable, Payroll deductions, Superannuation payable

- Equity accounts: Income tax, Historical balancing, Retained earnings, Current year earnings

- Expense accounts: Discounts given, Superannuation expense, Wages & salaries, Discount received.

Standard accounts listAll accounts lists provided by MYOB Essentials include the following accounts, plus additional accounts depending on the business type: Account type | Accounts included |

|---|

| Asset | - Banking accounts: Cheque account, Petty cash, Savings account

- Current Assets accounts: ABN withholding credits, Accounts receivable

Fixed Assets accounts: Furniture & fittings, Motor vehicles, Office equipment & computers, Plant & equipment.

| Liability | | Equity | | | Expense | - Accounting fees, Advertising, Bank charges, Discounts given, Electricity & gas, Insurance, Interest paid, Internet, Lease of equipment, Motor vehicle expenses, Office supplies, Postage & courier, Printing & stationery, Rates, Rent, Repairs & maintenance, Sub contractors, Sundry expenses, Superannuation expense, Telephone, Travel & accomodation, Wages & salaries, Water, Work cover insurance.

| Other Income | - Discount received, Interest income, Other income.

| Other Expense | |

Additional accounts for each business typeIn addition to the standard set of accounts, the accounts list for each business type includes the following accounts: | Business type | Includes... |

|---|

I sell products | - Income accounts for Sales

- Cost of Sales accounts for Freight, Packaging, Purchases and Raw material.

| I sell services | - Income accounts for Fee income and Licensing income

| I sell products & services | - Income accounts for Sales, Fee Income and Licensing Income

- Cost of Sales accounts for Freight, Packaging, Purchases and Raw material.

| I work in building & construction | - Income account for Construction, Renovation income and Service & repair income

- Cost of Sales accounts for Building contract insurance, Building material, Contractor costs, Freight, Hire of equipment.

| I work in agriculture | - Income accounts for Grain income, Livestock income, Produce income

- Cost of Sales accounts for Feed, Fertiliser, Freight, Pesticides, Purchase of livestock and Seed

- Expense accounts for Breeding expenses, Feed, Fertiliser, Pesticides and Veterinary

|

|

|