Accountants Enterprise with Practice Manager only When adding a new Accounting Year, it is best practice to set up the Time Processing Periods for each month as the prior month is ending. | UI Text Box |

|---|

| It is not best practice to set up the time processing periods for the whole financial year in advance. Having all periods available for selection when creating timesheets can lead to timesheets being entered for future periods in error. |

This help topic guides you through creating the new accounting year and the time processing periods for the first month of the new year. Each month, it's recommended that you close the previous accounting period (month). This is so no further changes can be made to your data once you run your monthly reports and reconcile them. You can also apply a Timesheet Lock date, which is optional. This allows you to lock off your data mid month if you run weekly or fortnightly reports. This stops changes to your data inclusive of your lock date. If receipts haven't been allocated to the correct invoice(s) in prior months, you may be able to reopen the accounting period to correct allocation issues. Locking off your data| UI Expand |

|---|

| title | AE / AO: To close an accounting period |

|---|

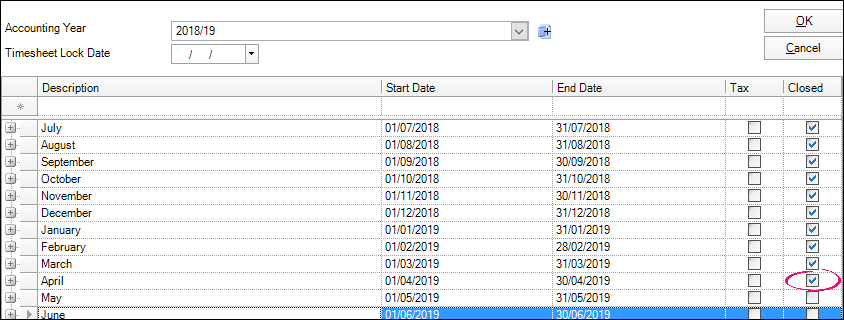

| Select | From the menu bar, go to Maintenance > Maintenance Map > Time Setup > Processing Time Setup. The Processing Time Setup page opens. Select From the Accounting Year from the drop-down, select the Accounting Year. Select From the table, select the Accounting Period from the table to be closed off. Select the checkbox in the Tax column (AE sites only): In the Tax column, select the checkbox if applicable. | UI Text Box |

|---|

| Select We recommend you leave the Tax checkbox only if the accounting period has been closed and if you have run the tax reports for the period and do not want to make any further changes to the tax in this period. We generally only recommend ticking this option where you are using the MAS export utility (AE sites only). If you are not using this function, there is no need to close the Tax period; you can just close the checkbox deselected, unless you are using the VPM to MAS utility. Closing the tax period has consequences: You can't re-open or make changes to a tax period once it's closed. Before closing the tax period, check all receipts have been allocated and reports run and reconciled. If you're not using this function, close the accounting period as per Step 5. |

Select In the checkbox in the Closed column to indicate that the accounting period is closed.

If the , select the checkbox. The accounting period is closed , the period will not be available for posting the next time you access the window and you cannot enter or post timesheets into that accounting period.

If the application contains draft timesheets, you cannot close the accounting period.

If draft bills exist within the application, you can close the accounting periodand all transactions are locked off for the month.  Image Added Image Added

Click OK to save the changes and close the . The Processing Time Setup page tab closes.

|

| UI Expand |

|---|

| UI Expand |

|---|

| title | AE only: To edit an accounting period |

|---|

| Select Maintenance > Maintenance Map > Time | title | AE / AO: To re-open an accounting period |

|---|

| Select Maintenance > Maintenance Map > Time Setup > Processing Time Setup. The Processing Time Setup page opens. Select the Accounting Year from the drop-down. Select the Accounting Period from the table to be re-opened. Select the checkbox in the Closed column which will remove the tick and re-open the period. | UI Text Box |

|---|

| When re-opening periods, you will need to do this in reverse order from the most recent period back to earlier periods. If you need tounallocatea transaction back in July for example and you are now in November and all periods have been closed up until October, you will need re-open each month from October back to July. |

Click OK to save the changes and close the Processing Time Setup page.

|

| Setting a timesheet lock date |

| | UI Expand |

|---|

| title | Setting a Timesheet Lock Date example |

|---|

| You have closed April and are now working in May. Once all data has been posted for the 1st week, run weekly reports and reconcile them. To ensure the data from the 1st week in May doesn't change, apply a lock date. Entering a lock date of 05/05/2019 means any data from 1/5/19 to 5/5/19 can't be altered. At the end of the next week, once all data is posted and reports run, change the lock date to 12/5/19. Repeat for the remaining weeks until the last week. At the end of the last week, you close the accounting period.

|

| UI Expand |

|---|

| title | To set a Timesheet Lock Date |

|---|

| From the menu bar, go to Maintenance > Maintenance Map > Time Setup > Processing Time Setup. The Processing Time Setup page opens.

|

Select Accounting Year from the drop-down, select the Accounting Year. Enter

|

the name of the accounting period in the first blank Description field at the top of the table. The description is limited to a maximum of 100 alphanumeric characters. Overtype the existing text to modify the description.Enter the Start and End Dates for the period. Enter the dates a Timesheet Lock Date for the accounting year. Enter a date in the format dd/mm/yyyy or select

|

them respective calendars.Select the checkbox in the Tax column. Select thischeckbox only if the tax period has been closed and if you have run the tax reports for the period and do not want to make any further changes to the tax in this period. Select the checkbox in the Closed column to indicate that the accounting period is closed.

If the accounting period is closed, the period will not be available for posting the next time you access the window and you cannot enter or post timesheets into that accounting period.

If the application contains draft timesheets, you cannot close the accounting period.

If draft bills exist within the application, you can close the accounting period. Click OK to save the changes and close the Processing Time Setup page. |

| UI Expand |

|---|

| title | AE only: To delete an accounting period |

|---|

| Select calendar.

Image Added Image Added | UI Text Box |

|---|

| This means you can't enter or amend timesheets before the nominated lock date. This enforces employees to complete their timesheets by a specified date. |

Click OK to save the changes. The Processing Time Setup tab closes.

|

|

Reopening your data| UI Expand |

|---|

| title | To reopen an accounting period |

|---|

| Re-opening an accounting period (month) should only be done in specific circumstances. For example, a receipt may have been allocated against the wrong invoice dated in a prior period, which has been closed. To fix this, the process would include: reopen the prior accounting period(s) (month(s)), reallocate the receipt against the correct invoice and close the reopened accounting period(s). | UI Text Box |

|---|

| When reopening periods, open the most recent period back to the earliest period required. For example, to unallocate a transaction in July when you're currently in November, open October back to July. |

From the menu bar, go to Maintenance > Maintenance Map > Time Setup > Processing Time Setup. The Processing Time Setup page opens. Select From the Accounting Year from the drop-down, select the Accounting Year. Click the row containing the accounting period you want to delete. Click  Image Removed to highlight the entire row. Image Removed to highlight the entire row. Press [Delete]. A Confirm Delete message is displayed. Click Yes. The Accounting Period is deleted. Click From the table, select the Accounting Period to be re-opened. In the Closed column, select the checkbox to remove the tick and re-open the period.  Image Added Image Added

Click OK to save the changes and close the . The Processing Time Setup page tab closes. Reallocate the required entry. Close the reopened accounting period(s).

|

|