- Created by KylieN, last modified by AdrianC on Aug 16, 2018

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 34 Next »

https://help.myob.com/wiki/x/Ag7nAQ

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

When it's time to pay super contributions, use the Pay superannuation page to download a file containing all of the contribution data. You can then upload this file to MYOB's super portal to make the contribution payments.

First, make sure you've set up all the required information and signed up to use MYOB's super portal. See Set up Pay superannuation.

1. Download a super contribution file

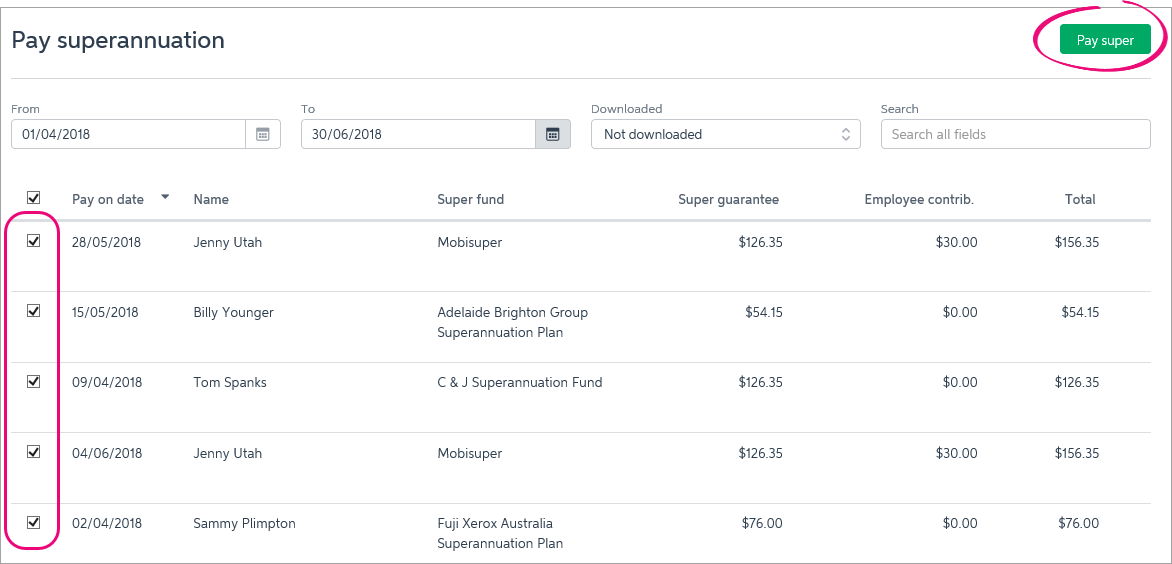

- From the Payroll menu, choose Pay superannuation. The Pay superannuation page appears.

- In the From and To fields, choose the dates you want to pay super contributions for.

- Click to select each super contribution you want to pay.

- Click Pay super.

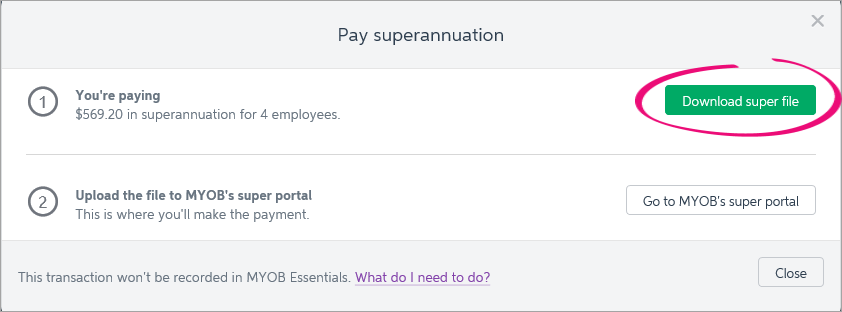

In the popup window, click Download super file.

Choose where to save the downloaded super file. Remember where you save it as you'll need to find it when you upload it to MYOB's super portal.

Don't open the downloaded file as this will interfere with the file format.

2. Pay super through MYOB's super portal

Once you've downloaded your super contribution file from MYOB Essentials (see above), you can upload it to MYOB's super portal.

You'll see the option to go to the super portal after you've clicked Pay Super on the Pay Superannuation page.

Accessing MYOB's super portal

If you've closed the Pay superannuation popup window (which has the button to go to MYOB's super portal), you can re-open it by displaying All downloaded files, selecting any contribution then clicking Pay super.

Learn more about MYOB's super portal.

Note that any payments you make through MYOB's super portal won't be automatically recorded in MYOB Essentials. For details on how to do this, see Recording super payments made through MYOB's super portal.

FAQs

What if a super contribution has been returned because of incorrect details?

If a super contribution was returned because of incorrect employee or super fund details, correct these details in MYOB Essentials. You might need to confirm some details with the employee or their superannuation fund. See Set up employees for paying super for help updating these details.

After updating the incorrect details:

- Enter a transaction in MYOB Essentials for the returned super payment.

If you have bank feeds on this bank account, allocate the deposit transaction (the returned super payment) to your Superannuation Payable liability account.

If you don't have bank feeds on this bank account, create a Receive Money transaction for the returned super payment. Allocate it to your Superannuation Payable liability account.

- Download a new super contribution file containing for the payment to be re-submitted. See Download a super contribution file above for instructions.

- Pay the contribution through MYOB's super portal. See Pay super through MYOB's super portal above for instructions.

- Enter the transaction in MYOB Essentials for the resubmitted super payment.

If you have bank feeds on this bank account, allocate the withdrawal transaction to your Superannuation Payable liability account.

If you don't have bank feeds on this bank account, create a Spend Money transaction for the resubmitted payment. See Recording super payments made through MYOB's super portal for details.

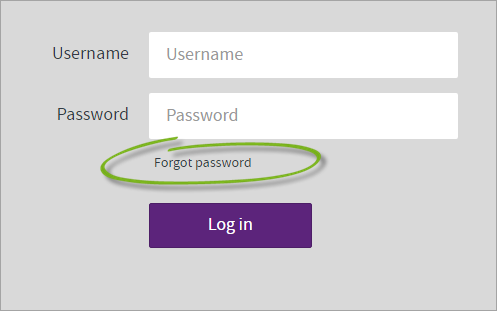

What if I've forgotten my super portal password?

If you forget your password, click Forgot password on the login screen. You will be emailed a temporary password, and will be prompted to change it the next time you log in to the super portal.

Where can I find help for the super portal?

If you need help for the super portal, see MYOB's super portal help.

Why can't I click the Pay super button in MYOB Essentials?

If the Pay super button isn't clickable and has a red circle with a line through it when you hover over it, it means you haven't set up all the required information and signed up to use MYOB's super portal.

For help setting up, see Set up Pay superannuation.

Once you've completed all setup steps, select each employee and pay run you want to include in the payment on the Pay superannuation page (see Download a super contribution file above). The Pay super button will then be active.

Can I log in to the super portal directly?

When you access the super portal from MYOB Essentials, a check is done to verify you're entitled to access the super portal. This is a security precaution to protect your payroll information from unauthorised access.

This means you can't access the super portal directly.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.