This page lists new features and improvements for all areas of MYOB Practice.

If you can't find one of these features or enhancements in MYOB Practice, clear your browser's cache and refresh the MYOB Practice tab. If you still can't see it, your practice may not have access to that feature.

Activity statements and tax improvements

-

Individual tax returns are available to MYOB AE/AO users.

-

Other return types are available if you're in the Early Access Program (EAP).

-

Activity statements are available to all users who can access MYOB Practice.

April 2024

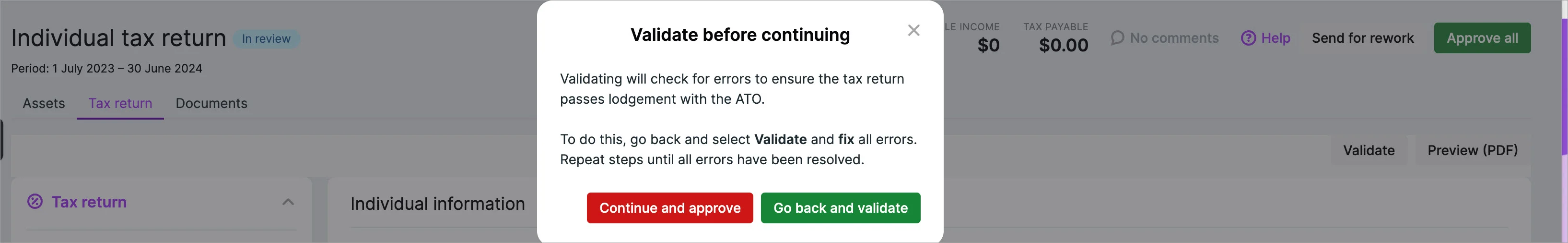

23 April - Tax validation message

You'll see a message to warn you if you approve a tax return that has validation errors or hasn't been validated, with an option to continue or go back and validate.

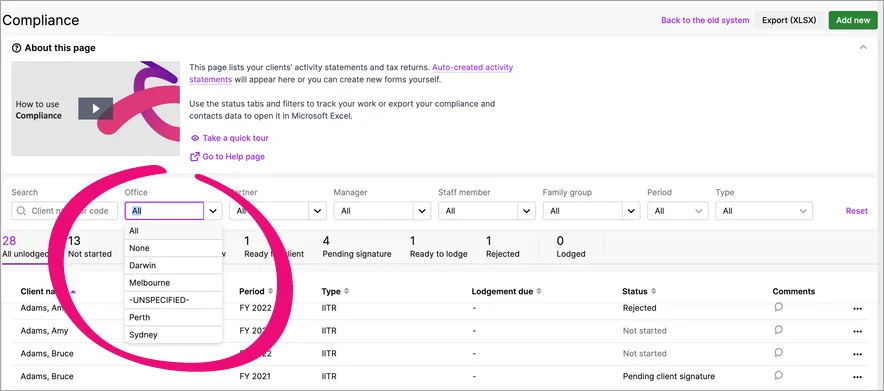

23 April - Filter tax returns by the client’s office category

This information only applies if you have MYOB Practice and MYOB AE/AO

If you applied multiple office categories to your clients in MYOB AE/AO, you can filter by office on the MYOB Practice Compliance list in All clients view. For example, if you want to find all tax returns or activity statements from clients with an office category of Melbourne.

-

The Office filter option is useful if you applied multiple office categories to your clients in MYOB AE/AO.

-

Filtering Office by None will include listing clients that have the default office value of UNSPECIFIED in AE/AO.

-

To see the Offices in the MYOB Practice Compliance filters, you need AE or AO version 5.4.50 (2023.3) released April 2024.

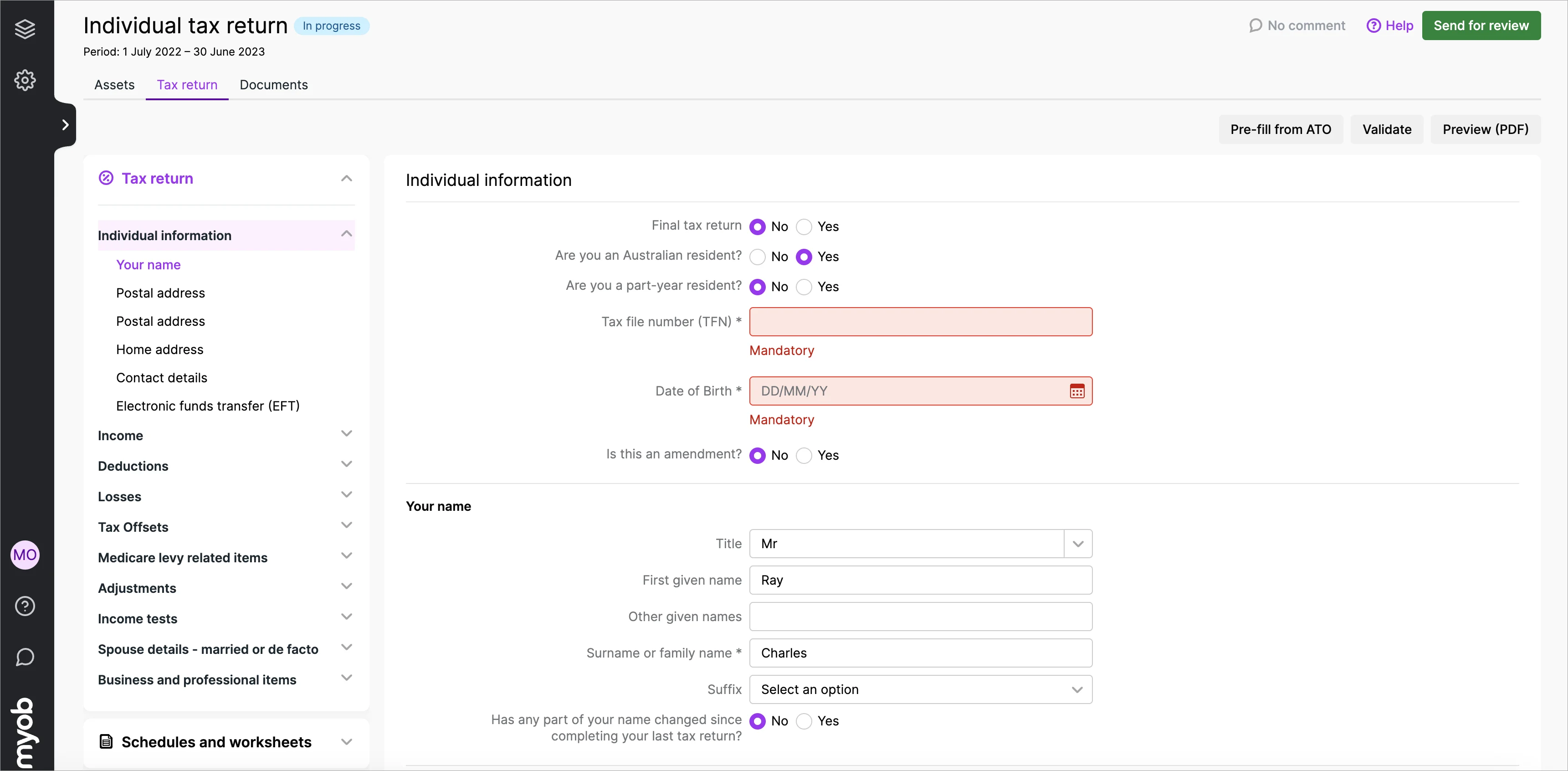

23 April - Individual tax returns are now available

We've released Individual tax returns in MYOB Practice.

If you use MYOB AE/AO, you can prepare and lodge individual tax returns in MYOB Practice Tax. See our onboarding guide on how to set up and get started.

15 April - Easily find and fix errors as you enter data in a tax return

We’ve improved error validations in individual tax returns and schedules. This makes sure the information you're entering is accurate and helps you avoid ATO rejections.

See errors as you type

While entering data into certain fields, we'll check for any errors and display a message in red below the field so you can fix it straight away.

Go directly to the source of the error

For any validation errors, just click the error message to go directly to the field that needs attention. This means you can find and fix errors quickly without searching.

This feature is available on the

Individual tax return fields

Schedules that are completed to enter income such as salary and wages, interest income etc.

Rental property schedule

Deductions schedule

We're planning to introduce it across other form types and schedules.

March 2024

15 March - Quick view of the tax estimate

You can now get a running balance of the taxable income and tax payable or refundable on top of the tax return.

This gives you quick visibility of estimated amounts based on what's currently entered in the tax return.

What are the fields displayed?

Return type | Fields displayed |

|---|---|

Individual and Company | - Taxable income |

Trust and Partnership | - Taxable income |

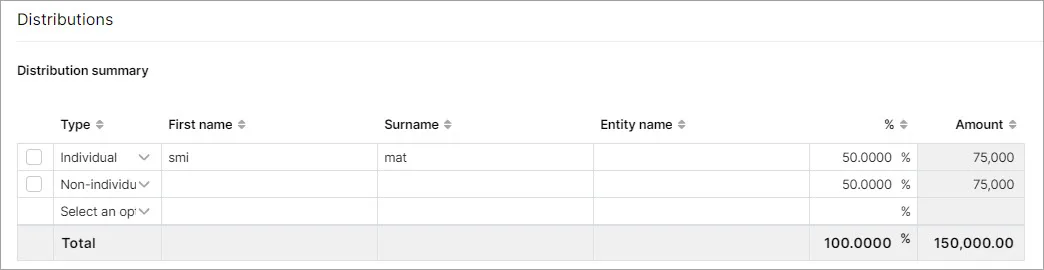

12 March - Populating distributions from trust and partnership income amounts into individual tax return

When you distribute to an individual beneficiary in a trust return or to an individual partner in a Partnership return, the amounts will automatically populate the individual tax return labels you're distributing into.

This feature is available only when distributing into an individual tax return. Distributing to non-individual tax return types is coming soon.

February 2024

1 February - Improvements to moving a tax return from MYOB AE/AO to MYOB Practice

You'll have a better experience when moving tax returns from AE/AO to MYOB Practice thanks to many improvements we've made throughout the process.

Moving a tax return from AE/AO to MYOB Practice is supported for IITR, CTR, PTR and TRT in 2022 and later years.

The Move the tax return online window's performance, visuals, descriptions and linked resources have been updated and improved.

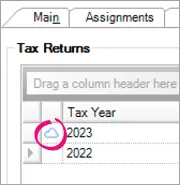

The Live button with the cloud icon at the top of AE/AO is now called MYOB Practice.

Previously, you'd need to create, rollover, open and close a tax return in AE/AO before you could open the Move the tax return online window.

Now the Move the tax return online window opens as soon as you click Create Return in AE/AO.Previously, with some computer screen resolutions, the Move the tax return online window would be cropped. Now it'll look good with all resolutions.

Previously, the Move the tax return online window would momentarily not be viewable when you click the Move the return online button. Now this won't happen when you click the button.

Previously, when moving the return was finished and you closed the Move the return online window without launching the return, there'd be nothing on the AE/AO window to indicate that the return was moved.

Now, the AE/AO window will automatically refresh and show the new return with a little cloud icon next to it, indicating it's a return in MYOB Practice.

Previously, after moving a return to MYOB Practice, you may have seen errors for your assets. This was caused by the depreciation worksheet in AE/AO not requiring an asset class, while MYOB Practice does require an asset class.

Now, we've fixed this by adding a Default Asset Class value in Client Files > Assets. You can transfer the asset class after moving the return to MYOB Practice at your convenience, instead of needing to fix all the assets before being able to move returns without issue.If you experience an issue with the migration process, you'll see more detailed error messages than before, most with links to more help.

Learn more about the process in the following pages:

January 2024

24 January - More ways to find a tax return

Above the list of returns on the Compliance page:

there's a new field that lets you filter by manager

the Search field lets you search by client code.

9 January - Focus on information in schedules with a cleaner interface

When you open a schedule, it'll expand to fill the whole browser tab. Other settings, menus and the client sidebar will be hidden. You'll see the client name and client code above the schedule.

December 2023

18 December

Changes to ATO pre-fill in MYOB Practice

In MYOB Practice, you can now pre-fill a tax return multiple times with the ATO pre-fill data. This saves time when completing a tax return and ensures that data is accurate.

Pre-filling tax return multiple times is available for tax returns created after 1 December 2023. For any returns before that date, you can enable this feature by deleting and re-creating the return.

15 December

2023 Individual tax return

Borrowing expenses worksheet

In a Rental property schedule, you can use the borrowing expenses worksheet to calculate the expenses directly incurred in taking out a loan for the property.

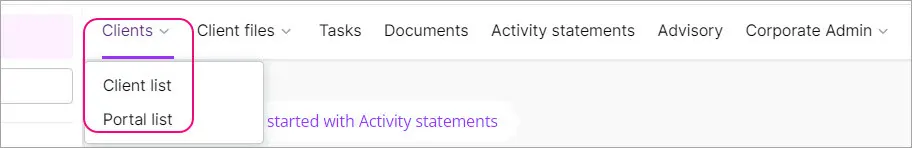

New navigation menus

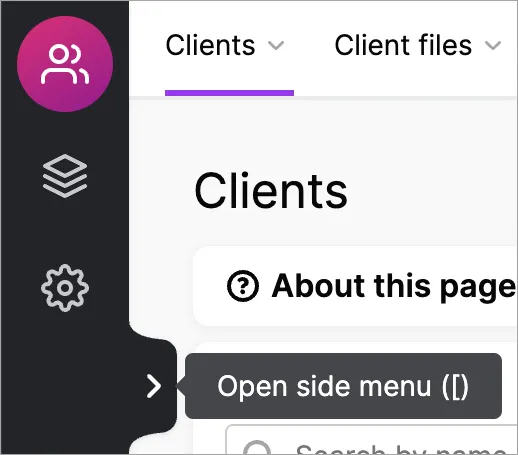

We've changed some of the menu items in the top navigation bar as part of our new and improved experience. There are no changes to the functionality of the software, just a fresh new name.

You'll notice:

Contacts is now called Clients with a submenu of Client list and Portal list.

Transaction processing is now called Client files with submenus for Online files and Desktop files.

Compliance is now called Activity statements or Tax (see note below).

If you're part of the Early Access Program for MYOB Practice tax, you'll see Tax in the menu. For all users of Practice, you can access activity statements on the same page.

13 December

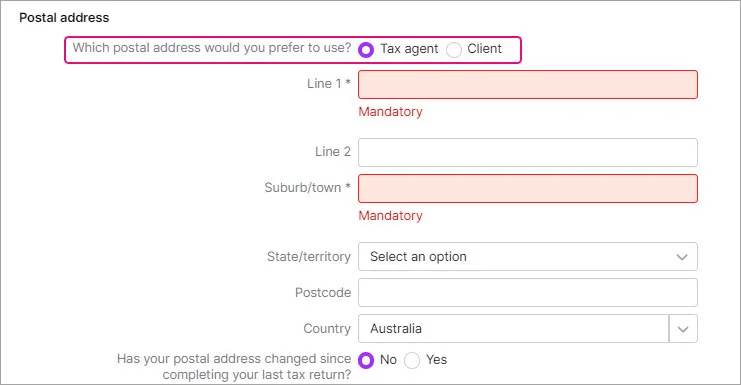

Choosing Postal address tax returns in MYOB Practice

On the Front cover of a tax return, you now have the option to choose between Tax agent's or client's postal address and decide where the ATO communications should be sent. Learn more.

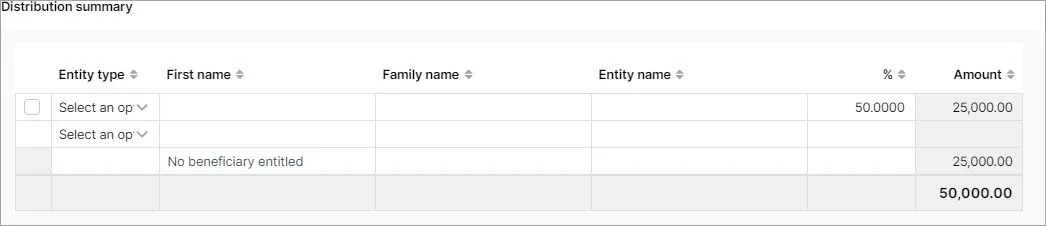

Trust and Partnership returns

In a 2023 Trust and partnership tax return, we've added a Distribution summary in the Distributions section. This will display a summary of the beneficiaries and partners.

Trust summary

Partnership Summary

11 December

Improved tax return navigation experience

The navigation panel is moved from the right of the page to the left.

The navigation panel will highlight which section and subsection you're in to help you quickly scan the list of sections and see where you’re located.

Each section of the navigation panel has its own scroll bar, instead of the one scroll bar for the whole panel. When you scroll one section, the other sections will no longer be scrolled out of view.

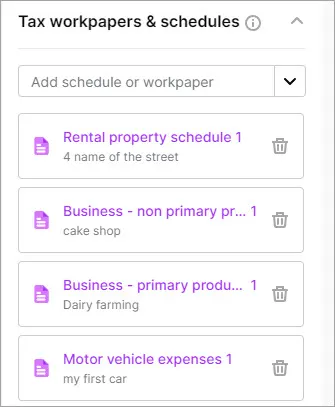

The Tax workpapers & schedules section is now called Schedules and worksheets and is divided into subsections for both of these types of attachments.

You may notice some other changes to the navigation bar order to create a consistent experience.

When you scroll through a tax return, the section header will remain at the top of the page so that you always know which section you’re in.

When you open a tax return, the Contacts side menu will be hidden to let you focus on the tax return. You can always show the side menu again by clicking Open side menu (the > greater than symbol) or by pressing the square bracket ([) keyboard shortcut.

Franking account worksheet improvements

In a 2023 Company tax return, when completing a Franking account worksheet, the opening balance will now integrate into Items 8P and 8M. You can choose to use the Franking worksheet or enter the amounts manually in the labels.

November 2023

20 November

2023 Partnership tax returns

We've made the following enhancements to the Distributions section:The Partnership distribution is now available within the tax return.

8 November

2023 trust tax returns

We've made the following enhancements to the Distributions section:Total distributable amounts will automatically populate from the tax return labels

You can enter a distribution percentage for beneficiaries that will automatically calculate the distributable income based on the percentage share.

October 2023

20 October

2023 tax returns - Contact name integrates from AE/AO

In a company, trust, or partnership return if you have an employee assigned in MYOB AE/AO under the Responsibility tab, you'll be able to select the names under the Agent details in the tax return created in MYOB Practice.

2023 tax returns - Displaying identifiers in workpapers and schedules

We've made it easier to identify the work papers and schedules with a unique identifier. For example, a rental property schedule will display the street name, and a motor vehicle schedule will display the make and model of the vehicle.

2023 Company return

We've added the motor vehicle expenses worksheet to a 2023 Company tax return. You can use this worksheet to calculate the motor vehicle expenses and integrate into the relevant label in the tax return.

4 October

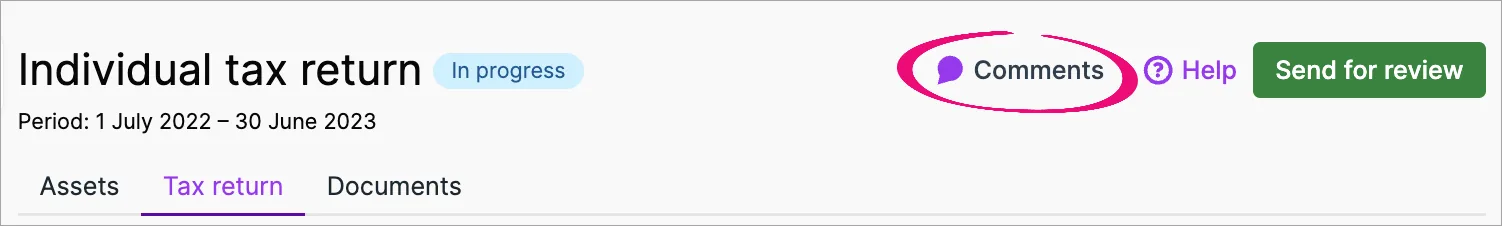

More ways to add comments to tax returns and activity statements

In September we introduced the ability to add comments to the Compliance page.

Now you can also add comments when you open an individual tax return or activity statement from the Compliance page. You can add and view the comment from the Assets, Tax return or Documents sub tabs.

Comments are synced between an opened tax return or activity statement and the Compliance list views.

Learn more about adding comments.

1 October

Front cover information in the tax return (Individual, Company, Trust and Partnerships)

When you add a new tax return in MYOB Practice, some of the front cover details will integrate from the client details. This will save time as most of the mandatory fields such as TFN, Name, and addresses, are populated.You can edit these fields in the tax return but the details will not integrate to AE/AO. That's why recommend making any changes in MYOB AE/AO.

September 2023

27 September

Make notes about tax returns and share your thoughts with your colleagues

You can add comments to tax returns to track and share information with other users in your practice. Learn more about adding comments.

1 September

2023 Individual tax return:

We've added a new field STP Finalised to the following workpapers:Salary and Wages payment summary

Employment termination payment summary

Foreign employment income payment summary.

This field is populated by ATO pre-fill. The values in the STP finalised field are:

TRUE - Data is finalised via Single Touch Payroll (STP). Review the data and lodge the return.

FALSE - Data is not finalised via STP. Check the data before lodging the return.

If your data isn't finalised, you can't pre-fill the tax return again using ATO pre-fill. This field is not lodged to the ATO.

N/A - this indicates the payer has submitted their finalised payment summaries for the payee using the PSAR or EMPDUPE arrangements. You'll need to manually complete the details.

Trust and partnership returns

We've added the Motor vehicle expenses workpaper. You'll be able to allocate the motor vehicle expenses to the required income item, such as rental or business income.

Company tax return improvements

When you enter amounts in the tax return, it will now integrate into the Calculation statement. This will then apply relevant tax offsets (in the priority order) and the tax on taxable income is calculated.

August 2023

31 August

Improvements to working with workpapers and schedules

When you enter data in a workpaper or schedule and the changes are automatically saved, you'll see a message saying "Autosaved. Close browser tab when done." This helps you know that it's safe to navigate away from the page without losing data.

Your browser tab title shows the name of the workpaper or schedule that's opened, along with initials to help identify the client or contact (for example, WN). This makes it easier to switch between tabs without gettings lost when you have multiple MYOB Practice tabs open. Previously, all MYOB Practice tabs had the same title.

The workpaper or schedule name will remain displayed at the top of the page if you scroll down the page. This makes it easier to remember which workpaper or schedule you're in if you switch to another tab or window and then return to the workpaper or schedule.

24 August

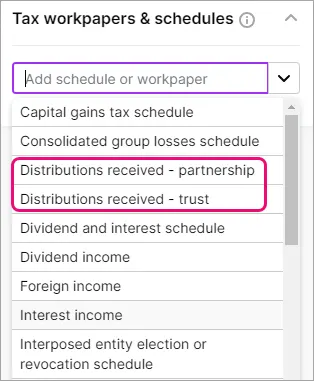

Trust and partnership returns

We've added new workpapers:

Distribution received - partnership

Distribution received - trust

Rental property schedule

You can edit all Ownership share and Private use fields where the values were automatically populated using the small pen icon located in the field. To reset the value, click the reset icon.

3 August

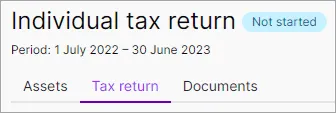

Improved tax return header

We've improved the header area at the top of tax returns. Most of the changes were made to display the information in a way that uses less space, so that you see more of the tax return by default. Here's what's changed:Replaced the Assets, Tax return and Documents tiles with smaller tabs.

Moved the status indicator (for example, Not started) next to the tax return title.

Example of the new header.

1 August

2023 Individual, Trust and Partnership tax return - Rental property schedule

You can edit all Ownership share and Private use fields where the values were automatically populated using the small pen icon located in the field. To reset the value, click the reset icon.

July 2023

12 July

Quickly see the most relevant activity statements and tax returns

The Compliance Period filter defaults to the current financial year.

5 July

Tax compliance for 2023 is here!

You've got all the latest updates you need for the new tax year, including:Reducing compliance costs for self education

Removal of low and middle income tax offset

Small business skills and training boost

Small business technology investment boost

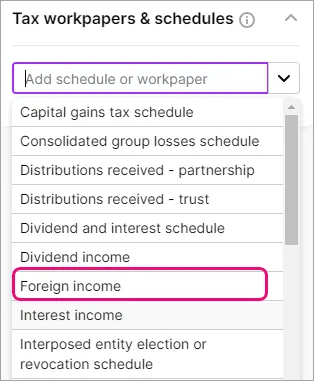

Company returns

We've added new workpapers:Distribution workpapers:

Distribution received - partnership

Distribution received - trust

Foreign income workpaper:

Individual returns

We’ve split the Payment summaries and income statements schedule into 6 separate schedules:

Salary or wages payment summaryForeign employment income payment summary

Employment termination payment summary

Australian superannuation income stream payment summary

Australian superannuation lump sum payments

Attributed personal services income payments

May 2023

29 May

Data validation of mandatory fields

We'll now display errors if you've not completed mandatory fields in a tax return. Clicking the error will take you to the specific field that is missing the data. Learn more.

12 May

More data in spreadsheet exports

The TFN and other contacts information is included when you export compliance data to a spreadsheet.

April 2023

20 April

Import from ledger

You can import the values from MYOB Business or AccountRight ledger into an activity statement. Learn more.

5 April

Revising an activity statement

You can now revise an activity statement in MYOB Practice. Learn more.

March 2023

31 March

Better staff management for tax-related tasks

You can now turn on roles that let you decide which staff in your practice can approve, unlock and lodge tax returns. Learn more about the new tax roles.

January 2023

Auto-create activity statements using ATO reports

We'll automatically create the activity statement from the Activity statement lodgment report (ASLR) and ATO data is pre-filled when you access the statement. Learn more.The auto-create activity statements is not available for all. If you would like to use this feature, contact support so we can switch it on for your practice.

Filtering activity statements if lodged by your client

You can filter the statements lodged by your client from your outstanding list of obligations. Learn more.

31 January

Partnership returns–Business workpapers

We've created 3 new workpapers for the Business income. Use these workpapers to enter a breakdown down of the business (PP and NPP) income and deductions

25 January

Trust returns–Business workpapers

We've created 3 new workpapers for the Business income. Use these workpapers to enter a breakdown down of the business (PP and NPP) income and deductions

12 January

Partnership and Trust returns - Rental property schedule

You can now add private use amounts to the rental property schedule.

3 January

Printing changes and enhancements

We've made enhancements to printing with new formats, and page breaks. You can print the workpapers that are attached to a tax return. Learn more

Partner Hub improvements

December 2023

6 December

Reward preferences in Partner Hub

You now view and edit your reward preferences from Partner Hub instead of through my.myob. This lets you control more in one location, from MYOB Practice.

February 2023

To find the Partner Hub, select Practice (the stack of three squares) on the left side of MYOB Practice.

23 February

Improvements to finding your way around the Partner Hub

We've added a new navigation bar to the top of the Partner Hub, so that you can easily find everything you need to know about the Partner Program and your team activity.

Client files and Contacts

January 2024

15 January

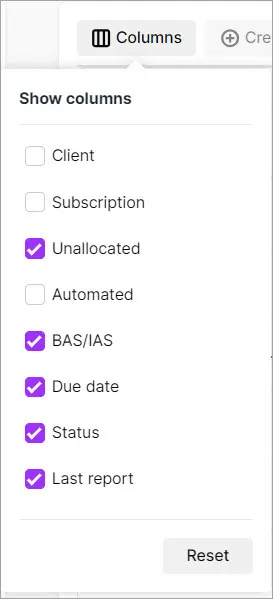

Adding columns to the Online files page

Click the Columns icon to add and remove the columns displayed.

October 2023

4 October

Import contacts in bulk

Quickly add multiple contacts by downloading a CSV template, entering their details, and import the CSV into MYOB Practice. Learn more about importing in bulk.

September 2023

26 September

Link a client file to multiple practices

When a client invites you to work on a file, accepting their invitation takes you to a new page where you can select which practice or practices you want to link to the file.

May 2023

11 May

Find clients that staff are working on

In the Contacts list, you can now filter to see the clients that staff are working on.If you’re using MYOB Practice and not AE/AO, you can now also assign the staff to clients in MYOB Practice.

If you use AE/AO with MYOB Practice, you can still assign staff in AE/AO that will appear in MYOB Practice.

Learn more about assigning staff to clients.

February 2023

8 February

A better look and feel

We’ve improved the visuals in MYOB Practice. You may notice a difference in the colours, buttons and other areas. These changes improve accessibility, making MYOB Practice easier to read and work with.This just changes the way things look; you don’t have to learn anything new and the way you work won’t change.

January 2023

18 January

Record proof of identity (POI)

If you use only MYOB Practice, you can now record, edit and delete your client verification for POI in MYOB Practice.

If you use MYOB AE/AO, the POI information you've recorded in the desktop software will be synced to MYOB Practice. You'll be able to see the information you entered in MYOB AE/AO.

In-product help improvements

June 2023

MYOB Practice in-product help is here!

Learn about the workflows by watching a video, reading our Help pages, or taking a quick tour without having to leave the product.

You'll see this banner on the following pages in MYOB Practice

Transaction Processing

Contacts

Portals

Compliance list page

Activity Statements

Use the toggle button (up arrow) on the top right of the panel to close the window if you no longer need it.