- Created by admin, last modified by AdrianC on Mar 30, 2021

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 19 Next »

https://help.myob.com/wiki/x/dgumAw

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

When an employee finishes working for you, you need to pay them the balance of the annual leave they’ve accrued but not yet used. You don’t need to pay them for unused personal leave, such as sick leave.

If the employee is also owed regular pay up to their termination date, process this as a separate pay - it makes it easier to identify the different components of the final pay.

Employment termination payments (ETPs)

If the final pay is an ETP (as defined by the ATO) your final pay process is a little different. For all the details see Processing an employment termination payment (ETP).

What's classified as an ETP?

ETPs include payments for unused rostered days off, payments in lieu of notice, a gratuity or 'golden handshake', and more. For a full list of payments that are ETPs, visit the ATO website.

ETPs can get tricky, so you might need help from the experts on our community forum or an accounting advisor.

Tax on final pay

Tax on final pays can get complicated, and our example in the steps below is a simple one. Seek advice from your accounting advisor or the ATO for help with your specific final pay needs. This help article on the ATO website is a good place to start.

To pay out unused leave

If your employee's final pay is not an ETP (if it is, go here), all you need to do is process any regular pay they're owed up until their last day. You'll also need to pay out any unused leave.

If the employee is owed any pay for the current pay period (up until their final day at work), process this like a normal pay. This may not be for a complete pay period, so you may need to adjust their hours or salary and the tax withheld.

Remember - this is just their final regular pay - and won't include any unused leave (which we'll cover below).

Processing this final regular pay ensures all applicable leave is accrued up to the employee's last day. Keeping this pay separate from any unused leave payment is a good way to clearly show what makes up the employee's final payments.

Need a refresher for doing a pay run?

Once you've processed their final regular pay, you can pay their unused leave which we cover next.

After you've paid the employee's final standard pay, you can work out how much paid leave they're owed which you'll need to pay out.

- Go to the Payroll menu and choose Employees.

- Click the employee's name.

- Click the Payroll details tab.

- Click the Leave tab.

- Take note of the total hours of accrued leave that you'll need to pay out, such as annual leave.

You can now pay the employee their unused leave.

- Start a new pay run for the employee. Need a refresher?

- Select the employee and click the dropdown

arrow to view their pay details.

arrow to view their pay details. - Enter the hours of leave being paid out. For example, if they've accrued 10 hours annual leave, enter 10 hours against the Annual Leave Pay pay item.

- Clear all other hours and amounts from the pay. This ensures super and leave is not accrued on this pay out.

- If required, click into the PAYG field and change the amount (this ATO article might help).

- Finish processing the pay as normal.

You're almost done...

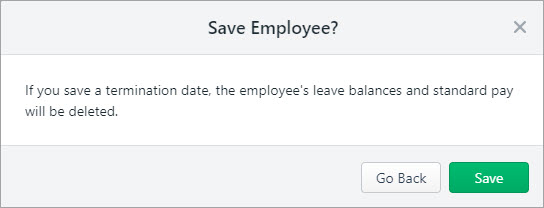

When you enter a Termination date for an employee, their leave balances and standard pay details will be deleted. This is OK as you won't need this information any longer.

- Go to the Payroll menu and choose Employees.

- Click the employee's name.

- Click the Payroll details tab.

- On the Employment details tab, enter or choose the Termination date.

- Click the Contact details tab.

- Select the option Inactive employee.

- Click Save. You'll see a message confirming the termination.

- Click Save to this message.

Need to provide an Employment Separation Certificate? Visit the Department of Human Services website for details.

One last thing to do:

If you've been reporting payroll information to the ATO via Single Touch Payroll, you'll need to notify the ATO of the termination.

If the employee returns to work, find out how to reactivate them.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.