- Created by admin, last modified by AdrianC on Jul 22, 2021

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 38 Next »

https://help.myob.com/wiki/x/4wQNB

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

STP finalisation deadline extension

As part of Single Touch Payroll reporting, usually you need to finalise your payroll information by 14 July. But the ATO recognise the impacts of COVID-19 on the Australian community, so if you need additional time you can complete your STP finalisation up until 31 July. Learn more on the ATO website.

When you finalise:

- you're letting the ATO know that you've completed all pays for the payroll year

- the status of the employee's income statement in myGov changes to Tax ready so they can pre-fill and lodge their tax return.

- Enter all pays up to 30 June (pays recorded in July which include June pay dates aren't included in the finalised year)

- Fix any incorrect pays

- Check that all pay runs sent during the payroll year have been accepted by the ATO.

Start by checking your year-to-date totals. If you've terminated any employees during the payroll year, make sure you've notified the ATO about them. Then you're ready to finalise.

If you're stuck or feeling unsure, try our free eLearning to discover everything you need to know about finalising your payroll information.

Before finalising, you should check that the year-to-date (YTD) amounts you've sent to the ATO for the payroll year match the payroll figures in MYOB.

Do this by comparing two reports to ensure they match:

- the YTD verification report in the Payroll Reporting Centre—this shows the YTD amounts you've reported to the ATO

- the Payroll Summary report in MYOB—this shows the YTD amounts you've processed through payroll in MYOB

- Go to the Payroll menu and choose Single Touch Payroll reporting.

- Click the the EOFY Finalisation tab.

- Choose the Payroll year. The Gross Payments (YTD) and PAYG withholding (YTD) values are the total amounts sent to the ATO for all your employees.

- Click View YTD verification report (PDF).

The report displays as a PDF. Take note of the total salary and wages YTD amount. Here's an example:

What am I looking at?

- This report shows the total of all ATO reporting category amounts sent to the ATO for all employees.

- The Reconciliation to Payroll section is not sent to the ATO. It shows total gross wages which you'll also see in the Payroll Summary report in MYOB. This amount will differ from the total gross wages reported to the ATO, as it doesn’t include Allowances, CDEP, Foreign Income, ETP components (not ETP Tax), Lump Sum values or any additional reimbursable/employee expenses.

- The ATO Reporting Category section lists the things that have been submitted to the ATO.

- The Total STP gross wages (in the ATO Reporting Category section) doesn't include allowances, such as JobKeeper amounts. This amount should be the same as what's shown in your Payroll Summary report in MYOB, minus any allowances or the other pay components which are listed in the Reconciliation to Payroll section.

- An employee's reportable fringe benefit amounts are reported to the ATO when you finalise, so these won't display on the YTD verification report until after you've completed the finalisation.

- In MYOB, go to the Reporting menu and choose Reports.

- Click the Payroll tab.

- Click the Payroll summary report.

- Set the report filters to cover the entire payroll year (1 July to 30 June).

- Check the YTD total for Salary and wages. Here's our example:

After you've run the above reports, compare the YTD total wage amounts on both. If they match (like in our example), you're ready to finalise.

If the reports don't match

Here are some things to check.

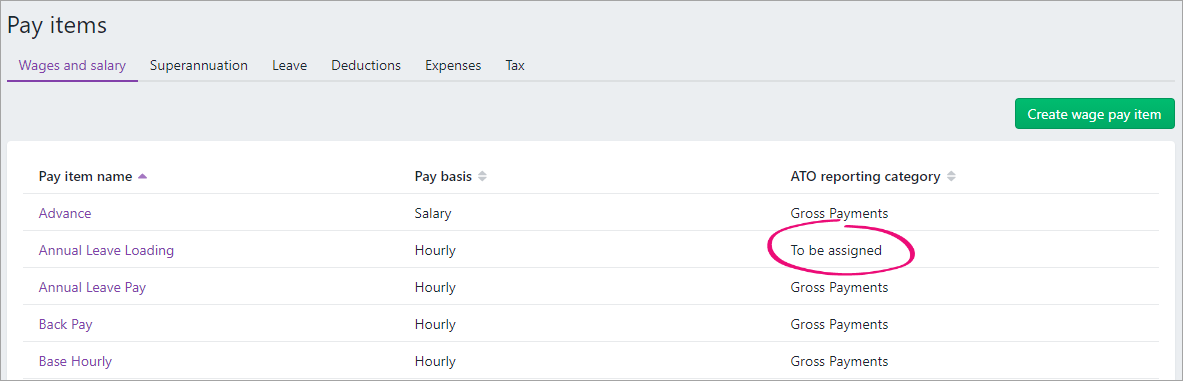

Make sure you've assigned an ATO reporting category to each of your pay items.

- Go to the Payroll menu and choose Pay items.

- On the Wages and salary tab, look for any pay items which are To be assigned. Here's an example:

- If any pay items are To be assigned:

- Click the pay item name to open it.

- Assign the applicable ATO reporting category. For help choosing the right one, see Assign ATO reporting categories for Single Touch Payroll reporting or speak to your accounting advisor.

- Click Save.

If you add or change the ATO reporting category in a pay item, enter a $0 pay for any employees who have been paid using that pay item. See below for steps to enter a $0 pay.

Once all pay items are assigned an ATO reporting category, run the YTD verification and Payroll summary reports again (as we did above) to ensure they match. If they do, you're ready to finalise. Otherwise, continue below to check the reported wage values for individual employees. This will help you narrow down your out of balance.

There are two reports you (or your accounting advisor) can use to check the amounts paid to individual employees for the payroll year.

- In MYOB, run the Payroll register report (Reporting menu > Reports > Payroll tab > Payroll register > click the dropdown arrow

for each employee).

for each employee). - In the Single Touch Payroll reporting centre, click the ellipsis

button for an employee and choose View summary report (PDF). This report shows a summary of all ATO reporting category amounts sent to the ATO for an employee (gross payments, PAYG withholding, allowances, etc.).

button for an employee and choose View summary report (PDF). This report shows a summary of all ATO reporting category amounts sent to the ATO for an employee (gross payments, PAYG withholding, allowances, etc.).

Here's what these reports show:

| Report | Description |

|---|---|

| Payroll register (in MYOB) | The total wages include all pay items and doesn't reduce the total wages by any non-taxable deduction or wage pay items, and pay items that don't have an ATO reporting category. |

| Summary of Payments (in the Single Touch Payroll reporting centre) | The gross payments amount is reduced by any non-taxable deduction or wage pay items, and pay items that don't have an ATO reporting category. |

To ensure the latest year-to-date amounts are sent to the ATO for an employee, you can enter a $0 pay for them as described below.

A $0 pay (also called a void pay) is like any other pay, but you'll enter zero for all hours and amounts. When you record a $0 pay, the employee's latest year-to-date payroll totals will be sent through to the ATO.

- Start a new pay run (Payroll menu > Create pay run).

- Ensure the Date of payment is in the payroll year you're finalising, for example 30 June.

- Removing all hours and amounts from each employee's pay, like this example.

- Complete the pay run as you normally do and declare it to the ATO. Need a refresher?

Once the pay run has been accepted by the ATO, run the above reports again to confirm the totals match.

Reports still don't match? You might need help from an expert to dig a little deeper into your issue. Reach out to your accounting advisor, or try the MYOB professionals on our community forum. Of course, you can always get help from our support team.

As part of processing an employee's final pay, you need to notify the ATO. This lets the ATO know the employee's termination date and any ETP components in their final pay.

Here's how:

- Go to the Payroll menu and choose Single Touch Payroll reporting.

- Click the Employee terminations tab

- For the terminated employee, enter or choose their Employee end date.

- Click Notify the ATO.

Enter your name as the authorised declarer and click Send.

This declaration is processed in the same way other Single Touch Payroll reports are. They must have a status of Accepted in the payroll reporting centre before you can finalise your STP information.

To finalise Single Touch Payroll payroll information

Finalising your Single Touch Payroll information is done in just a few clicks.

- Go to the Payroll menu and choose Single Touch Payroll reporting.

- Click the EOFY finalisation tab and choose the Payroll year you're finalising.

- If you need to report fringe benefits for an employee (what is this?):

- Select the option Enable RFBA.

For each applicable employee, enter values for both:

RFBA ($)

Section 57A $

The combined value of these must be above the thresholds set by the ATO.

- Select each employee you want to finalise, then click Finalise and notify the ATO.

- Enter your name and click Send.

What's next?

Each employee that has been finalised will have the Final indicator ticked in the payroll reporting centre. You can let these employees know that they can now sign in to myGov to complete their tax returns. That's right—you don't need to complete payment summaries for them!.

You're also ready to start processing pays from 1 July for the new payroll year. The latest tax tables will automatically apply so you don't have to worry about downloading them.

Super rate increase from 1 July 2021

The mandatory superannuation guarantee rate increased from 9.5% to 10% from 1 July 2021.

Before you do your first pay in July, you should check that your superannuation guarantee pay item is set to 10%.

FAQs

Why don't my STP reports match the ATO's Business Portal?

Each STP report sent to the ATO includes the employer pay period information and the employee year-to-date (YTD) amounts.

As the ATO doesn't allow you to delete these reports, the Business Portal will show every pay run declared through STP, including ones that you have deleted or reversed in your software.

So, in most cases, if you've made payroll adjustments the Business Portal may not match your STP reports. And that's OK. Just make sure you check year-to-date totals in MYOB before finalising. See To check year-to-date totals, above.

Will my YTD totals be correct if I've only started reporting part of the way into the financial year?

The ATO does not receive the details of individual pay runs, only the year-to-date payroll amounts. So, provided you've submitted a pay after setting up STP, the latest year-to-date totals will be submitted. Still, we recommend you check your YTD amounts prior to finalising.

How do I undo a finalisation?

You can undo an individual employee's finalisation. When you do, the employee's income statement in myGov will no longer be Tax ready so they won't be able to pre-fill and lodge their tax return.

- Go to the Payroll menu and choose Payroll Reporting.

- Click the EOFY finalisation tab.

- Choose the Payroll year.

- Select the employee whose finalsation you want to undo.

- Click Finalise and notify the ATO.

- Enter the name of the Authorised sender and click Send. The Final indicator tick is removed for the employee. If it's still there, click a different tab then return to the EOFY finalisation tab.

- When you're ready, you can finalise the employee again.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.