- Created by KylieN, last modified by AdrianC on Nov 18, 2019

https://help.myob.com/wiki/x/JoCU

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

If your business makes sales where customers can pay using PayPal, this article shows you how to setup MYOB Essentials Accounting to record these transactions.

Want to receive payments online?

Online invoice payments make it easy for your customers to pay straight from their online invoice using Visa, MasterCard, AMEX or Bpay, and automatically records the payments on your Essentials business file - so you can spend less time chasing payments and updating your books.

See Online invoice payments for sign up details.

PayPal transactions are much the same as other transactions which involve a merchant fee. In other words, the merchant (in this case PayPal) takes a percentage share of the transaction for providing the credit facilities. In our example, a $100 sale is received through PayPal, from which $2 is paid to PayPal, resulting in a net sale of $98. You will need to record both transactions in MYOB Essentials Accounting, in other words a customer receipt of $98 and a merchant charge of $2.

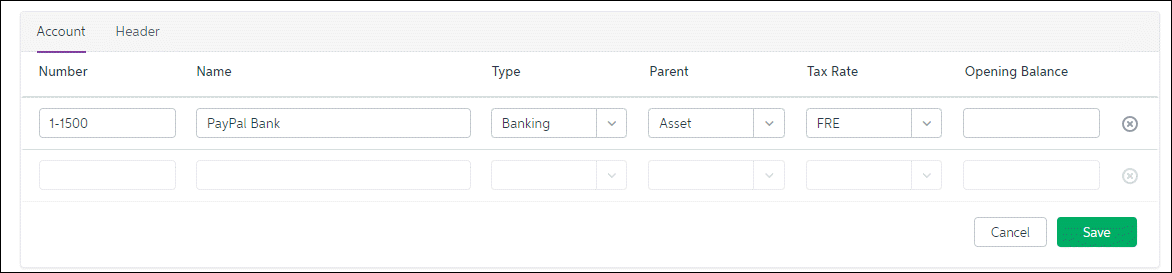

Task 1: Create a PayPal bank account

A PayPal bank account is required, against which you can record PayPal sales. This account will show you the balance owed to you by PayPal (or the balance you owe PayPal). It can be used like a normal bank account for making payments from or recording transfers to other accounts. Unfortunately at this stage, the PayPal account can't be setup with bank feeds. To create this account in MYOB Essentials Accounting, complete the following:

- In MYOB Essentials, click your business name and choose Accounts List. The Accounts List page appears.

- Click Add new.

- For the Account Type, select Banking.

- Enter a Account Number that suits your account list.

- For the Account Name, enter PayPal Bank or similar.

- Select the applicable Tax Rate/GST Type. If you're unsure which to choose, check with your accountant. Here's our example:

- Click Save.

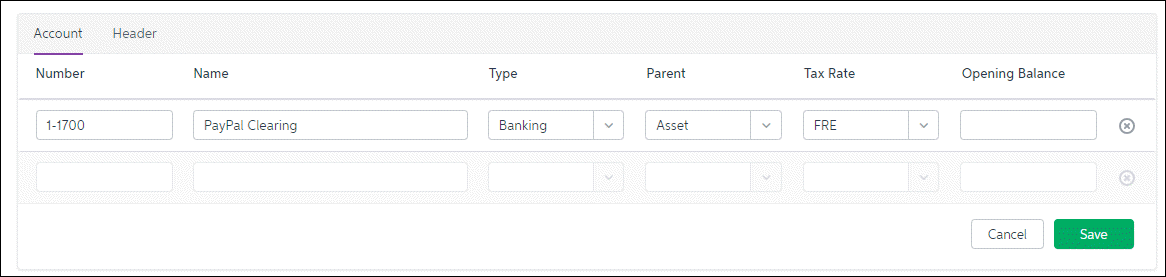

Task 2: Create a PayPal clearing account

This account is required to record the PayPal fees against. To create this account, complete the following:

- In MYOB Essentials, click your business name and choose Accounts List. The Accounts List page appears.

- Click Add new.

- For the Account Type, select Banking.

- Enter an Account Number that suits your account list.

- For the Account Name, enter PayPal Clearing or similar. You can also specify a Short Name such as PayPal or similar.

- Select the applicable Tax Rate/GST Type. If you're unsure which to choose, check with your accountant. Here's our example:

- Click Save.

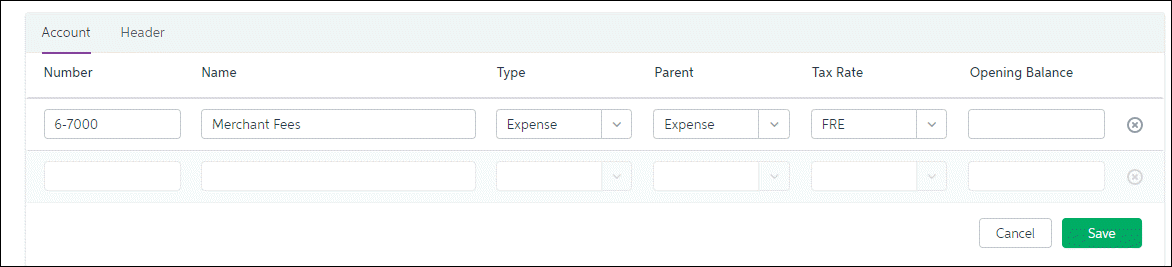

Task 3: Create an expense account for the PayPal fees

This account is required to record the PayPal fees as an expense to your business. To create this account, complete the following:

- In MYOB Essentials, click your business name and choose Accounts List. The Accounts List page appears.

- Click Add new.

- For the Account Type, select Expense.

- Enter an Account Number that suits your account list.

- For the Account Name, enter Merchant Fees or similar.

- Select the applicable Tax Rate/GST Type. If you're unsure which to choose, check with your accountant. Here's our example:

- Click Save.

Task 4: [Optional] Create a supplier card for the PayPal fees

When you record the PayPal fees using a Spend Money transaction it's a good idea to allocate the transaction to a supplier. For this reason a supplier card needs to be created.

To do this:

- On the Contacts menu, click Create contact. The Contact page appears.

- In the Name field, enter PayPal or similar.

- Click Save.

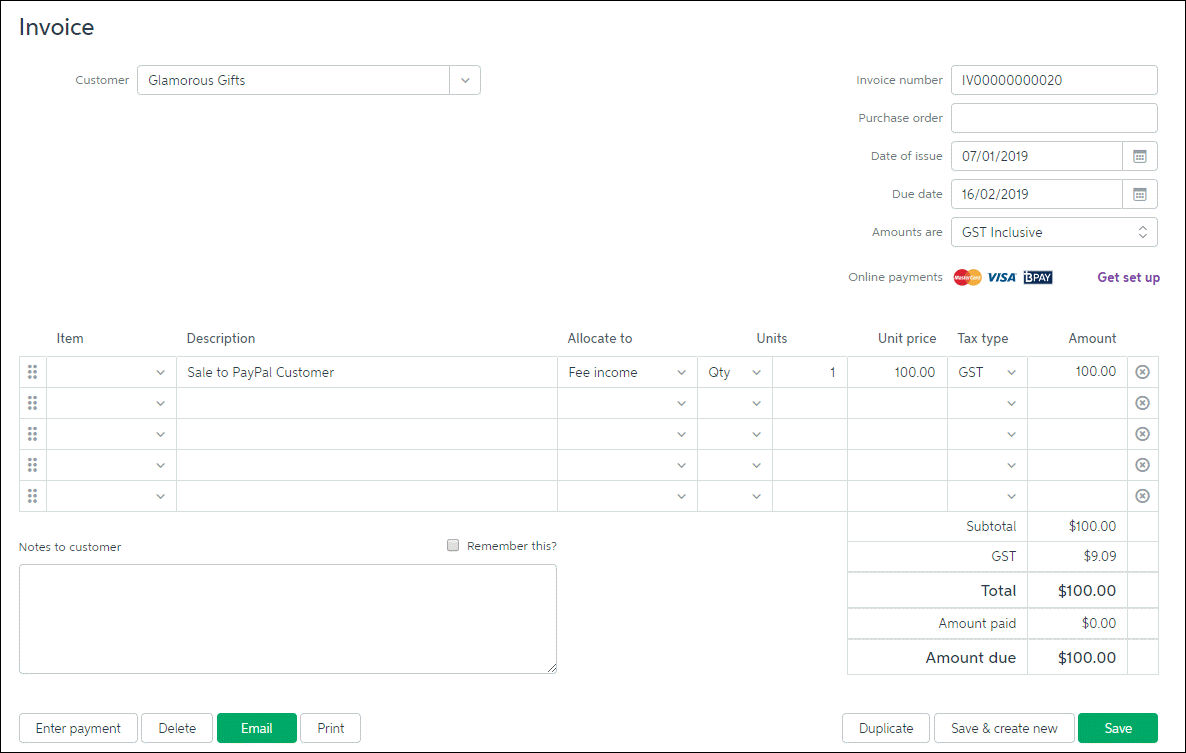

Task 5: Record the sale

Record the sale for the customer as per normal. In our example below, a sale for $100 has been recorded for a customer who is paying through PayPal.

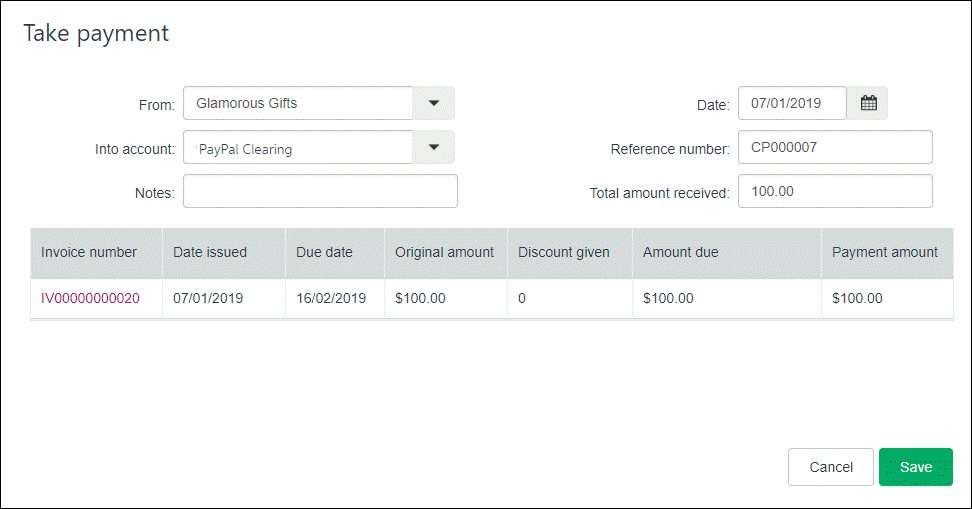

Task 6: Receive the payment

When payment for the sale is received it comprises the net payment you will receive for the sale, plus the PayPal fees. In our example the total sale is $100 which comprises a net sale value of $98 plus a $2 PayPal fee. This is recorded using a customer payment for the full amount to the PayPal clearing account, and then a Receive Money for $98 to the PayPal account from the clearing account. To record the payment for the sale:

- On the Sales menu, click Take payment. The Take payment page appears.

- In the From field, select the applicable customer. The list of invoices open against that customer appears.

- In the Into account field, select your PayPal clearing account.

- In the Total amount received field, enter the full amount the customer paid (including fees). Also enter this amount into the Payment amount column next to the invoice. See our example below.

- Click Save.

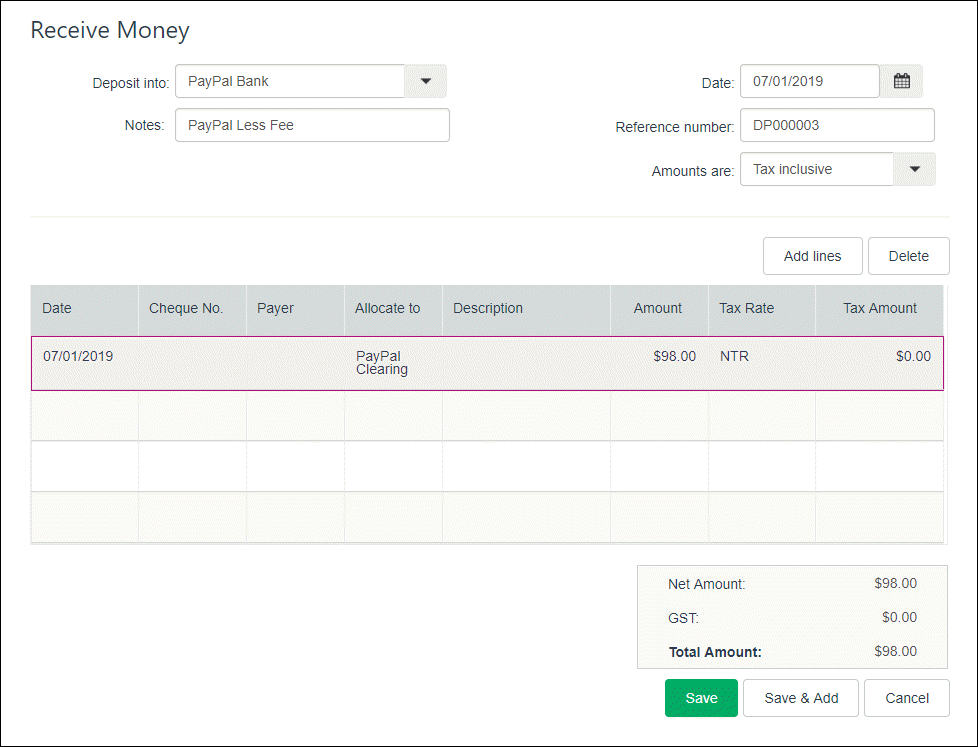

And here's our example of the Receive Money transaction, which you view via Banking > Receive Money:

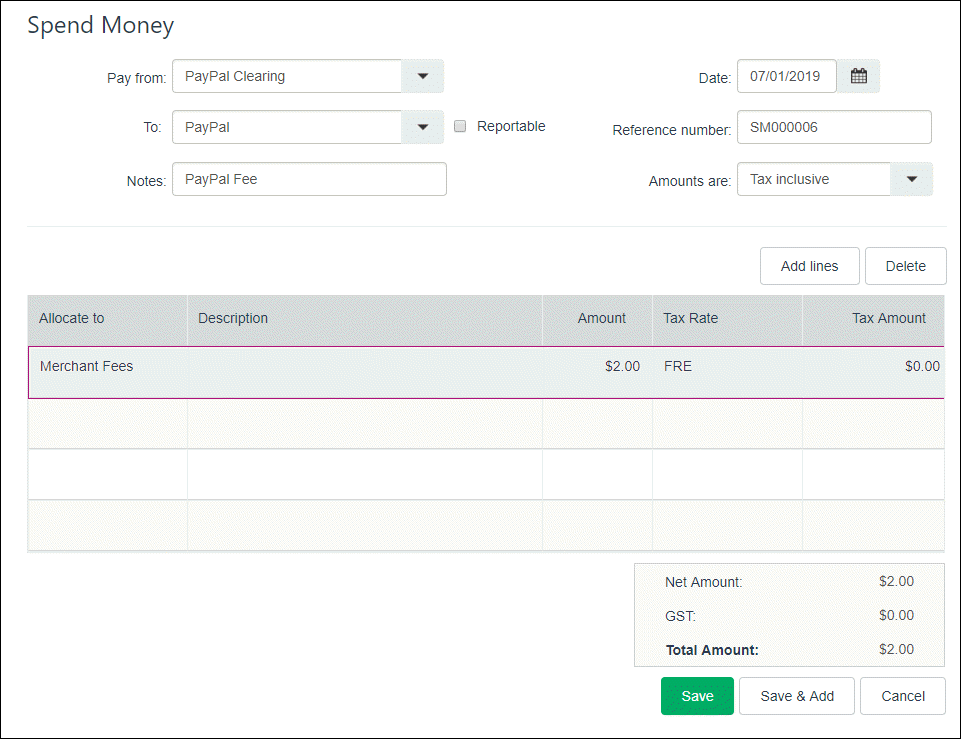

Task 7: Record the PayPal fees

- On the Banking menu, click Spend money. The Spend Money page appears.

- In the Pay from field, select your PayPal clearing account.

- [Optional] In the To field, select the PayPal contact.

- In the Allocate to column, allocate the transaction to the PayPal expense account.

- In the Amount column, enter the PayPal fee. See our example below.

- Click Save.

FAQs

Can I set up a bank feed on my PayPal account?

Currently you can't set up a bank feed directly from a PayPal account. But there are a few ways PayPal payments can be managed. One way is to link your PayPal account to a bank or credit card account. If you have a bank feed set up for that bank or credit card account, then all transactions, including the PayPal ones, will show in that bank feed.

For more information about PayPal payment methods, see the PayPal website.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.