After you've set up Single Touch Payroll (STP), you'll notice one extra step at the end of each pay run. And at the end of the payroll year you'll finalise your payroll information with the ATO.

Reporting each pay to the ATO

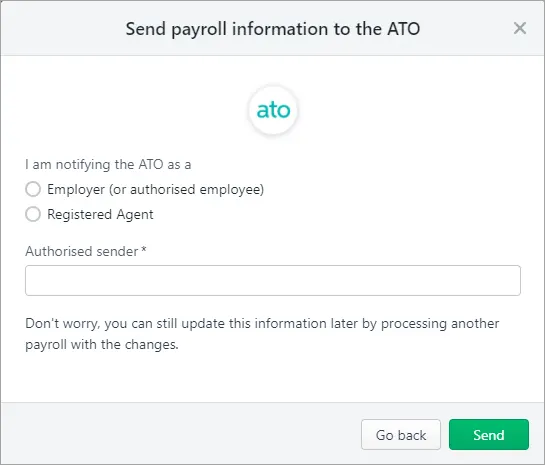

You won't notice anything new while entering your pays, but after you record a pay you'll now be prompted to send the payroll information to the ATO.

This is easily done – just enter your details and click Send.

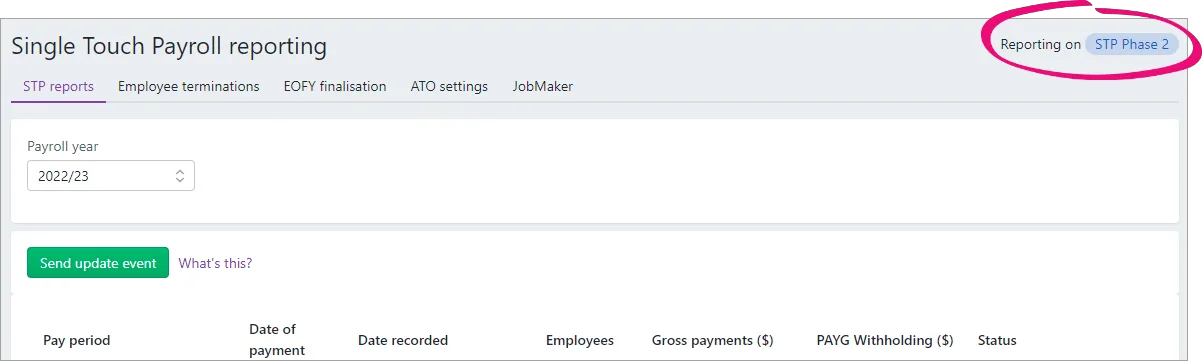

You can check the status of your submissions by going to the Payroll menu > Single Touch Payroll reporting. If a payment is rejected, find out out to fix it.

End of year finalisation

At the end of the payroll year, you'll finalise your STP reporting. It's a simple process that lets the ATO know you're finished reporting payroll information to them for the year.

Finalising also changes the status of your employees' income statements in myGov to Tax ready. This means they'll be able to pre-fill and lodge their tax returns.

Typically, most businesses will need to finalise their STP information by July 14, but you should clarify the due dates with the ATO.

For all the details, see End of year finalisation with Single Touch Payroll reporting.

FAQs

How do I know if I'm set up for STP?

You'll know you're set up if you can access the STP reporting centre (Payroll menu > Single Touch Payroll reporting). In the top-right corner you'll also see whether you're reporting on STP Phase 1 or 2. How to move to STP Phase 2.

If your MYOB business has not set up STP, or you're a user who needs to add themselves as an STP declarer, you'll be prompted to Get started.

What if I make a mistake in a pay run?

Mistakes happen and in MYOB they're easy to fix. Depending on what needs fixing, you might be able to adjust the employee's next pay or undo the pay and record it again.

With STP, your employees' year to date (YTD) figures are sent to the ATO after each pay run. So if changing an employee's pay affects their YTD figures, the updated figures will be sent to the ATO the next time you do a pay run.

If a pay has been accepted by the ATO and you need to undo it, you'll need to reverse the pay and report the reversal to the ATO.

For all the details on fixing pays, see Fixing a pay.

If the pay you need to change is in a payroll year that's been finalised with the ATO, see Changing a pay after finalising with Single Touch Payroll.

How do I add another declarer for STP?

Each person who processes payroll in your company file must add themselves as a declarer before they can send payroll information to the ATO.

If someone else in your business needs to be set up to report payroll for STP, see Add a declarer for Single Touch Payroll reporting.