- Created by AdrianC, last modified by RonT on Jun 06, 2023

https://help.myob.com/wiki/x/8YzMAQ

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

New Zealand only

For Australian help, click here.

- Allowances are extra payments made to employees, including travel, meals, tools or particular skills

- To include an allowance on an employee's pay, set up a new pay item (instructions below)

- To check which allowances your employees might be entitled to, see the Ministry of Business website

OK, let's step you through how to set up an allowance.

Set up an allowance pay item

Pay items are used to add extra payments to employees' pays. Here's how to set up a pay item for a $20 meal allowance, but the same approach can be used for any allowance. If the allowance amount varies between employees, you can change the amount when you process your pays, or you can set up additional pay items.

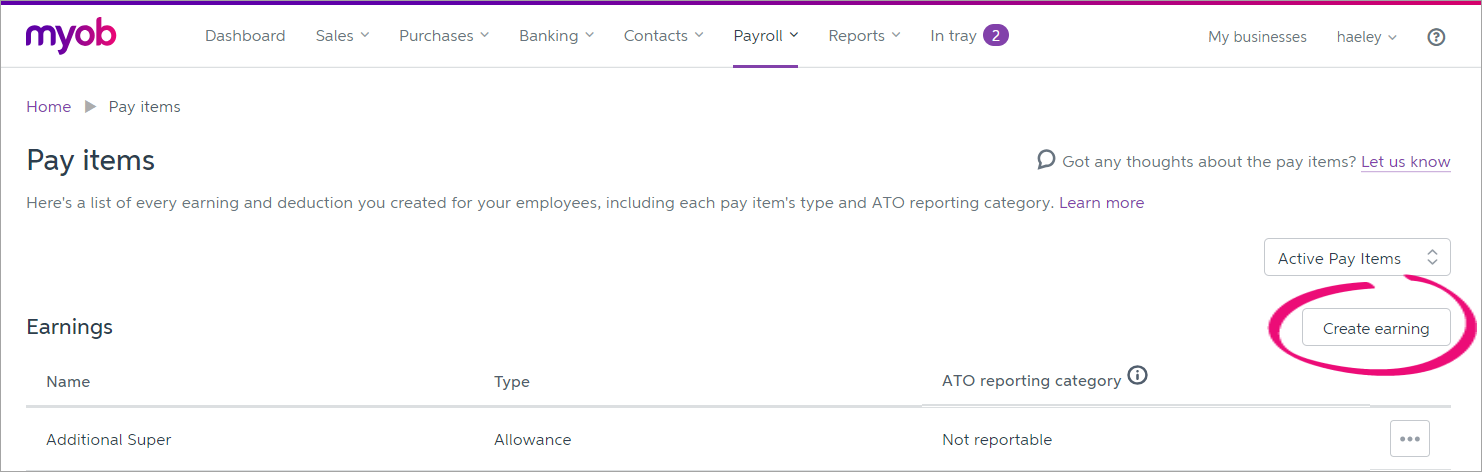

- Go to the Payroll menu and choose Pay items.

- Click Create earning.

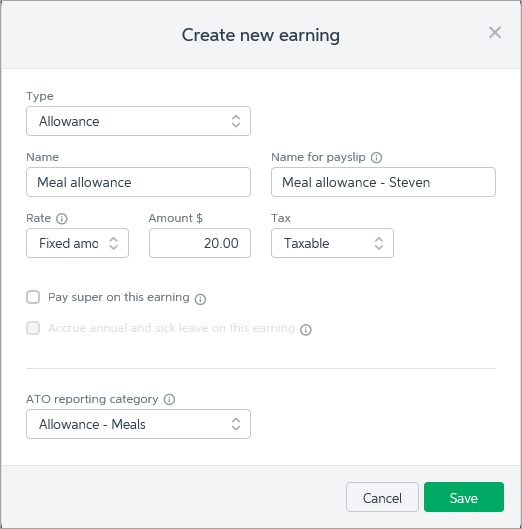

- Set up the earning:

- For the Type, select Allowance.

- Enter a Name for the earning.

If you'd like a different, more personalised, name to show on payslips for this earning, enter a Name for payslip, such as "Meal Allowance - Steven". Otherwise, this can be the same as the Name field.

For the Rate, choose whether the allowance will be paid as a Fixed amount, on a Per hour basis, or Per km or Per unit.

- Enter the Amount for the allowance. If needed, you can change this amount during the pay run.

- Choose whether the overtime is Taxable or Non-Taxable. If unsure, check with your accounting advisor or the ATO/IRD.

Select your options.

this option... means this... Don't include in KiwiSaver contributions Select this option if compulsory employer and employee contributions should be excluded from this earning. If unsure, check with your accounting advisor or check the IRD website. Don't include in gross earnings when calculating leave payments Select this option to exclude the pay item from gross earnings for leave calculations. If you're not sure which pay items to exclude, check the IRD website. Learn more about Leave calculations. Don't accrue annual leave on this pay item for pro-rata employees Select this option if you don't want employees to accrue pro-rata annual leave on this pay item. Note that employees with a fixed annual leave entitlement will never accrue leave on pay items. Here's our example meal allowance setup.

- Click Save.

- Repeat these steps if you need to create additional allowance pay items.

- When you're done, assign the pay items to your employees as described in the next task.

Assign the pay item to an employee

To include an allowance pay item in an employee's pay, you need to assign it to them. Here's how:

- From the Payroll menu, choose Employees.

- Click the employee's name.

- Click the Pay items - earnings & deductions tab.

- In the Earnings section, click the dropdown arrow next to the Add earning... field.

- Choose the allowance pay item to be assigned to the employee. The pay item is assigned to the employee.

- Repeat step 5 if you need to assign any additional pay items to the employee.

- Click Save.

- Repeat from step 2 to assign pay items to another employee.

OK, you're now ready to pay the allowance when you do a pay run. See the next task for details.

Pay the allowance

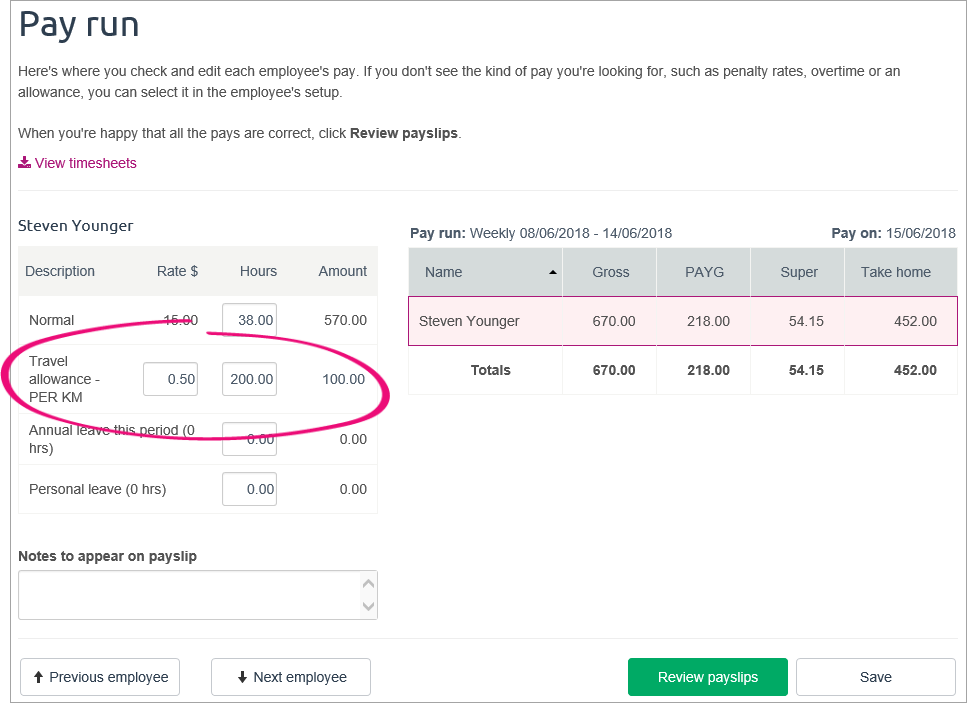

When you process the employee's next pay, the allowance will be listed.

- Go to the Payroll menu and choose Enter Pay.

- Select the employee to be paid then click Start Pay Run.

- Next to the allowance pay item, enter or confirm the amount (or Hours) being paid. Here's our example meal allowance:

- Continue processing the pay as normal.

FAQs

How do I set up a per KM travel allowance?

When setting up an allowance pay item (task 1 above), choose the Per km rate.

When you apply this new earning to an employee and process a pay run, the earning will work the same as an hourly earning. If you want, you'll be able to adjust the per kilometre rate for the employee in the pay run.

When you pay the employee (task 3 above), enter the number of KM travelled in the Hours column. In this example, a travel allowance for 200KM is being paid:

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.