- Created by admin, last modified by AdrianC on Sep 09, 2019

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 53 Current »

https://help.myob.com/wiki/x/JR8kAw

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

If you need to enter payments that aren’t associated with your suppliers (for example, for telephone bills and bank charges), enter these as Spend Money payments. For more information see Spend money.

In MYOB Essentials, the Bills page is used to record your business expenses. Business expenses refer to the purchases you make from your suppliers for business supplies, and the payment of these purchases.

When you receive a bill from a supplier for a purchase you’ve made, first you need to create the purchase as a bill in MYOB Essentials. Then, you can pay the bill (see Entering payments made to suppliers).

To speed things up, you can also:upload supplier invoices to your in tray and create your bills from those uploaded documents.

Setting up suppliers and items

You can set up suppliers and items at any time—before you begin entering a bill (using the Contacts menu or the Items list link) or while creating it (using the Add Supplier and Add Item list options).

To enter a bill

On the Bills page, click Create bill. The Bill page appears.

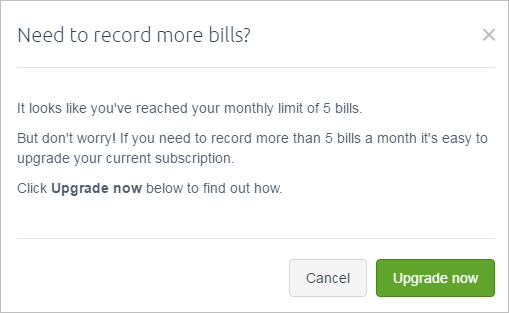

Working in Essentials Accounting Starter? If you've reached your monthly limit of 5 bills, you'll be prompted to upgrade your subscription if you try to create a new one.

Click the Upgrade now button to be taken to the Subscription details page and view your upgrade options.

If necessary, change the Bill number. This number is automatically generated, based on the last number used.

If you change the bill number, you’ll change the automatic numbering. For example, if you change the number to EX000081, the next time you create a bill, MYOB Essentials will display the new bill number as EX000082.

Enter information about the supplierIn the Supplier field, enter the supplier’s name, or click the dropdown arrow and select the supplier from the list. The supplier’s address details appear in the field below.

Entering an expense billed to you by a new supplier?

Click the dropdown arrow for the Supplier field and select + Add supplier from the list. Enter the supplier’s details in the Add New Supplier window and click Save.

If you want to link the bill to a document from the supplier, click Link document:

Select a previously uploaded document (or upload one and select it)

Click Link document to bill.

For more information on linking documents to transactions, see Working with In tray documents.

Check the due date, payment terms and tax preference

- Check the date in the Date of issue field.

- Check the date in the Payment due date field.

- If you want to record the invoice or bill number as specified by the supplier, enter it in the Supplier invoice number field.

- If you account for tax/GST, choose an option from the Amounts are list.

- If you want the prices to include tax/GST, choose Tax/GST inclusive. Note that this is the default preference.

- If you want the prices to exclude tax/GST, choose Tax/GST exclusive.

Enter the items you’re buying In the Item column of the list, enter the number of the item you’re being billed for, or select it from the list.

Entering a new item?

Click the dropdown arrow in the Item column and select + Add Item from the list. Enter the item details in the Add New Item window and click Save.

The item Description, Account, Unit price and Tax rate/GST type appear, based on the details you entered when you created the item.

The Qty and Total also appear. The default quantity is 1. You can change this in the Qty field.

To remove an item from the list, click the delete icon (

) to the right of the item line.

) to the right of the item line.Repeat from step 8 for each item on the bill. The totals are calculated at the bottom of the bill:

Subtotal—the total for the items added to the bill

Tax/GST—the amount of tax/GST applied to the bill

Total—the subtotal amount plus the tax/GST amount

Amount paid—the total of any bill payments made

Amount due—the total minus the amount paid.

If you want to add a note about the bill, enter it the Notes field.

Check that all the information in the bill is correct.

Complete the bill

If you want to:

save the bill, click Save. The bill is saved and the Bills page appears.

enter a payment for the bill, click the Enter payment link, and then click Yes to the confirmation message. On the Enter supplier payment page, enter the payment details.For more information, see To enter a payment to a supplier.

FAQs

Can I show tax/GST for each line item on my bills?

MYOB Essentials can only show the total tax/GST on a bill, not for each line item.

How can I record cash purchases?

If you want to keep track of cash purchases, set up a contact called "Cash Purchases" and choose this contact when making a cash purchase.

Why can't I click Save when entering a bill?

If the Save button is inactive (it's a dull colour and a red circle appears when you hover over it) it means some required information is missing from the bill.

Make sure a supplier is selected and the details of the bill are entered, then the Save button will be clickable.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.