- Created by DijanaN, last modified by MiriamA on Sep 13, 2023

https://help.myob.com/wiki/x/5g90Aw

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

Online invoice payments offer businesses the option to pass on the surcharge associated with online payments to their customers. That means that the surcharge for card payments can be added to a customer invoice.

Choose your location to see how surcharging works and how to turn it on or off.

Australia only

When you pass on the surcharge to your customers, you are adding the 1.8% surcharge for card payments (Amex, VISA, Mastercard, Apple Pay, Google PayTM or PayPal) to their invoice. BPAY is excluded from this, so you will continue to be charged for payments received via BPAY.

How does it work?

If you're already using online payments, you can turn on customer surcharging. This will apply to all customers who make payments using a credit or debit card.

When customer surcharging is turned on, the 1.8% surcharge fee can be passed on to your customers. The 1.8% surcharge fee is GST inclusive, regardless of whether the invoice includes GST.

Next, you just need to create and send invoices like you normally would.

To turn surcharging on or off for all invoices

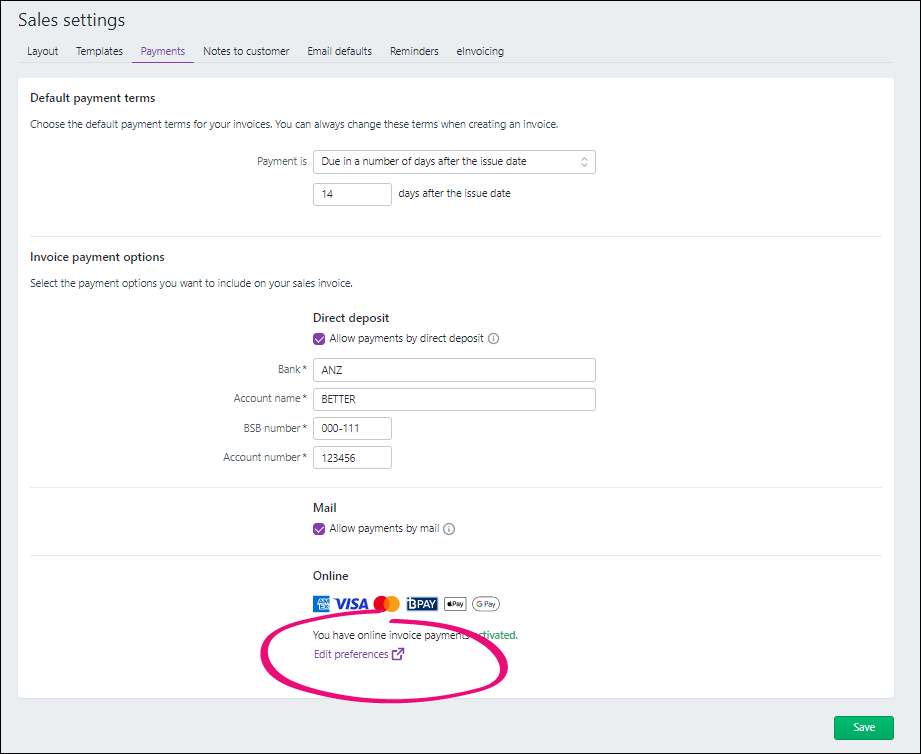

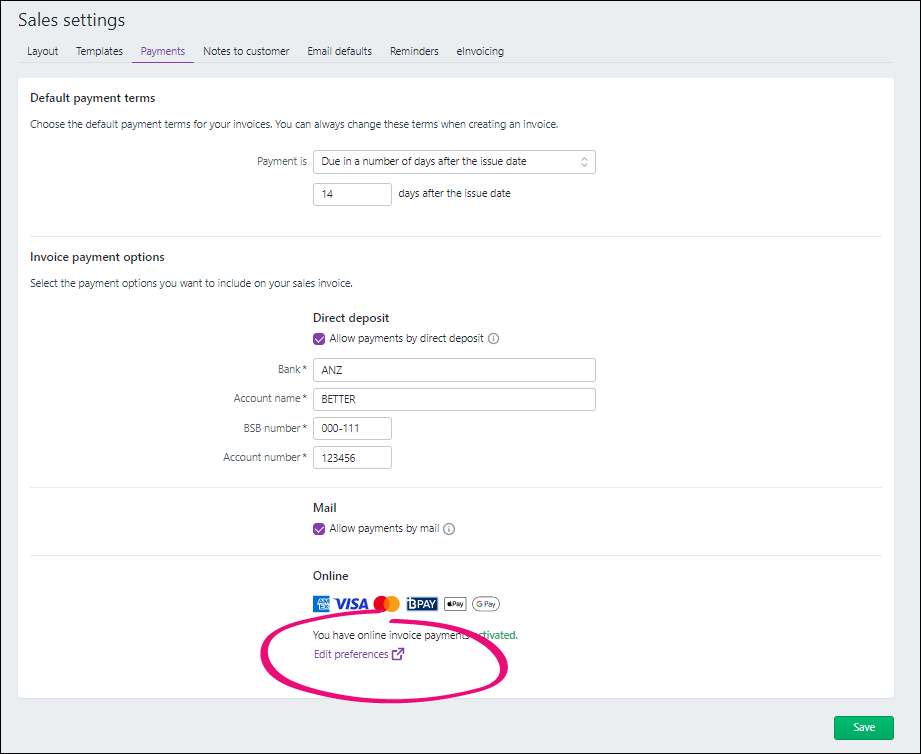

- Click your business name in the top right corner and choose Sales settings.

- Click the Payments tab.

- Click Edit preferences.

- Select the option Enable the option to pass on credit card surcharges and choose the applicable income account. This will be the MYOB income account you want to use to track surcharges.

Click Save. Now, you just need to create and send invoices like you normally would. See Creating invoices and Emailing, printing or downloading invoices if you need a refresher.

Do you create recurring invoices? The option to pass on customer surcharging for all invoices isn't available yet for invoices created from recurring transactions. Instead you'll have to enable this before you send each invoice, by opening it and selecting the Apply Surcharge option. See 'To turn surcharging on or off for a single invoice', below.

To turn surcharging off for all invoices, repeat these steps and select the option Don't surcharge credit card payments.

Once you've turned on customer surcharging (see the steps above), you can choose to turn surcharging on or off for individual invoices.

- Create the invoice as you normally would.

Select or deselect the Apply surcharge option.

If you change this setting on an invoice you've already sent, you'll need to save your changes and re-send the invoice.

- Complete the invoice as normal and send it to your customer.

The customer will receive the invoice as they normally would. When they click on Pay Now, they'll be asked to select their payment method.

If a customer chooses to pay via BPAY, they will not incur a surcharge fee. However, you will continue to be charged any fees related to payments received via BPAY.

When they select Credit or Debit Card, they'll be asked to enter their card details. The amount owing, the surcharge fee, and total amount due (invoice and surcharge fee) will be listed as shown below.

When they click Submit, the payment will be processed.

PayPal users

If you've turned on customer surcharging for for PayPal, the surcharge will appear as ‘Handling’ in the payer's PayPal wallet.

Handling the payment

When a customer makes a payment, the details will automatically be entered into your MYOB business, and the invoice will be closed off. We'll also send you an email with a detailed break down of the payments.

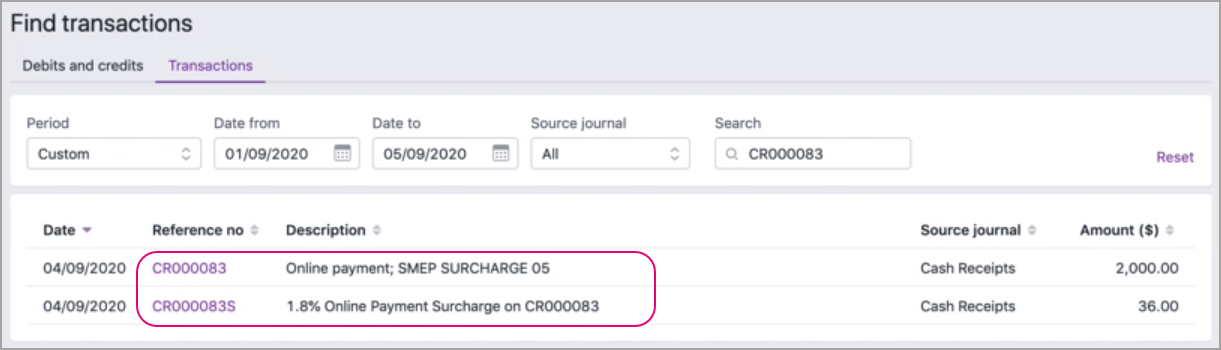

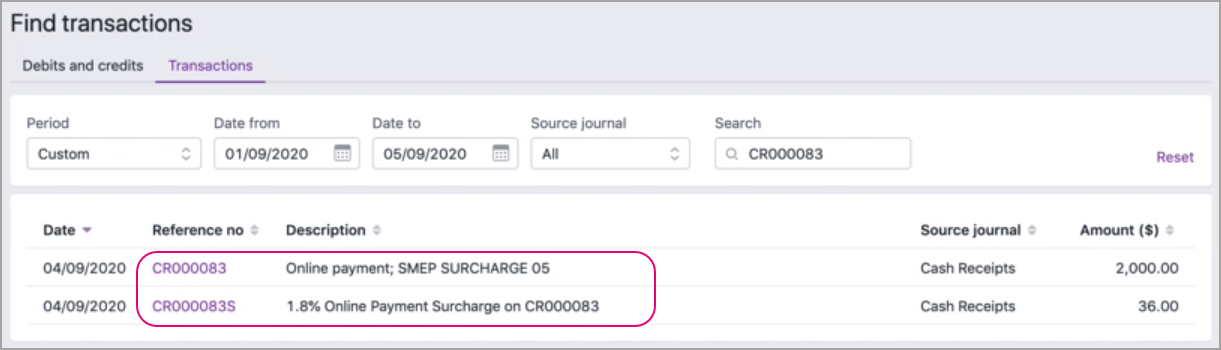

Note that the payments you receive will be recorded as unmatched and the surcharge fees will be recorded under the ledger account you chose when you turned on surcharging (see the steps above). The surcharge amount will have the same reference number as the received payment, but with an additional 'S' at the end.

For example, say you receive three online payments on Monday. The payment details of each transaction will be listed as unmatched. MYOB will deposit the total of the three payments overnight into your bank account as one lump sum. So on Tuesday, you would match the deposited transaction that will appear on your bank feed and bank statements. For more information see Matching bank transactions.

Google Pay is a trademark of Google LLC.

FAQs

What are the fees and charges related to online payments?

- Any of your invoices paid using a credit card (AMEX, Visa, Mastercard, Apple Pay, Google PayTM or PayPal); via our online payment service, will surcharge the payer a 1.8% fee (incl. GST)

- All fees related to invoices paid using BPAY; via our online payment service, will be charged to your business and not the payer

The surcharge of 1.8% will be applied to the invoice total, with the surcharge amount settled along with the invoice amount into your bank account. It will later be debited from your account during your monthly MYOB billing cycle.

- The $0.25 per transaction fee will only be charged to your business and not the payer.

Where do I find the surcharge amounts?

You'll see individual surcharge amounts in your transactions list:

- Go to Banking and choose Find transactions.

- Click the Transactions tab. A list of transactions appear.

- The surcharge amount will have the same Reference no as the received payment, but with an additional 'S' at the end.

How do I change the bank account my fees and charges are debited from?

Only the Owner or an Online admin user can change the bank details. Tell me more about user access.

- Click your business name in the top-right corner and choose Sales settings.

- Click the Payments tab.

- In the Invoice payment options section, click Edit preferences.

- Click Edit for Bank account for direct debit of fees to change the business bank account that will be debited for fees and charges.

- Follow the prompts to update your account details.

- Click Next and complete your Direct Debit Request details.

- Click I agree to save.

- If applicable, you can change the Ledger account to record fees and charges.

- When you're done, click Save.

You'll receive an email within 48 hours confirming the changes you made.

New Zealand only

When you pass on the surcharge to your customer, your customer pays the 2.7% surcharge for online invoice payments (VISA, Mastercard, Apple Pay or Google PayTM).

GST on surcharges

If you pass on the surcharge and there’s GST on your invoice, GST will also apply to the surcharge. GST is applied to the surcharge because providing a payment service is considered part of the sale. For more information, see IR’s GST on surcharges page.

For example, if you sell taxable goods and services, such as shoes, and provide an online payment service that has a surcharge, then you are selling the:

- shoes, and

- payment service.

As a result, the surcharge incurs GST at the same rate as the shoes.

Turning surcharging on and off

When you set up online payments, you chose if you wanted to pass on the surcharge to customers. You can turn this on or off whenever you like.

Next, you just need to create and send invoices like you normally would.

To turn surcharging on or off for all invoices

- Click your business name in the top right corner and choose Sales settings.

- Click the Payments tab.

- In the Invoice payment options section, click Edit preferences.

- In the Online payment settings page, in the Surcharging section, select:

- Enable surcharing on invoices – to turn on surcharging for all invoices

- Never pass on the surcharge – to turn off surcharging for all invoices

Click Save. Now, you just need to create and send invoices like you normally would. See Creating invoices and Emailing, printing or downloading invoices if you need a refresher.

Do you create recurring invoices? The option to pass on customer surcharging for all invoices isn't available yet for invoices created from recurring transactions. Instead you'll have to enable this before you send each invoice, by opening it and selecting the Apply Surcharge option. See 'To turn surcharging on or off for a single invoice', below.

Once you've turned on customer surcharging (see the steps above), you can choose to turn surcharging on or off for individual invoices.

- Create the invoice as you normally would.

Select or deselect the Apply surcharge option.

If you change this setting on an invoice you've already sent, you'll need to save your changes and re-send the invoice.

- Complete the invoice as normal and send it to your customer.

The customer will receive the invoice as they normally would. When they click on Pay Now, they'll be asked to select their payment method.

When they select Credit or Debit Card, they'll be asked to enter their card details. The amount owing, the surcharge fee, any applicable GST and total amount due (invoice and surcharge fee) will be listed.

When they click Submit, the payment will be processed.

Handling the payment

When a customer makes a payment, the details will automatically be entered into your MYOB business, and the invoice will be closed off. Here's how it'll work:

The individual payments you receive for a day will be recorded in your Undeposited Funds Account.

To check the account you've nominated, go to Accounting > Manage linked accounts > Bank Account for undeposited funds.

The fees and, if applicable, surcharge and surcharge GST, will be recorded in your nominated merchant fees account.

To check the account you nominated, click your business name in the top-right corner > Sales settings > Payments tab > Edit preferences > Ledger account to record merchant fees.

- A bank deposit will then be automatically created to include all undeposited funds that were settled. This will not work if you've selected Undeposited Funds as the income account to record your payments.

- If you use bank feeds, the lump sum deposit for the day's customer payments will be automatically matched to the bank deposit.

If you need more details about your online invoice payments, see the Transaction Details report.

Google Pay is a trademark of Google LLC.

FAQs

What are the fees and charges related to online payments?

- When your payer pays via Visa, Mastercard, Apple Pay or Google Pay and you have enabled surcharging, they will be charged 2.7% of the invoice value.

- The 2.7% surcharge will be applied to the invoice total and the invoice amount (minus the $0.25 merchant fee) will be settled to your bank account. For example, if the invoice is $100 and you have enabled surcharging, your customer will pay $102.7 and you will receive $99.75.

- If a surcharged invoice contains goods or services with GST, you will also receive the surcharge GST.

Where do I find the surcharge amounts?

Typically, the surcharge isn't recorded in your accounts as it is paid by your customers and debited before the funds settle. The surcharge can, however, be calculated as 2.7% of the invoice value.

If the surcharge incurred GST, we'll record the surcharge and its GST in your nominated merchant fee account. To check or change the account you nominated, click your business name in the top-right corner > Sales settings > Payments tab > Edit preferences.

You can always view the fees and, where applicable, the surcharge GST in the Transaction Details report.

How do I change the bank account my fees and charges are debited from?

Only the Owner or an Online admin user can change the bank details. Tell me more about user access.

- Click your business name in the top-right corner and choose Sales settings.

- Click the Payments tab.

- In the Invoice payment options section, click Edit preferences.

- Select the Stripe account settings tab. If prompted, sign in to your Stripe account.

- Click Edit for Payout Details to change the business bank account that will be debited for fees and charges.

- Update your account details.

- Click Save.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.