You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 57 Next »

https://help.myob.com/wiki/x/BgAnBQ

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

To pay an employee, you'll need to set them up in MYOB and enter some basic details (Payroll menu > Create employee).

- Obtain a completed Tax code declaration (IR330) from each new employee (get the IR330 from Inland Revenue)

- Check the employee's KiwiSaver eligibility status

- Obtain the employee's bank account details for wage payments

- Ensure you maintain the required records for each of your employees

To add an employee

Go to the Payroll menu and choose Create employee. Use the tabs on this page to enter the employee's details. Mandatory information is identified in MYOB with an asterisk (*).

Here's an overview of each tab.

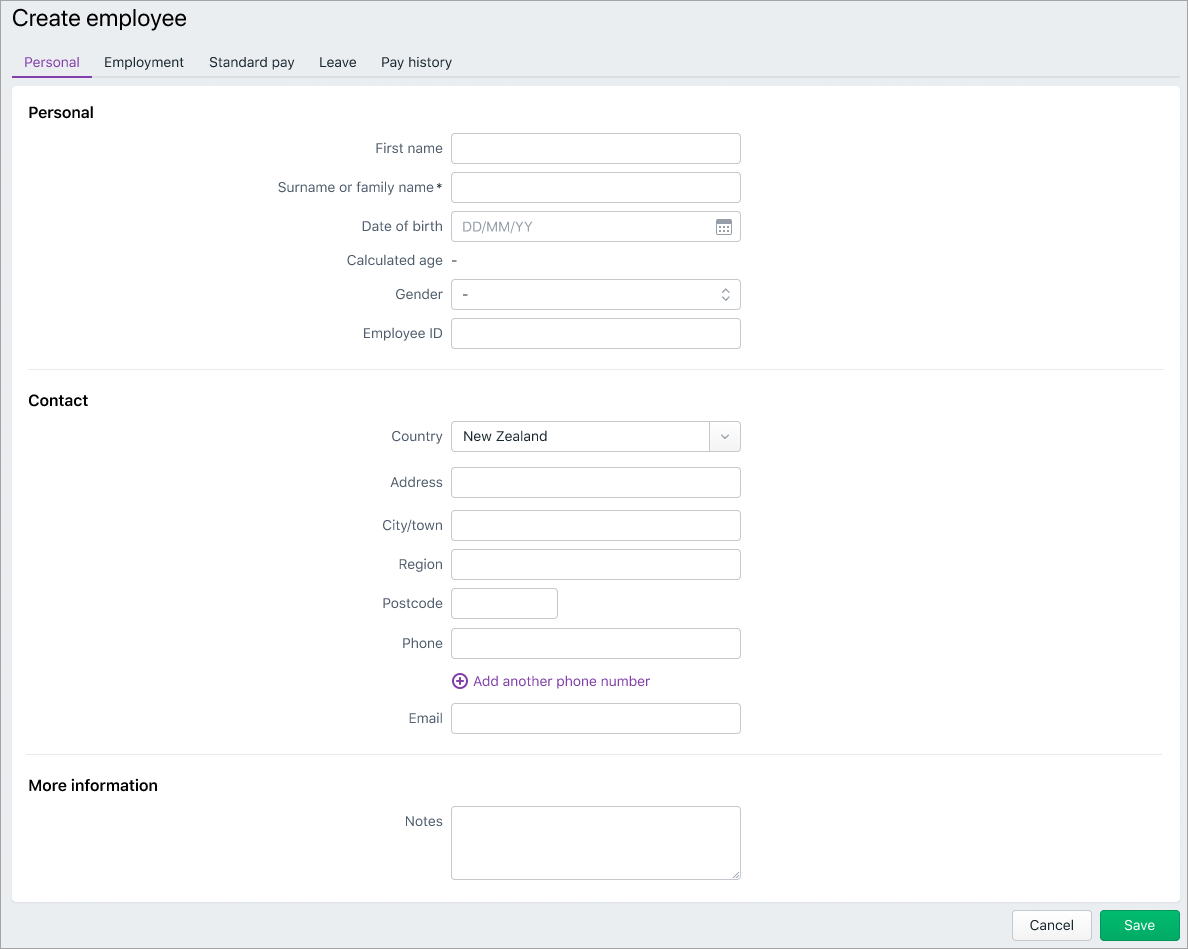

No surprises here—this is where you'll enter the employee's personal and contact details.

Some things to note:

- Use the Employee number field if you use a number or code system to identify each employee.

- Phone number must be in the format 0XX and not +64

- Enter an Email address if you'll be emailing their pay slips. Acceptable characters include A-Z, a-z, 0-9 and @ . - _

- Use the Notes field for additional information, like an emergency contact.

Here you'll enter the employee's start date and their tax, KiwiSaver and bank account details.

Some things to note:

- Employment status (Permanent, Casual, Fixed-term or Contractor). This will determine the employee's default leave setup (see below about the Leave tab)

- You'll find the Tax code and IRD number on the employee's completed IR330 form

- Choosing STC as the Tax Code requires additional ACC levy information

- Choosing WT as the Tax code requires a Tax rate (%), and the KiwiSaver status will default to Exempt.

- IRD number must be 9-digits long (older IRD numbers are 8-digits long so must be preceded by a zero)

- Choose the employee's KiwiSaver Status

- Enter Bank account details if you'll be paying the employee into their bank account

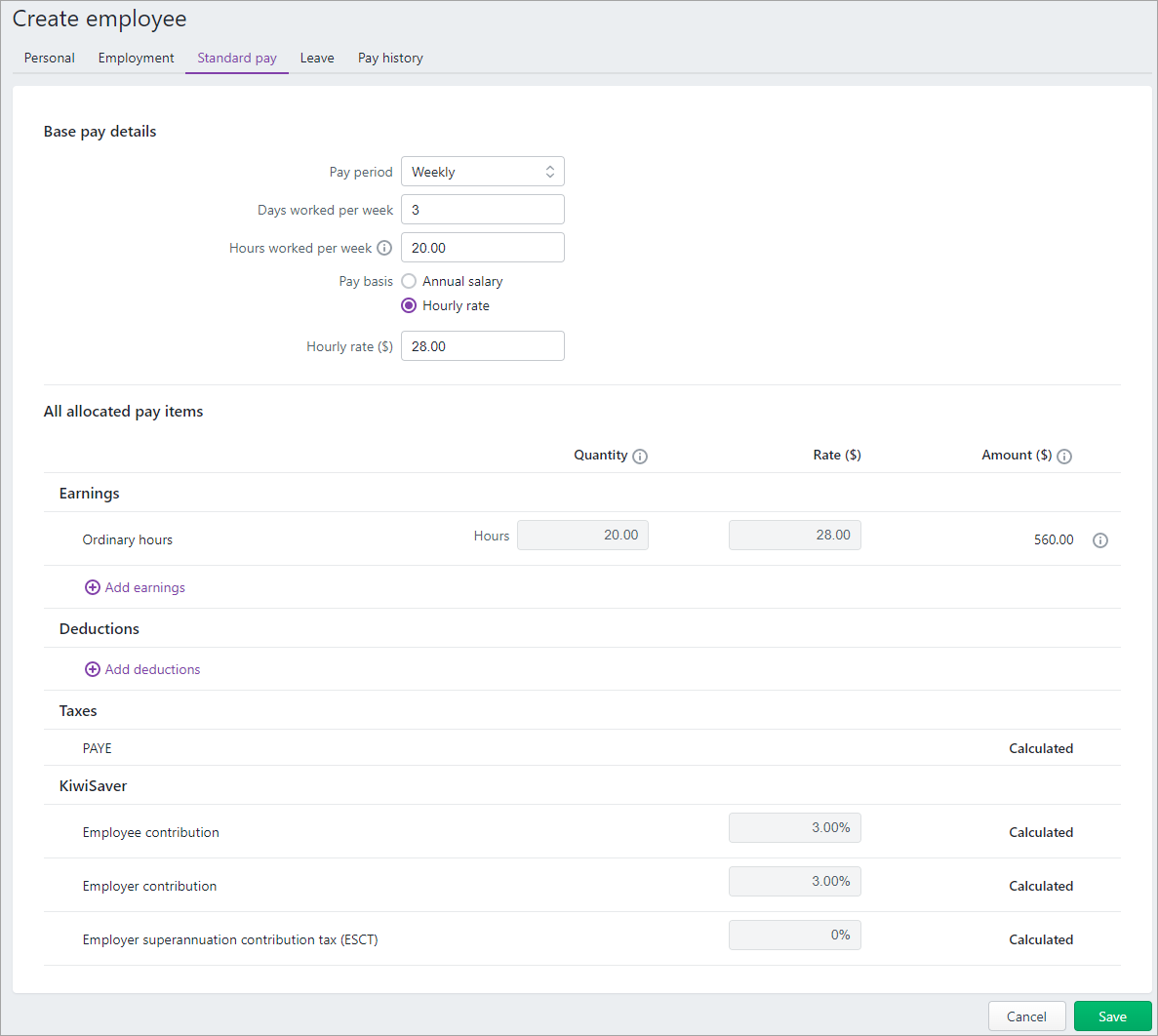

This is where you set how much the employee is paid and choose the earnings and deductions to include in their pay. You can set default amounts here, but you can always change these when you do a pay run.

Some things to note:

- Choose the employee's Pay period (how often you'll pay them) and whether they're paid an Annual salary or Hourly rate.

- The Days worked per week and Hours worked per week you enter here are used to calculate leave. If these vary from pay to pay, you can enter 0 here and enter the values when you do a pay run.

- By default, the Salary earning is assigned to salaried employees and Ordinary hours earning is assigned to hourly-based employees. These cannot be removed. The Quantity and Rate is from the Base pay details at the top of the screen.

- Click Add earning and Add deduction to choose the earnings or deductions to include in the employee's regular pay. Need to create an earning or deduction?

- If you enter a custom rate or amount for an earning or deduction, it'll only apply to this employee. Also see Creating earnings and deductions - NZ.

- You'll see PAYE and KiwiSaver amounts when you do a pay run, as they're automatically calculated.

Here's an example standard pay for a part-time employee who works 20 hours per week over 3 days.

Remove or reset earnings and deductions

Use the ellipsis button next to an earning or deduction to unlink (remove) it from the employee, or to reset a custom amount back to its default value.

next to an earning or deduction to unlink (remove) it from the employee, or to reset a custom amount back to its default value.

This is where you set up the employee's leave based on their employment status that you've set on the Employment tab.

To learn more about leave and what your employees are entitled to, visit employment.govt.nz

Click a leave name to:

- set up that leave for this employee, and

- enter any leave balances they've already accrued.

In some cases, employees and employers may agree to pay holiday pay regularly with the employee's pay instead of providing 4 weeks of annual leave. This is usually referred to as "Pay as you go"

The pay as you go payment must be at least 8% of the gross earnings in each pay.

Holiday Pay entitlement (at least 8% of gross earnings) can be used for employees where it's not possible or practical to provide 4 weeks annual holidays.

This might include:

- fixed term contract holders, less than 12 months, or

- employees with irregular work patterns, like casuals.

Learn more about pay-as-you-go for fixed-term employees or those with changing work patterns at employment.govt.nz

Some things to note:

- The default rate is set to 8% of gross earnings.

- You can increase this percentage if required, based on the employment agreement.

- You can select the option Include in each pay to make this pay-as-you-go entitlement active for the eligible employees.

Annual Holiday entitlement (at least 4 weeks’ paid annual leave available each 12 months of continuous employment with you) can be used for:

- permanent employees (full time/part time)

- fixed term contract holders with 12 months or more

- some casual employees if they have a regular work pattern.

Learn more about annual holiday entitlements at employment.govt.nz

Some things to note:

- Definition of a week is based on the Hours worked per week you've set in the employee's Standard pay tab.

- If the employee has already accrued annual holidays when you add the employee into MYOB, enter their Opening leave balance (weeks). If you have this value in hours or days, you'll need to convert it into weeks. We recommend speaking to the employee and agreeing with them about what the conversion will be in weeks.

- Estimated leave in advance is calculated based on the number of weeks between today and the employee's Next anniversary date.

- Estimated leave available is the leave currently available for the employee to take, based on the Current leave balance and Estimated leave in advance. You'll also see the Estimated leave available when doing a pay run.

Employees are entitled to 10 days of sick leave per year, and this balance appears after working continuously for 6 months. For example, if the employee starts on 1 December 2022, they'll become entitled to sick leave on 1 June 2022, then 10 more days will be added to their balance on 1 June 2023.

Learn more about sick leave entitlements at employment.govt.nz

Some things to note:

- The Next anniversary date defaults to 6 months from the Start date you've set in the employee's Employment tab.

- By default, 10 days will be added to the employee's sick leave entitlement at their next anniversary. You can increase this if required, based on the employment agreement.

- If the employee is entitled to sick leave when you add the employee into MYOB, enter their Opening balance (days). If you have this value in hours, you'll need to convert it into days.

An employee gets an alternative holiday for working on a public holiday that is an otherwise working day.

Learn more about alternative holiday entitlements at employment.govt.nz

If the employee is entitled to any alternative holidays when you add the employee into MYOB, enter their Opening balance (days). If you have this value in hours, you'll need to convert it into days.

If you want to keep track of family violence leave balances, use the Notes field on the Personal tab.

If an employee has already been paid (prior to setting them up in MYOB) this is where you'll enter their pay history for the previous 52 weeks. This is used to calculate payments for holidays and leave.

When entering pay history, enter a separate row for each pay period the employee was paid in the previous 52 weeks.

For all the details, see Pay history - NZ.

What's next?

Once you've finished setting up payroll, you're ready to pay your employees!

Need some help?

Contact our support team and we'll get you back on track.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.