You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 6 Next »

https://help.myob.com/wiki/x/h4yO

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

An employee might want their employer-paid super to go to one fund, and salary sacrifice super payments to go to another fund.

But you can only assign one super fund for each employee card in AccountRight...so how is it done?

Easy. Just set up two cards for the employee and assign a different superannuation fund to each.

Here are the details:

You need to create two employee cards which we'll refer to as the primary card and the secondary card.

Make sure you've set up your employee's super funds.

Here's the info you need to record in each card:

| In this card... | record this info... |

|---|---|

| Primary card |

|

| Secondary card |

|

If you're using Pay Superannuation, check super fund and employee details to make sure all mandatory information is recorded.

- Set up the Superannuation Guarantee category to cater for the employee's mandatory super payments.

- This category might already exist in your company file.

- Click Employee and select the employee's primary card.

Here's our example:

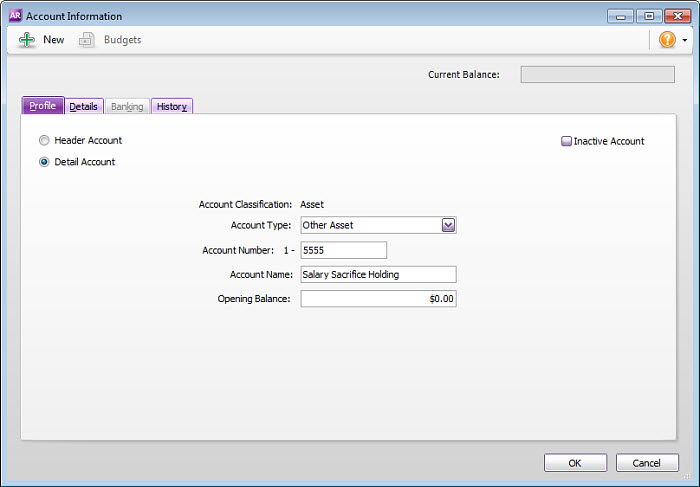

- Create an asset account with the Account Type set to Other Asset. This account will be used as a "holding" account for the salary sacrifice super payments.

- Set up a payroll deduction category. This will be used to deduct the salary sacrifice super payments from the primary card.

- For the Linked Payable Account, select the salary sacrifice "holding" asset account created at step 2. Ignore the warning about the type of account you've selected.

- For the Calculation Basis, enter the dollars per pay period to be deducted.

- Click Employee and select the employee's primary card.

- Set up a payroll wages category. This will be used to pay the salary sacrifice super amounts deducted from the primary card.

- For the Type of Wages, select Salary.

- Override the expense account and select the salary sacrifice "holding" asset account created at step 2. Ignore the warning about the type of account you've selected.

- Click Employee and select the employee's secondary card.

- Set up a superannuation category for the salary sacrifice payments. This will be used to report the salary sacrifice amount for the second fund.

super guarantee category - link to primary employee card

create a super holding (asset) account

create a deduction payroll category - link to holding account, assign to primary card

create salary sacrifice wages category - link to holding account, assign to secondary card

create salary sacrifice super category - assign to secondary card

FAQs

Set up the payroll categories

Process the employee's pay

primary card - full pay with sal sac deducted

secondary card - zero pay - manually enter the sal sac value

Note: super can be processed as normal