- Created by admin, last modified by RonT on Jun 08, 2023

https://help.myob.com/wiki/x/2IER

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

New Zealand only

For Australian help, click here.

When adding an employee into MYOB Essentials, you'll need to set up their annual leave and personal leave (sick leave) entitlements.

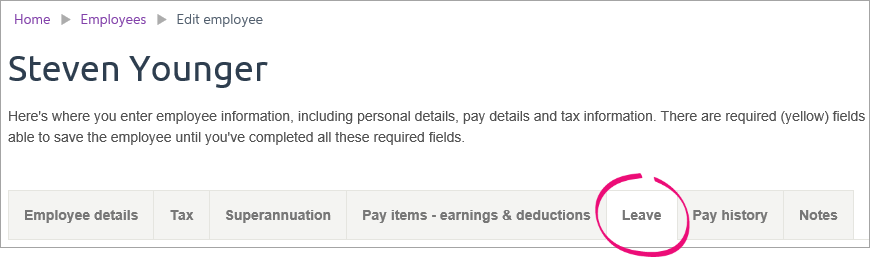

You do this on the Leave tab of the employee's record (Payroll menu > Employees > click the employee > Leave tab).

Not sure what leave your employees are entitled to?

Take a look at the Employment New Zealand website.

To set up leave

For each employee entitled to leave, you need to:

- Enter opening leave balances (this is the leave already owing to an employee when you set them up in MYOB Essentials)

- Set up their leave entitlements (this is how much leave the employee will accrue as they work)

Once you've set up an employee's leave, learn about managing their leave (this includes viewing leave balances, adjusting leave, showing leave on payslips, and paying unused leave).

Enter opening leave balances

New employees

When you add a new employee (Payroll menu > Employees > Add Employee), their annual leave, alternative holiday and sick leave opening balance on the Leave tab will probably be zero. The employee will begin accruing leave after you have included them in a pay run.

Under the Holidays Act 2003, an 'accrual' is considered to be an estimate of entitlements. For more information, see the Employment New Zealand website.

Existing employees

If you’ve been tracking annual leave for an employee in another system, enter the Opening available balance and Opening estimated leave accrued since anniversary.

These balances will be reflected in their respective Current balances fields. Note that you can choose whether to display current balances in hours, days or weeks.

With each pay run, the current balance will increase, while the opening balances will remain the same.

After the pay run which includes the employee’s anniversary date in Essentials has occurred, the opening available balance is rolled into the current balance available. If you need to adjust an employee's leave, see Managing your employees’ leave.

When you finish entering annual leave opening balances, enter opening balances for both alternative holidays and sick leave.

Annual leave

There are two methods of managing annual leave (also known as annual holidays) entitlements in MYOB Essentials: fixed and pro-rata. It's important to consider these carefully.

All employees are entitled to a minimum of four weeks’ annual holidays each year after 12 months of continuous service. MYOB Essentials manages leave in hours, so you need to work out what an employee’s four week leave entitlement is in hours. When employees work the same, or a similar number of hours each week, this process is simple.

For example, an employee who works 40 hours a week would receive 160 hours per year. With employees who work variable hours or a have a pattern that changes weekly, determining a four-week entitlement may not be as easy.

When unclear, employers and employees can agree on what genuinely constitutes a working week, and then multiply this by four to arrive at an annual entitlement. One option is to use the longest working week as this will ensure the employee can take four weeks paid leave regardless of the weeks taken.

Decisions on entitlements should always be made in accordance with good faith obligations and via engagement and agreement with employees.

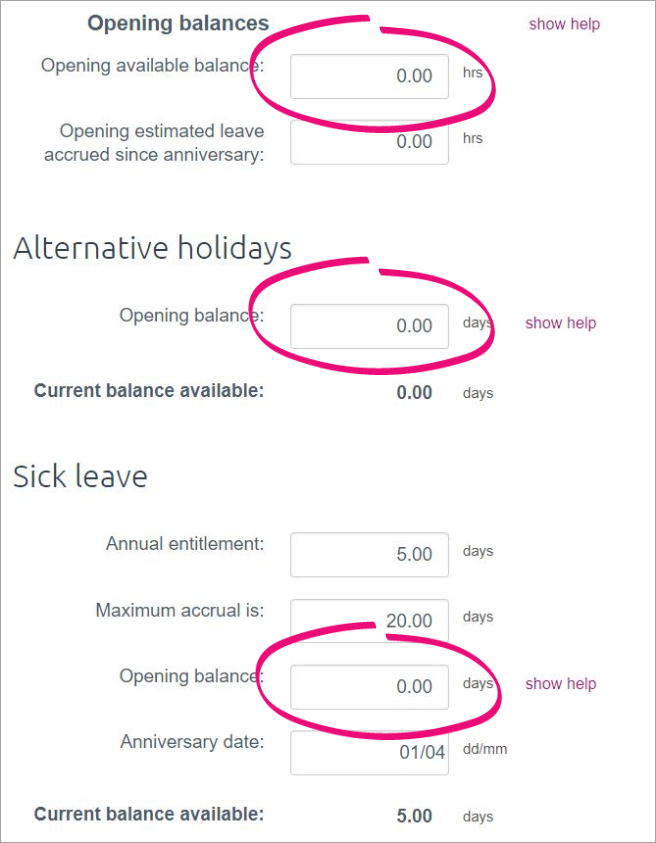

Fixed

We recommend using this method which accrues the same amount of leave each pay period regardless of the hours worked. Work out the annual entitlement in hours and enter this in the hrs/year (fixed) field.

Each pay, a portion of the entitlement is added to the employees estimated leave accrued since anniversary and on the next leave anniversary date, the estimated accrued leave is given to the employee as available leave and the estimated leave accrued since anniversary resets to zero.

It's important to check the employees receive their full entitlements. If required, you can update their balance using the available balance adjustment field.

Pro-rata

Pro-rata is a leave accrual method which calculates an employee’s four weeks of leave based on the hours worked each pay. Historically, this method has been used when an employee’s hours varied across pay periods, so it was difficult to determine what a working week was for the purpose of annual leave.

It’s important to note that this method isn’t defined within the Holidays Act and MBIE’s guidance cautions about its use, as there’s a risk that an employee may not receive their full four weeks of leave.

While MYOB Essentials continues to support this method of leave calculation, we caution that it should only to be used when an agreement exists to use it and that its use should be reviewed regularly in case a work pattern has changed or becomes predictable.

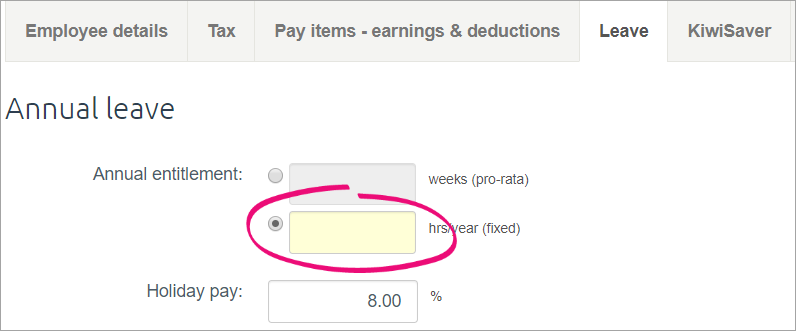

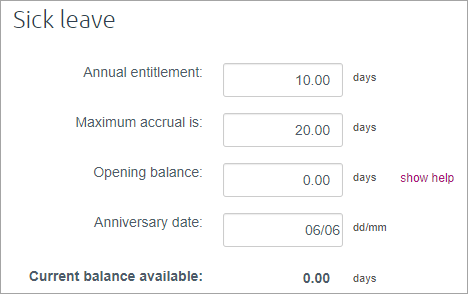

Sick leave

Most employees are entitled to 5 days of sick leave per year (increasing to 10 days per year from 24 July 2021). The first entitlement becomes available after 6 months service of continuous service, then every 12 months.

From 24 July 2021, the minimum annual entitlement must be 10 days and cannot be pro-rated based on hours or days worked. Unused sick leave is carried over up to the maximum amount defined, which must be at least 20. For new employees, minimum sick leave entitlements are set up by default. For migrating employees, enter their sick leave anniversary date and then any existing balances in the Opening balance field.

Continuous service typically means having a regular work pattern and expectation of ongoing work. Employees who work irregularly, such as casuals, can still be entitled to sick leave if during a six-month period they have worked for the employer an average of at least 10 hours per week, including at least one hour per week, or 40 hours a month.

To learn more about sick leave entitlements, visit the Employment New Zealand website.

Anniversary dates

Anniversary dates determine when employees are entitled to leave. An employee will typically have a different anniversary date for annual holidays and sick leave.

Holiday pay

All employees must have their holiday pay rate set to 8% (or higher, if specified in the employment agreement). For employees who receive annual leave entitlements, the holiday pay rate is used as part of the final pay calculation. It is also used for employees who are eligible to be paid holiday pay with each pay instead of receiving annual holiday entitlements.

Employees who have their status in the employee details set to Casual or Fixed-term will have holiday pay added to each pay by default. However, there are instances where this is not correct:

- Employees on a fixed term contract of 12 months or greater should have their status set to Full-time to receive annual leave entitlements. Only employees on genuine fixed-term agreements of less than 12 months are eligible to be paid holiday pay with each pay.

- Employees on casual employment agreements are not automatically eligible to be paid holiday pay with each pay. Depending on their work pattern it’s possible that they should be set up as a part time employee and receive annual leave entitlements. We recommend checking with MBIE if you’re unsure.

Available and accruing annual leave

The Holidays Act 2003 states that an employee isn’t entitled to annual holidays until 12 months of continuous employment has passed. However, it’s common practice for employers to allow employees to take leave in advance of it becoming entitled. This will result in a negative available balance until the next anniversary date.

The Estimated accrued leave since anniversary field tracks an estimate of the leave accrued since the last anniversary (or start date within the first year). While the concept of leave accruing is not described in the Holidays Act 2003, it is provided in MYOB Essentials to show how much leave an employee can take in advance.

The accrual estimate increases each pay. On the annual leave anniversary date:

- the accrued hours are added to the Available balance, and

- the estimate accrual resets to zero.

The amount added to their available leave on the anniversary date must be four weeks (in hours) based on their agreed definition of a week.

For both the available and estimated accrued leave, adjustment fields are provided to update leave balances when work patterns change. For more details see Updating leave balances.

Once you've set up leave, see how to pay leave.

FAQs

How do I adjust an employee's leave balance?

How do I pay rostered days off (RDOs)?

While MYOB Essentials can't track the accrual of RDOs, you can set up a new earning to cater for RDO payments.

For all the details see Rostered days off (RDOs).

How do I pay long service leave?

While MYOB Essentials can't track the accrual of long service leave, you can set up a new earning to cater for long service leave payments.

For all the details see Long service leave.

How do I pay time off in lieu?

While MYOB Essentials can't track the accrual of time off in lieu, you can set up a new earning to cater for time in lieu payments.

For all the details see Time off in lieu.

How do I pay parental leave?

See this topic for all the details: Paid parental leave (New Zealand)

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.