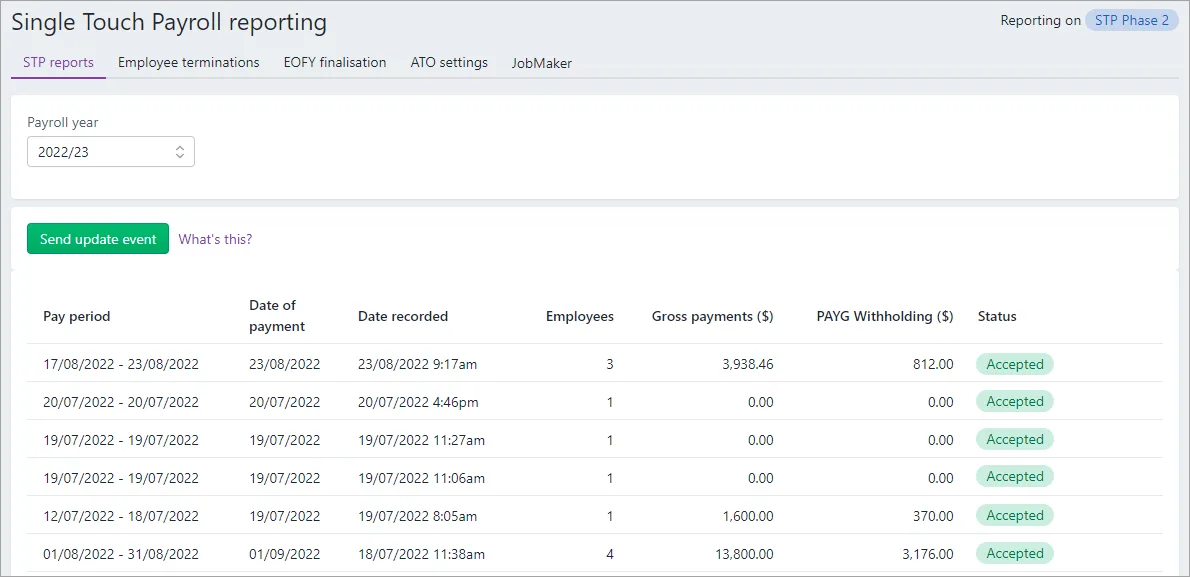

When you do a pay run, you'll report it to the ATO for Single Touch Payroll (STP) reporting. You can view your submitted payroll reports in the STP reporting centre (Payroll menu > Single Touch Payroll reporting > STP reports tab).

On the STP reports tab you can:

view your submitted STP reports (one report per pay run)

send an update event to the ATO to sync your payroll data (STP Phase 2 only)

download a PDF report showing what has (and hasn't) been sent to the ATO

send payroll reports that are yet to be sent (those with a status of Not Sent)

view the ATO's response to a submission (to help troubleshoot rejected reports)

To view payroll reports

From the Payroll menu, choose Single Touch Payroll reporting.

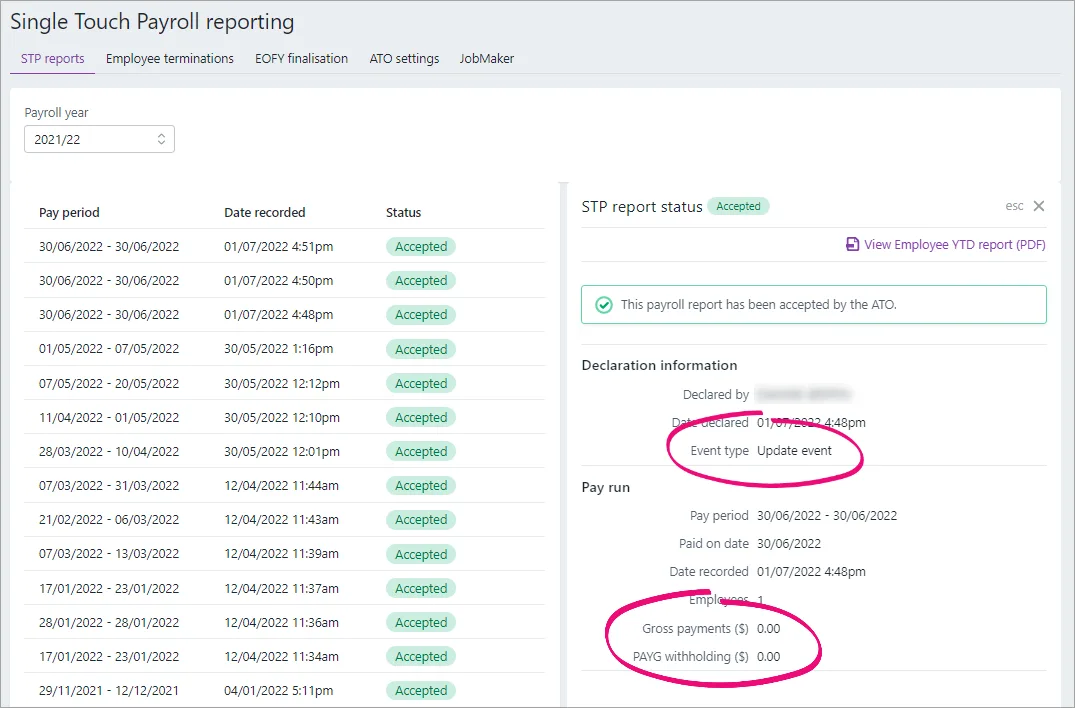

Click the STP reports tab. Reports are listed with basic information and their status.

Click a report to see more details.

To send an update event

You can sync your payroll totals in MYOB with the figures held by the ATO. This is a quick way of ensuring the ATO has the current year to date payroll figures for your employees.

If you're reporting via STP Phase 2, you can send an update event from the STP reporting centre. Otherwise you'll need to record a zero dollar ($0) pay for each employee whose year to date payroll totals you want to send to the ATO.

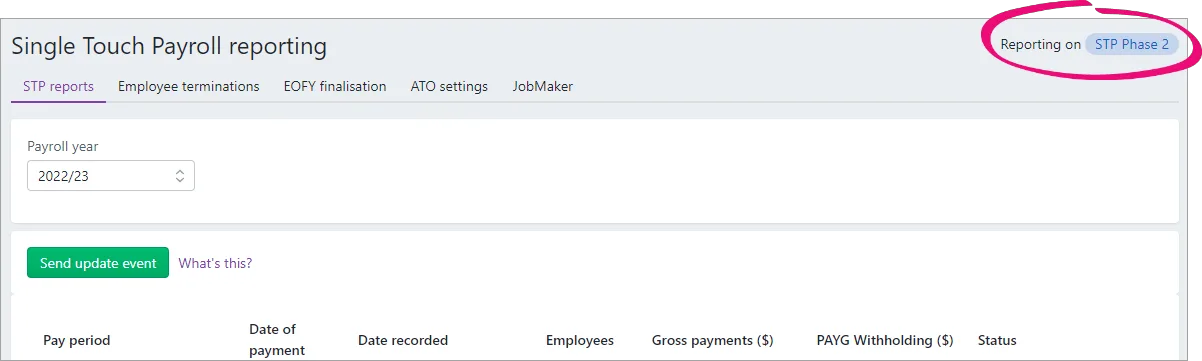

Am I reporting via STP Phase 2?

You can check in the STP reporting centre (Payroll menu > Single Touch Payroll reporting). How do I get ready for STP Phase 2?

Sending an update event for STP Phase 2

From the Payroll menu, choose Single Touch Payroll reporting.

Click the STP reports tab.

Choose the applicable Payroll year.

Click Send update event.

When prompted, enter your details and click Send.

An update event will be listed with your other payroll submissions on the STP reports tab, but with zero (0.00) amounts.

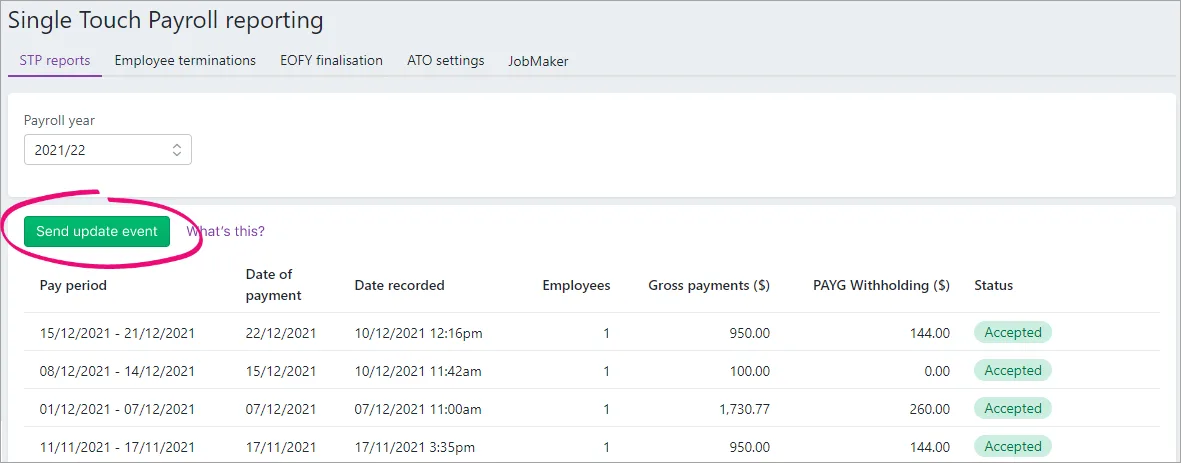

Sending an update event for STP Phase 1

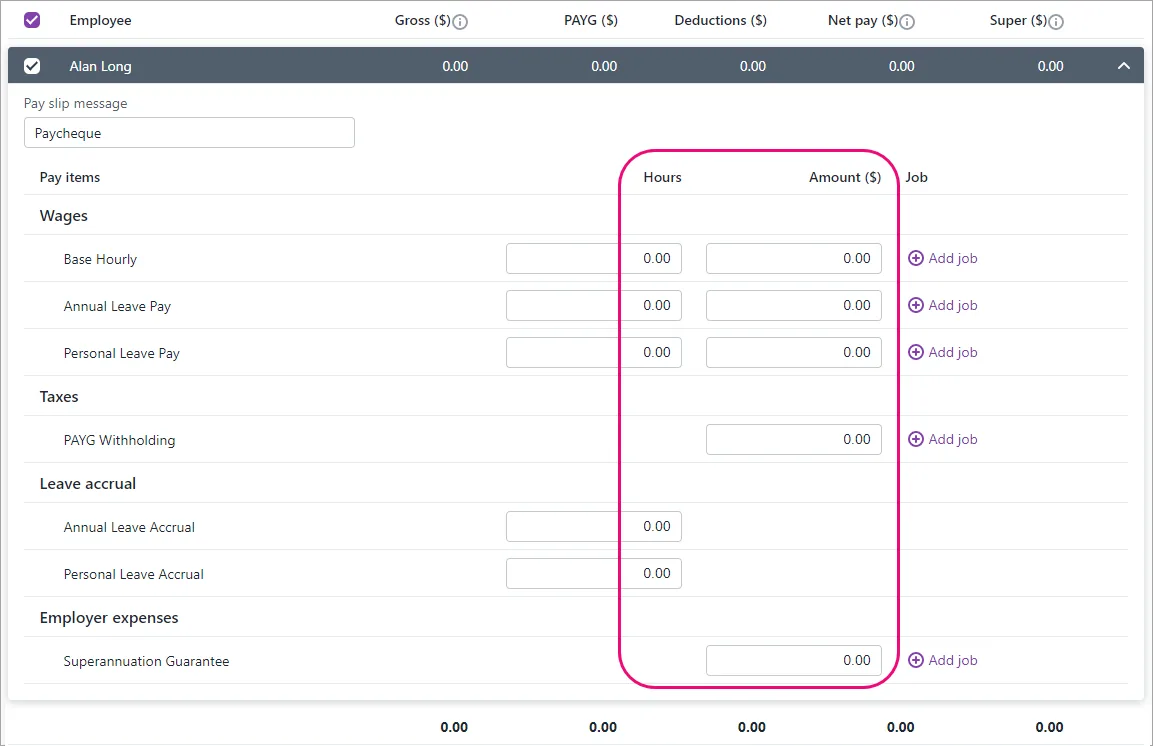

You can send an update event for an employee by recording a $0 pay. This type of pay is also called a void pay and it's like any other pay, but you'll enter zero for all hours and amounts.

When you record a $0 pay, the employee's latest year to date payroll totals will be sent to the ATO.

Start a new pay run (Create menu > Pay run).

Ensure the Date of payment is in the payroll year you're sending the update event for.

Select only the employees you want to send an update event for.

Remove all hours and amounts from each employee's pay, like this example.

Complete the pay run as you normally do and declare it to the ATO. Need a refresher?

To download a report (PDF)

Go to the Payroll menu and choose Single Payroll Payroll reporting.

Click the STP reports tab.

Click the report you want to view.

Click View Employee YTD report (PDF). The report downloads and displays in a new browser tab.

What the report shows

The report has 2 parts identified with these headings:

Payroll reporting - employer pay period - if the report has been accepted by the ATO, this part of the report shows the amounts that have been submitted for the pay period (pay run).

Payroll reporting - employee year-to-date - this shows the year-to-date amounts submitted to the ATO for each employee that was paid in this pay period (pay run).

To view ATO response

If a report you've sent to the ATO is rejected, you can view the ATO's response to find out why.

Go to the Payroll menu and choose Single Payroll Reporting.

Click the STP reports tab.

Click the report you want to view. Details of the ATO's response are displayed.

Learn how to fix rejected reports in Single Touch Payroll.

Report statuses

Here's a description of each report status you might see in the payroll reporting centre and what to do if something needs fixing.

Sending

The report has just been sent from MYOB and is in transit to the ATO.

There's nothing to fix - reports will sit in Sending until the ATO receives them. This can take up to 72 hours during peak periods.

Pays in reports with this status can only be reversed. Tell me more

Sent

The report has been sent and is awaiting a reply from the ATO.

There's nothing to fix - wait for the ATO's response.

Pays in reports with this status can only be reversed. Tell me more

Not sent

The report has not arrived at the ATO for one of these reasons:

The declaration hasn't been agreed to.

The person who processed the pay has not gone through the connect to ATO steps and added themselves as a declarer.

To fix this, an authorised declarer can click the report then click Send to ATO.

To make another person a declarer, see Add a declarer for Single Touch Payroll reporting.

Pays in reports with this status can only be deleted. Tell me more

Accepted

Report has been sent to and accepted by the ATO with no errors.

All good!

Pays in reports with this status can only be reversed. Tell me more

Rejected

The report has been sent but rejected by the ATO. Rejected reports will have a reason for the rejection, and what needs to be fixed for it to be accepted.

The Rejected status will remain for the report. Once you've addressed the issue, updated payroll information will be sent to the ATO on your next pay run.

To fix this, see Fix rejected reports

Pays in reports with this status can only be deleted. Tell me more

Accepted with errors

Report has been sent to and accepted by the ATO, however there are some things that you'll need to fix before the next pay run.

To fix this:

From the Payroll menu, choose Single Touch Payroll reporting.

Click STP reports.

Click in the Status column for the report you want to view. The information you need to check and update is listed in the report. Fix all items before your next pay run.

Pays in reports with this status can only be reversed. Tell me more

FAQs

I've processed a pay dated on or before 30 June - why is it showing as a $0 update event in the STP reporting centre?

If you process a pay in the new payroll year (e.g. 1 July or later) but the Date of payment is in the pervious payroll year (e.g. 30 June or earlier), the ATO will treat the pay as an update event. Even if the pay contains amounts that you're reporting to the ATO, they'll consider it an update event (and not a pay event) because it's related to the previous payroll year.

But don't worry, even though the pay run shows as a $0 update event in the STP reporting centre, the updated year-to-date payroll totals (for last payroll year) for the employees in the pay run will still be reported to the ATO.

What information is sent to the ATO?

Your employees' year to date figures are sent to the ATO. This means each time you submit a pay run to the ATO, your employees' latest year to date figures are sent.

What information is sent to the ATO?

Your employees' year to date figures are sent to the ATO. This means each time you submit a pay run to the ATO, your employees' latest year to date figures are sent.

What's the difference between a "pay event" and an "update event"?

Information submitted from MYOB will be received by the ATO as either a pay event or update event.

A pay event can only occur in the current payroll year, where both employee and employer year-to-date totals are submitted to the ATO. A regular pay run is considered a pay event.

An update event can occur in the current or a previous payroll year, and only the employee's year-to-date totals for the applicable payroll year are sent to the ATO. Recording a $0 pay is considered an update event.

How do I fix or delete a report that's been sent to the ATO?

You can't delete or "undo" a report from the STP reporting centre. Instead, you can either reverse the incorrect pay and record it again, or wait until the next pay run and adjust it accordingly.

All submitted reports will remain listed in the payroll reporting centre, even if you change or delete a pay in MYOB.