MYOB Business Pro only

When a customer wants to buy goods or services from you, but you're not yet ready to invoice them, you can create a sales order for them. This will detail the selling price, quantity, and type of goods or services provided. Later, when you're ready to ship the items, or you've completed the service, you can invoice the customer.

Why you should use sales orders:

Good customer relations

Avoid losing customer orders. You have a centralised record of your customer orders that you can pull up at any time, anywhere, so long as you have a web browser.

Sales orders ensure that both the customer and the business have a clear understanding of the order. The order details can be referred to in case of any confusion or disputes.

You're able to easily convert a sales order to an invoice and we'll retain the original sales order, so you can see the whole history of the sale with the customer.

Better inventory management

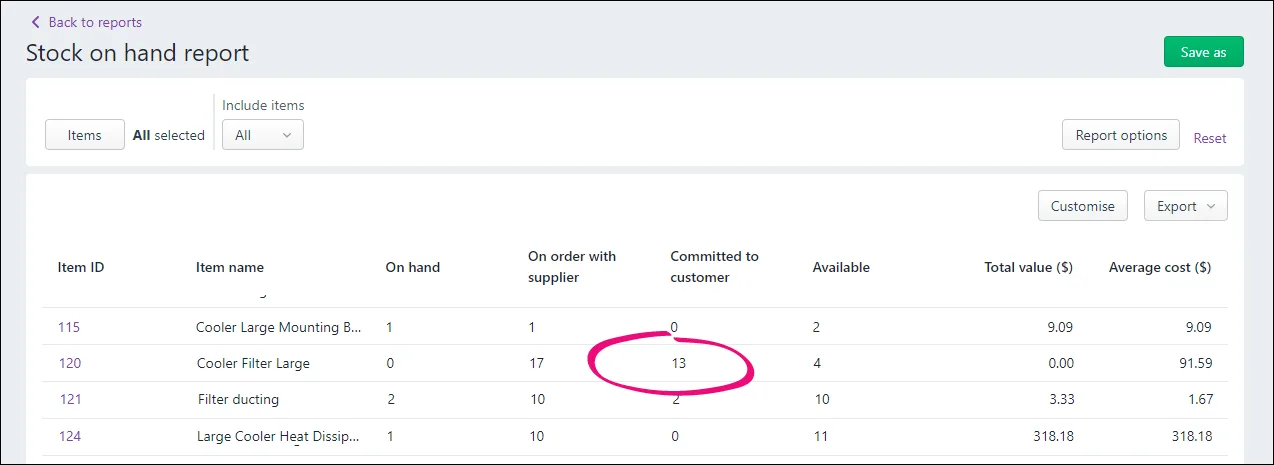

Sales orders help you keep track of orders and manage inventory. When you enter a sales order for inventoried items, they are marked as committed to customers. This helps your purchasing department make informed inventory ordering decisions. The quantity that is committed to customers is indicated in the Reorder report and the Stock on hand report:

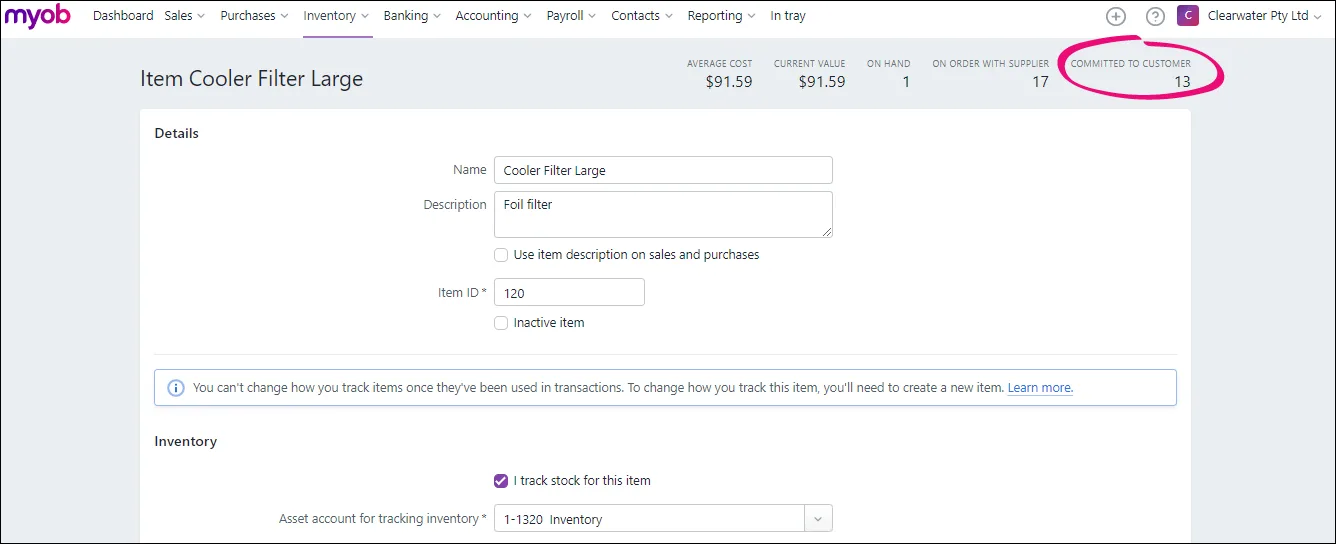

You can also see number of items committed to customers in the item itself:

When you combine sales orders with the other inventory tracking features in MYOB Business, like purchase orders, inventory reports and stock reordering, your business gets a clear view on how much of your inventory is committed to customers, how much is on-hand and how much on order.

Suits the way you do business

You can use sales orders in whatever way suits your business.

For example, if you're a service-based business, you can create a sales order to book and itemise the service – handy if you're not sure exactly when you'll deliver the service.

Or, if you have a customer who orders very frequently, you may not want to create an invoice for them every time. You could use a sales order to keep track of their multiple orders, and then send an invoice at the end of the month.

Sales orders are useful for retailers, wholesalers, manufacturers and any other type of business that needs to track customer orders as part of their sales workflow.

Both goods-based and service-based businesses can use sales orders.

Sales order availability

Sales orders are only available for MYOB Business Pro users or AccountRight users accessing their company file in a web browser. If you are an AccountRight browser user, see the FAQ's below for information on what sales order features are available.

Creating and using sales orders

You can create a sales order from scratch by following these steps.

Create a sales order

From the Create menu, choose Sales order.

Choose the Customer you're ordering for. The customer’s address details appear in the field below. If you've entered a shipping address when you added the customer, this will appear on PDF copies of the sales order.

If you want to:Add a new customer:

Click the Customer dropdown arrow and choose Create customer. Enter as much (or as little) info as you like and click Save. You can always go back later and fill in additional details.Add missing details to an existing customer:

Type the customer's name in the Customer field and hit Enter. Click the dropdown next for the information you want to add, such as the ABN or billing or shipping address, add the details and click Save.

(Australia only) The status of the ABN you've entered in the customer's record will checked, and the status shown. Click the status to see more details.

If necessary, change the Sales order number. This number is automatically generated, based on the last number used in any sales transaction, such as an invoice or quote.

If you have one, enter the Customer PO Number.

Check the date in the Issue date field.

Click the date in the Promised date field to enter the date you promise to deliver the items to the customer.

Select an option from the Amounts are list. Click Field layout and select the applicable option based on what you're ordering.

If you want the prices to include tax or GST, choose Tax inclusive. Note that this is the default tax preference.

If you want the prices to exclude tax or GST, choose Tax exclusive.

Click Field layout and select the applicable option based on what you're ordering.

If you're ordering items, in the Item ID column, click the dropdown to choose an item or search for an item by entering all or part of the Item ID or Supplier item ID. As you type, matching items are shown.

When you choose an item:the item's Description, Category for tracking sales, Unit selling price and Tax code appear automatically, based on what you entered when you created the item (you can edit these details if you want)

the total price of the items is calculated automatically in the Amount field.

Enter the number of Units of this item you're selling. The calculated Amount is displayed.

Repeat the above steps for each item you're ordering. Need to add or remove blank lines or line items?

If you're selling services:

In the Description column, enter a description of the service you're providing.

Choose the Category the income from this service will be allocated to. If you're not sure, check with your accounting advisor.

Enter the Amount of this service.

If required, change the Tax code. If you're not sure, check with your accounting advisor.

Repeat step 11 for each service you're selling. Need to add or remove blank lines or line items?

Enter any charges for Freight, and if required, change the default Tax/GST code. If you can't enter Freight, you'll be prompted to specify a linked category for freight. (What is a linked category?) The totals are calculated at the bottom of the sales order:

Subtotal—the total for the items added to the sales order

Tax—the amount of tax applied to the sales order

Total—the total amount of the sales order including the tax or GST amount

(Optional)

Choose a Job if the line item relates to a specific job. Tell me more about jobs.

If you want to add a note about the sales order, choose a Notes to customer. This note will appear if you create a PDF of the sales order. You could use this area to add additional details about the order.

Check that all the information in the sales order is correct.

If you want to email the sales order:

Click Email sales order.

Enter or update your From name and Reply-to email address.

If an email address has been saved for the customer, it appears in the To field, but you can add one or change it if needed.

If you want to email the invoice to additional recipients, click Email or CC to enter additional recipients.

If you want to email a copy of the invoice to yourself, select the option Email me a copy. The customer will not be able to see this information.

A PDF of the sales order will be automatically attached to the email, but if you'd If you'd like to attach additional files (total size of uploaded documents can't exceed 25MB):

click and drag files onto the Email sales order page

click browse for files and select files to upload

to remove an attachment, click the remove (x) icon next to it.

Choose the sales order template that'll be used if the customer prints or downloads their sales order as a PDF. Click Preview to see what it'll look like. Click Customise template to set up your sales templates.

When you're ready, click Send. The sales order is saved and emailed.

When you're ready to ship inventory items to a customer (or, if you're a service-based business, you've completed a job), you can convert the sales order to an invoice. You can then send the invoice to the customer to complete the sale.

In MYOB Business (or if you are an AccountRight user working on your company file in a web browser) the original sales order is retained when you convert it to an invoice, so you can go back to it.

For all the details, see Converting a sales order to an invoice.

Features still to come

We'll be delivering further features and improvements to sales orders*, enabling you to:

convert a quote to a sales order

apply a deposit to a sales order.

Keep track of new features and improvements

Keep track of all MYOB Business new features and improvements. Visit (and bookmark) the MYOB Business Release Notes.

* New feature availability is subject to change

FAQs

Who can enter sales orders?

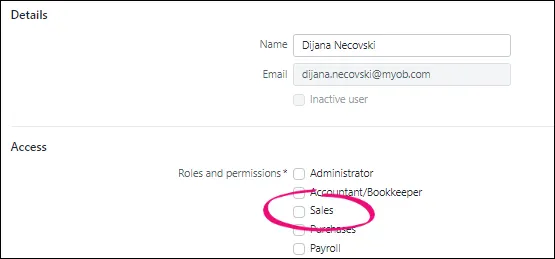

Any user with the following role or permissions can enter purchase orders:

Administrator

Accountant/Bookkeeper

Sales

You can prevent an ordinary MYOB Business file user entering purchase orders by deselecting the Sales role and permissions:

Find out more about user roles and permissions.

What’s the difference between sales orders and quotes?

A quote is the price you'll charge a customer for a sale of certain goods and services. The quoted price is valid for a specified period.

A sales order confirms the sale of goods or services to a customer. It's a promise to provide goods and services for an agreed price by a specified date.

You can use either or both, depending on how do business. A sales order often results from an initial quote.

When you enter a sales order for an inventoried item, it's marked as committed to a customer, helping you to make informed stock purchasing decisions. Quotes don’t affect the quantities of inventoried items.

In a future release, you’ll be able to convert quotes to sales orders.

Can I convert a quote to a sales order?

Not yet, the ability to convert a quote to a sales order is coming in a future release.

Can I receive a payment on a sales order?

Not yet, the ability to apply payments, such as deposits, on sales orders is coming in a future release.

What sales order features are available in AccountRight browser?

Many sales order features in AccountRight desktop are available when you when you access your company file in a web browser, but there are still some coming.

In the browser, you are not yet able to:

put a deposit on a sales order

convert a quote to a sales order

backorder items to fulfil sales.

Terms in sales orders, multiple currencies and adding a salesperson to a sales order are not available in AccountRight browser.

If you need to do these tasks, you can do them in AccountRight desktop.

There are a couple of things you can do with sales orders in AccountRight browser that you can't do in AccountRight desktop:

retain a sales order after converting it to an invoice

create a sales order for the Items & Services layout.

The following table compares the sales order features available in AccountRight desktop versus AccountRight browser:

Feature | AccountRight desktop | AccountRight browser* |

|---|---|---|

Apply a deposit to a sales order | Yes | Not yet available |

See sales order activity | Yes | Yes |

Convert quote to sales order | Yes | Not yet available |

Backorder items to fulfil sales | Yes | Not yet available |

Convert sales order to invoice | Yes | Yes |

Retain original sales order after converting to an invoice | Yes | |

Create sales order for Items & Service layout | Yes | |

Email a sales order | Yes | Yes |

Print a sales order | Yes | Yes |

Apply freight to a sales order | Yes | Yes |

Create sales order for inventoried and non-inventoried items | Yes | Yes |

Create sales order for service items | Yes | Yes |

Apply terms to a sales order | Yes | |

Add a salesperson to a sales order | Yes | |

Create or edit sales orders using multiple currencies | Yes |

* New feature availability is subject to change