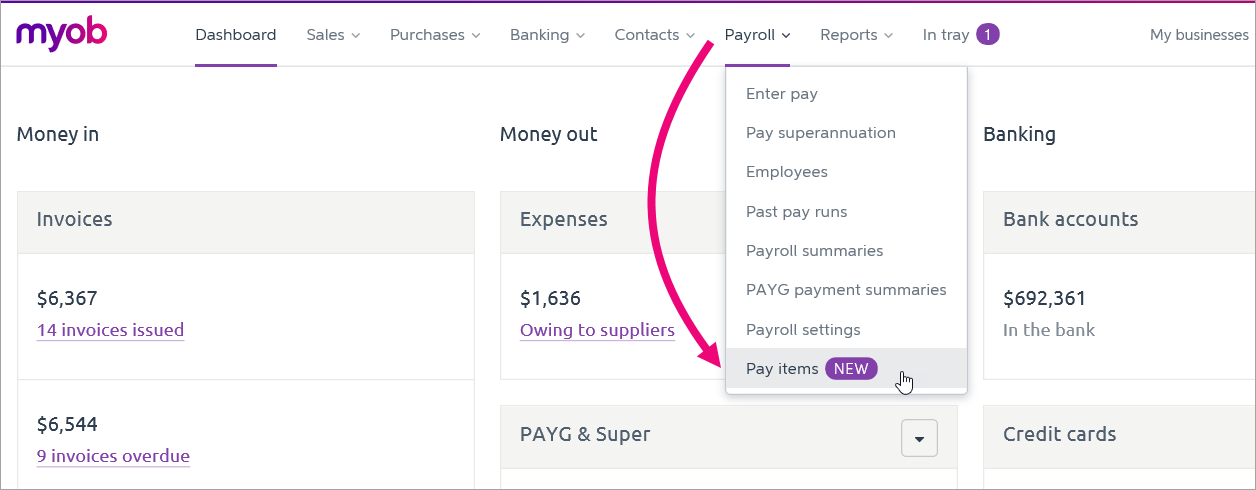

Pay items are earnings or deductions included in an employee's pay on top of regular salary and wages (e.g., allowances, bonuses, super salary sacrifice, etc.). When you create a new pay item for an employee, it becomes available to link to all your employees. The Pay items page lists every earning and deduction in your MYOB Essentials business. From this page you can create, edit, and delete pay items. To find the Pay items page, go to the Payroll menu and select Pay items.  Your pay items are separated into Earnings and Deductions, with the name and type listed for each. If you're in Australia, you'll also see the ATO reporting category assigned to each pay item. Your pay items are separated into Earnings and Deductions, with the name and type listed for each. If you're in Australia, you'll also see the ATO reporting category assigned to each pay item.

For more information on ATO reporting categories and Single Touch Payroll, see Single Touch Payroll. Creating, editing, and deleting pay itemsYou can create, edit, and delete pay items from the Pay items page. From any employee's page, you can create, edit, or unlink pay items. Note that editing a pay item from an employee's page will also affect any other employee that item is linked to. | UI Expand |

|---|

| From the Pay items page- From the top menu, click Payroll > Pay Items.

- Click Create earning or Create deduction.

- Set up the pay item and click Save.

You can now link this item to an employee from the employee's page.

From an employee's page- From the top menu, click Payroll > Employees, then click on the employee.

- Click the Pay items - earnings & deductions tab.

- Under either Earnings or Deductions, click the drop down menu and choose +Create new earning or +Create new deduction.

- The Create new earning window appears. Set up the pay item and click Save.

- To link this item to the employee, click Save again.

|

| UI Expand |

|---|

| Deleting a pay item will delete it from all employees and saved pay runs that are linked to it, but historical pay runs will not be affected. If you would rather unlink a pay item from an employee, you can do that from the employee's page. - From the top menu, click Payroll > Pay Items.

- Click the ellipses button (...) for the pay item and select Delete.

|

|