- Created by MichelleQ, last modified by RonT on Jun 06, 2023

https://help.myob.com/wiki/x/tQCEAQ

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

New Zealand only

For Australian help, click here.

- Deductions are amounts withheld from employee pays (other than taxes) and paid to a third party, such as child support payments

- If you want to know about some of the rules governing workplace deductions, check the Employment New Zealand website

- Deductions are set up as pay items in MYOB Essentials, which are then assigned to your employees to be included in their pays (instructions below)

- You can set up one deduction for multiple employees, or set up separate deductions

Before or after tax deductions

If you're not sure whether a deduction is pre-tax or post-tax, check with your accounting advisor or the IRD.

OK, let's step you through how to set up a deduction, assign it to an employee, then what it looks like when you process a pay.

Set up a deduction pay item

I'm in New Zealand

- Go to the Payroll menu and choose Pay items. The Pay items page appears.

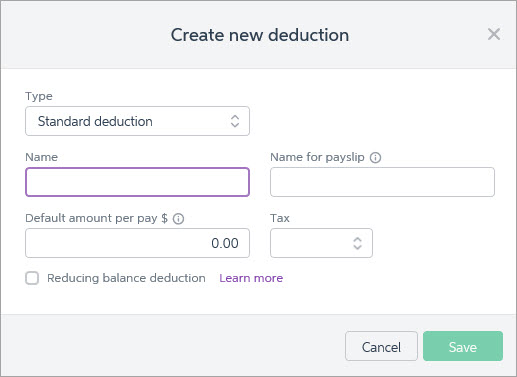

- Click Create deduction. The Create new deduction window appears.

Select the deduction Type.

Type Description Standard deduction This is for any deduction which isn't a child support or court fines deduction. Child support If you are required to make child support deductions for an employee, you will be notified by the IRD of the amount to deduct.

Employees who pay child support are entitled to keep 60% of their net (after-tax) earnings. If a child support deduction will leave the employee with less than 60% of their net pay, MYOB Essentials will automatically adjust the child support deduction to comply with the protected net earnings rule. Learn more about Child support deductions.

Court fines If the Ministry of Justice notifies you by letter to deduct money from an employee's pay and pay it to them, you need to set up a court fines deduction.

Employees who are required to pay court fines are entitled to keep 60% of their net (after-tax) earnings. If a court fines deduction will leave the employee with less than 60% of their net pay, MYOB Essentials will automatically adjust the court fines deduction to comply with the protected net earnings rule.

Learn more about Court fines deductions.

Want to add an SLCIR deduction?

You can enter compulsory extra deductions (SLCIR deductions) from the Tax tab in the employee profile.

Enter the deduction Name, such as "Union fees".

If you'd like a different, more personalised, name to show on payslips for this deduction, enter a Name for payslip, such as "Union fees - Steven".

Enter the deduction Default amount per pay. You can override this amount for an employee when assigning this pay item to them (see the next task for details).

When you process your pays, you can only change the amount for a Standard deduction type – you can't change an amount for a Court fines or Child support deduction type.

- In the Tax field, choose whether the deduction is Before tax or After tax. If unsure, check with your accounting advisor or the IRD.

If applicable, choose the option Reducing balance deduction.

What's a reducing balance deduction?

This type of deduction is a regular deduction with a ‘balance’ to be paid. Each pay period a deduction is made, and the balance decreases. Once the balance reaches zero, the deduction stops automatically. A common example would be a court fines deduction.

Learn more about Reducing balance deductions.

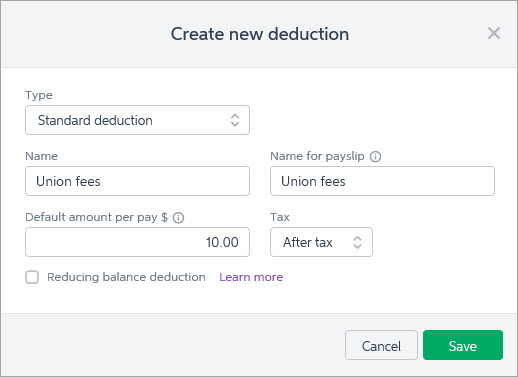

Here's our example deduction for $10 union fees:

- Click Save.

- Repeat these steps if you need to create more deductions.

Assign the pay item to an employee

To include a deduction pay item in an employee's pay, you need to assign it to them. Here's how:

- From the Payroll menu, choose Employees.

- Click the employee's name.

- Click the Pay items - earnings & deductions tab.

- In the Deductions section, click the dropdown arrow next to the Add deduction... field.

- Choose the deduction pay item to be assigned to the employee.

- (Optional)

- Edit the Amount column to override the default amount set when the deduction was created. The new amount will apply to this employee only - other employees will still be deducted the default amount.

- If it's a reducing balance deduction, enter the Balance owed ($). This is the total amount to be deducted over time.

- Repeat step 5 if you need to assign any additional deductions to the employee.

- Click Save.

- Repeat from step 2 to assign deductions to another employee.

Next time you process a pay, the deduction will be listed. See the next task for details.

Process a pay with the deduction

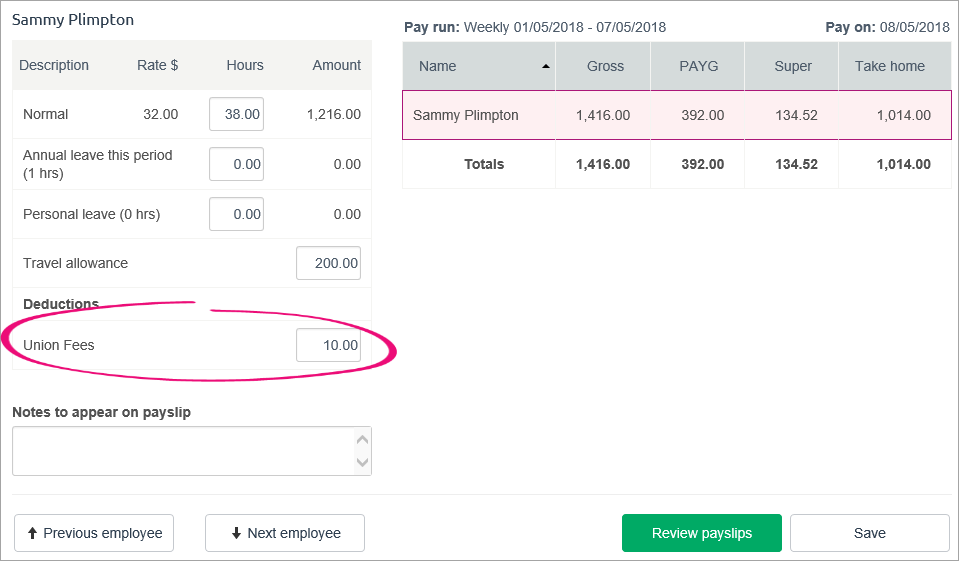

After you've assigned a deduction pay item to an employee, it'll appear in their pay. Let's take a look:

- Go to the Payroll menu and choose Enter Pay.

- Select the employee to be paid then click Start Pay Run.

If required, enter or change the deduction amount for this pay. Here's our example:

Protected net earnings

Child support and court fines deduction amounts cannot be changed in the pay run. Based on the employee's pay, the deduction amount may automatically reduce to protect minimum earnings. Learn more about protected net earnings on the IRD website.

- Continue processing the pay as normal. Amounts deducted are allocated to your payroll deductions account, ready to be paid to the applicable third party.

FAQs

What happens to the deducted money?

Money deducted from employee pays needs to be paid to the applicable third party. For example, deducted union fees need to be paid to the applicable union. Check with the third party regarding their accepted payment methods.

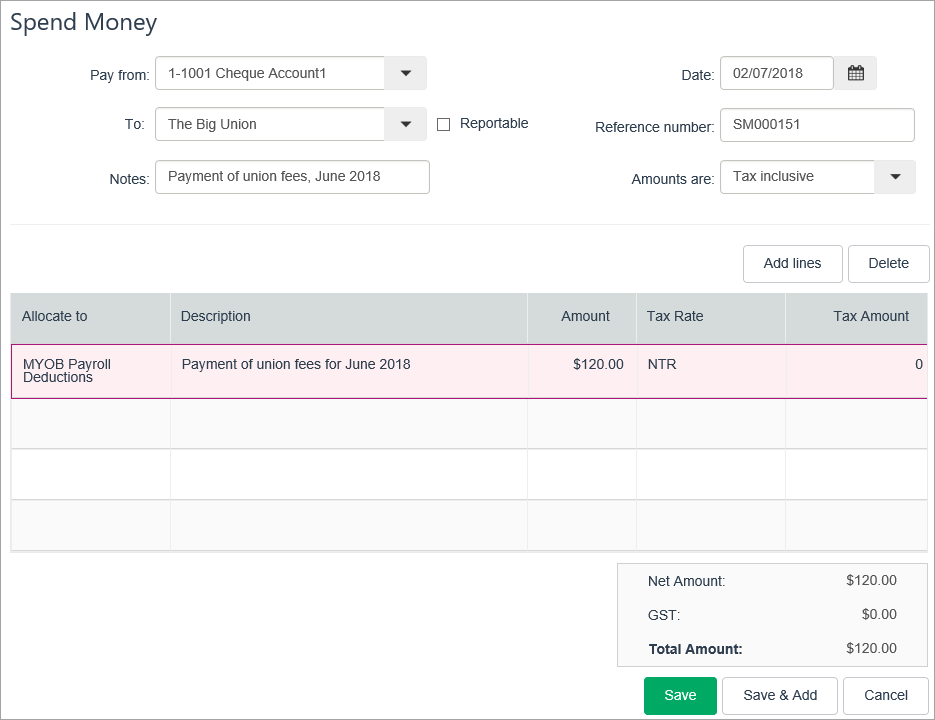

After you've made the payment, you can record it in MYOB Essentials using a Spend money transaction (Banking menu > Spend money).

Here's an example - note the following:

- In the Pay from account we've chosen the MYOB Essentials bank account the payment is coming from.

- In the To field we've chosen the organisation the payment went to (we set up a supplier record for this purpose).

- In the Allocate to field we've chosen the MYOB Payroll Deductions account.

Can I change the account my deductions are allocated to?

Deductions withheld from pays are allocated to a liability account in MYOB Essentials called Payroll deductions. This is a system account which cannot be changed.

You can find this account by clicking your business name and choosing Accounts list, then scrolling down to Liability > Current Liabilities.

What if the deduction amount varies between employees?

If you're in New Zealand, you can set a different amount for employee deductions when assigning pay items.

Otherwise you can either:

- create a single pay item with a zero amount, assign it to your employees, then enter the amount against the pay item when you do a pay run, or

- create separate pay items for each employee.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.